The Balance Sheet of A Ltd. as at 31.3.2022 and 31.3.2021 were as follows Share Capital ₹ 60,000 Reserve and Surplus ₹ 41,000

The Balance Sheet of A Ltd. as at 31.3.2022 and 31.3.2021 were as follows:

| Particulars | Note. No. | 31st March, 2023 | 31st March, 2022 |

| I. EQUITY AND LIABILITIES: | |||

|

(1) Shareholder’s Funds: (a) Share Capital (b) Reserve and Surplus |

60,000 41,000 |

50,000 46,000 |

|

|

(2) Non-Current Liabilities: Long-term Borrowings |

25,000 | 20,000 | |

|

(3) Current Liabilities (a) Trade Payables (b) Short term Provisions |

12,000 17,000 |

10,000 20,000 |

|

| Total | 1,55,000 | 146,000 | |

| II. ASSETS: | |||

|

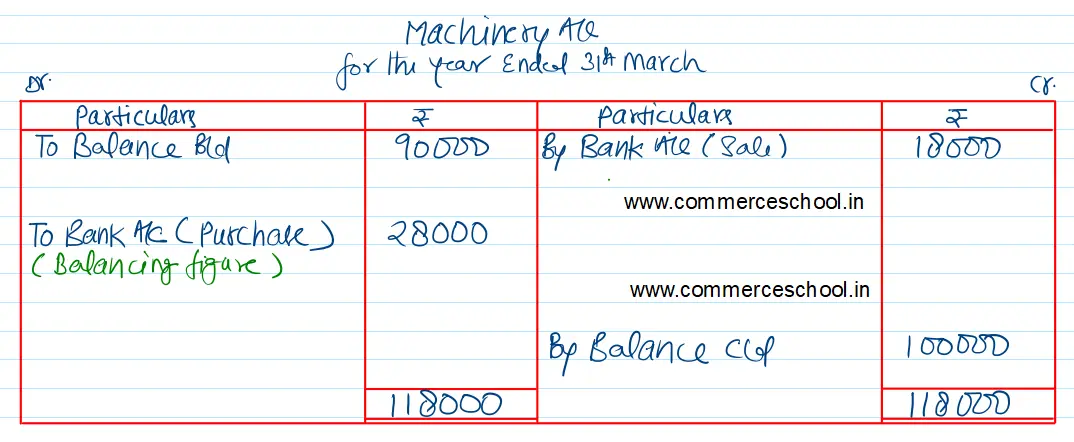

(1) Non-Current Assets: (a) Property, Plant and Equipment and Intangible Assets (i) Property, Plant and Equipment (Machinery) |

1,00,000 | 90,000 | |

|

(2) Current Assets: (a) Inventories (b) Trade Receivables (c) Cash & Cash Equivalents |

