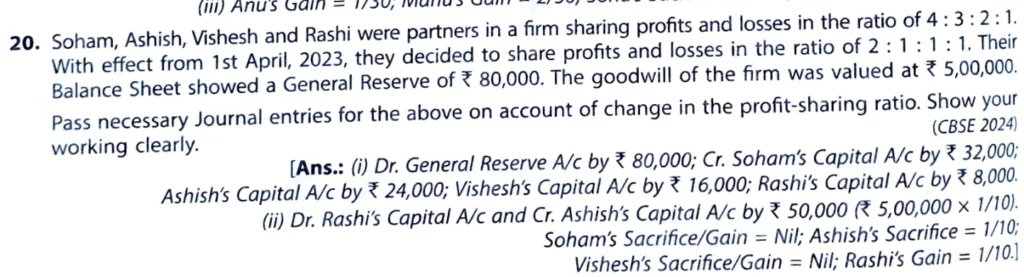

Soham, Ashish, Vidhesh and Rashi were partners in a firm sharing profits and losses in the ratio of 4 : 3 : 2 : 1. with effect from 1st April, 2023, they decided to share profits and losses in the ratio of 2 : 1 : 1 : 1

Soham, Ashish, Vishesh and Rashi were partners in a firm sharing profits and losses in the ratio of 4 : 3 : 2 : 1. with effect from 1st April, 2023, they decided to share profits and losses in the ratio of 2 : 1 : 1 : 1. Their Balance Sheet showed a General Reserve of ₹ 8,000. The goodwill of the firm was valued at ₹ 5,00,000.

Pass necessary Journal entries for the above on account of change in the profit sharing ratio. Show your working clearly.

[Ans.: (i) Dr. General Reserve A/c by ₹ 80,000; Cr. Soham’s Capital A/c by ₹ 32,000; Ashish’s Capital A/c by ₹ 24,000; Vishesh’s Capital A/c by ₹ 16,000; Rashi’s Capital A/c by ₹ 8,000. (ii) Dr. Rashi’s Capital A/c and Cr. Ashish’s Capital A/c by ₹ 50,000 (₹ 5,00,000 x 1/10). Soham’s Sacrifice/Gain = Nil; Ashish’s Sacrifice = 1/10; Vishesh’s Sacrifice/Gain = Nil; Rashi’s Gain = 1/10.]