The following balances appear in the books of Crystal Ltd. on Jan. 1, 2023: Machinery Account 15,00,000, Provision for depreciation account 5,00,000

The following balances appear in the books of Crystal Ltd. on Jan. 1, 2023:

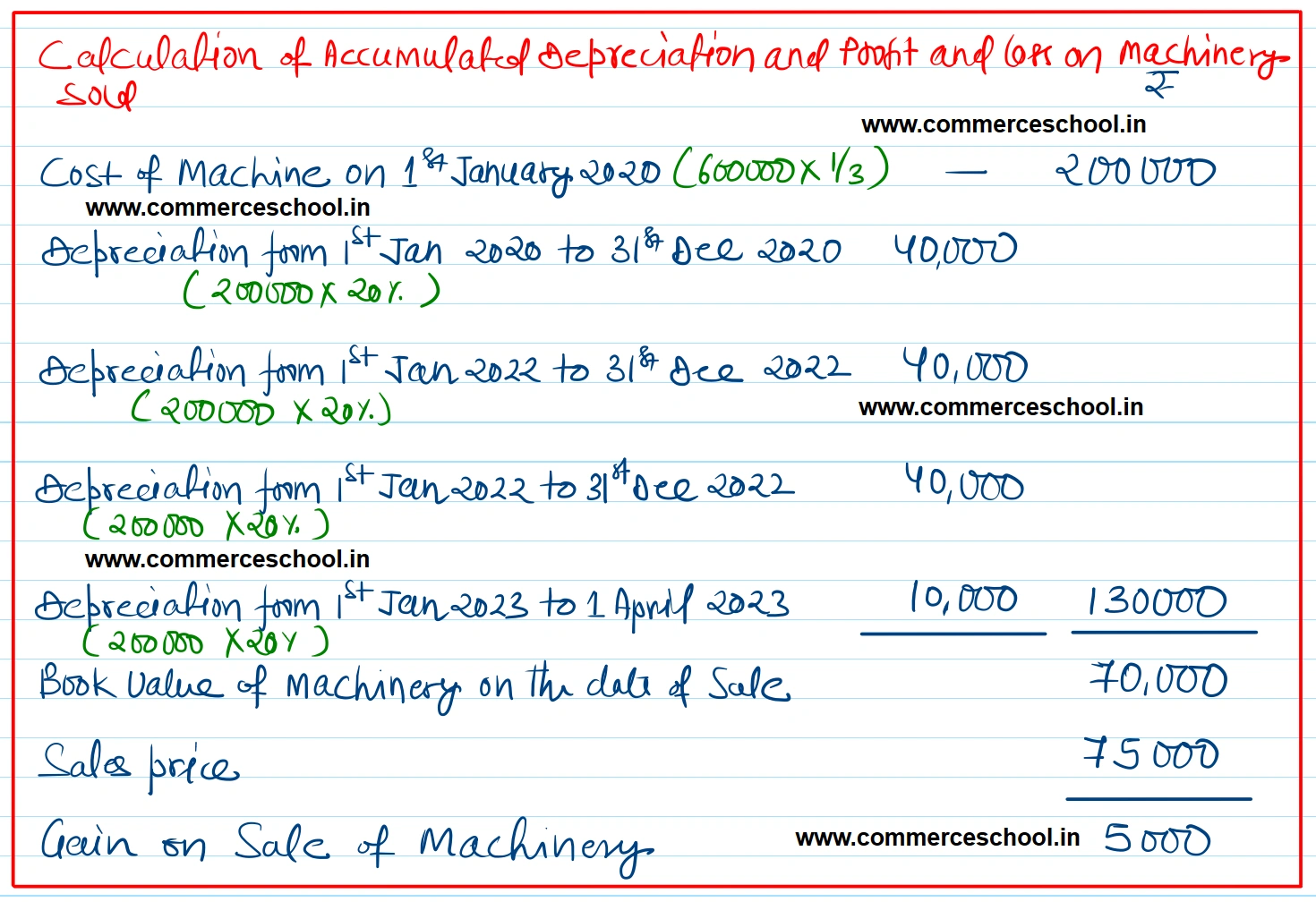

On April 01, 2023 a machinery which was purchased on January 01, 2020 for ₹ 2,00,000 was sold for ₹ 75,000.

