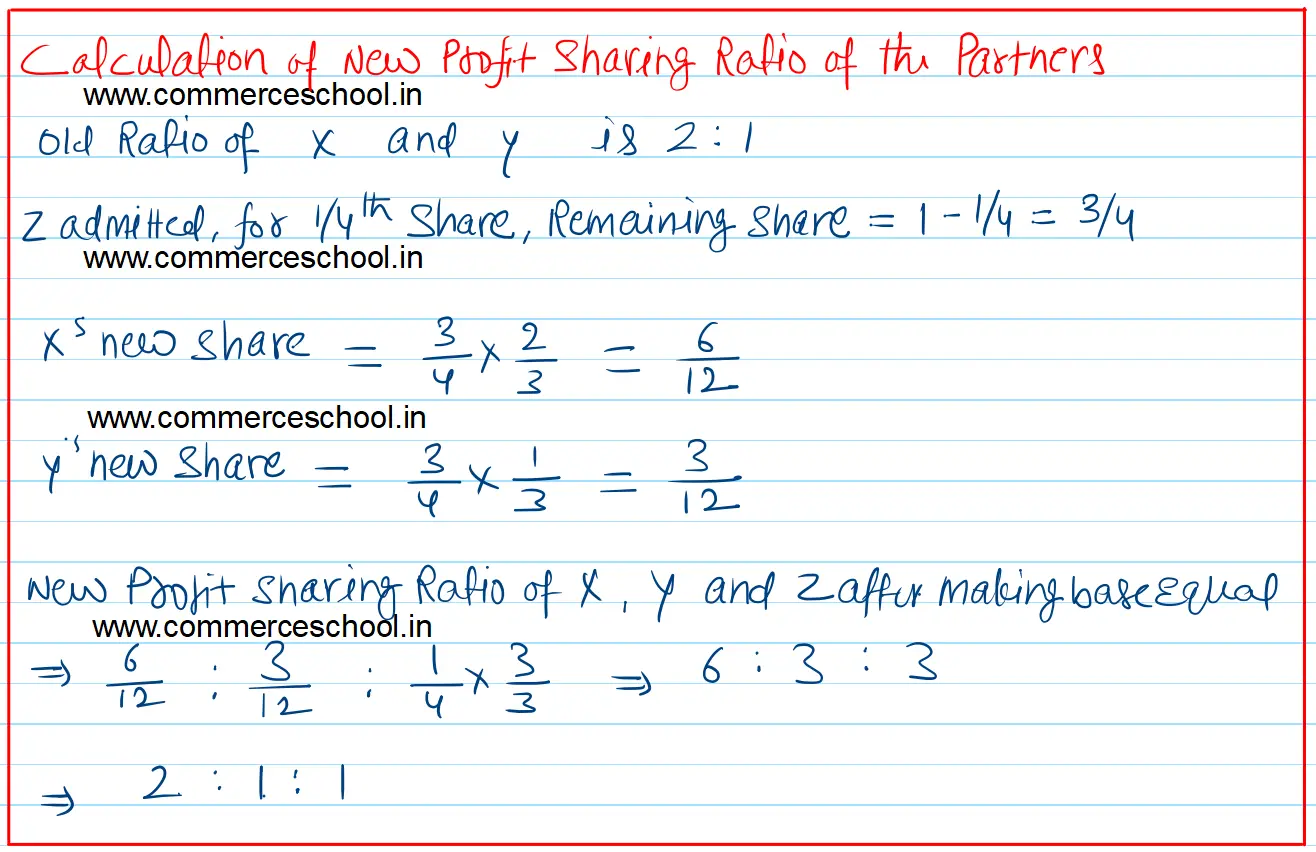

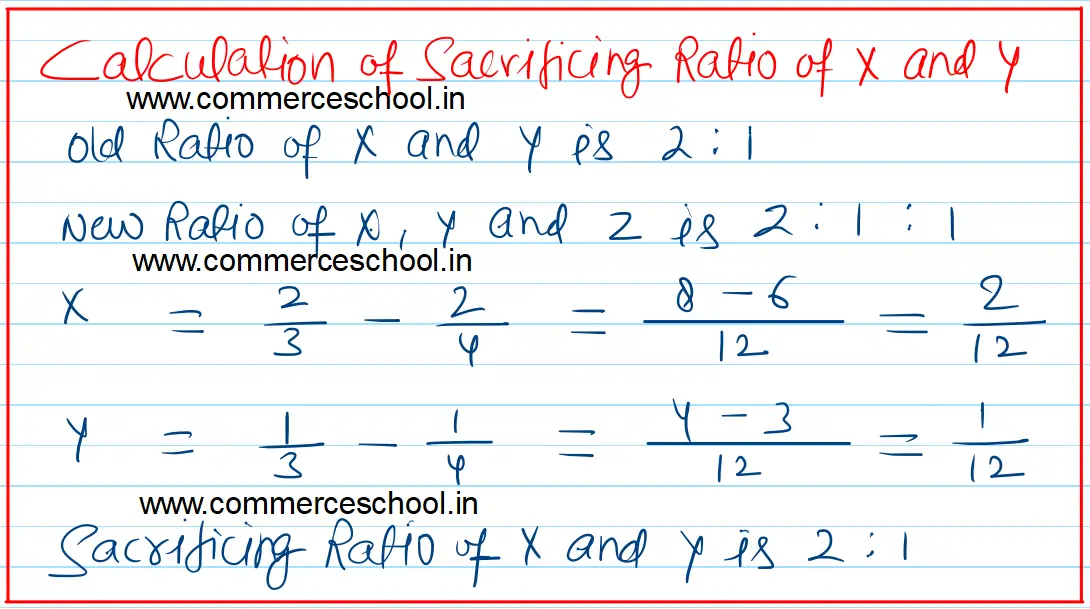

X and Y are partners sharing profits in the ratio of 2 : 1. Their balance Sheet as at 31st March, 2022 was as follows:

