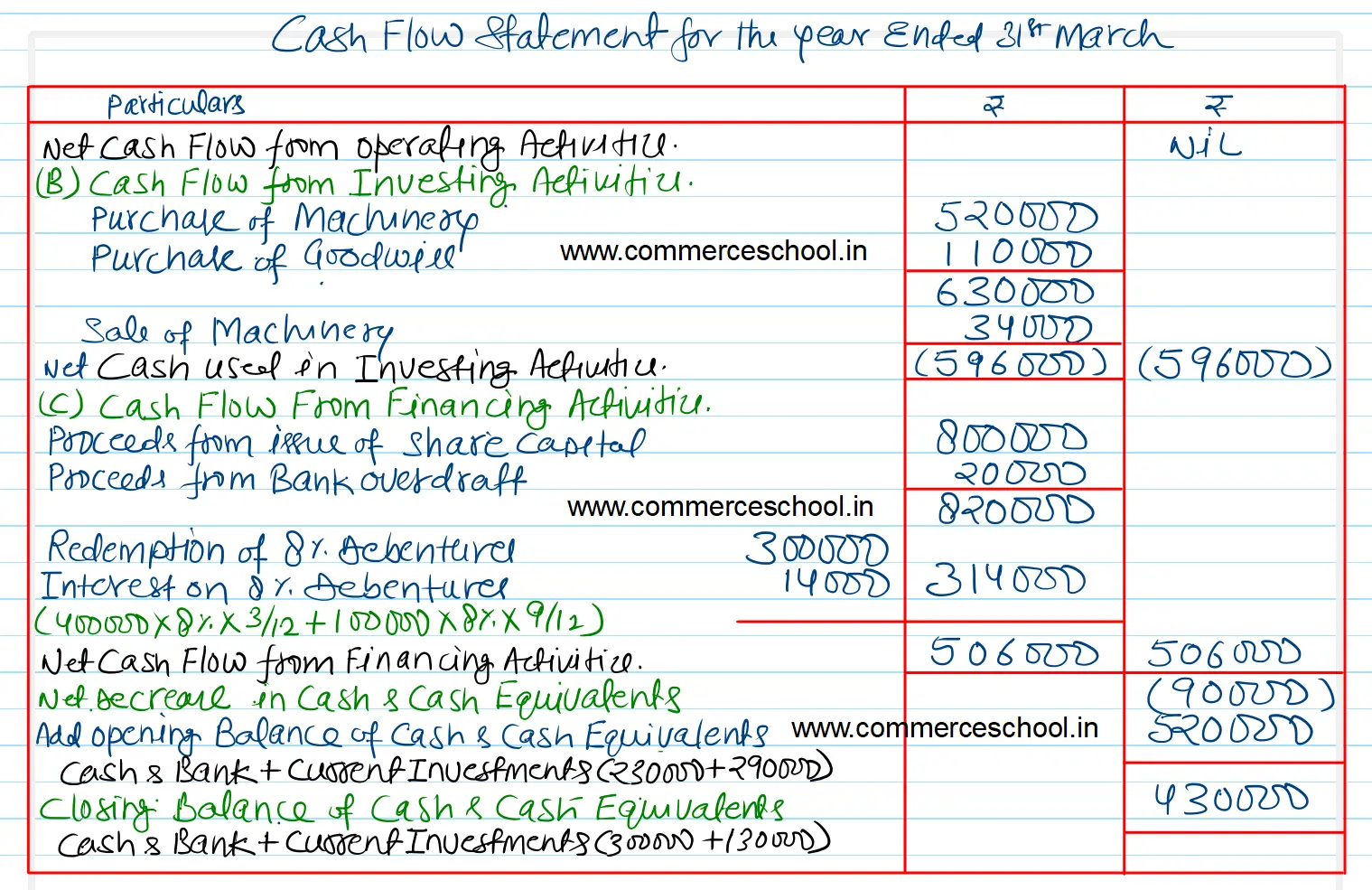

There was ‘Nil; net cash flow from operating activities of Ashok Ltd. during the year ending 31st March, 2019. From the following Balance Sheet of Ashok Ltd. as at 31st March, 2019, prepare a Cash Flow Statement

There was ‘Nil; net cash flow from operating activities of Ashok Ltd. during the year ending 31st March, 2019. From the following Balance Sheet of Ashok Ltd. as at 31st March, 2019, prepare a Cash Flow Statement:

