The following balances were taken from the books of Shri R. Lal as at 31st March, 2023 Capital ₹ 1,00,000 Drawing ₹ 17,600

The following balances were taken from the books of Shri R. Lal as at 31st March, 2023:

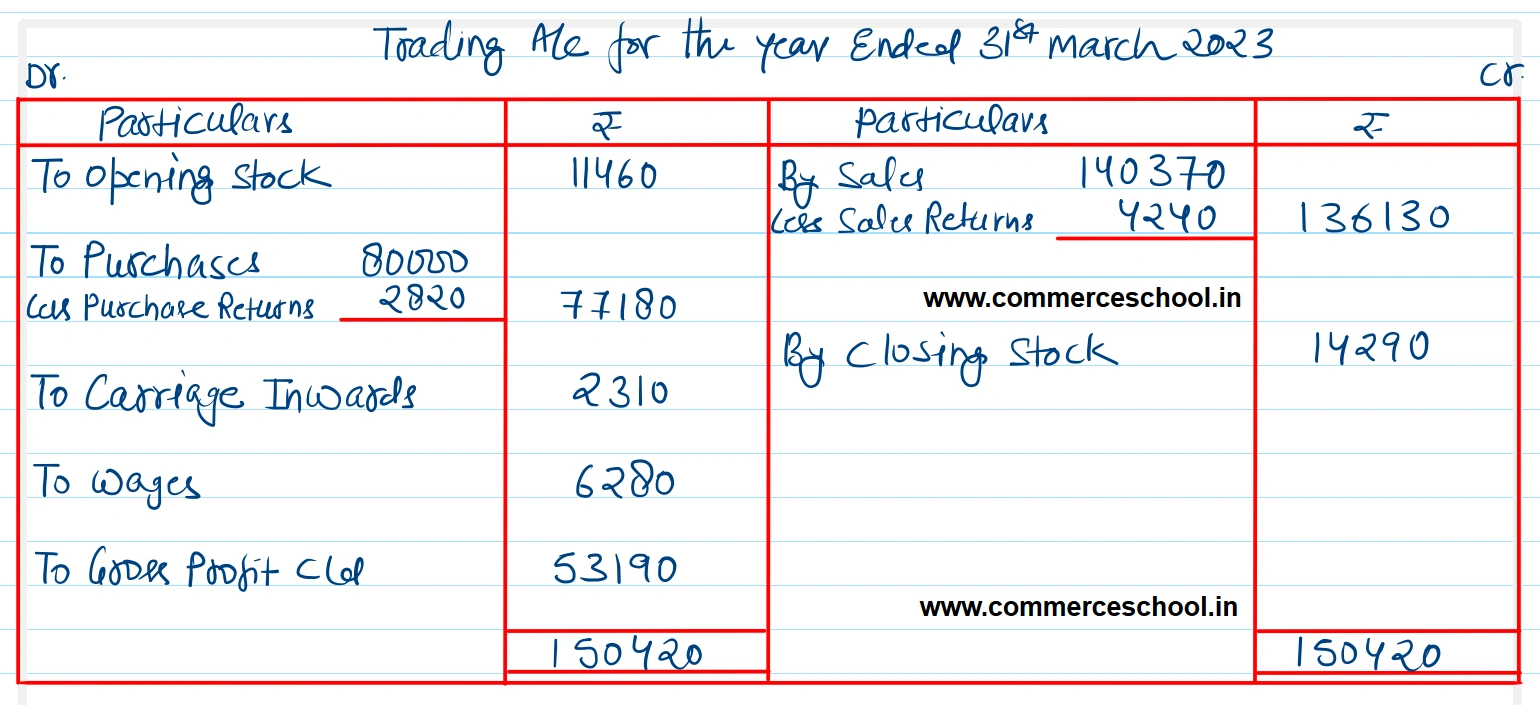

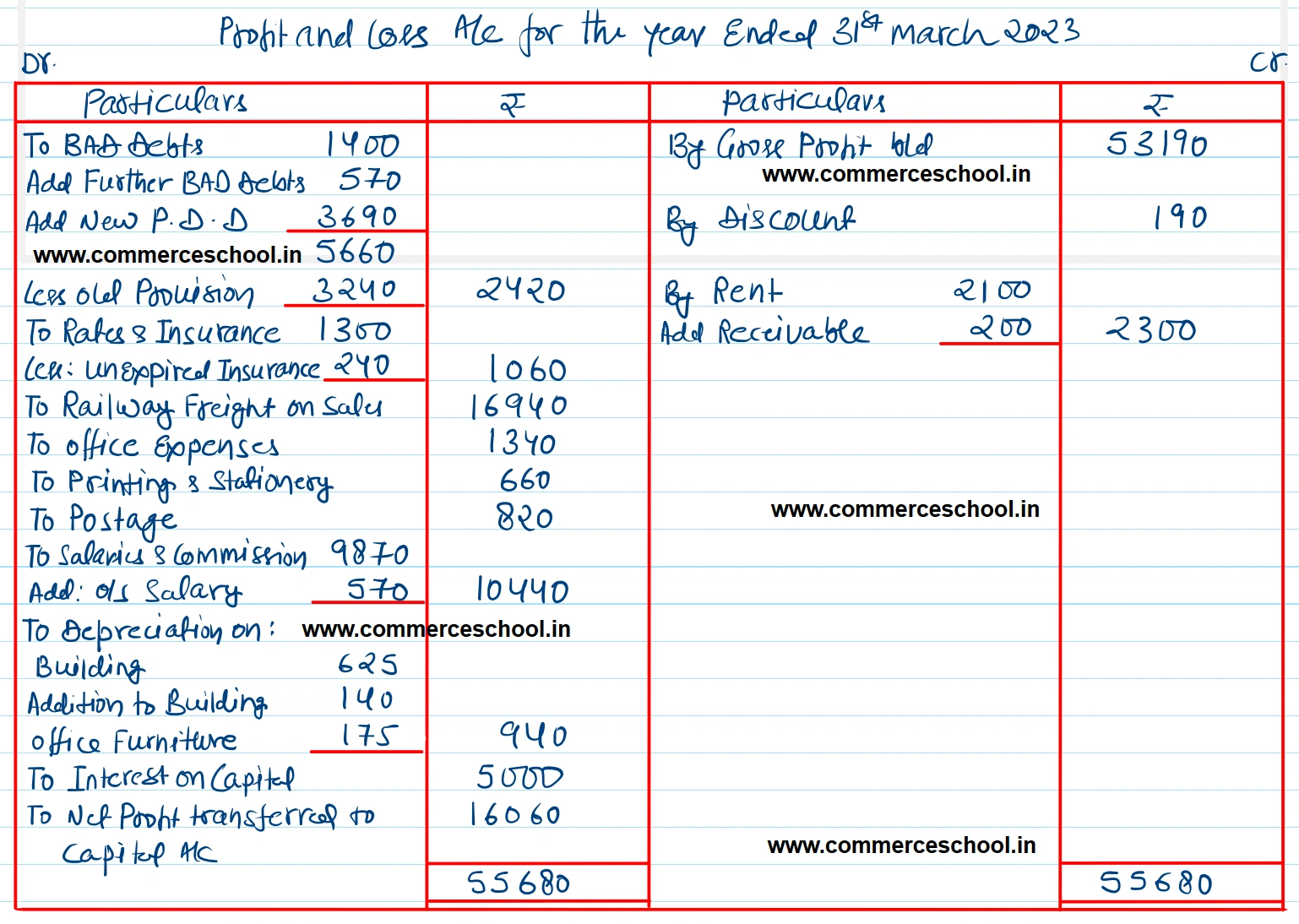

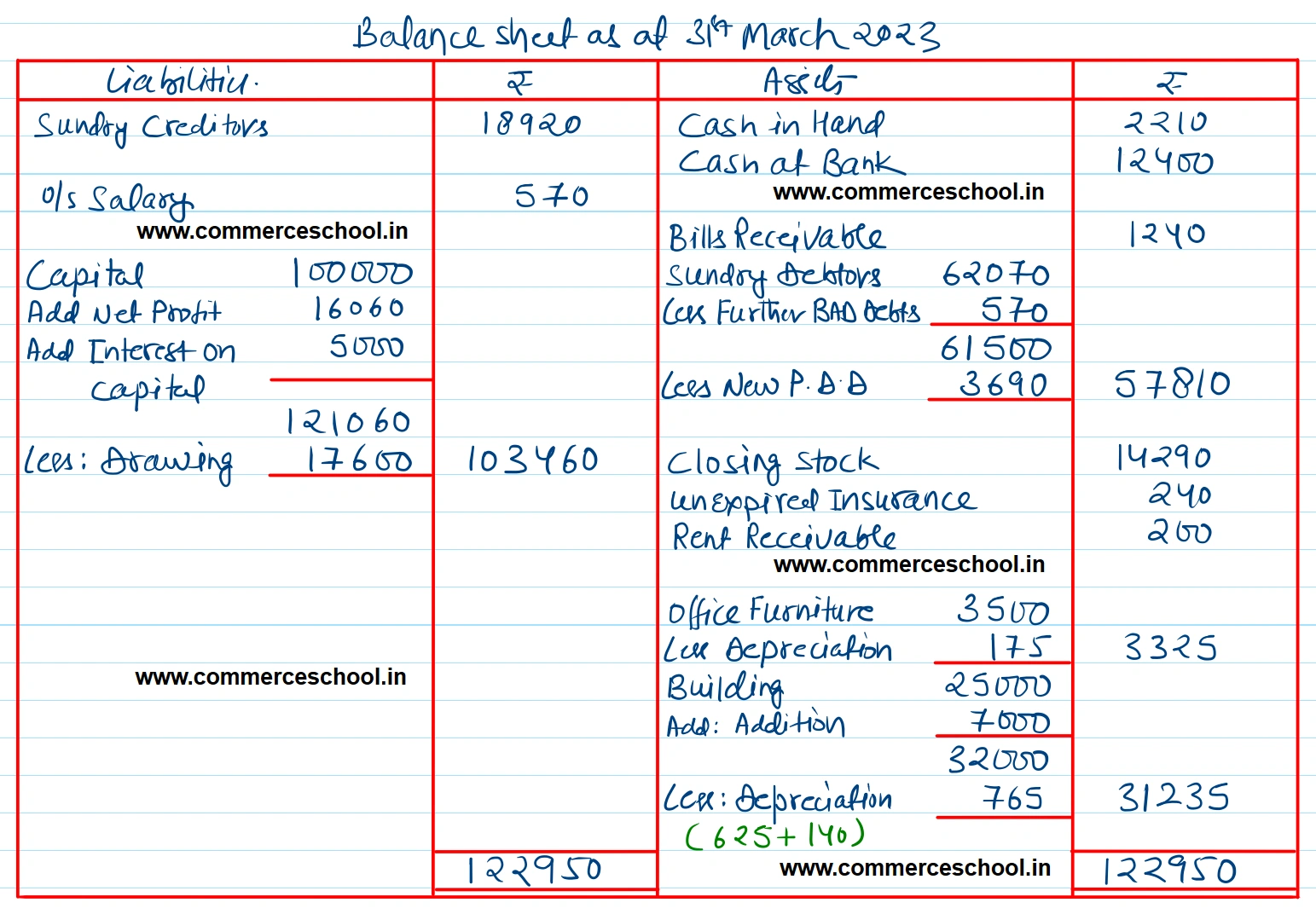

Prepare Trading and Profit & Loss A/c and a Balance Sheet as at 31st March, 2023, after keeping in view the following adjustments:

(i) Depreciate old Building at 21/2% and addition to Building at 2% and Office Furniture at 5%.

(ii) Write off further Bad-debts ₹ 570.

