The following information relates to a partnership firm: (a) Sundry Assets of the firm ₹ 6,80,000. Outside Liabilities ₹ 60,000.

The following information relates to a partnership firm:

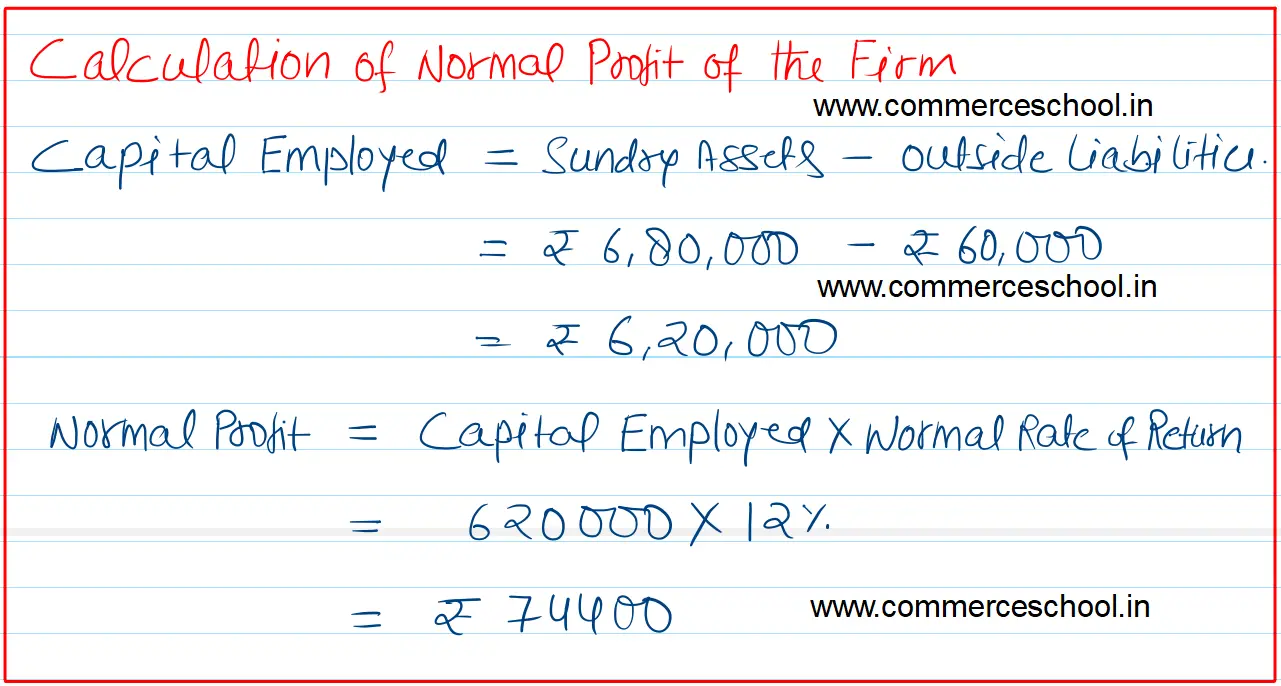

(a) Sundry Assets of the firm ₹ 6,80,000. Outside Liabilities ₹ 60,000.

