X and Y are partners in a firm. They share profits and losses in the ratio of 2 : 1. Their Balance Sheet as at 31st March, 2023 stood as under:

X and Y are partners in a firm. They share profits and losses in the ratio of 2 : 1. Their Balance Sheet as at 31st March, 2023 stood as under:

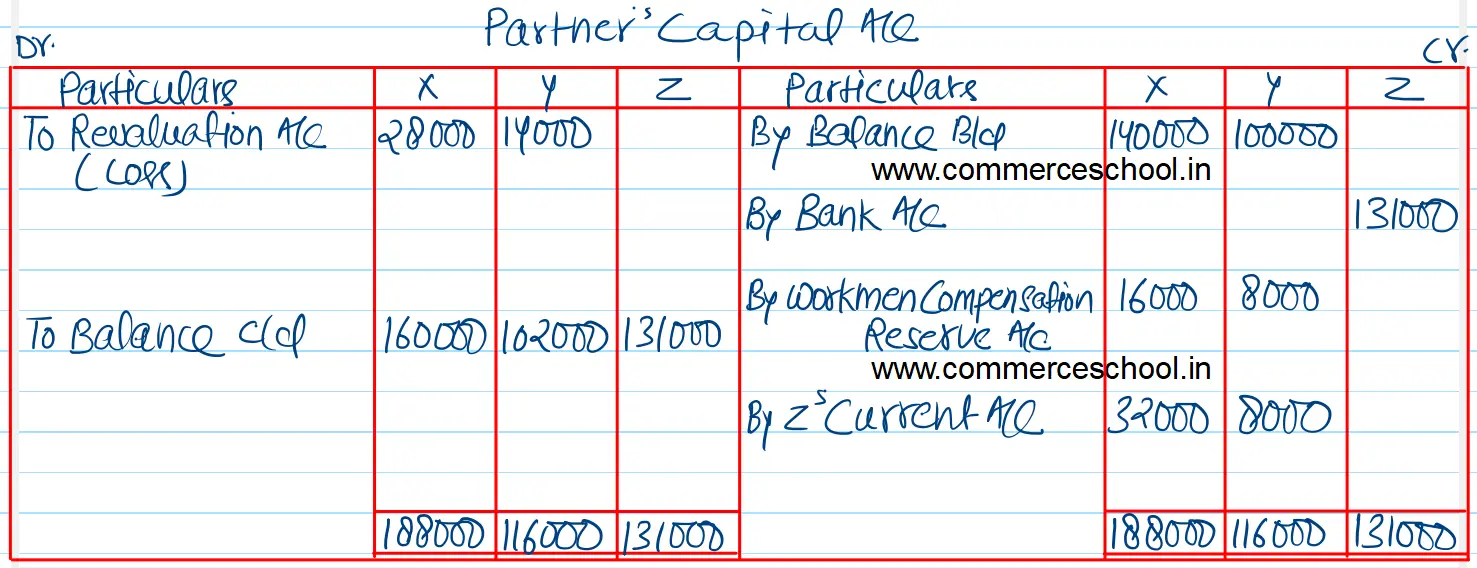

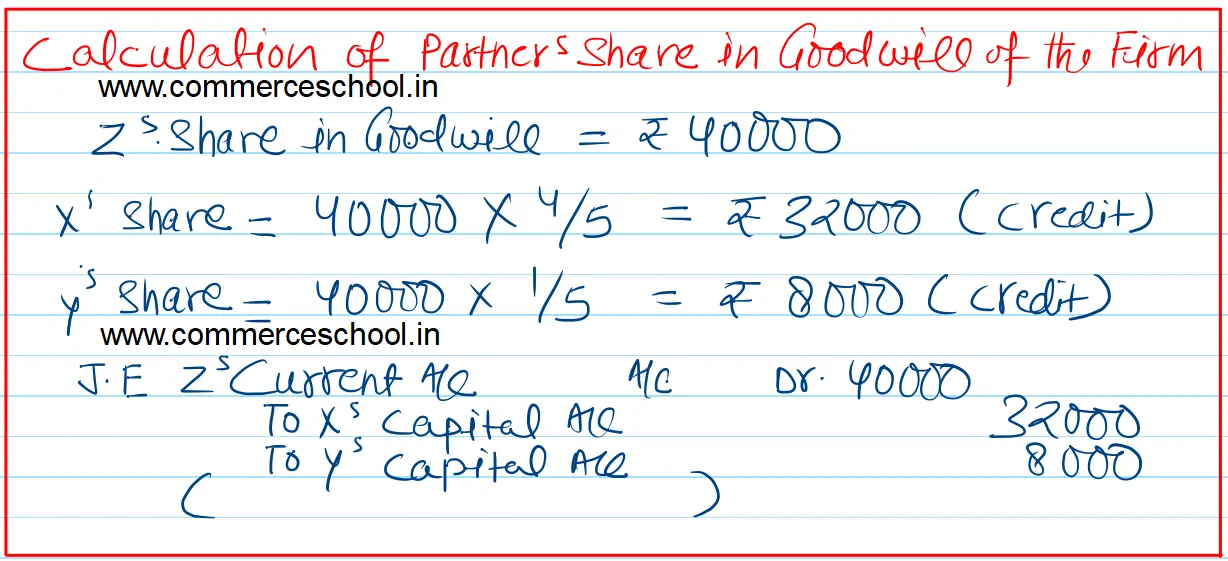

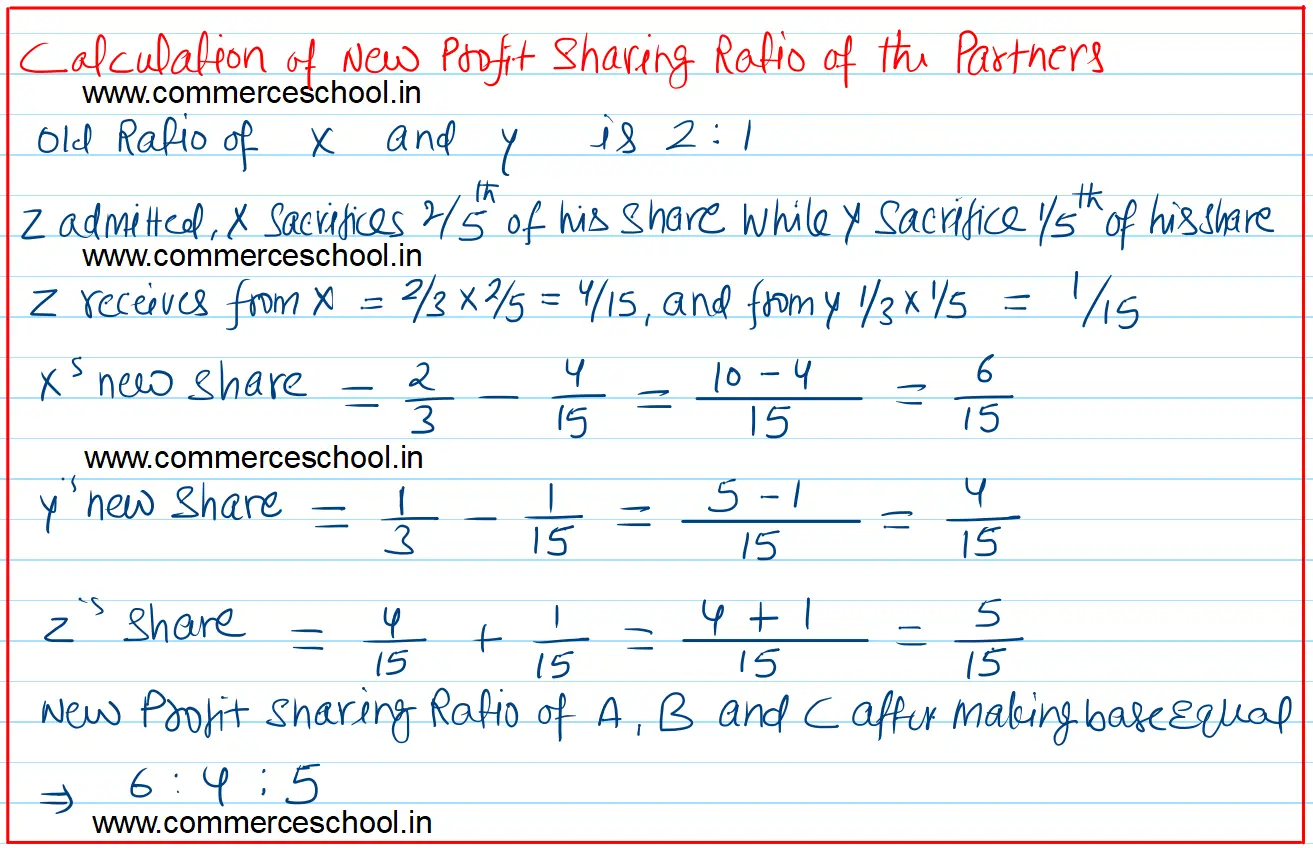

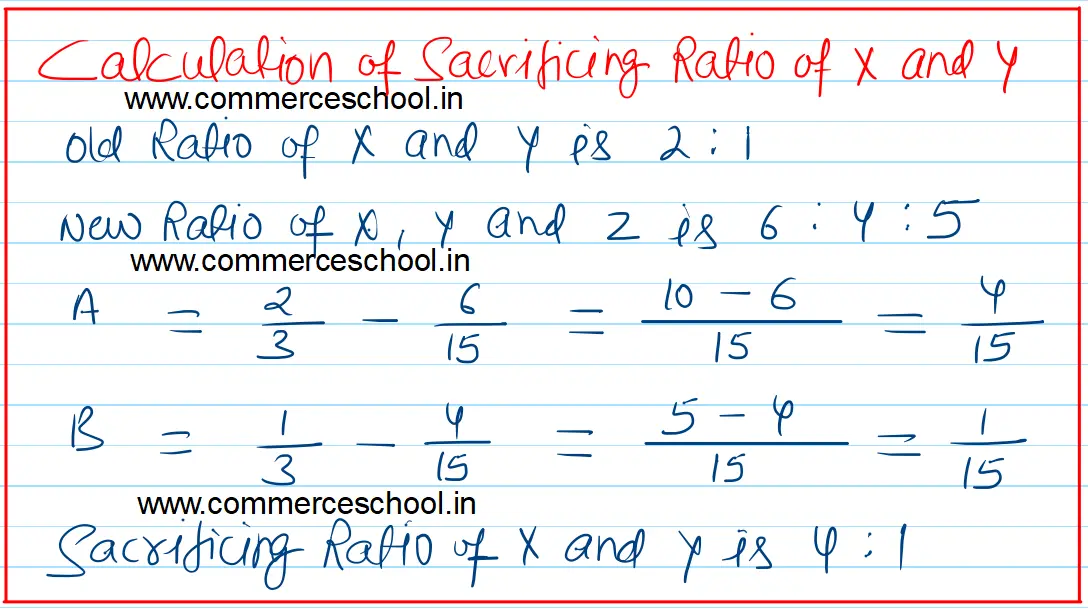

Z is admitted in the partnership. X surrenders 2/5th