The following is the Balance Sheet of A and B as at 31st March, 2023. The profit sharing ratios of the partners are 3 : 2.

The following is the Balance Sheet of A and B as at 31st March, 2023. The profit sharing ratios of the partners are 3 : 2.

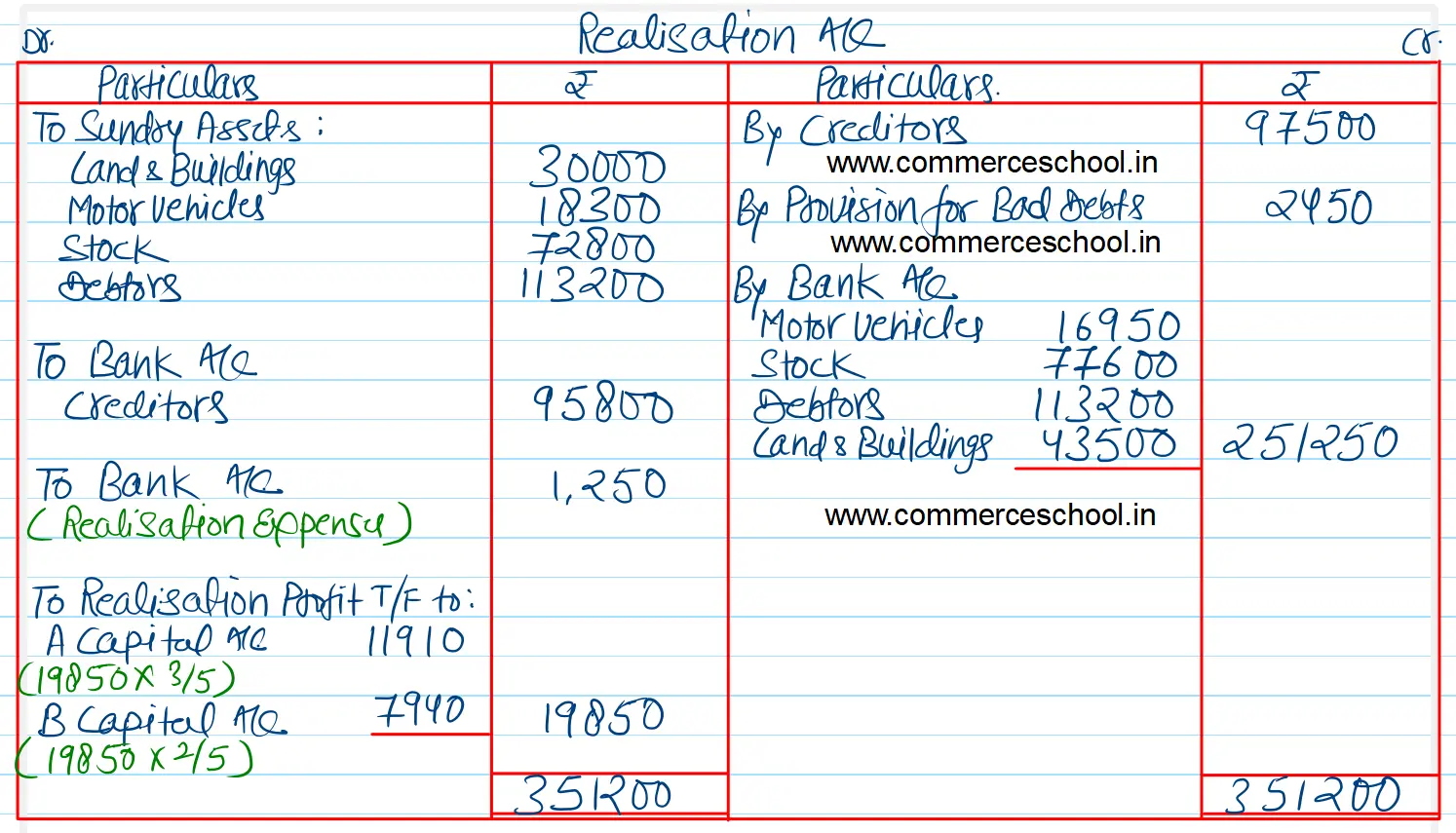

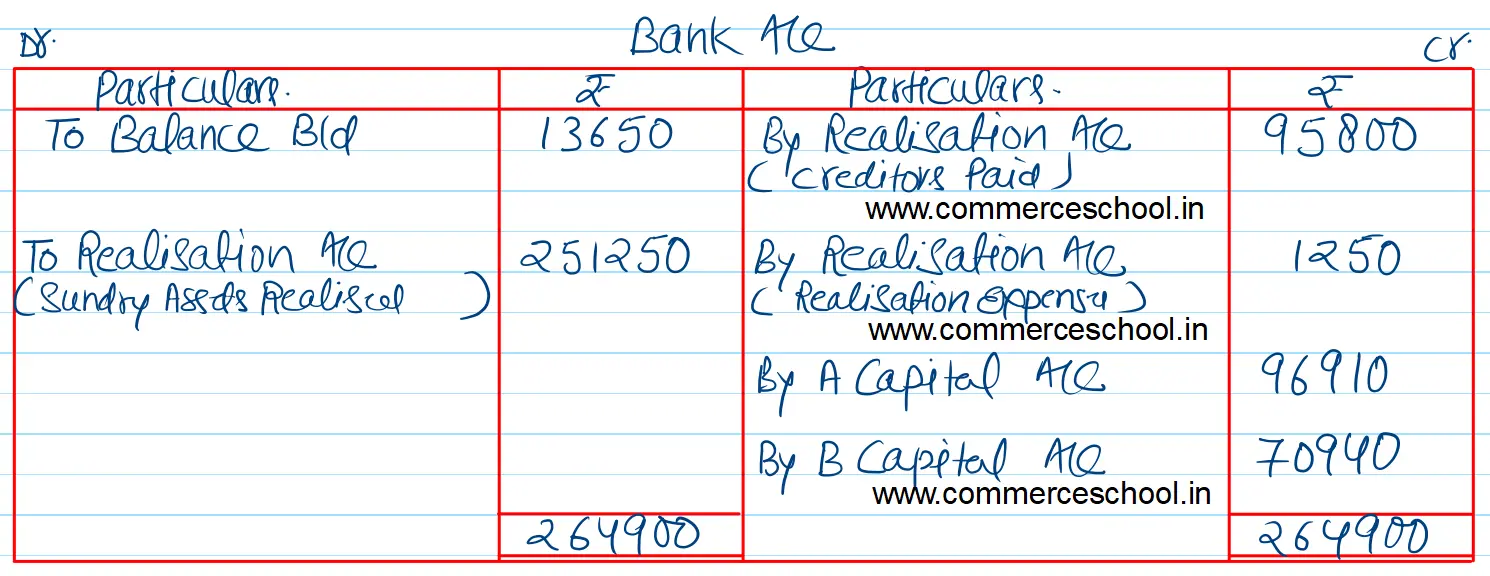

The partners decided to dissolve the firm on and from the date of the Balance Sheet. Motor Vehicles and Stock were sold for cash at ₹ 16,950 and ₹ 77,600 respectively and all Debtors were realised in full. Land & Buildings were sold at ₹ 43,500. Creditors were paid off subject to discount of ₹ 1,700. Expenses of realisation were ₹ 1,250.