A new machine was purchased on July 01, 2023 for ₹ 6,00,000. Depreciation is provided on machinery at 20% p.a. on the Straight line method and books are closed on December 31 every year.

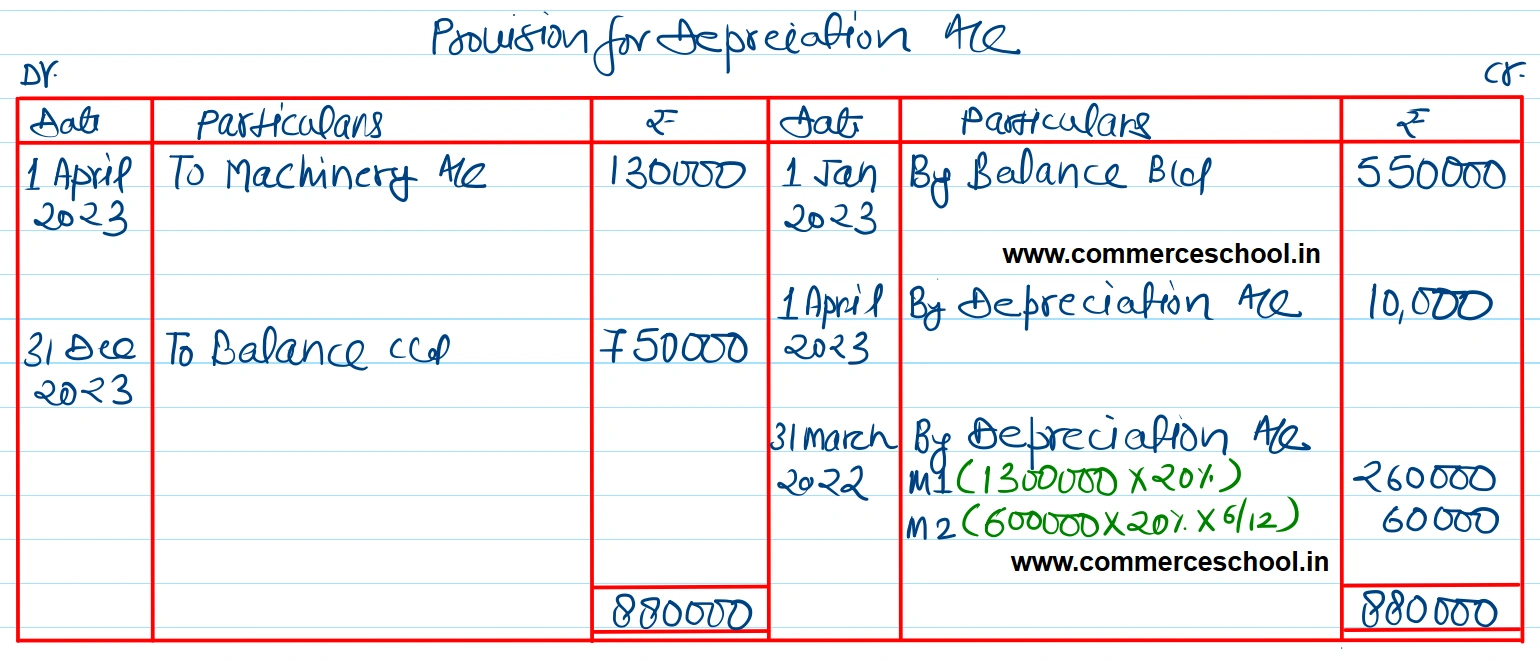

Prepare the machinery account and provision for Depreciation A/c for the year ending December 31, 2023.

[Ans. Gain on Sale of Machinery ₹ 5,000; Balance in Machinery A/c ₹ 19,00,000; Balance in Provision for Depreciation A/c ₹ 7,50,000.]

| ₹ | |

| Machinery Account | 15,00,000 |

| Provision for depreciation account | 5,00,000 |

Anurag Pathak Answered question