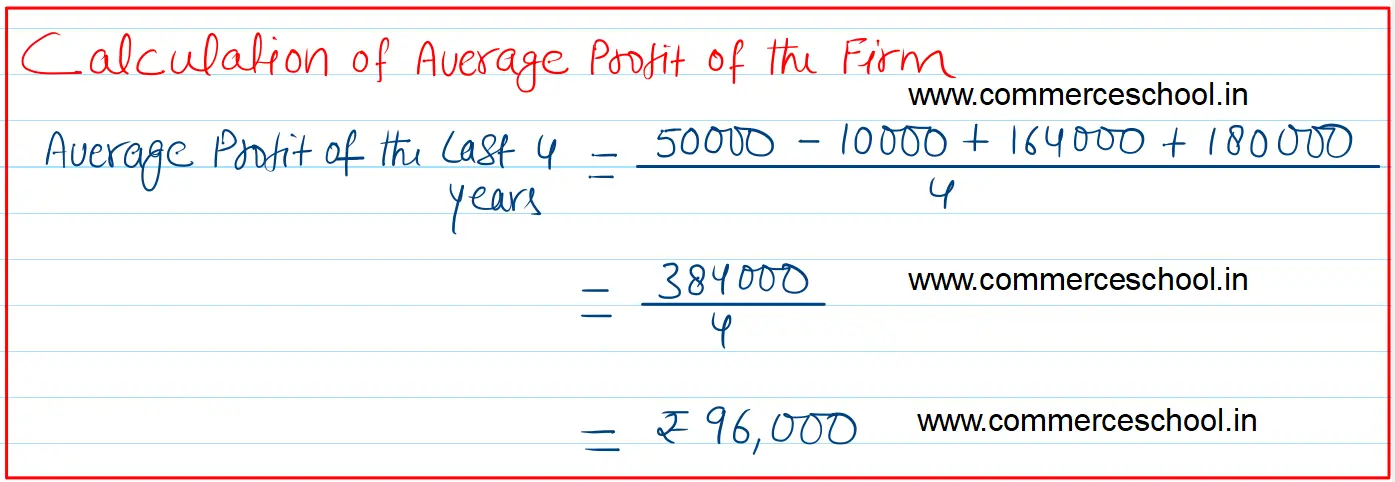

(b) Profits and losses for the past years : Profit 2021 ₹ 50,000; Loss 2022 ₹ 10,000; Profit 2023 ₹ 1,64,000 and Profit 2024 ₹ 1,80,000.

(c) The normal rate of return in a similar type of business is 12%.

Calculate the value of goodwill on the basis of:

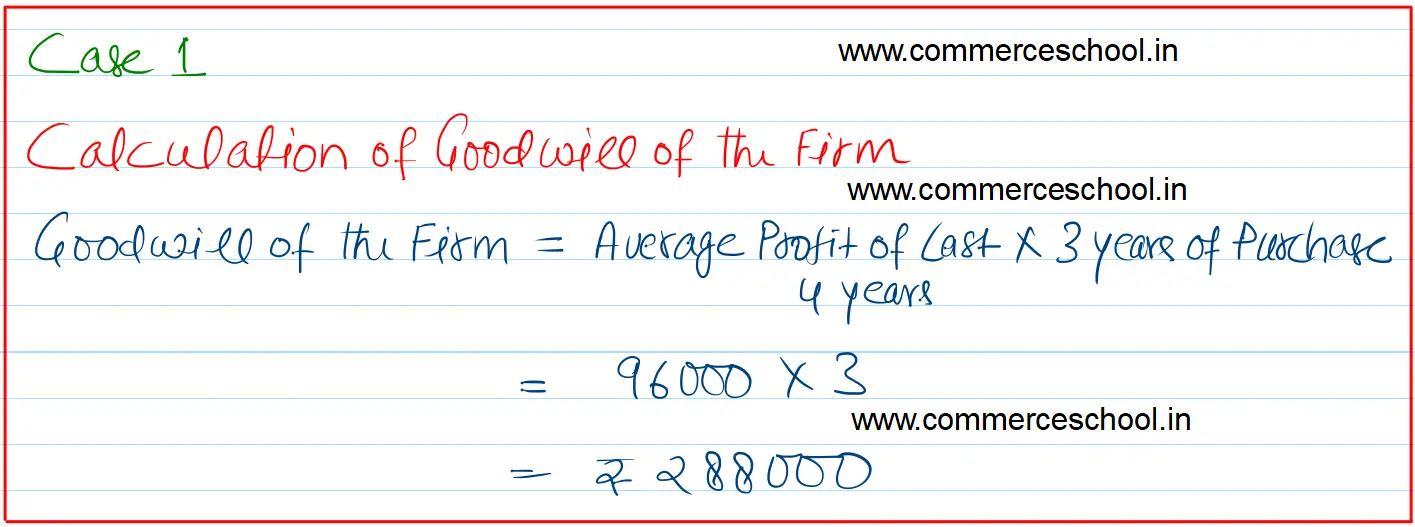

(i) Three year’s purchase of average profits.

