The following balances appeared in Plant Account and Accumulated Depreciation Account in the books of Bharat Ltd

The following balances appeared in Plant Account and Accumulated Depreciation Account in the books of Bharat Ltd.:

Additional Information:

Plant costing ₹ 1,45,000; accumulated depreciation thereon ₹ 70,000, was sold for ₹ 35,000.

You are required to:

(i) Compute the amount of Plant purchased, depreciation charged for the year and loss on sale of plant.

(ii) Show how each of the items related to the plant will be shown in the cash flow statement.

| Balance as at: | 31.3.2021 | 31.3.2022 |

| Plant Accumulated Depreciation | 7,50,000 1,80,000 | 9,70,000 2,40,000 |

Anurag Pathak Answered question

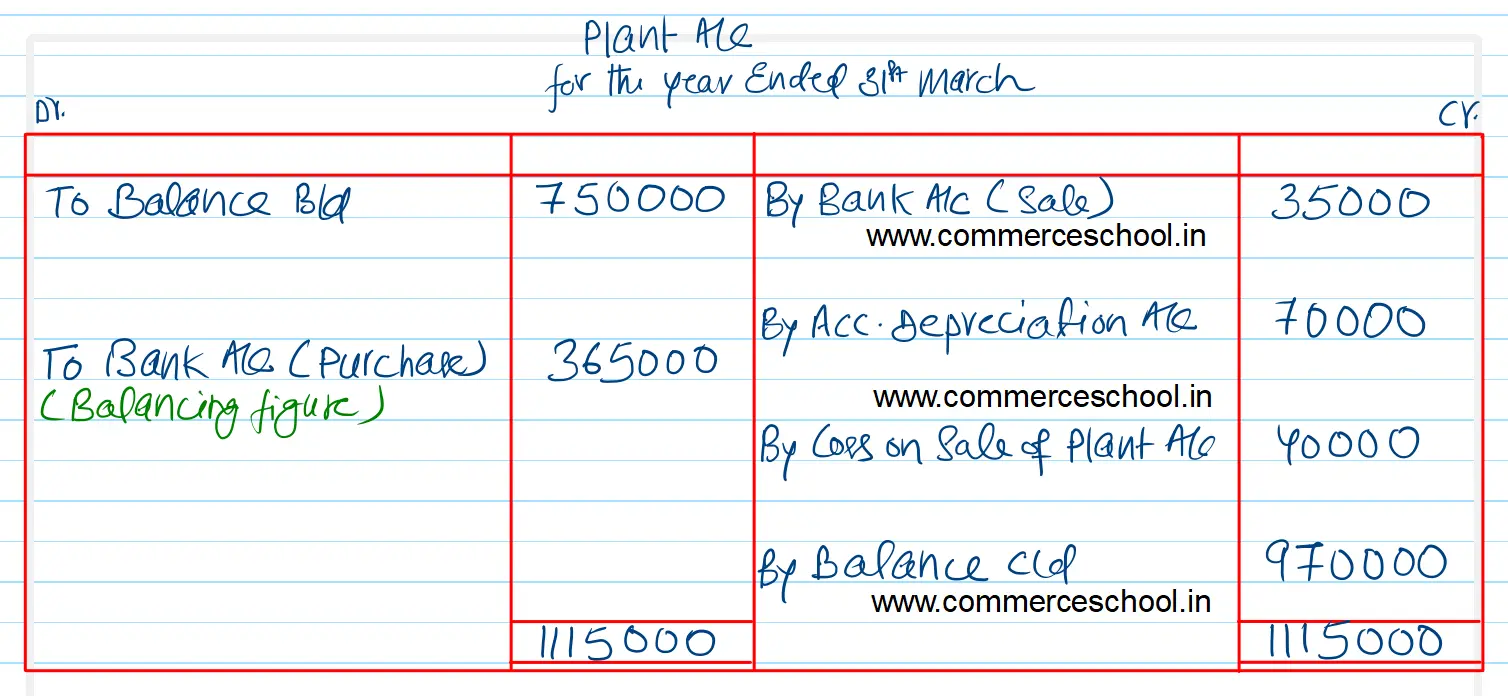

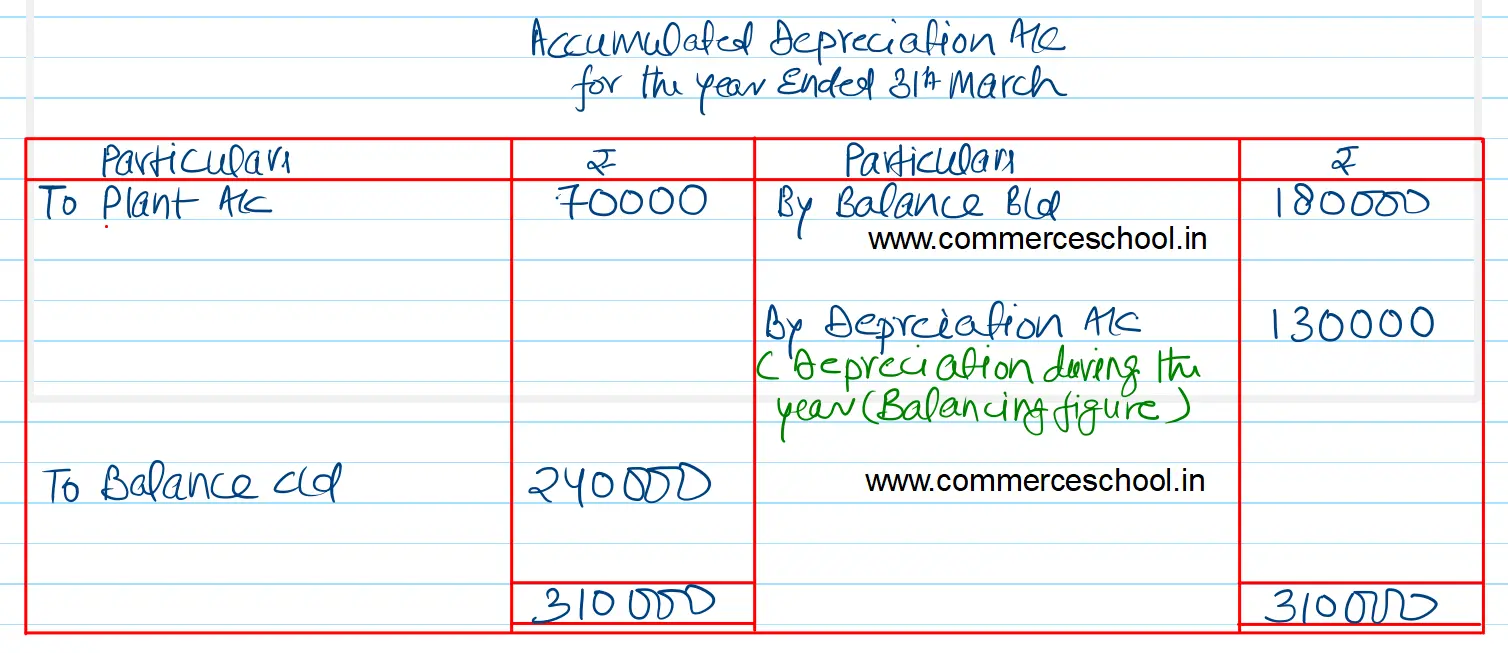

Solution:-

(i) Inflow from sale of plant ₹ 35,000 and outflow on purchase of plant ₹ 3,65,000 will be reported under the ‘Cash flow from investing activities’.

(ii) Loss on sale of plant ₹ 40,000 and current year’s depreciation ₹ 1,30,000 will be added to net profit while computing cash flow from operating activities.

Anurag Pathak Edited answer