Sushil and Girish are partners in a firm sharing profits in the ratio of 3 : 2. Their Balance Sheet as at 31st March, 2023 was as follows:

Sushil and Girish are partners in a firm sharing profits in the ratio of 3 : 2. Their Balance Sheet as at 31st March, 2023 was as follows:

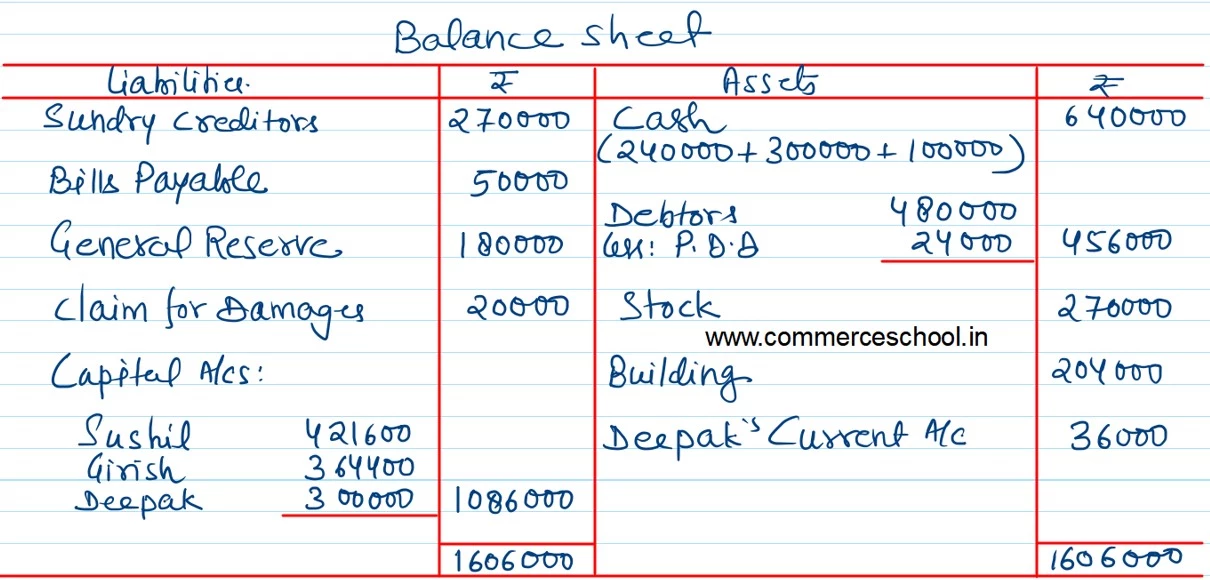

| Liabilities | ₹ | Assets | ₹ |

| Sundry Creditors

Bills Payable Capital A/cs: Sushil Girish |

2,70,000

50,000 1,80,000 4,00,000 3,50,000 |

