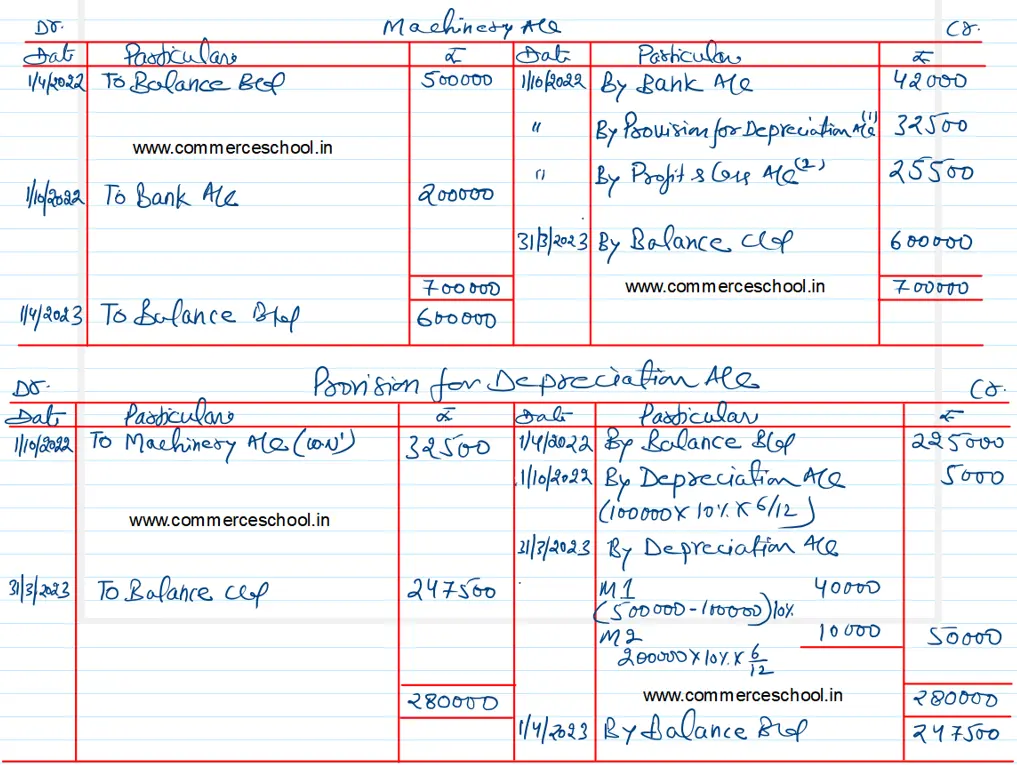

The following balances exist in the books of X Ltd. Machinery Account 5,00,000 Provision for Depreciation Account 2,25,000

The following balances exist in the books of X Ltd.:

| 1st April, 2022 |

Machinery Account Provision for Depreciation Account |

5,00,000 2,25,000 |

The machinery is depreciated @ 10% p.a. by the Fixed Instalment Method, the accounting year being April – March. On 1st October, 2022, a machinery which was purchased on 1st July, 2019 for ₹ 1,00,000 was sold for ₹ 42,000 and on the same date a fresh machine was purchased for ₹ 2,00,000. Prepare Machinery Account and Provision for Depreciation Account for the year 2022-23.

Anurag Pathak Changed status to publish