of his share and Y surrenders 1/5th of his share in favour of Z. The following information is given about the firm:

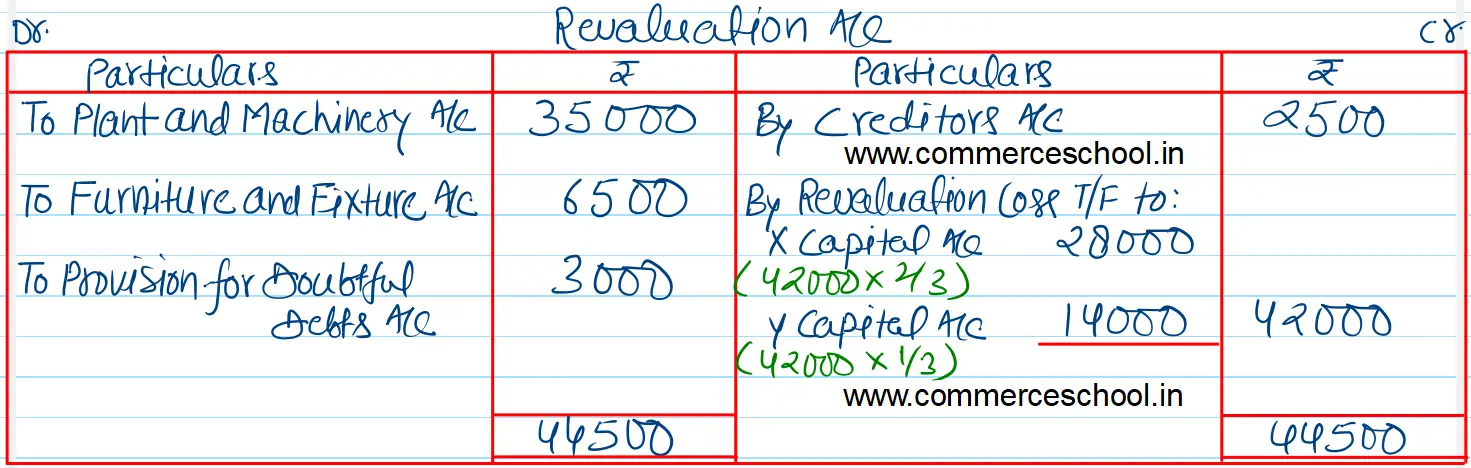

(i) Plant and Machinery be reduced by ₹ 35,000 and furniture and fixture be reduced to ₹ 58,500.

