The following balances appear in the books of M/s Amrit: On 1st April, 2022, they decided to dispose off a machinery for ₹ 8,400, which was purchased on 1st April, 2018 for ₹ 16,000

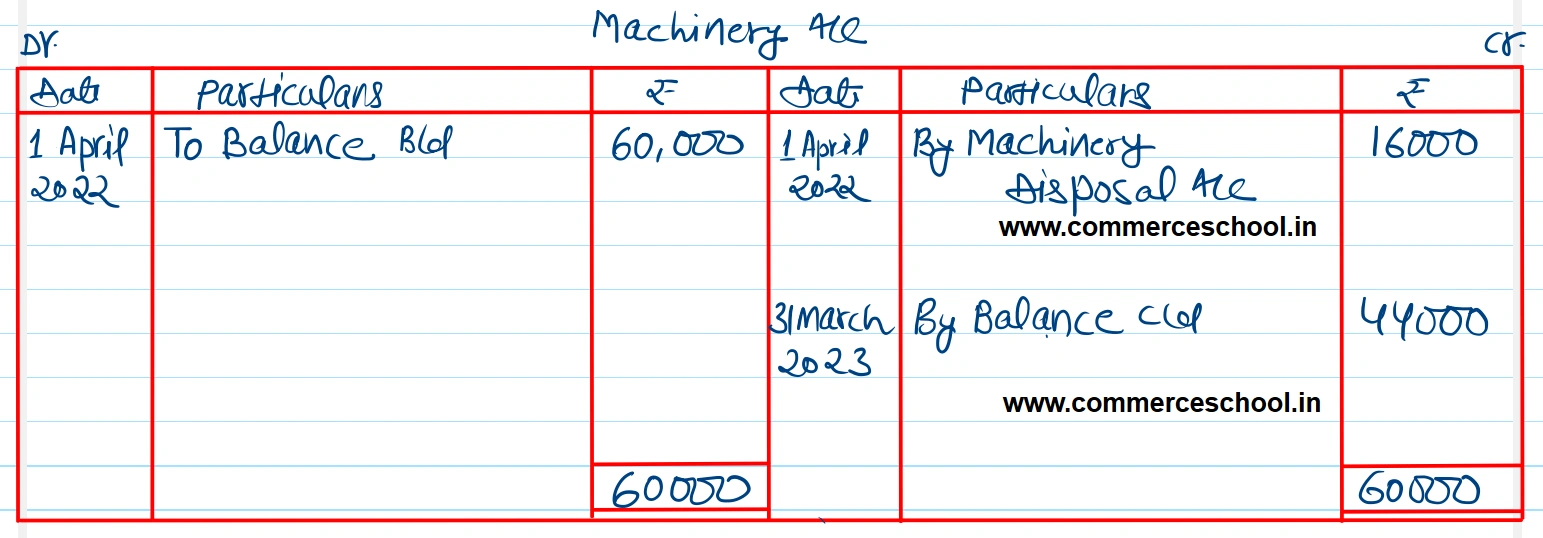

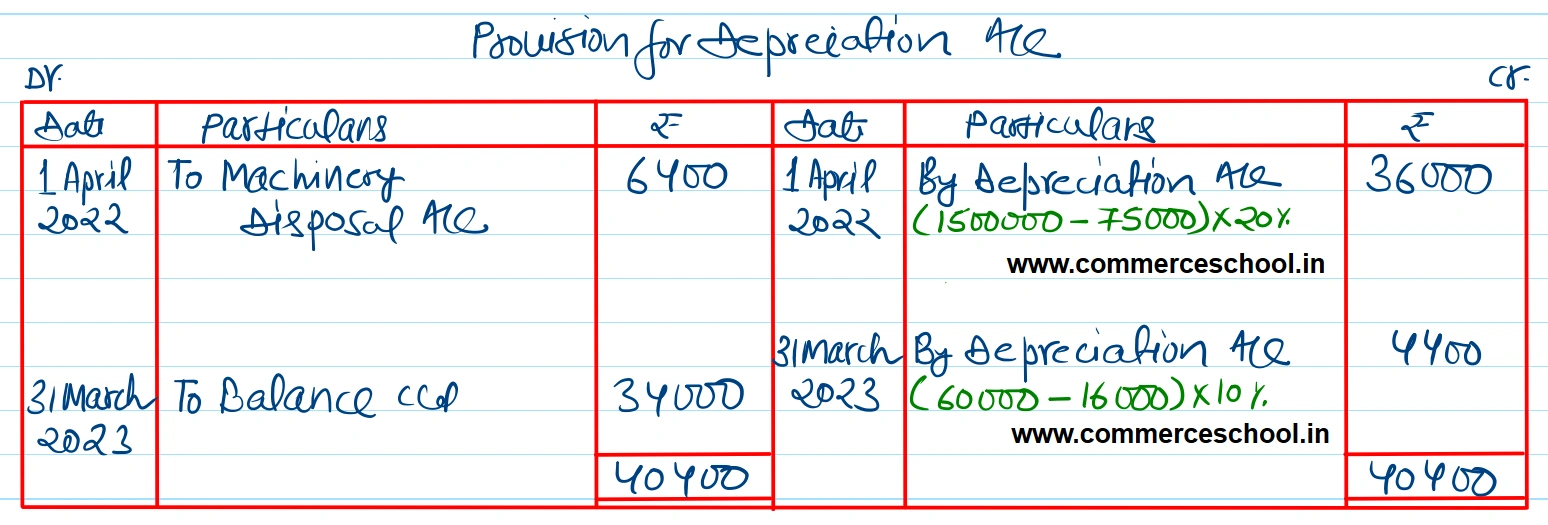

The following balances appear in the books of M/s Amrit:

