Sushil and Satish are partners in a firm sharing profits in the ratio of 3 : 2. Their Balance Sheet as at 31st March, 2023 was as follows:

Sushil and Satish are partners in a firm sharing profits in the ratio of 3 : 2. Their Balance Sheet as at 31st March, 2023 was as follows:

| Liabilities | ₹ | Assets | ₹ | ||

| Outstanding Rent

Creditors Workmen Compensation Reserve Capital A/cs: Sushil Satish |

50,000 60,000

|

13,000 20,000 5,600

1,10,000 |

Cash

Sundry Debtors Stock Profit & Loss A/c Machinery |

80,000

|

10,000 76,000 20,000 4,000 38,600 |

| 1,48,600 | 1,48,600 |

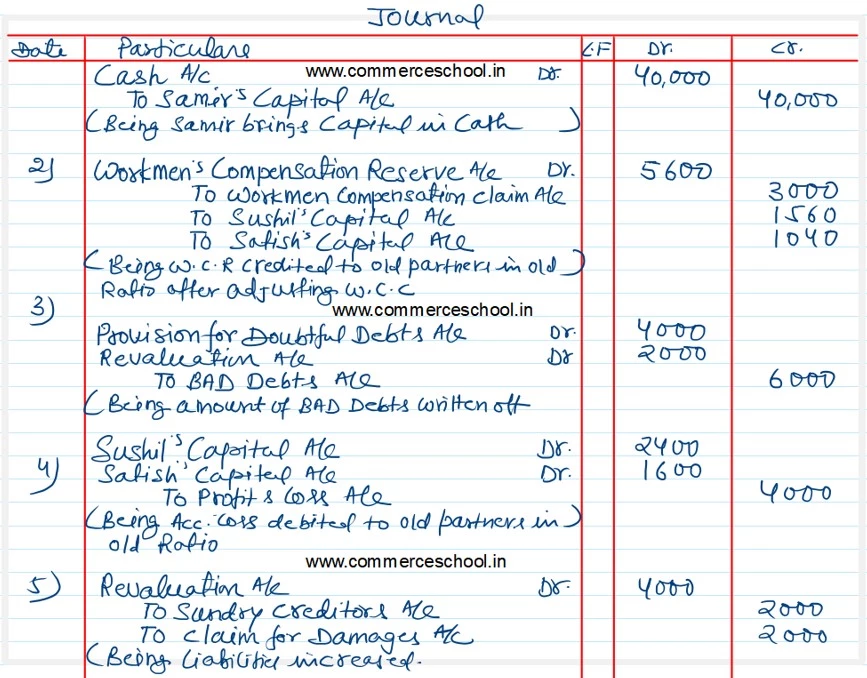

On 1st April 2023, they admitted Samir as a partner on the following terms:

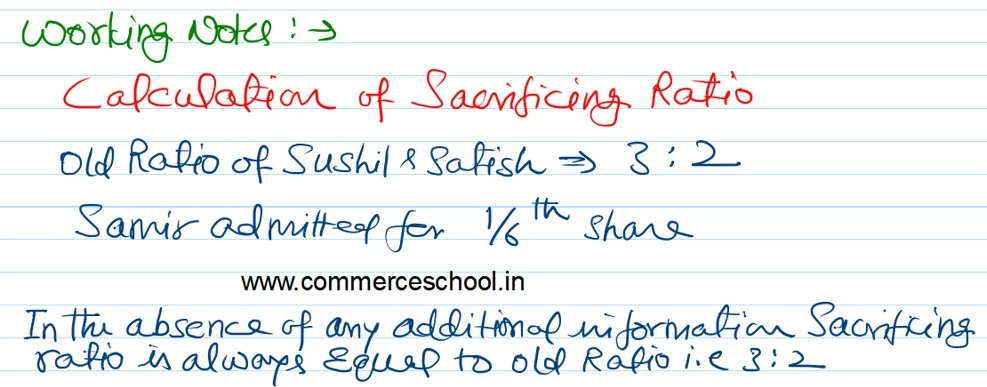

i) Samir will bring ₹ 40,000 through cheque as his share of capital and will be entitled to 1/6th share in the profits.

