Tejvir started business with cash ₹ 5,00,000. Pass Journal entries for the following transactions:

Pass Journal entries for the following transactions:

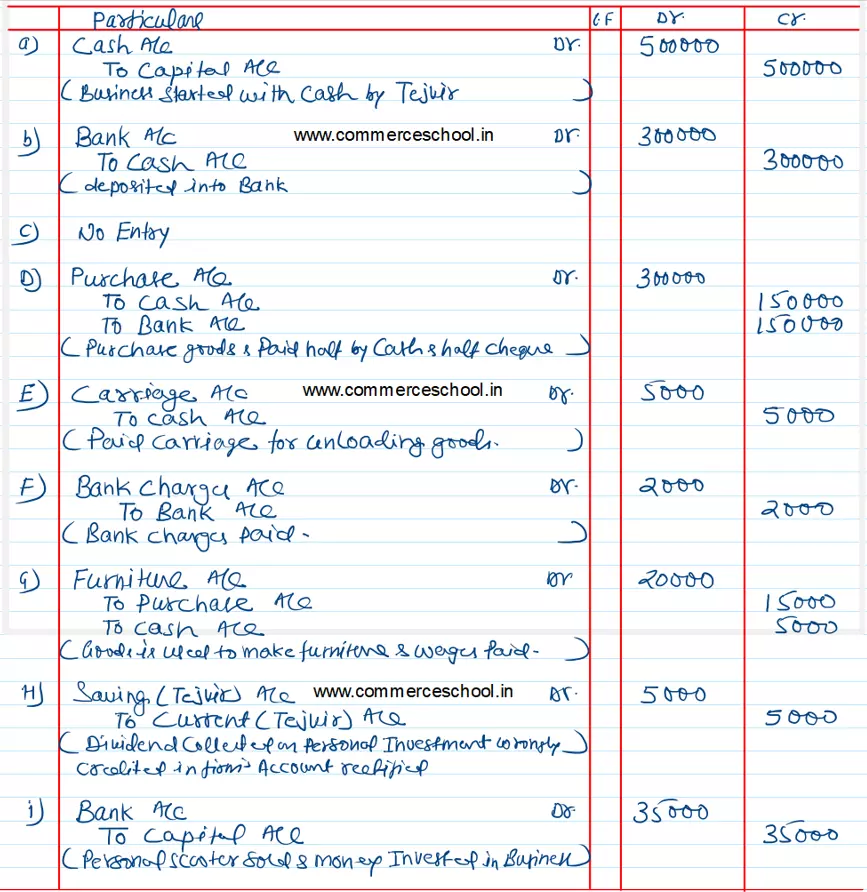

(a) Tejvir started business with cash ₹ 5,00,000.

(b) Opened a bank account depositing ₹ 3,00,000.

(c) Invested in shares (personal) for ₹ 50,000, paid out of Savings Account.

(d) Bought goods (timber) for ₹ 3,00,000, paid half by cash and half by cheque.

(e) Paid carriage for unloading the timber ₹ 5,000.

(f) Bank charges ₹ 2,000.

(g) Goods of ₹ 15,000 were used to make furniture and wages paid ₹ 5,000.

(h) Dividend collected by bank ₹ 5,000 wrongly credited in firm’s account.

(i) Tejvir sold his personal scooter for ₹ 35,000 and deposited the amount in firm’s bank account.

Solution:-

Note:-

(g) expenses incurred against assets purchased or manufactured are debited to the asset A/c. Thus no wages account would be opened for wages paid to the furniture. Expenses account are opened when goods are purchased and for business day to day expenses.

(i) Tejvir has invested in shares for personal purposes. Dividend received against it must be debited to his personal savings account. but it was credited to the firm’s account by mistake. thus a rectification entry would be passed where tejvir savings account would be debited and firm’s current account would be credited.