Cash

Debtors Stock Patents Building |

2,40,000

4,32,000 3,00,000 74,000 2,04,000 |

| 12,50,000 | 12,50,000 |

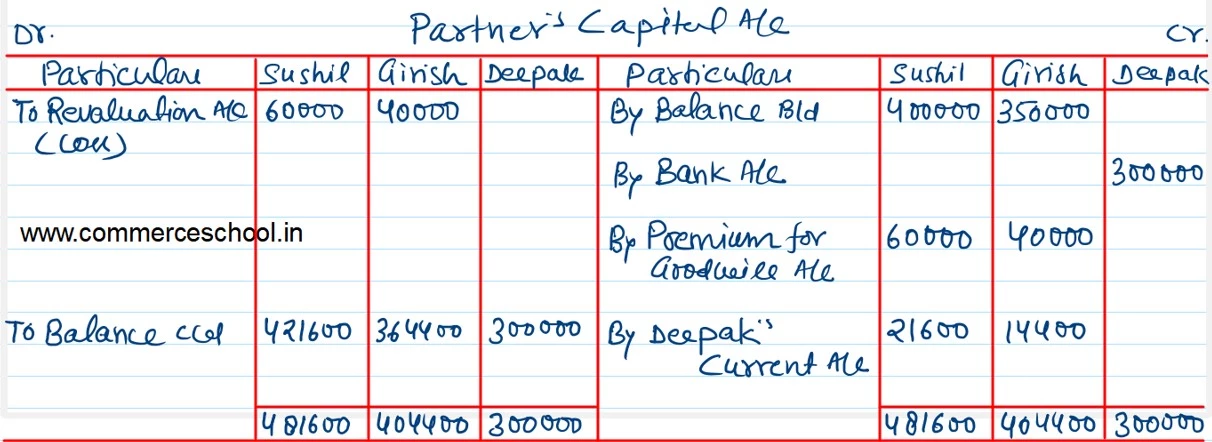

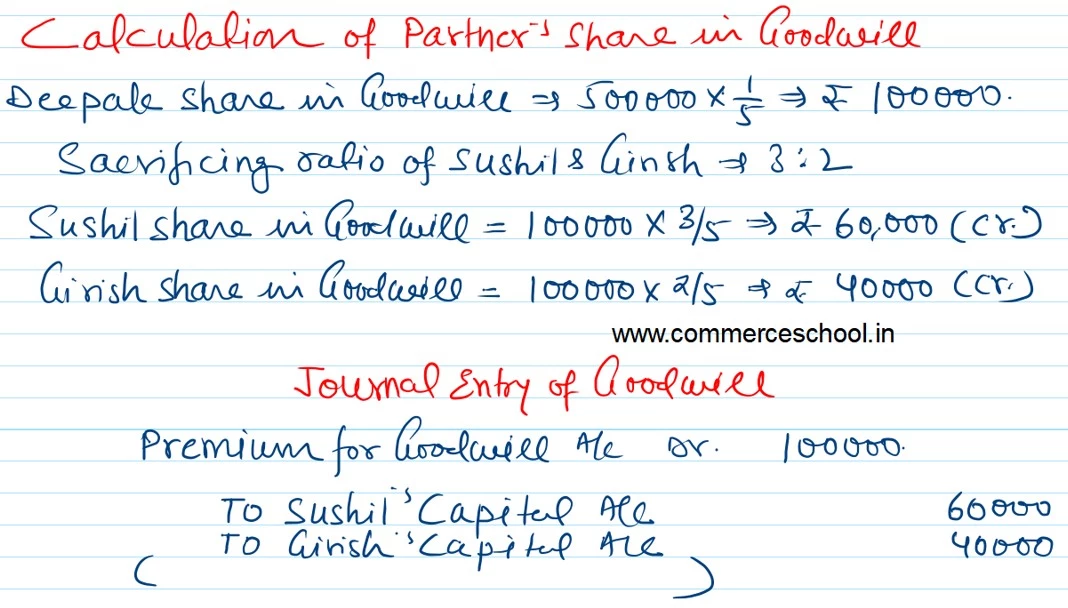

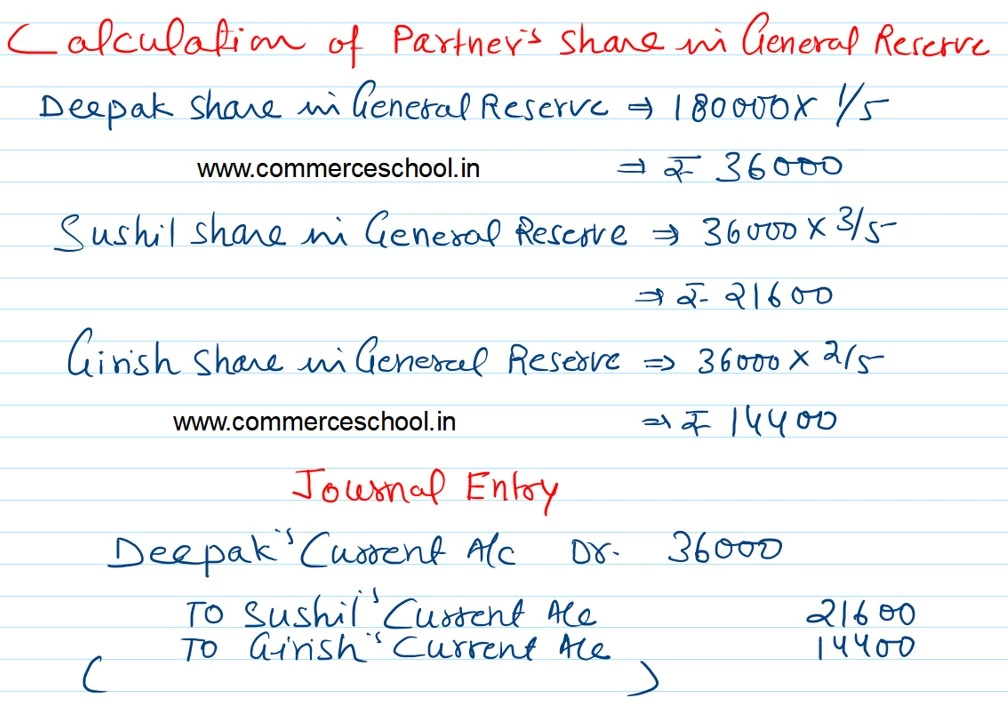

Deepak is admitted into the partnership on 1st April, 2023 giving him 1/5th share in the profits. He is to bring ₹ 3,00,000 as Capital and his share of goodwill subject to the following terms:

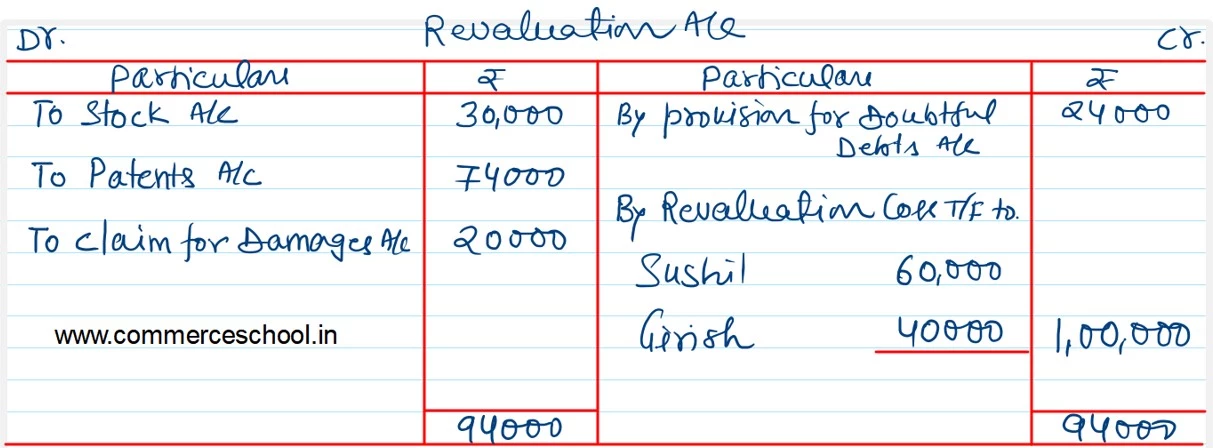

(i) Goodwill of the firm is valued at ₹ 5,00,000.

(ii) Stock to be reduced by 10% and Provision for Doubtfule Debts be reduced by ₹ 24,000.

(iii) Patents are valueless:

(iv) There was a claim against the firm for damages amounted to ₹ 20,000. The Claim has now been accepted.

(v) The partners have decided that General Reserve is to remain undistributed.

Prepare Revaluation Account, Partner’s Capital Accounts and Balance Sheet of the new firm.