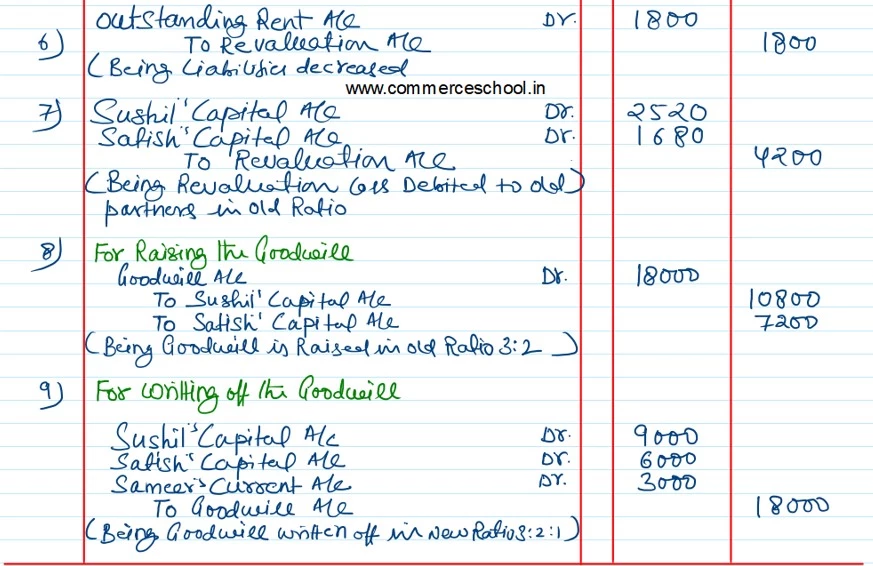

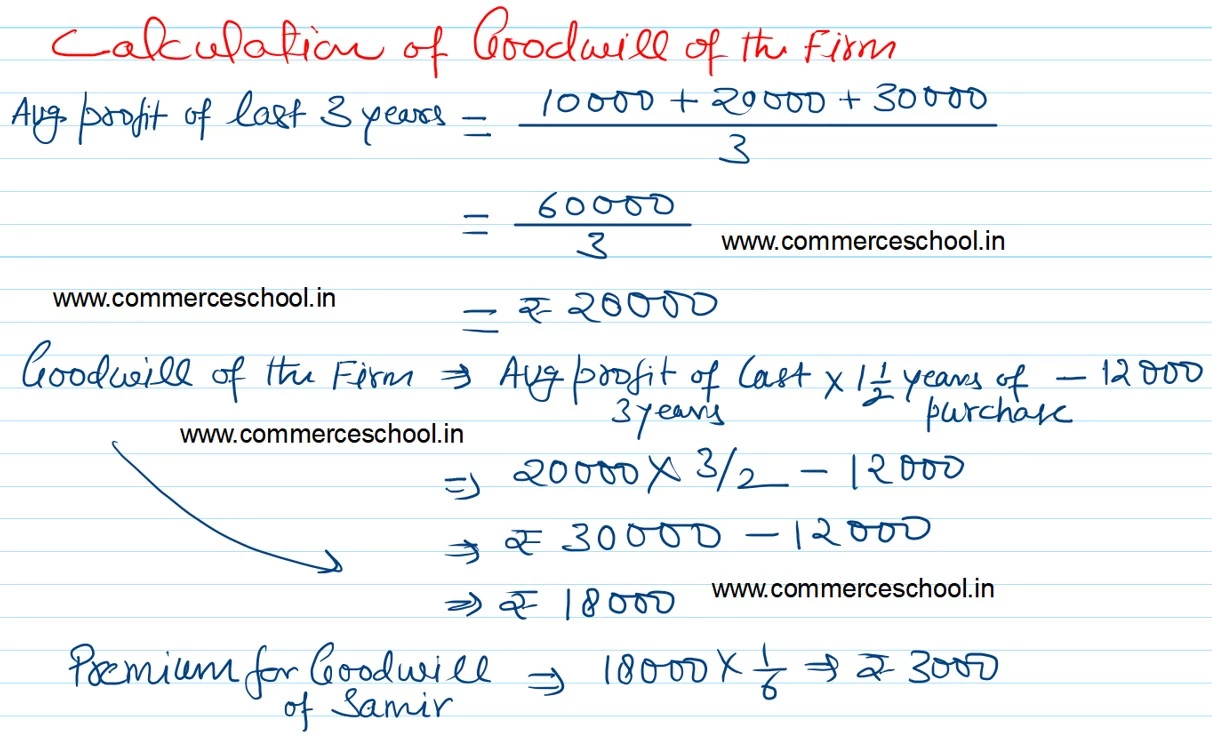

ii) Samir is not to bring goodwill in cash, Sushil and Satish raise the goodwill in the books which is valued at 1 and a half years purchase of the average profit of last 3 years, less ₹ 12,000. Profits for the last 3 years amounted to ₹ 10,000; ₹ 20,000 and ₹ 30,000.

iii) Claim on account of Workmen’s compensation is ₹ 3,000.

iv) To write off Bad Debts of ₹ 6,000.

v) Creditors are to be paid ₹ 2,000 more.

vi) There being a claim against the firm for damages, liabilities to the extent of ₹ 2,000 should be created.

vii) outstanding rent be brought down to ₹ 11,200.