Ashok Ltd. Balance Sheet as at 31st March, 2019

| Particulars | Note. No. | 31st March, 2023 | 31st March, 2022 |

| I. EQUITY AND LIABILITIES: | |||

|

(1) Shareholder’s Funds: (a) Share Capital (b) Reserve and Surplus |

19,00,000 1,60,000 |

11,00,000 2,00,000 |

|

|

(2) Non-Current Liabilities: Long-term Borrowings |

1,00,000 | 4,00,000 | |

|

(3) Current Liabilities (a) Short term borrowings (b) Short term Provisions |

2,50,000 1,90,000 |

2,30,000 2,70,000 |

|

| Total | 26,00,000 | 22,00,000 | |

| II. ASSETS: | |||

|

(1) Non-Current Assets: (a) Property, Plant and Equipment and Intangible Assets (i) Property, Plant and Equipment (ii) Intangible Assets |

15,00,000 2,80,000 |

11,00,000 1,70,000 |

|

|

(2) Current Assets: (a) Current Investments (b) Inventories (c) Trade Receivables (d) Cash & Bank |

1,30,000 3,90,000 3,00,000 |

2,90,000 4,10,000 2,30,000 |

|

| Total | 26,00,000 | 22,00,000 |

Notes to Accounts:

| 31.3.2023 | 31.3.2022 | |

|

Reserves and Surplus: Surplus (Balance in Statement of Profit and Loss) |

1,60,000 | 2,00,000 |

|

Long Term Borrowings 8% Debentures |

1,00,000 | 4,00,000 |

|

Short-Term Borrowings Bank Overdraft |

||

|

Short term Provisions Provision for Tax |

2,50,000 | 2,30,000 |

|

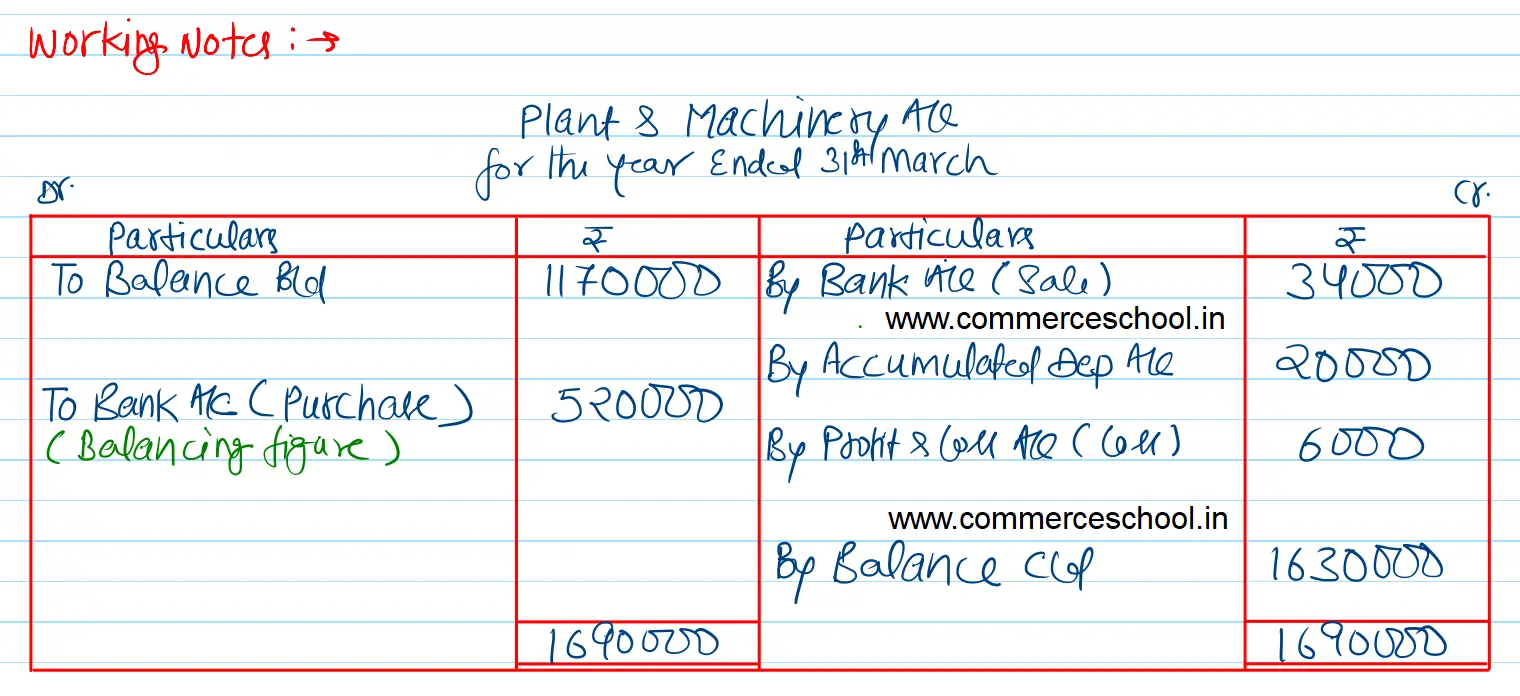

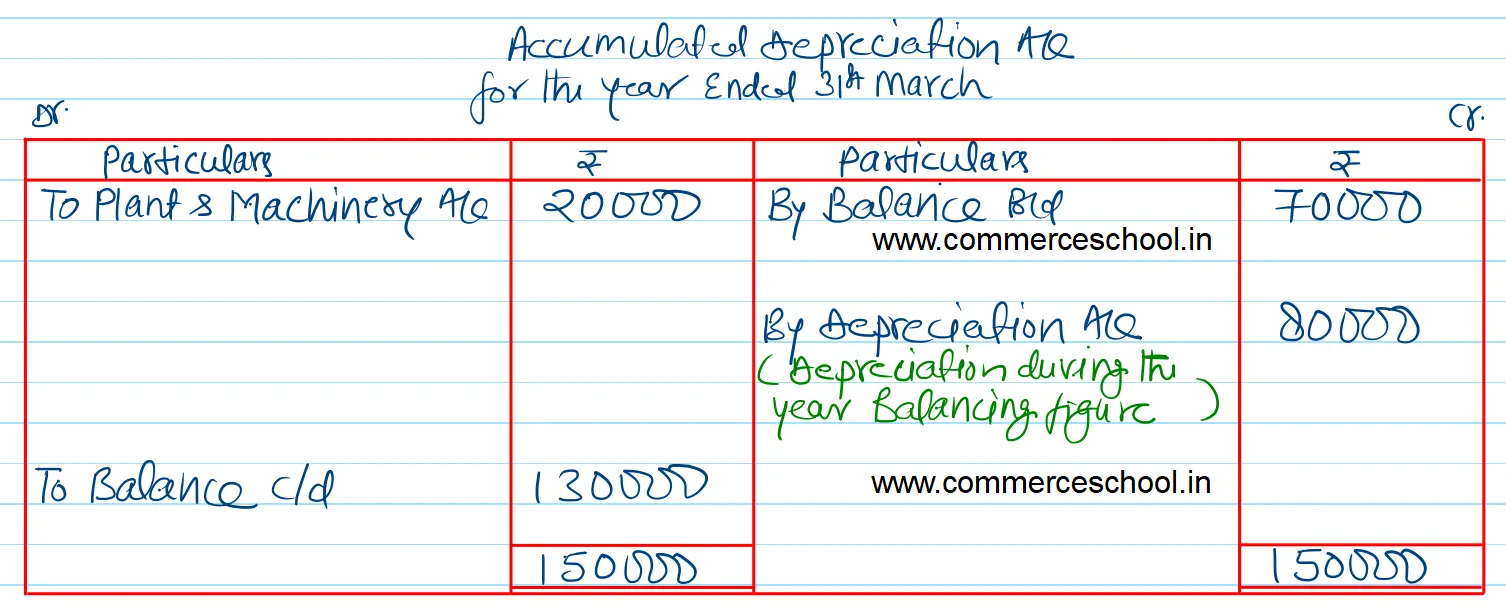

Property, Plant and Equipment Plant & Machinery Accumulated Depreciation |

16,30,000 (1,30,000) |

11,70,000 (70,000) |

| 15,00,000 | 11,00,000 | |

|

Intangible Assets Goodwill |

2,80,000 | 1,70,000 |

Additional Information:-

(i) A machinery of the book value of ₹ 60,000, (depreciation provided thereon ₹ 20,000) was sold at a loss of ₹ 6,000.

(ii) 8% Debentures were redeemed on 1st Junly, 2018.

[Ans. Cash used in Investing Activities ₹ 5,96,000; Cash from Financing Activities ₹ 5,06,000.]