Suman and Rajan were partners in a firm sharing profits and losses in the ratio of 3 : 1. The firm was dissolved on 31st March 2019. Pass the necessary Journal entries for the following transactions after various assets (other than cash in hand and a bank) and third-party liabilities have been transferred to Realisation Account.

Suman and Rajan were partners in a firm sharing profits and losses in the ratio of 3 : 1. The firm was dissolved on 31st March 2019. Pass the necessary Journal entries for the following transactions after various assets (other than cash in hand and a bank) and third-party liabilities have been transferred to Realisation Account.

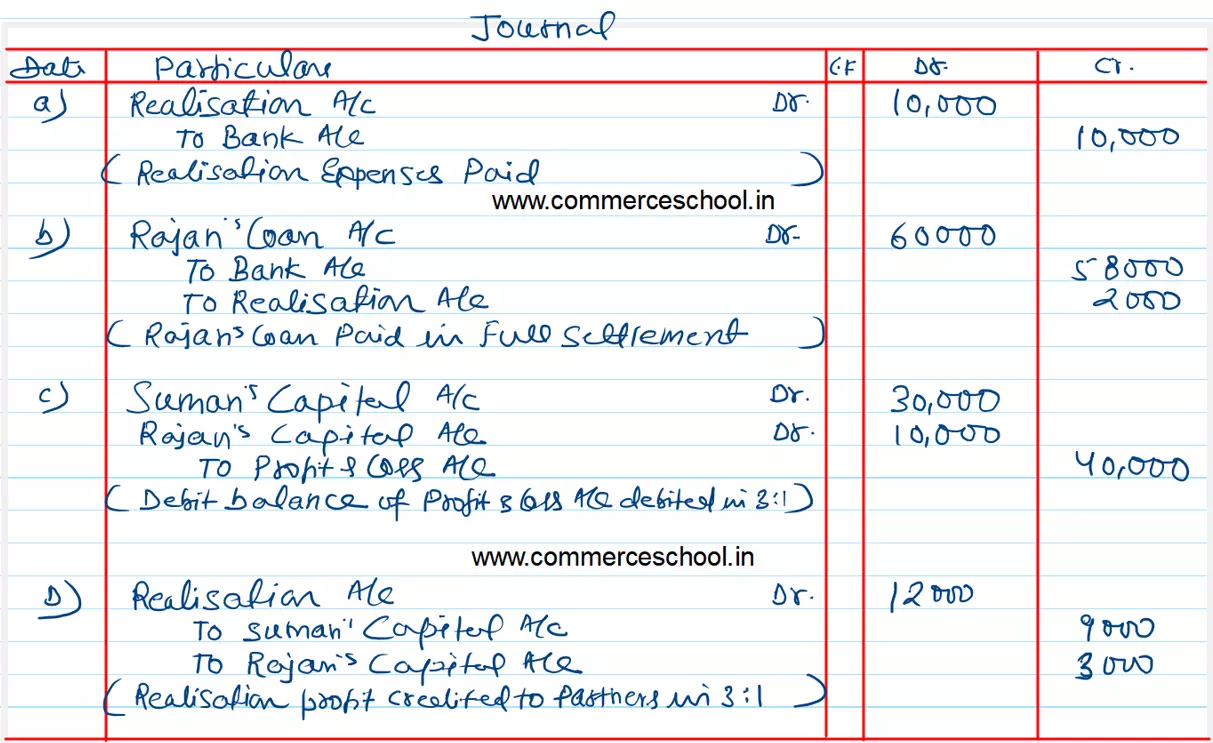

(a) Dissolution expenses ₹ 10,000 were paid by the firm.

(b) Rajan had given a loan of ₹ 60,000 to the firm for which he accepted ₹ 58,000 in full settlement.

(c) The firm had a debit balance of ₹ 40,000 in the Profit & Loss Account on the date of dissolution.

(d) Profit on realisation was ₹ 12,000.

Anurag Pathak Changed status to publish