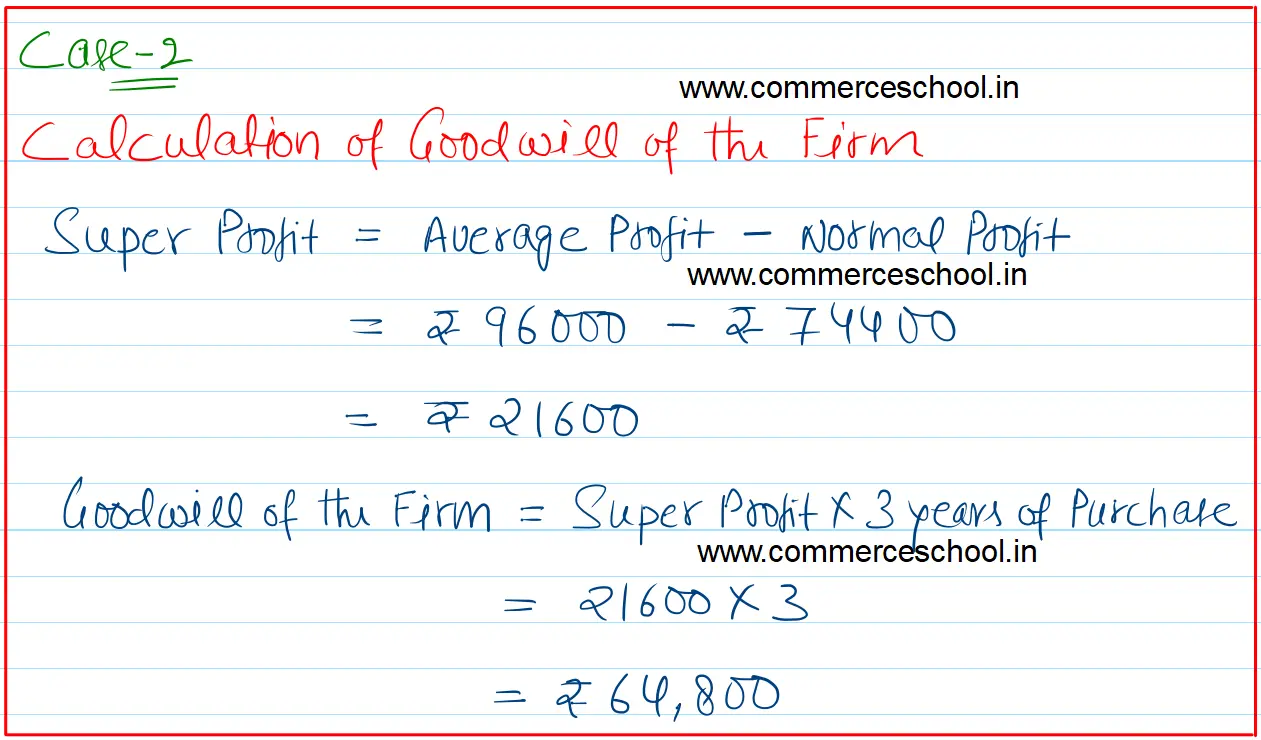

(ii) Three year’s purchase of super profits.

