The following balances were extracted from the books of Mr. Din Dayal as at 31st March, 2023 Stock at the beginning ₹ 41,000 Rent ₹ 9,600

The following balances were extracted from the books of Mr. Din Dayal as at 31st March, 2023:

| Particulars | ₹ | Particulars | ₹ |

| Stock at the beginning | 41,000 | Purchases | 2,20,000 |

| Rent | 9,600 | Sales | 2,80,000 |

| Salary | 20,000 | Returns (Dr.) | 6,000 |

| Bad-debts | 400 | Returns (Cr.) | 2,000 |

| Proivision for Doubtful Debts | 3,000 | Carriage Inward | 3,500 |

| Travelling Expenses | 1,400 | Carriage Outward | 500 |

| Insurance Premium | 1,800 | Capital | 1,75,000 |

| Proprietor’s Withdrawals | 4,000 | Loan (Cr.) | 20,000 |

| Telephone Charges | 7,300 | Debtors | 40,000 |

| Printing and Advertising | 5,000 | Creditors | 27,000 |

| Commission (Cr.) | 6,000 | Investments | 5,000 |

| Rent from Sublet | 4,800 | Interest on Investments | 600 |

| Land and Building | 1,40,000 | ||

| Furniture | 10,000 | ||

| Cash | 2,900 |

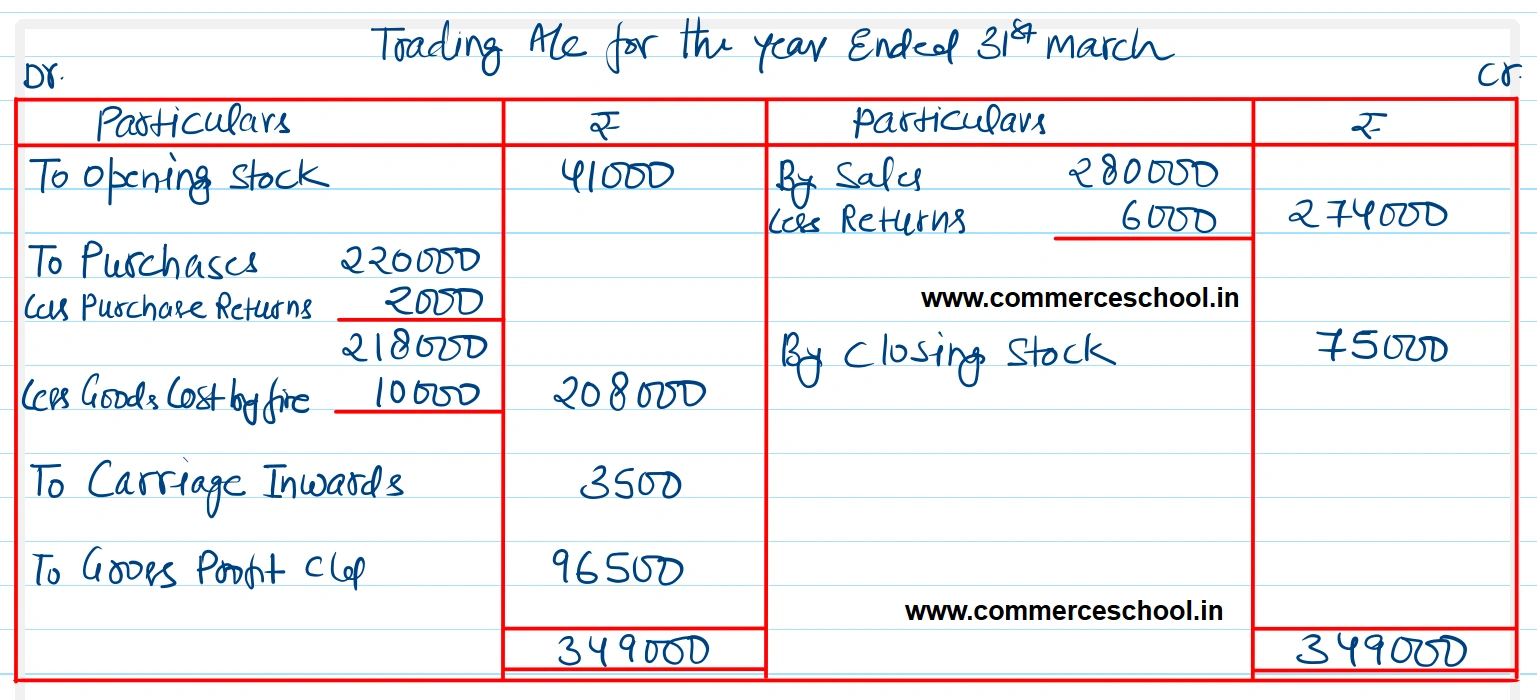

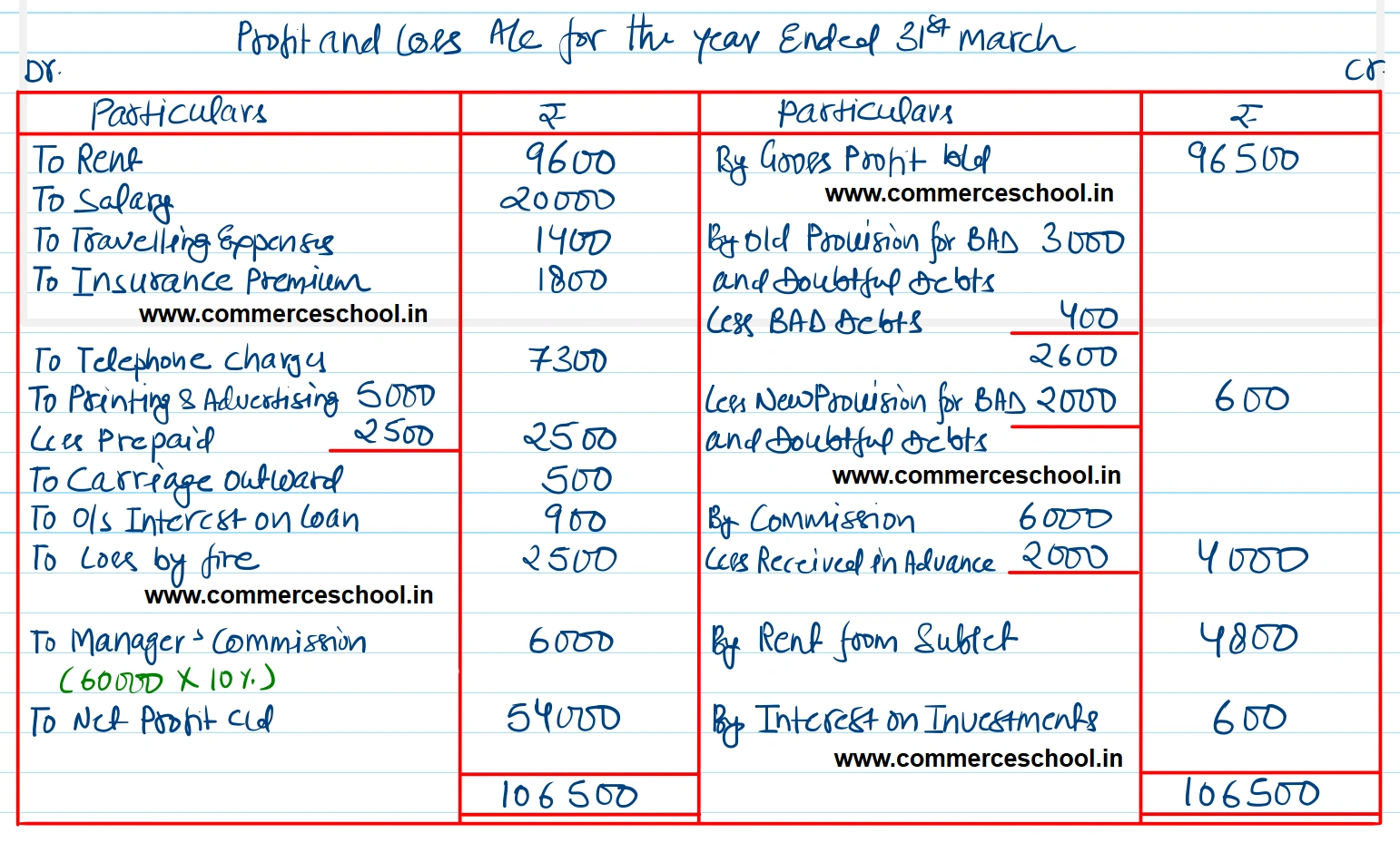

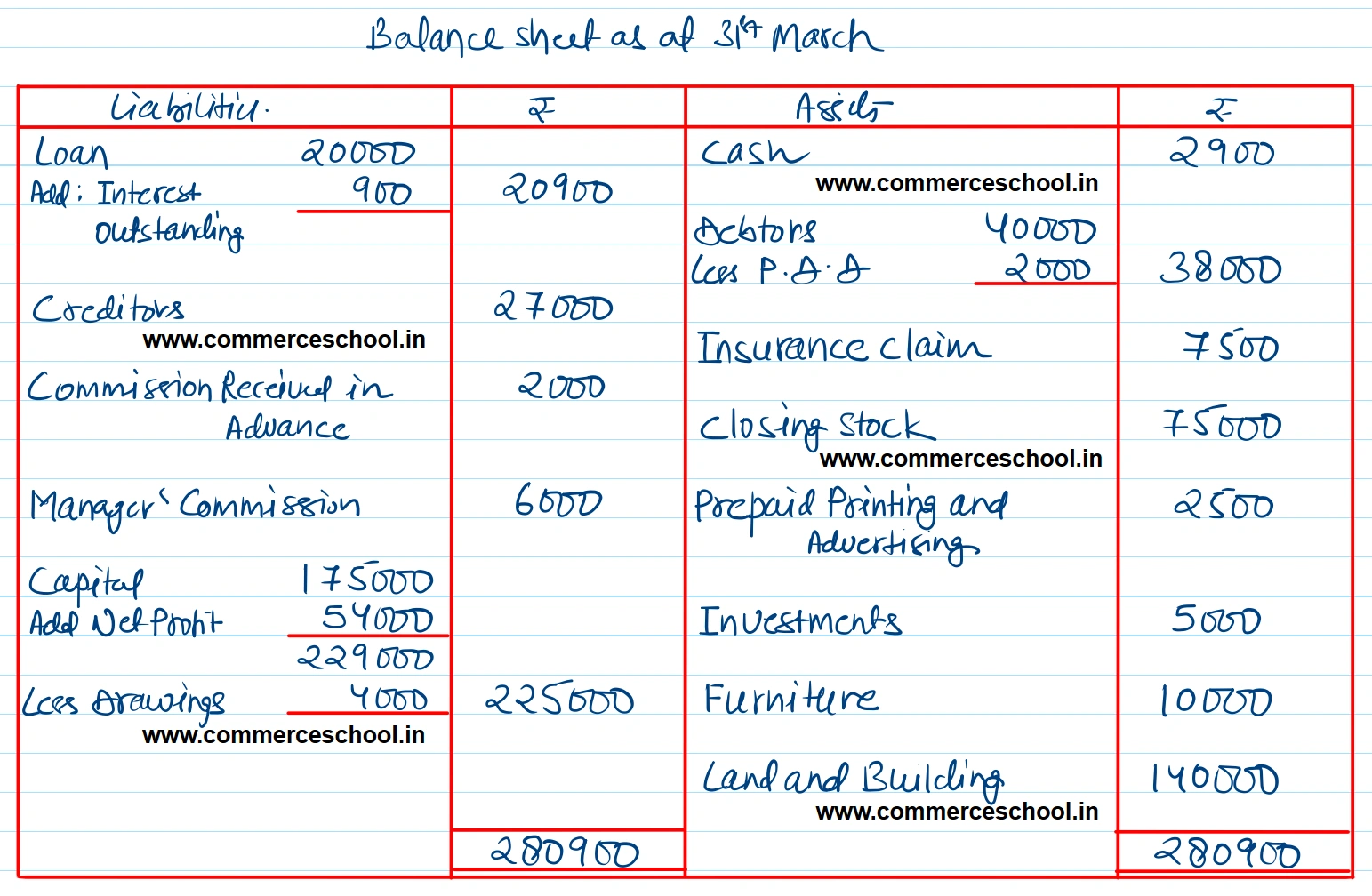

Prepare Trading and Profit & Loss Account for the year and a Balance Sheet as at 31st March, 2023, after taking into account the following:

(1) Stock was valued at ₹ 75,000 on 31st March, 2023. You are informed that a fire occured on 28th March, 2023 in the godown and stock of the value of ₹ 10,000 was destroyed. Insurance Company admitted a claim of 75%.

(2) One-third of the commission received is in respect of work to be done next year.

(3) Create a provision of 5% for Doubtful Debts.

(4) 50% of Printing and Advertising is to be carried forward as a chrage in the following year.

(5) ₹ 900 is due for interest on loan.

(6) Provide for Manager’s Commission at 10% on Net Profit before charging such commission.

[Ans. Gross Profit ₹ 96,500; Net Profit ₹ 54,000; Balance Sheet Total ₹ 2,80,900.]

Solution:-