(ii) Provision for bad and doubtful debts is to be increased by ₹ 3,000.

(iii) Actual liability for workmen compensation claim is ₹ 16,000.

(iv) A liability of ₹ 2,500 included in creditors is not likely to arise.

(v) Z’s share of goodwill is valued at ₹ 40,000 but he is unable to bring it in cash.

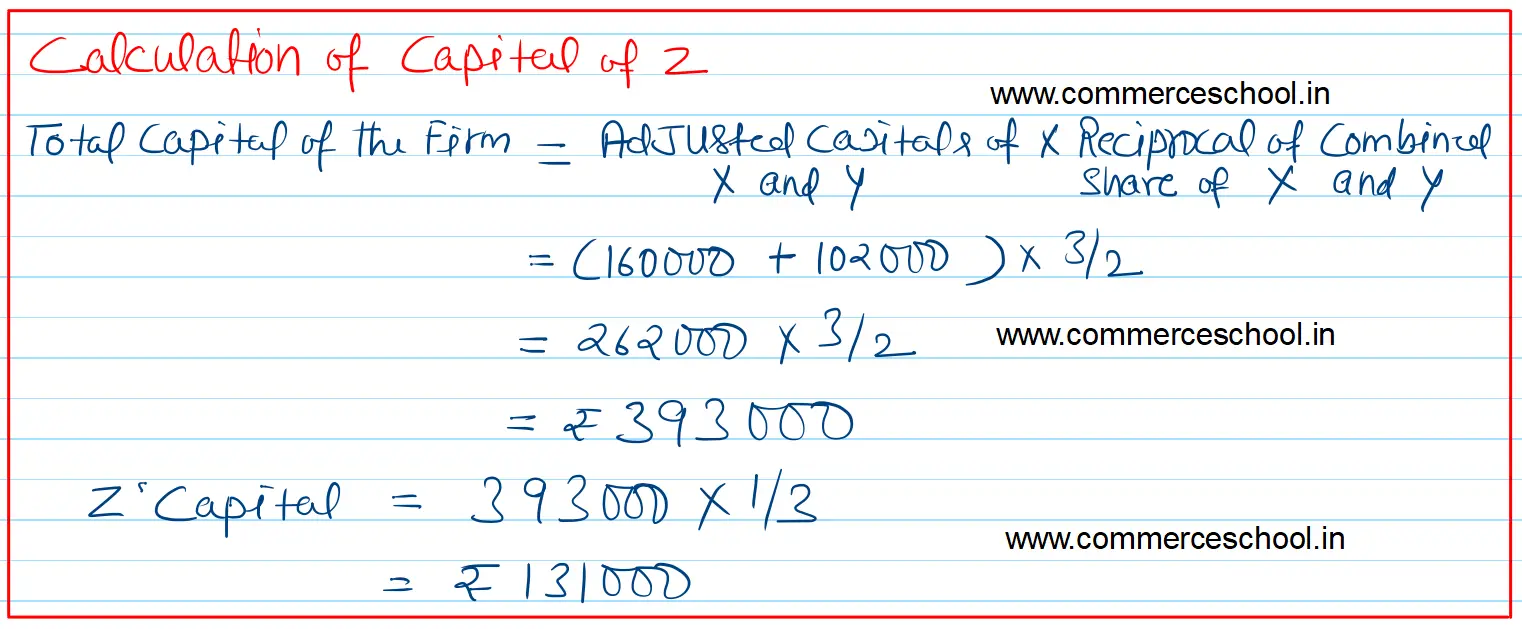

(vi) Z is to bring in Capital proportionate to his share after all adjustments.