(iii) Increase the Bad-debts Provision to 6% of Debtors.

(iv) On 31st March, 2023 ₹ 570 are outstanding for salary.

(v) Rent receivable ₹ 200 on 31st March, 2023.

(vi) Interest on capital at 5% to be charged.

(vii) unexpired Insurance ₹ 240.

(viii) Stock was valued at ₹ 14,290 on 31st March, 2023.

[Ans. Gross Profit ₹ 53,190; Net Profit ₹ 16,060; Balance Sheet Total ₹ 1,22,950.]

Solution:-

| Particulars | ₹ | Particulars | ₹ |

| Capital | 1,00,000 | Rent (Cr.) | 2,100 |

| Drawing | 17,600 | Railway Freight on sales | 16,940 |

| Purchases | 80,000 | Carriage Inwards | 2,310 |

| Sales | 1,40,370 | Office Expenses | 1,340 |

| Purchase Returns | 2,820 | Printing & Stationery | 660 |

| Stock on 1.4.2022 | 11,460 | Postage | 820 |

| Bad Debts | 1,400 | Sundry Debtors | 62,070 |

| Bad Debts Provision on 1.4.2022 | 3,240 | Sundry Creditors | 18,920 |

| Rates & Insurance | 1,300 | Cash at Bank | 12,400 |

| Discount (Cr.) | 190 | Cash in Hand | 2,210 |

| Bills Receivable | 1,240 | Office Furniture | 3,500 |

| Sales Returns | 4,240 | Salaries & Comission | 9,870 |

| Wages | 6,280 | Addition to Building | 7,000 |

| Building | 25,000 |

Anurag Pathak Answered question