While comparing the cash book of Mayank with the bank pass book on 30th September, 2024 you find the following:

While comparing the cash book of Mayank with the bank pass book on 30th September, 2024 you find the following:

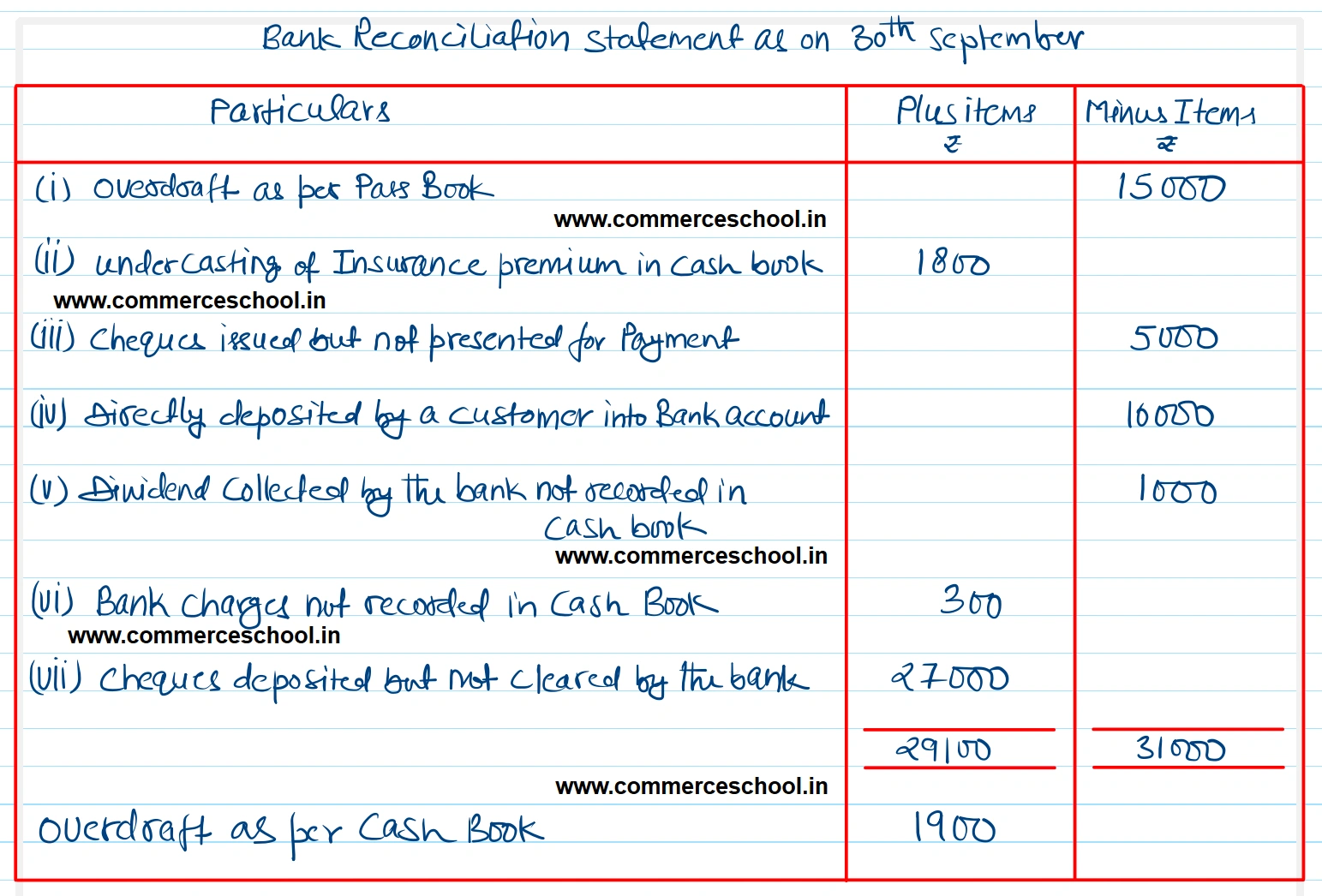

(i) The bank pass book showed a debit balance of ₹ 15,000.

(ii) Bank paid insurance premium ₹ 2,000, but it was recorded as ₹ 200 only in cash book.

(iii) Cheques issued in favour of suppliers in September, amounted to ₹ 55,000, but cheques for ₹ 50,000 only were presented for payment upto 30th September.

(iv) Direct deposit of ₹ 10,000 in Mayank’s bank account by a customer on 25th September, had not been recorded in the Cash book.

(v) Dividend collected by bank, but not recorded in cash book ₹ 1,000.

(vi) Bank charged ₹ 300 for its services, but they were yet to be recorded in cash book.

(vii) Cheques amounting to ₹ 78,000 were depsited with bank in the last week of Septemer, but cheques for ₹ 51,000 only had been cleared before 1st October.

Prepare the bank reconciliation statement asceratining bank balance/overdraft as per cash book.

[Ans. Overdraft as per Cash Book ₹ 1,900.]