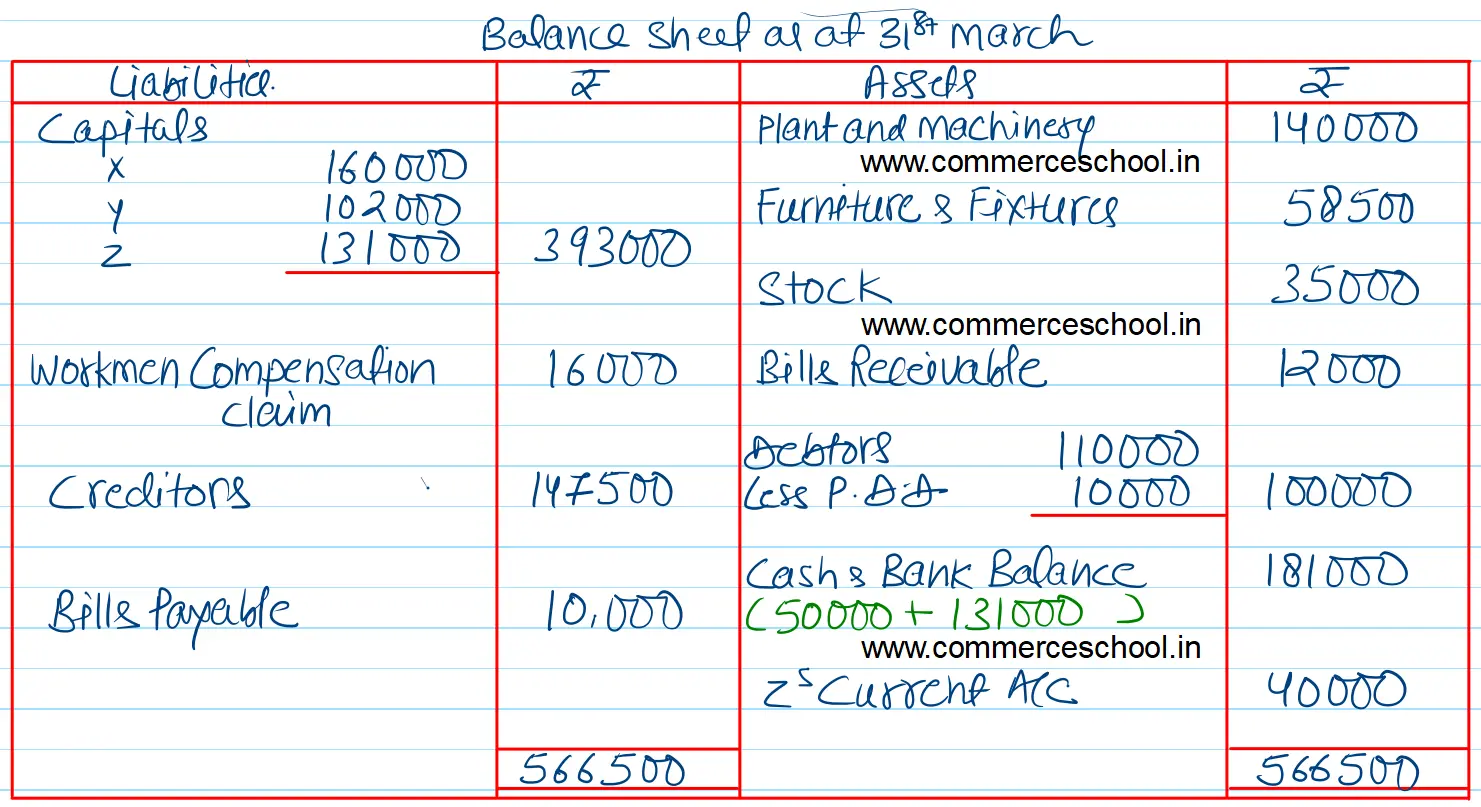

Prepare Revaluation Account, Capital Accounts and Balance Sheet after Z’s admission. Also calculate the new profit sharing ratio.

[Ans. Loss on Revaluation ₹ 42,000; Capital Accounts : X ₹ 1,60,000; Y ₹ 1,02,00 and Z ₹ 1,31,000; Cash & Bank Balance ₹ 1,81,000; Z’s Current A/c (Dr.) ₹ 40,000; Balance Sheet Total ₹ 5,66,500; Sacrificing Ratio 4 : 1; New Ratio 6 : 4 : 5.]

| Liabilities | ₹ | Assets | ₹ |

| Capitals: X Y | 1,40,000 1,00,000 | Plant and Machinery | 1,75,000 |

| Workmen Compensation Reserve | 40,000 | Furniture and Fixtures | 65,000 |

| Creditors | 1,50,000 | Stock | 35,000 |

| Bills Payable | 10,000 | Bills Receivable | 12,000 |

| Debtors 1,10,000 Less: PDD 7,000 | 1,03,000 | ||

| Cash & Bank Balance | 50,000 | ||

| 4,40,000 | 4,40,000 |

Anurag Pathak Answered question