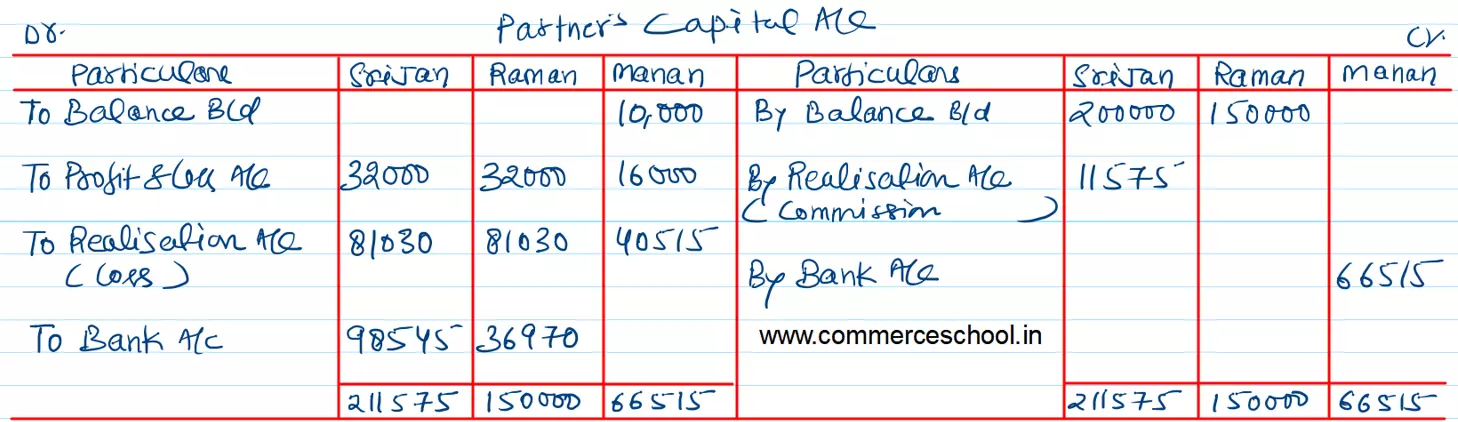

Srijan, Raman and Manan were partners in a firm sharing profits and losses in the ratio of 2 : 2 : 1. On 31st March, 2017 their Balance sheet was as follows:

Srijan, Raman and Manan were partners in a firm sharing profits and losses in the ratio of 2 : 2 : 1. On 31st March, 2017 their Balance sheet was as follows:

| Liabilities | ₹ | Assets | ₹ |

| Capitals:

Srijan Raman Creditors Bills Payable Outstanding Salary |

2,00,000

1,50,000 75,000 40,000 35,000 |

Capital: Manan

Plant Investments Stock Debtors Bank Profit & Loss Account |

10,000

2,20,000 70,000 50,000 60,000 10,000 80,000 |

| 5,00,000 | 5,00,000 |

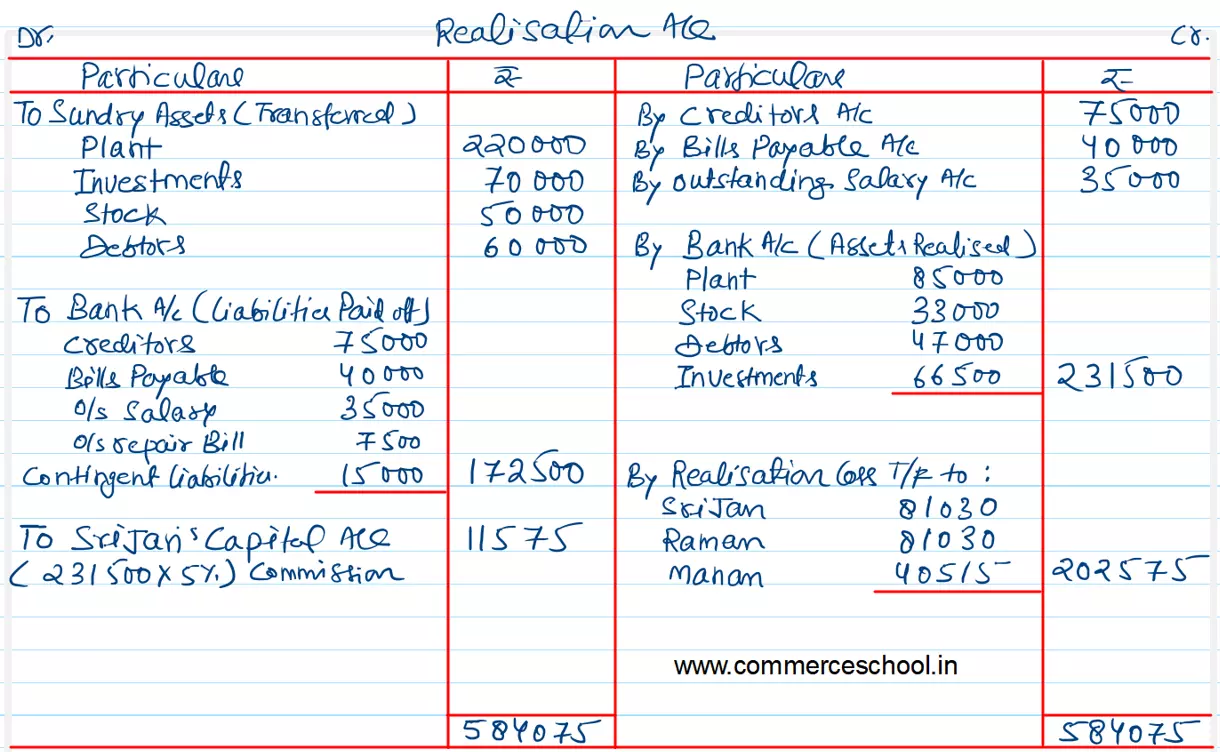

On the above date they decided to dissolve the firm.

(a) Srijan was appointed to realise the assets and discharge the liabilities, Srijan was to receive 5% commission on sale of assets (except cash) and was to bear all expenses of realisation.

(b) Assets were realised as follows:

Plant – ₹ 85,000

Stock – ₹ 33,000

Debtors – ₹ 47,000

(c) Investments were realised at 95% of the book value.

(d) The firm had to pay ₹ 7,500 for an outstanding repair bill not provided for earlier.

(e) A contingent liability in respect of bills receivable, discounted with the bank has also materialised and had to be discharged for ₹ 15,000.

(f) Expenses of realisation amounting to ₹ 3,000 were paid by Srijan.

Prepare Realisation Account, Partner’s Capital Accounts and Bank Account.

[Ans.: Loss on Realisation – ₹ 202,575; Final Payaments to Srijan – ₹ 98,545; Raman – ₹ 36,970; Manan will bring – ₹ 66,515; Total of Bank Account – 3,08,015.]