The following Trial Balance has been extracted from the books of Shri Santosh Kumar as at 31st March, 2023

The following Trial Balance has been extracted from the books of Shri Santosh Kumar as at 31st March, 2023:-

| Particulars | Dr (₹) | Cr (₹) |

| Plant and Machinery | 1,00,000 | |

| Furniture | 12,000 | |

| Capital Account | 1,91,000 | |

| Household Expenses | 16,000 | |

| Sales | 4,68,000 | |

| Loose Tools | 20,000 | |

| Goodwill | 10,000 | |

| Opening Stock (1-4-2022) | 20,000 | |

| Returns Outward | 4,000 | |

| Discount | 6,000 | |

| Purchases | 2,12,000 | |

| Returns Inwards | 8,000 | |

| Wages | 1,00,000 | |

| Salaries | 60,000 | |

| Outstanding Salaries | 5,000 | |

| Investments at 10% p.a. | 6,000 | |

| Interest on Investments | 300 | |

| Sundry Creditors | 24,000 | |

| Miscellanous Receipts | 2,000 | |

| Carriage Inwards | 12,000 | |

| General Expenses and Insurance | 39,000 | |

| Advertisement Expenses | 15,000 | |

| Postage | 4,000 | |

| Sundry Debtors | 56,000 | |

| B. Barua | 2,000 | |

| Cash Balance | 14,000 | |

| Bank | 3,200 | |

| Suspense Account | 2,500 | |

| 7,06,000 | 7,06,000 |

The following additional information is available:-

(i) Stock on 31st March, 2023 was ₹ 30,800.

(ii) Depreciation is to be charged on Plant and Machinery at 5% and Furniture at 6% Losse Tools are revalued at ₹ 16,000.

(iii) Create a provision of 2% for Discount on Debtors.

(iv) Salary of ₹ 2,000 paid to Shri B.Barua, a temporary employee, stands debited to his personal account and it is to be correctedff.

(v) Write off 1/5th of advertisement expenses.

