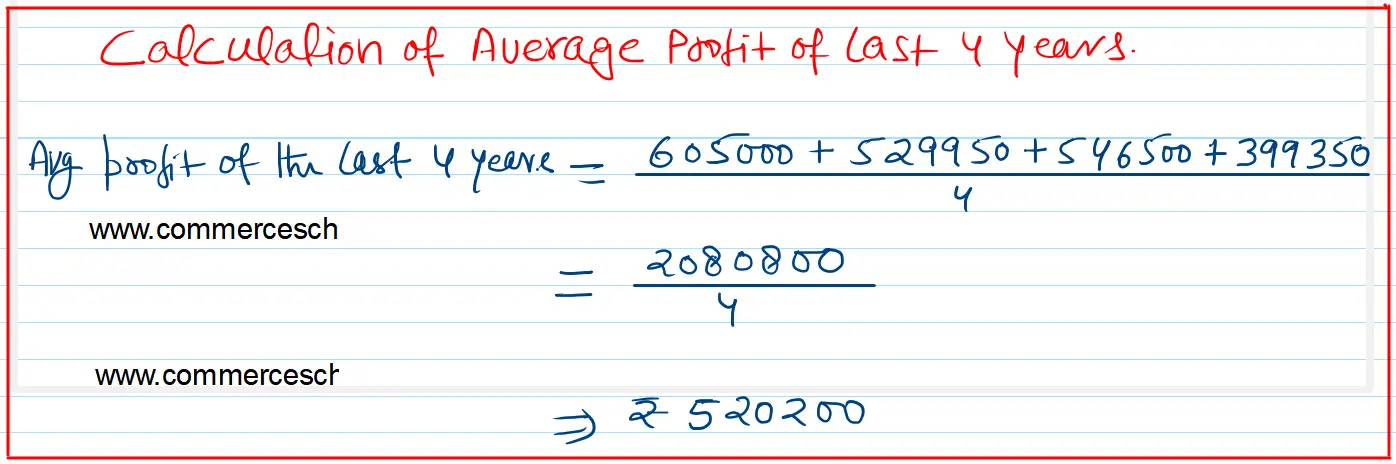

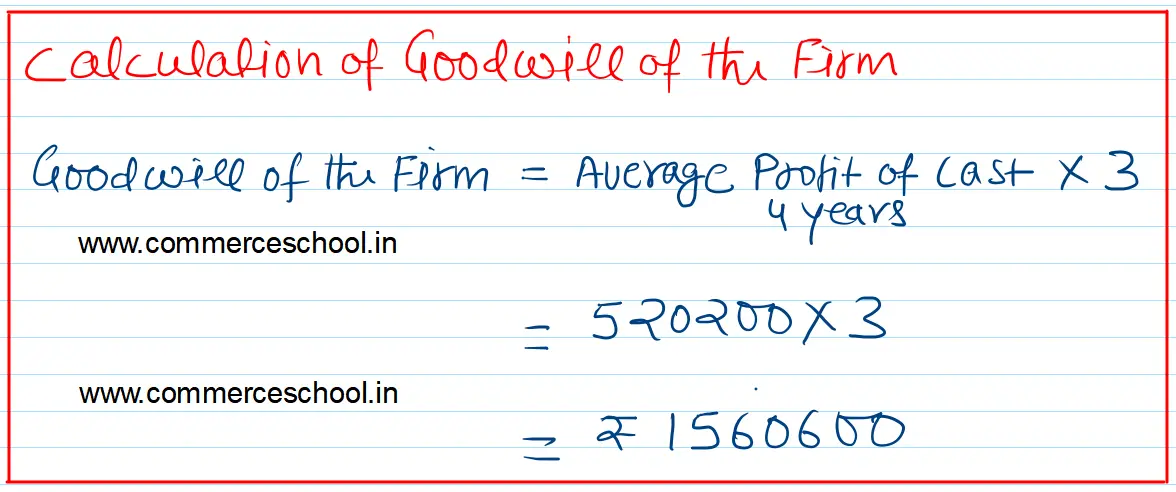

Sonu and Sumit are partners sharing profits and losses in the ratio 3 : 2. They admit Sahil as a partner for 1/5th share. For this purpose, goodwill of the firm is to be valued on the basis of 3 year’s purchase of last 4 year’s average profit