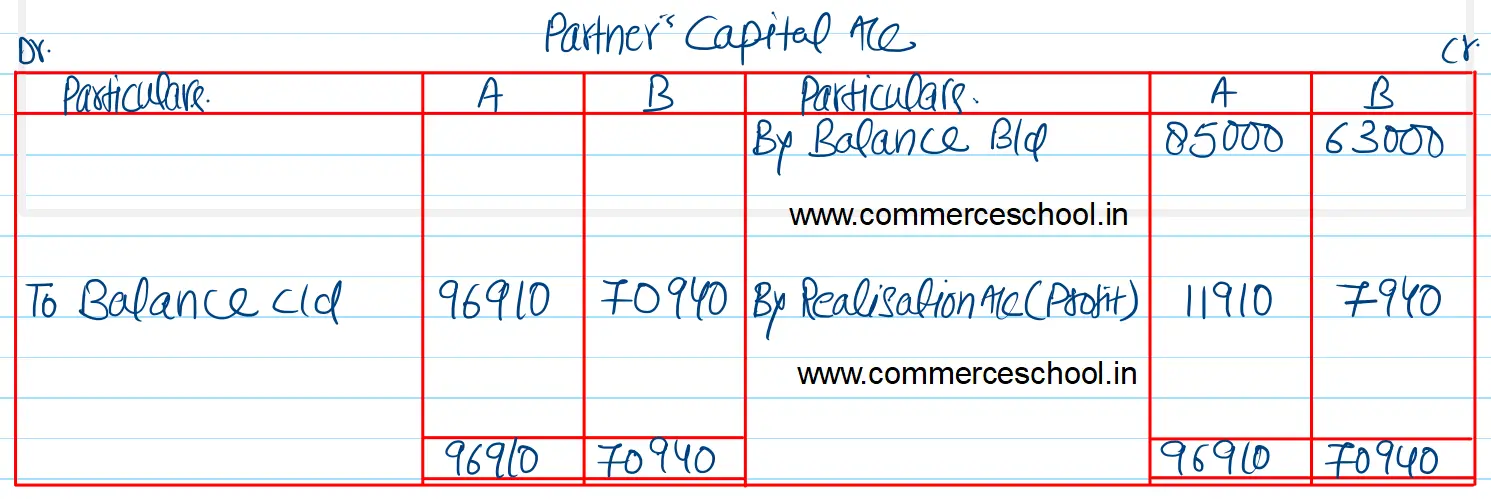

Prepare Realisation Account, Bank Account and Partner’s Capital Accounts to close the books of the firm as a result of its dissolution.

[Ans. Gain on Realisation ₹ 19,850; Amount paid to A ₹ 96,910 and B ₹ 70,940; Total of Bank A/c ₹ 2,64,900.]

| Liabilities | ₹ | Assets | ₹ |

| Creditors | 97,500 | Land & Buildings | 30,000 |

| Capital Accounts: A B | 85,000 63,000 | Motor Vehicles | 18,300 |

| Stock | 72,800 | ||

| Debtors 1,13,200 Less: Provision for Bad Debts 2,450 | 1,10,750 | ||

| Cash at Bank | 13,650 | ||

| 2,45,500 | 2,45,500 |

Anurag Pathak Answered question