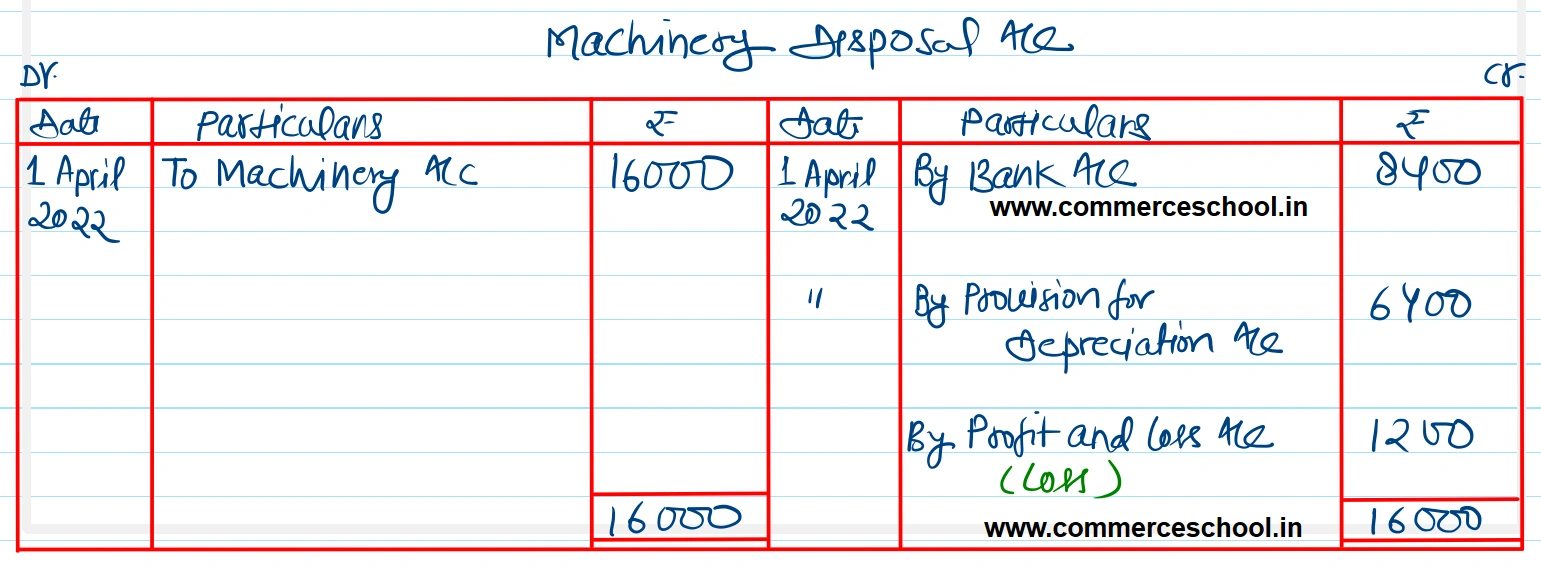

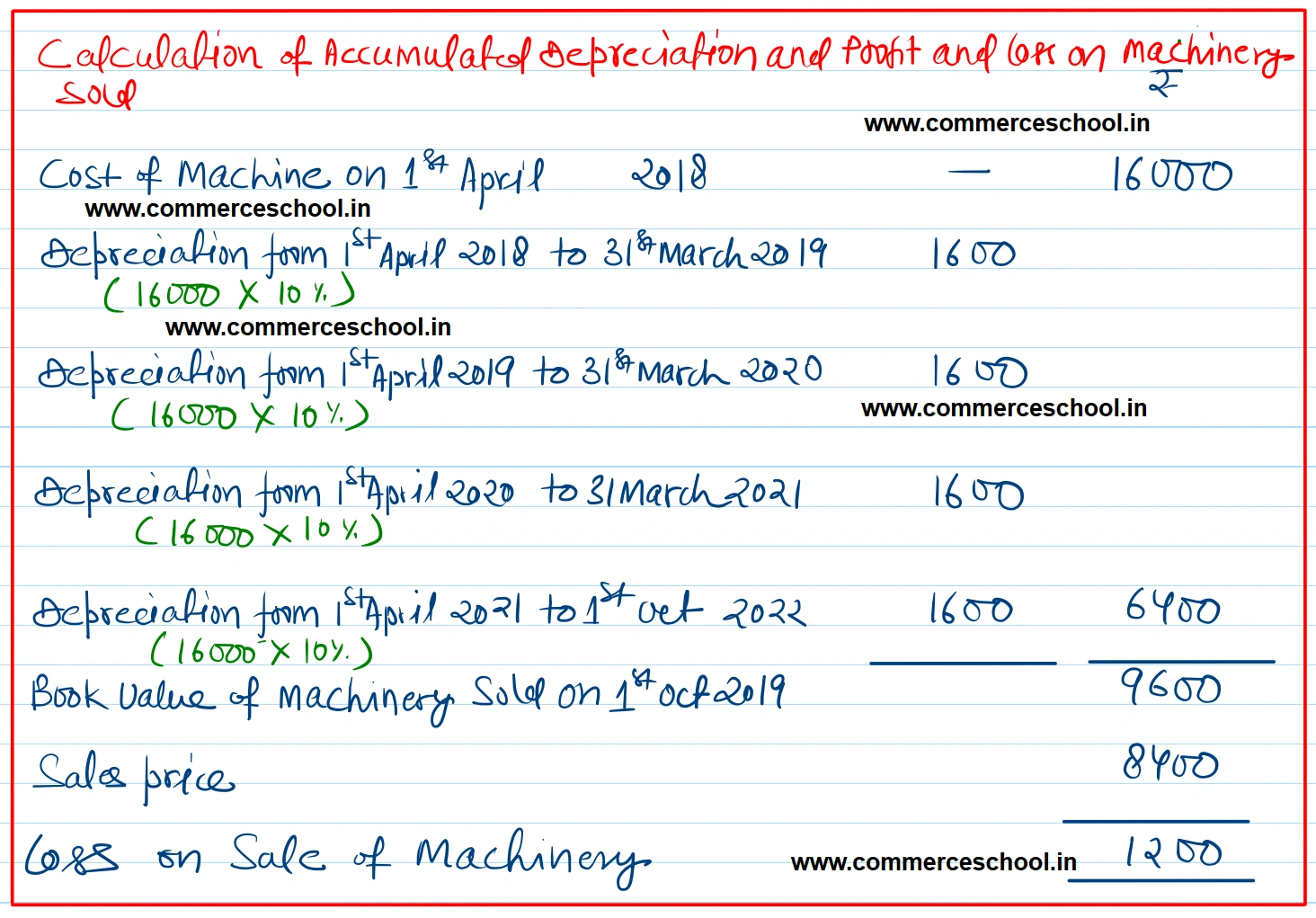

On 1st April, 2022, they decided to dispose off a machinery for ₹ 8,400, which was purchased on 1st April, 2018 for ₹ 16,000.

You are required to prepare Machinery A/c, Provision for Depreciation A/c and Machinery Disposal A/c for 2022-23. Depreciation was charged at 10% p.a. on original cost method.

[Ans. Loss on sale ₹ 1,200; Balance of Machinery A/c ₹ 44,000; Balance of Provision for Depreciation A/c ₹ 34,000.]

Anurag Pathak Answered question