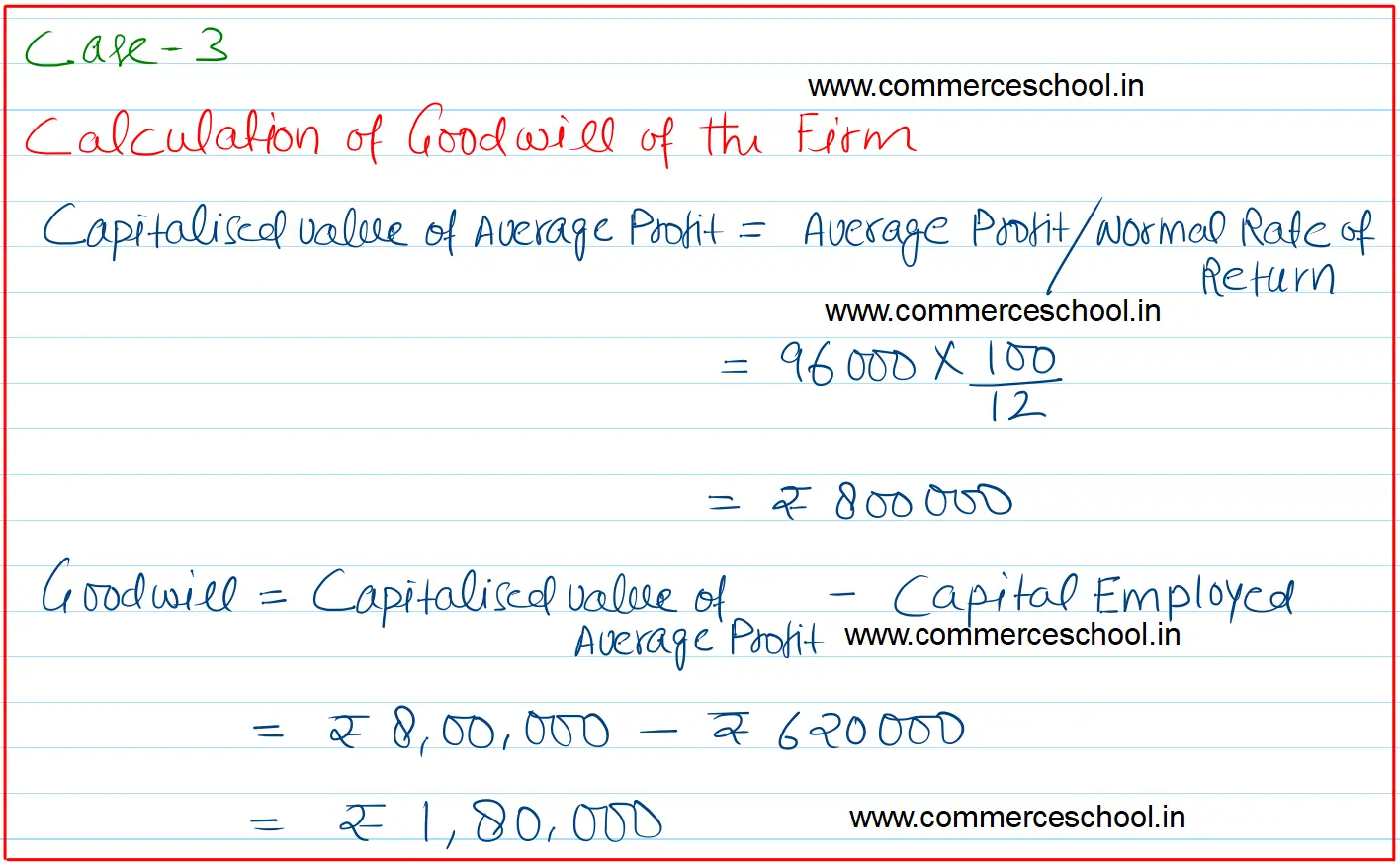

(iii) Capitalisation of average profits, and

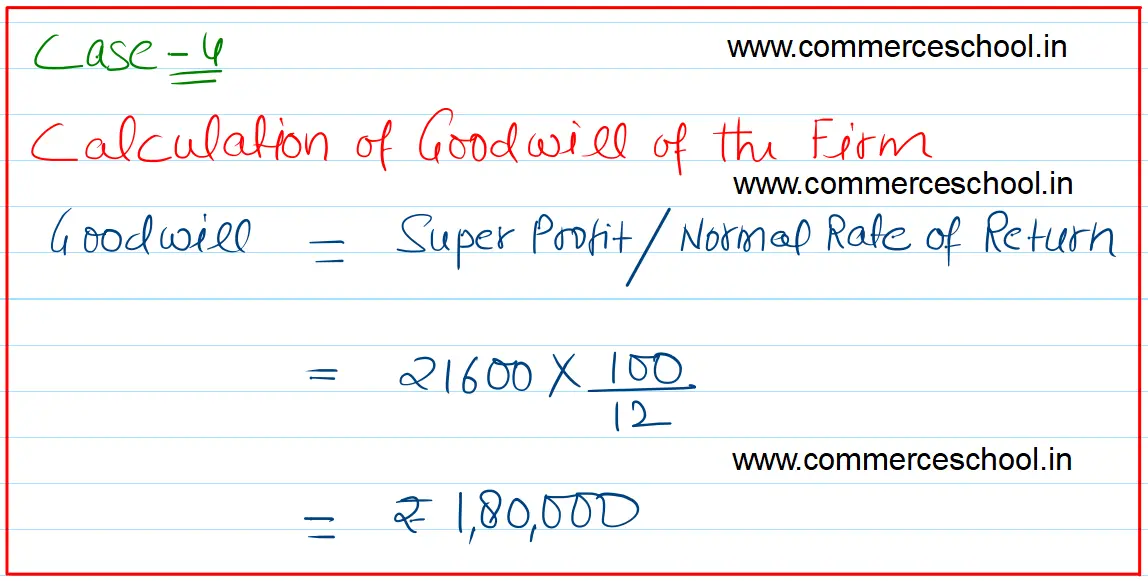

(iv) Capitalisation of super profits.

[Ans. (i) ₹ 2,88,000; (ii) ₹ 64,800; (iii) ₹ 1,80,000 and (iv) ₹ 1,80,000.]

Anurag Pathak Answered question