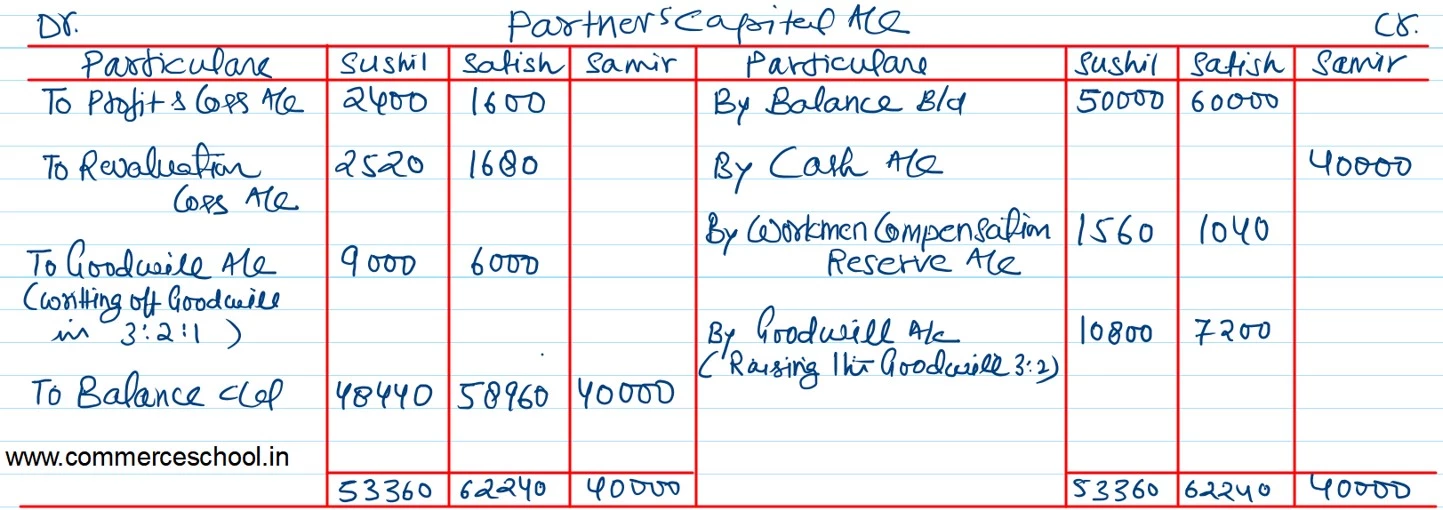

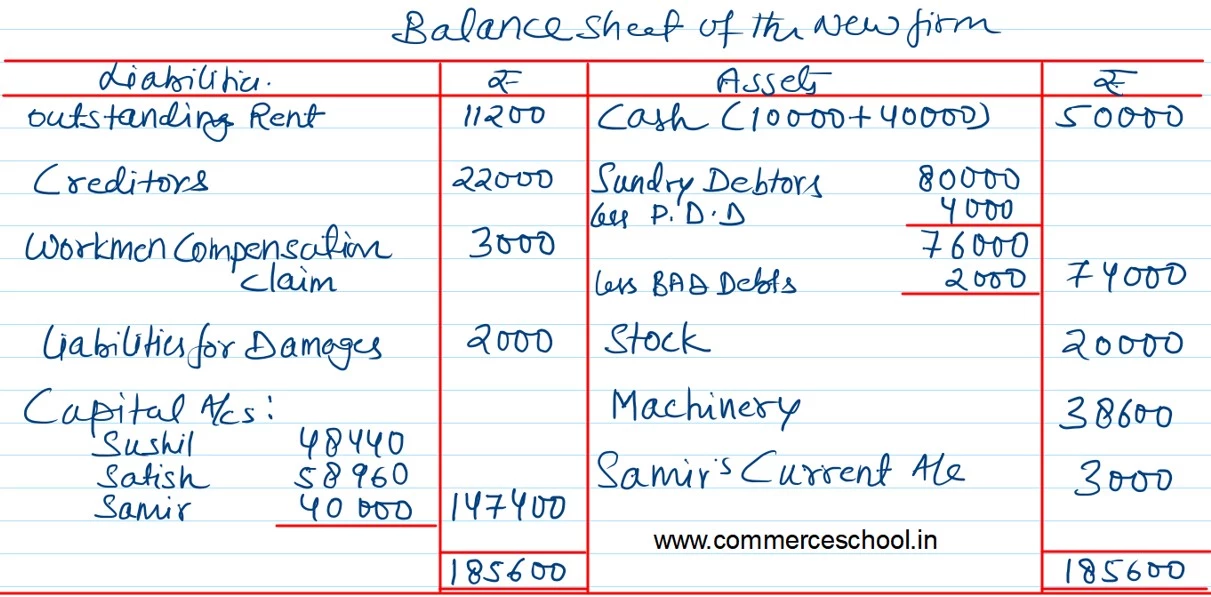

Pass Journal entries, prepare Partner’s Capital Accounts and opening Balance Sheet.