The following is the trial balance of Mr. Amar Chand as at 31st March, 2023: Stock on 1st April, 2022 ₹ 62,000 Purchases and Sales ₹ 3,15,000 ₹ 4,48,000

The following is the trial balance of Mr. Amar Chand as at 31st March, 2023:

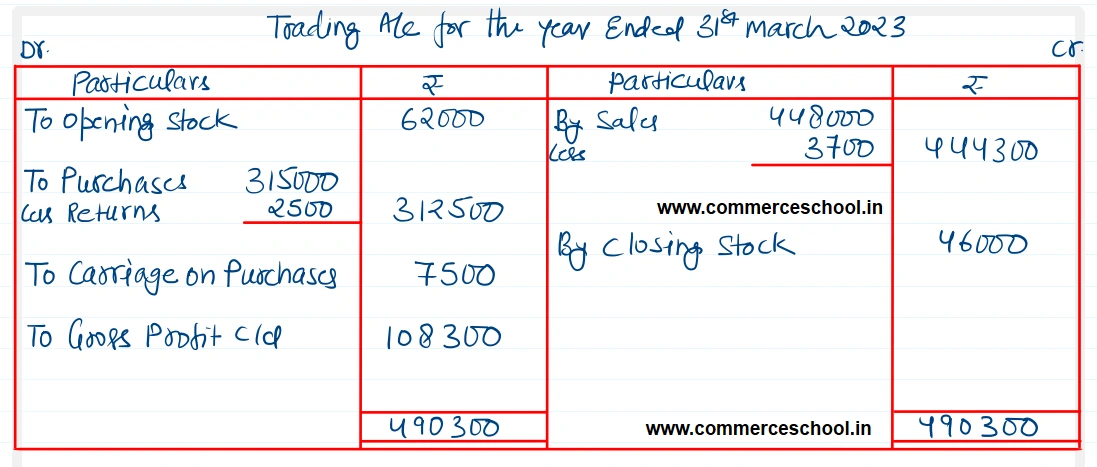

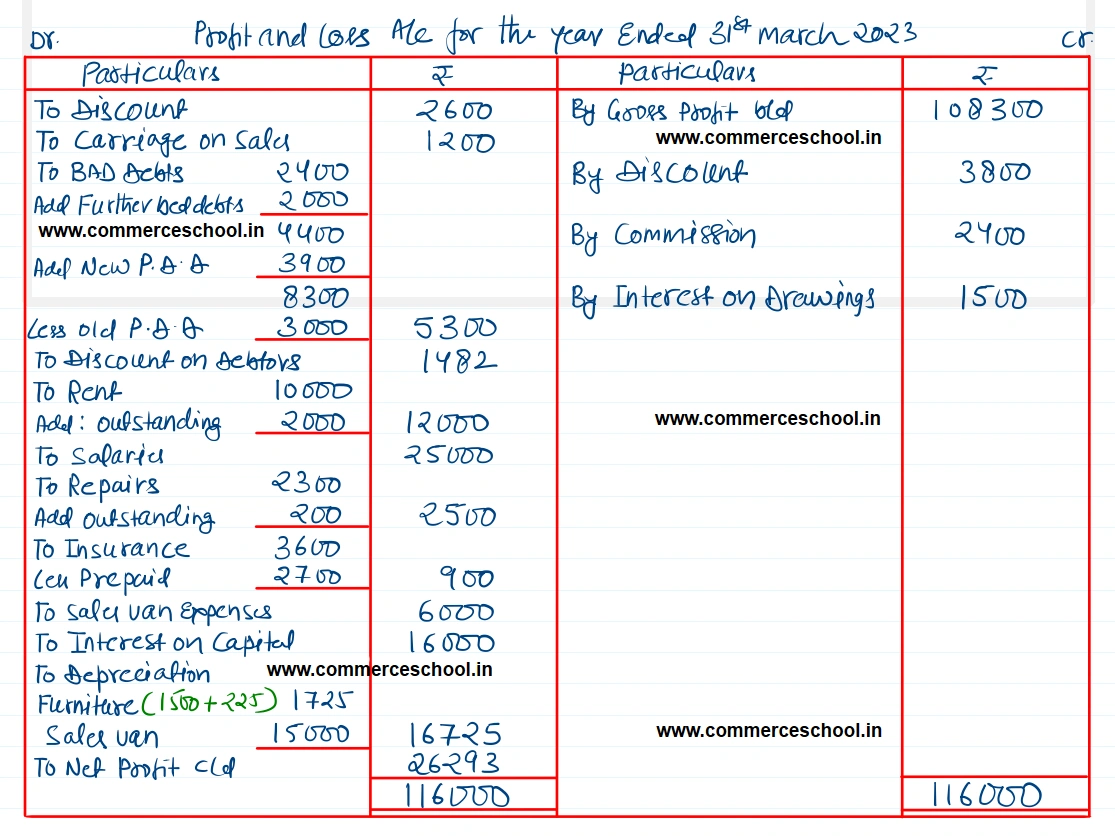

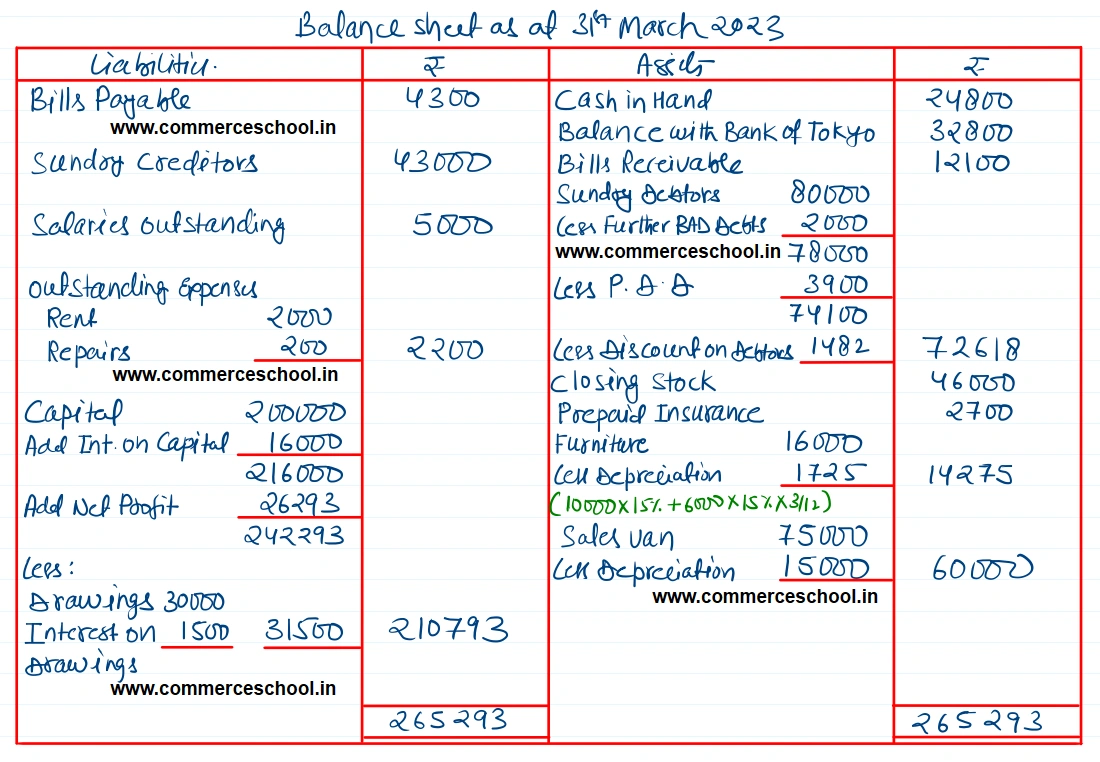

Taking into account the following adjustments, prepare Trading and Profit & Loss Account and the Balance Sheet as at 31st March, 2023:-

(1) Stock on 31st March, 2023 was valued at ₹ 46,000.

(2) Depreciate Furniture at 15% p.a. and Sales Van at 20% p.a.

(3) A sum of ₹ 200 is due for repairs.

(4) Write off ₹ 2,000 as further bad-debts and create a provision for doubtful debts @ 5% on Debtors. Also provide 2% for discount on Debtors.

(5) Rent is paid at the rate of ₹ 1,000 per month.

(6) Allow 8% interest on Capital and Charge ₹ 1,500 as interest on Drawings.

[Ans. Gross Profit ₹ 1,08,300; Net Profit ₹ 26,293; Balance Sheet Total ₹ 2,65,293.]

