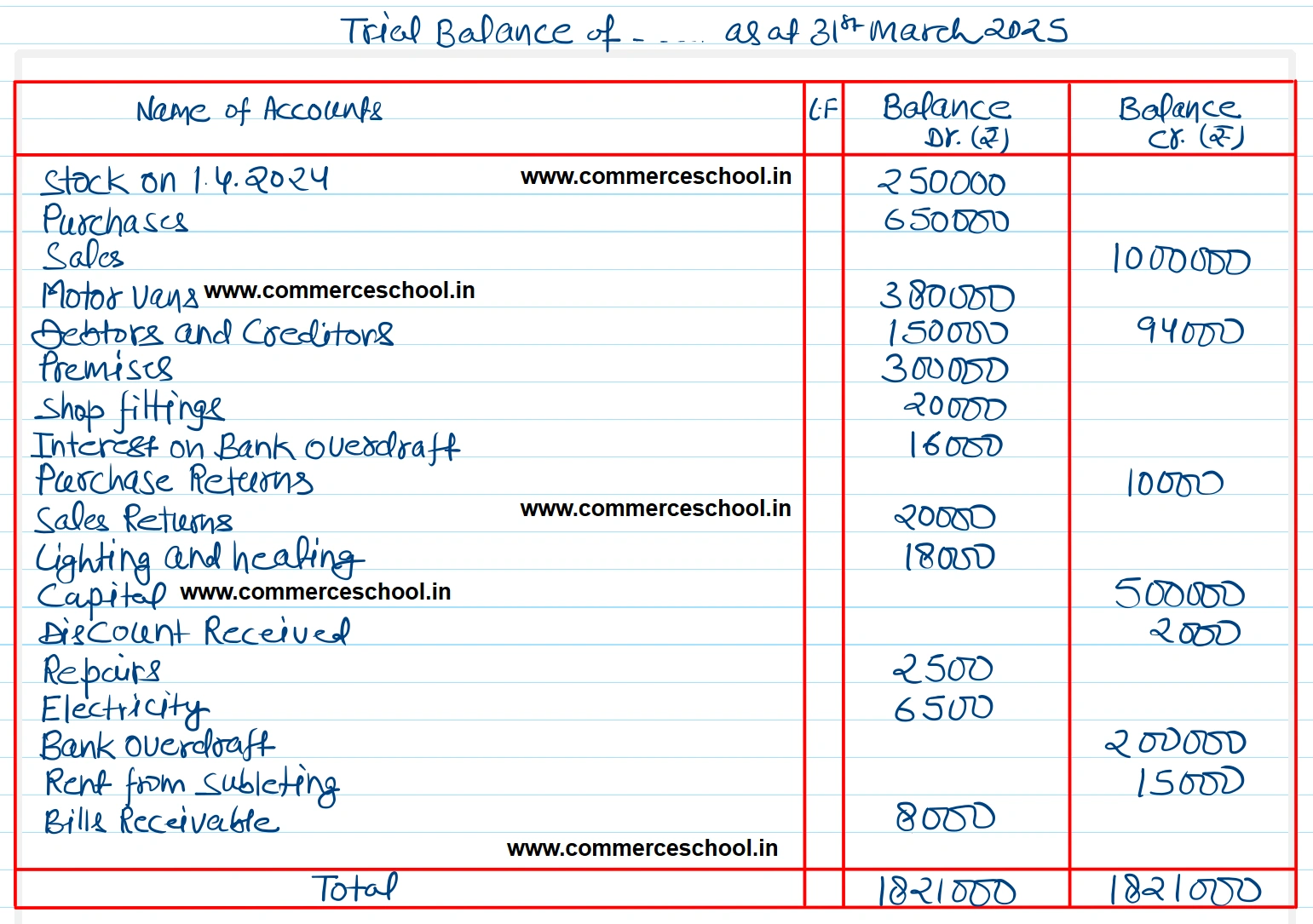

The following is the Trial Balance prepared by an inexperienced accountant. Redraft it in a correct form and give necessary notes:

The following is the Trial Balance prepared by an inexperienced accountant. Redraft it in a correct form and give necessary notes:-

Trial Balance for the year ending 31st March 2025

| Particulars | Amount ₹ | Particulars | Amount ₹ |

| Cash in Hand | 5,200 | Bank Overdraft | 16,400 |

| Plant & Machinery | 75,000 | Capital | 50,000 |

| Typewriter | 6,400 | Goodwill | 8,000 |

| Stock (1-4-2024) | 13,100 | Sundry Creditors | 8,200 |

| Purchases | 84,100 | Sales | 1,60,000 |

| Carriage Inwards | 2,800 | Returns Inwards | 2,400 |

| Carriage Outwards | 1,600 | Drawings | 2,120 |

| Sundry Debtors | 18,300 | Investments | 4,000 |

| Bills Payable | 12,000 | ||

| Rent Paid | 9,600 | ||

| Wages | 16,500 | ||

| Advertisement | 4,500 | ||

| Discount Received | 3,200 | ||

| 2,52,300 | 2,51,120 |

[Ans. Dr. Balance of Corrected Trial Balance ₹ 2,53,620; Cr. Balance of Corrected Trial Balance ₹ 2,49,800.

Therefore, in order to reconcile the Trial Balance ₹ 3,820 will be written on Cr. side as ‘Suspense Account’.]

Anurag Pathak Changed status to publish