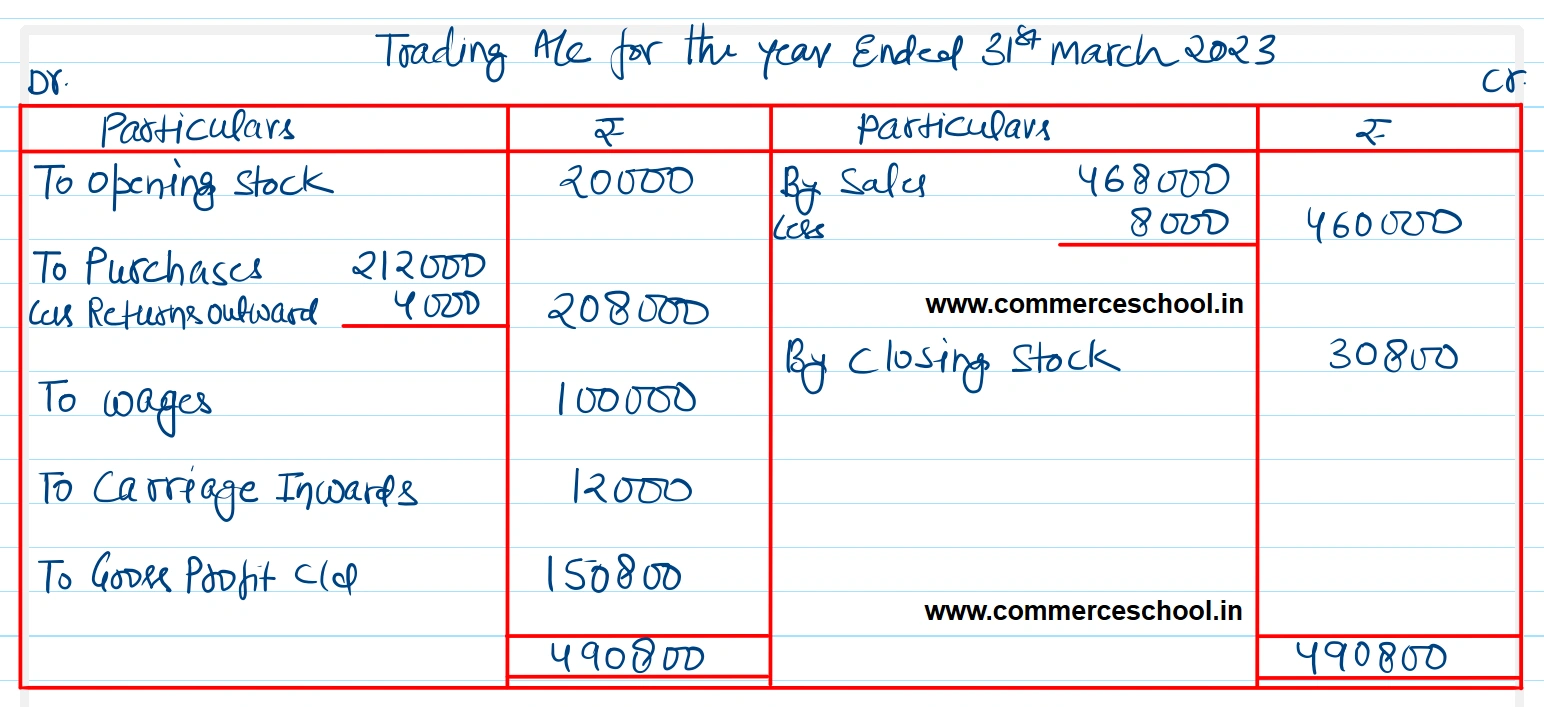

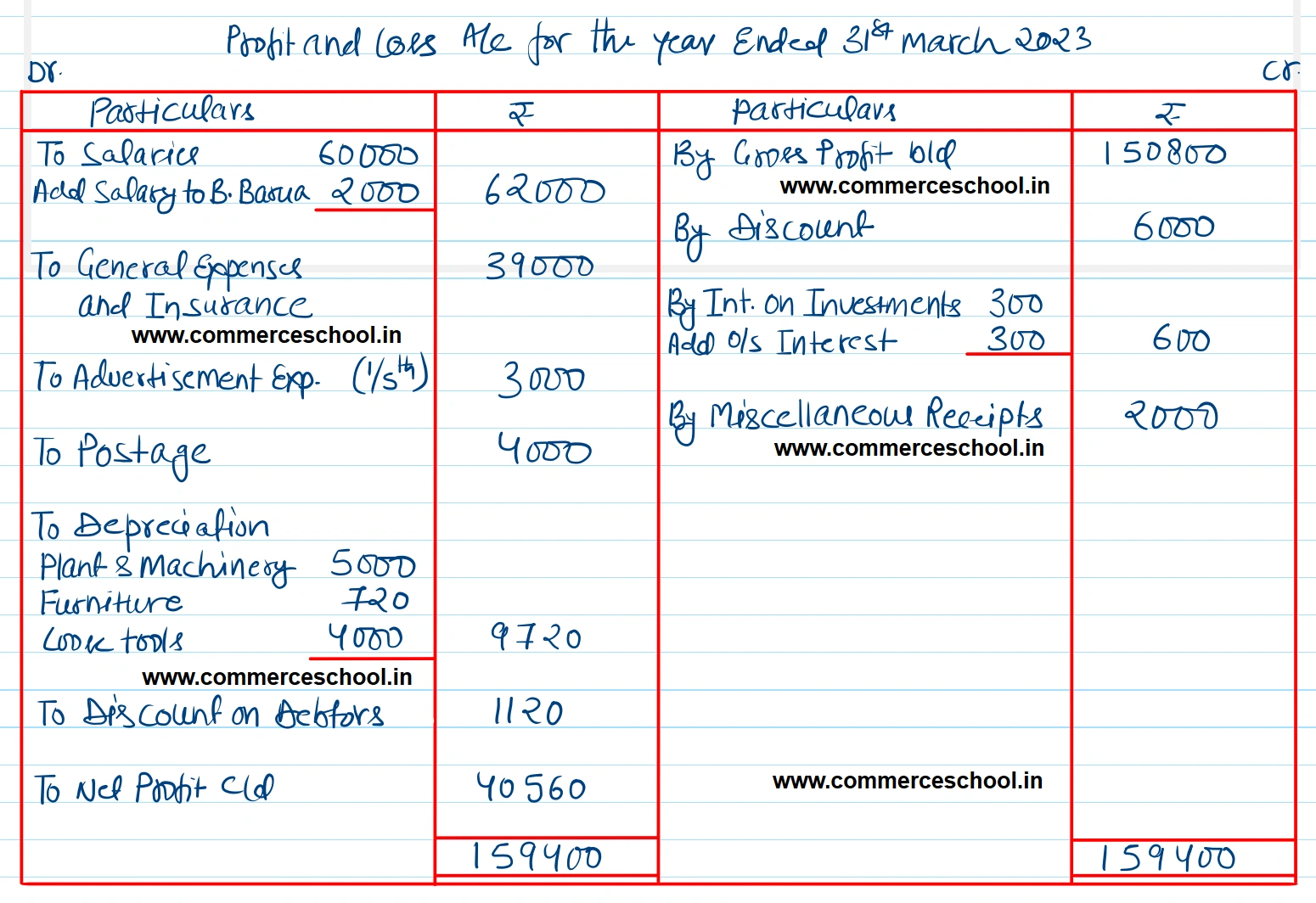

You are to prepare Trading and Profit & Loss Account for the year ended 31st March, 2023 and a Balance Sheet as at that date.

[Ans. Gross Profit ₹ 1,50,800; Net Profit ₹ 40,560; B/S Total ₹ 2,50,260.]

Solution:-

Hints:-

(1) Household Expenses means Drawings.

(2) Interest on Investments shown on the Cr. side of P & L A/c will be ₹ 300 + ₹ 300 = ₹ 600. Investments shown on the Assets side will be ₹ 6,300, i.e., ₹ 6,000 + ₹ 300 for accrued interest.

(3) 4/5 of Advertisement Expenses will be shown on the Assets side of Balance Sheet.