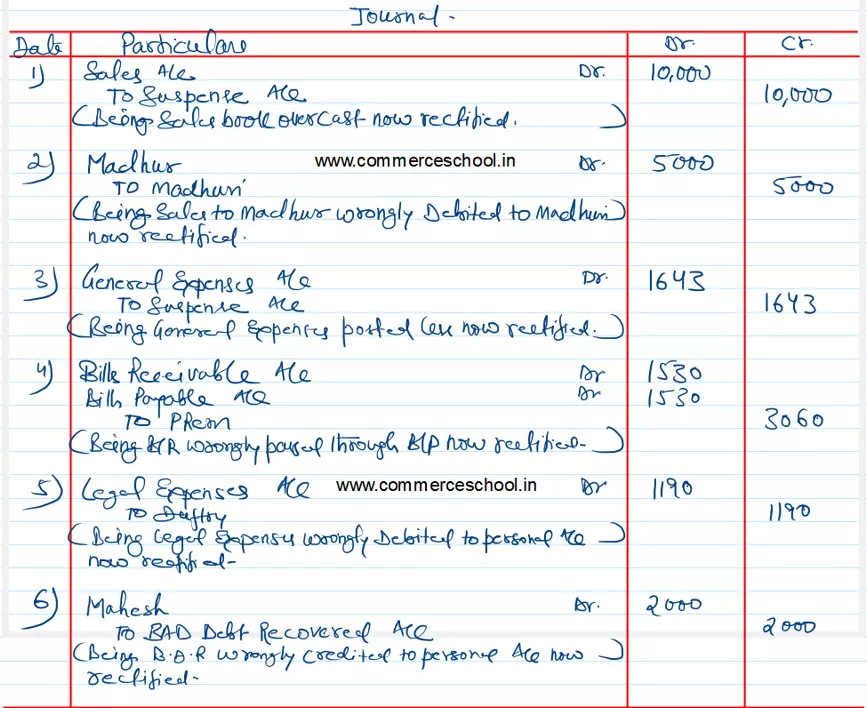

The following mistakes were identified in the books of a firm after its books were closed and a Suspense Account was opened in order to match Trial Balance:

The following mistakes were identified in the books of a firm after its books were closed and a Suspense Account was opened in order to match Trial Balance:

(i) Sales Book was overcast by ₹ 10,000.

(ii) A sale of ₹ 5,000 to Madhur was wrongly debited to the account of Madhuri.

(iii) General Expenses of ₹ 1,825 were posted in the General Ledger as ₹ 182.

(iv) A Bill Receivable for ₹ 15,530 was passed through Bills Payable Day Book. This bill was given by Prem.

(v) Legal Expenses of ₹ 1,190 paid to Mr. Duftry was debited to his Personal Account.

(vi) An amount of ₹ 2,000 due from Mahesh which had been written off as a bad debt in previous year was recovered and is posted to the personal account of Mahesh.

Find out the nature and amount of the Suspense Account and pass entries for the rectification of the above errors in the subsequent year’s books.