24,000 26,000 5,000 |

20,000 32,000 4,000 |

|

| Total | 1,55,000 | 1,46,000 |

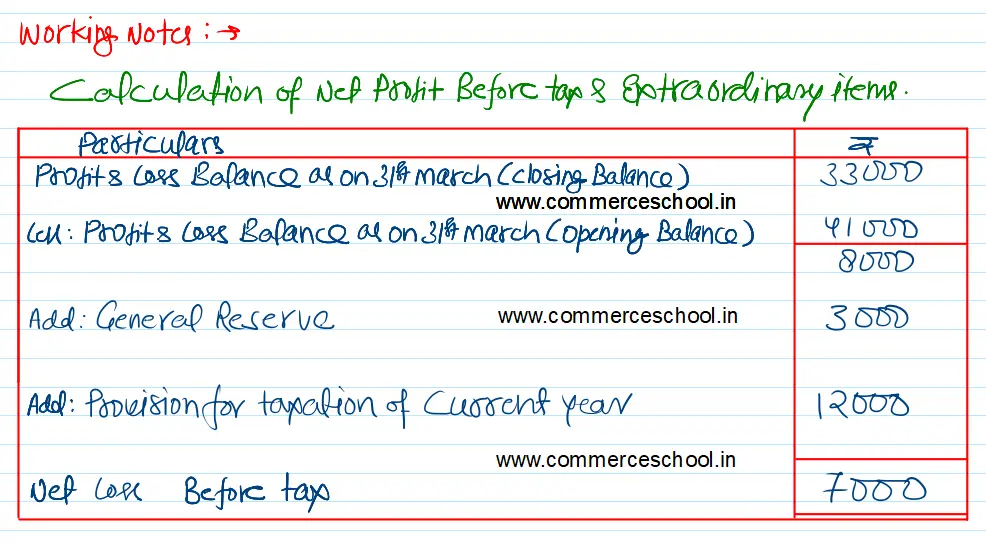

Notes to Accounts:-

| 31.3.2023 | 31.3.2022 | |

|

(1) Reserve & Surplus: General Reserve Profit & Loss Balance |

8,000 33,000 |

5,000 41,000 |

| 41,000 | 46,000 | |

|

(2) Short term Provision: Income Tax Provision |

17,000 | 20,000 |

Additional Information:

(i) Depreciation written off on machinery was ₹ 18,000.

(ii) Interest paid on Long-term Borrowings amounted to ₹ 3,000.

(iii) Income tax of ₹ 15,000 has been paid.

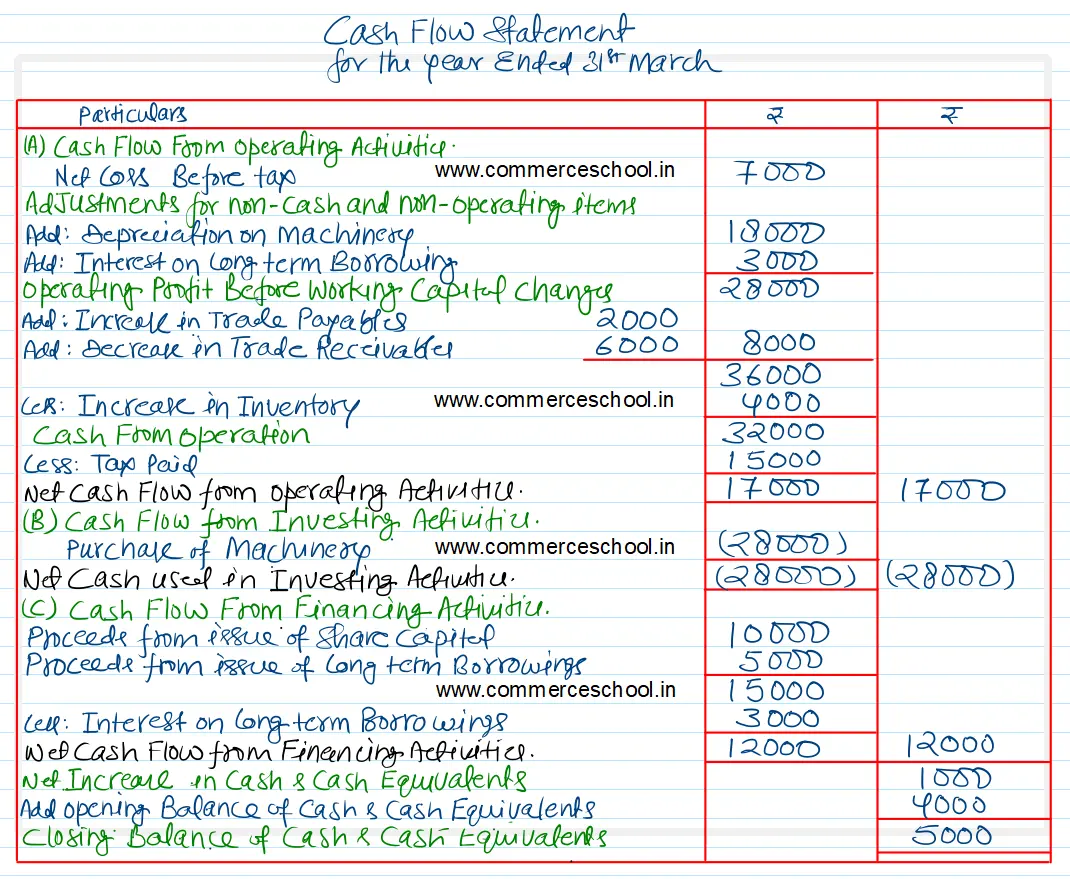

Prepare a Cash Flow Statement.

[Ans. Cash Flow from Operating activities ₹ 17,000; Cash used in investing activities ₹ 28,000; Cash from financing activities ₹ 12,000; Income tax provision made ₹ 12,000.]