Sonu and Sumit are partners sharing profits and losses in the ratio 3 : 2. They admit Sahil as a partner for 1/5th share. For this purpose, goodwill of the firm is to be valued on the basis of 3 year’s purchase of last 4 year’s average profit. Profits for the last four years ended on 31st March were as follows:

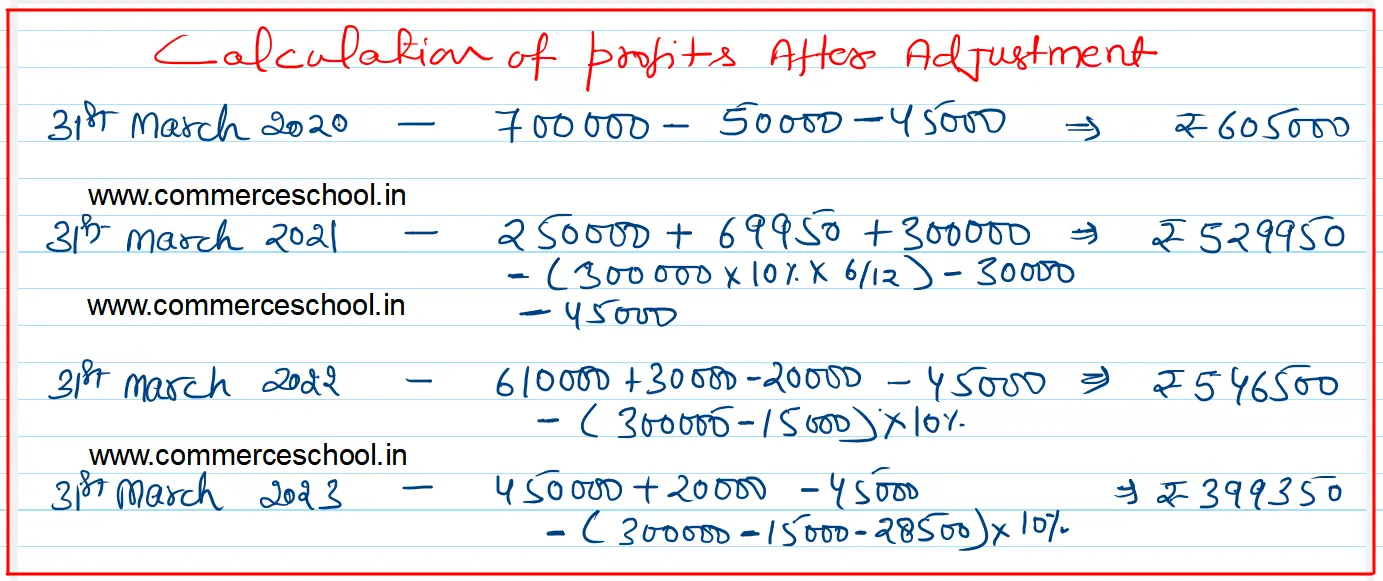

| Year | Profits (₹) |

| 2020 | 7,00,000 (including an Abnormal Gain of ₹ 50,000) |

| 2021 | 2,50,000 (after charging an Abnormal Loss of ₹ 69,950) |

| 2022 | 6,10,000 |

| 2023 | 4,50,000 |

Following additional information is made available:

i) On 1st October, 2020, the firm had purchased a computer for ₹ 3,00,000 and it was debited to stationery expenses. Depreciation is to be charged on computer @ 10% p.a. on Diminishing Balance Method.

ii) Closing Stock of 2021 and 2022 were overvalued by ₹ 30,000 and ₹ 20,000 respectively.

iii) To cover the Operating Cost, an annual charge of ₹ 45,000 should be made for the purpose of goodwill valuation.

Calculate goodwill of the firm.

In second step 300000*10% *6/12 will be 15000.how could it be 30000

IT is ₹ 15,000, read and calculate carefully

IT is 15,000, read and calculate carefully.

In second step ( 300000*10% *6/12) will be equal to 15000 . How could it be 30000