Solution:-

| Dr. (₹) | Cr. (₹) | |

| Stock on 1st April, 2022 | 62,000 | |

| Purchases and Sales | 3,15,000 | 4,48,000 |

| Returns | 3,700 | 2,500 |

| Sundry Debtors and Creditors | 80,000 | 43,000 |

| Bills Receivable and Payable | 12,100 | 4,300 |

| Drawings and Capital | 30,000 | 2,00,000 |

| Cash in Hand | 24,800 | |

| Balance with Bank of Tokyo | 32,800 | |

| Discount | 2,600 | |

| Carriage on Purchases | 7,500 | |

| Carriage on Sales | 1,200 | |

| Bad-Debts | 2,400 | |

| Bad-Debts Provision | 3,000 | |

| Furniture on 1st April, 2022 | 10,000 | |

| New Furniture purchased on 1st January, 2023 | 6,000 | |

| Rent | 10,000 | |

| Salaries | 25,000 | |

| Commission | 2,400 | |

| Repairs | 2,300 | |

| Insurance (Annual Premium paid on 1st Jan, 2023) | 3,600 | |

| Salaries Outstanding | 5,000 | |

| Sales Van | 75,000 | |

| Sales Van Expenses | 6,000 | |

| 7,12,000 | 7,12,000 |

Anurag Pathak Answered question