What is Meant by ‘Fixed Capital’ of a Partner?

The fixed Capital method is one of the methods to maintain the capital accounts of partners in a partnership firm.

Here are some Key Points:-

- Fixed Capital means capital invested by each partner remains fixed unless the partner introduces further capital or withdraws it.

- In the Fixed Capital Accounts Method, two accounts are maintained for each partner, i.e., Capital Account and a Current Account.

Let’s Discuss both Account one by one

Capital Account:-

Ony the transactions of additional capital and withdrawals are shown in the capital account.

The balances of the capital account remain the same unless further capital is introduced or withdrawn.

The balances of the Partner’s Capital Accounts are shown on the liabilities side of the Balance Sheet as per Business Entity Concept.

Note:- The balance of the Capital Account in the Fixed capital Method always shows a credit balance or nil balance. As no recurring nature transactions are recorded into it.

Current Account:-

Transactions concerning partners of a revenue (Current) nature are recorded in the Partner’s Current Account.

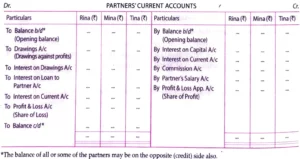

Following transactions are recorded

Debit Side:-

- Drawings out of profit

- Interest on Partner’s Drawings

Credit Side:-

Interest on Capital

Partner’s Salary

Partner’s Commission

Partner’s Share in Distributable Profit

Due to the record of transactions of recurring nature, the balance in the Current Account fluctuates with every transaction with the partner.

The credit balance in the Partner’s Current Account is shown on the liabilities side of the Balance Sheet, which means the amount in the Current Account is payable to the partner.

The debit balance in the Partner’s Current Account is shown on the assets side of the Balance Sheet, which means the amount in the current account is receivable or due from the partner.

Note:- Balance in Partners current can either be debit or credit due to the record of all recurring nature transactions.