X and Y are partners sharing profits in the ratio of 2 : 1. Their balance Sheet as at 31st March, 2022 was as follows:

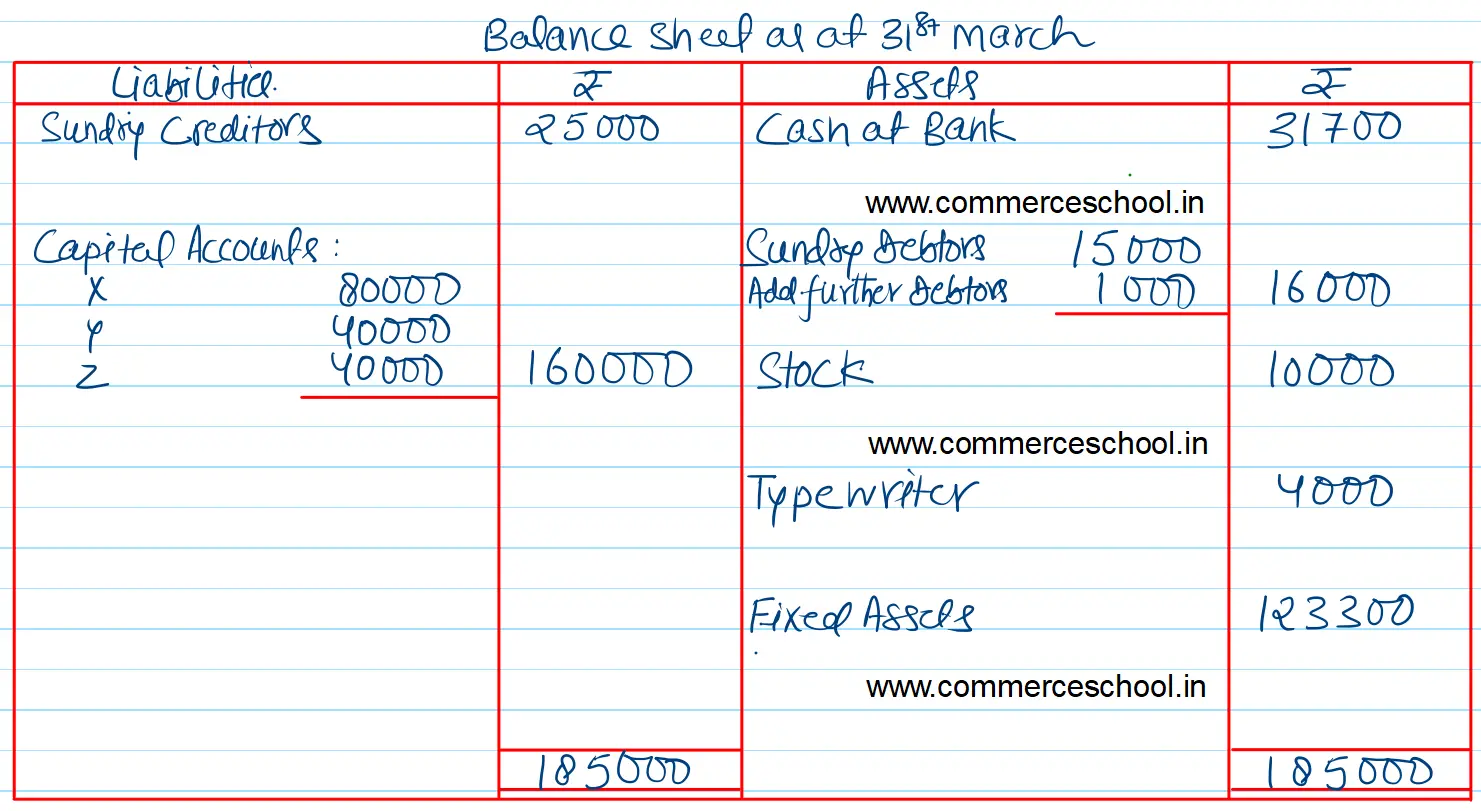

| Liabilities | ₹ | Assets | ₹ |

| Sundry Creditors | 25,000 | Cash at Bank | 5,000 |

| Reserve Fund | 18,000 | Sundry Debtors | 15,000 |

|

Capital Accounts X Y |

75,000 62,000 |

Stock | 10,000 |

| Investments | 8,000 | ||

| Typewriter | 5,000 | ||

| Fixed Assets | 1,37,000 | ||

| 1,80,000 | 1,80,000 |

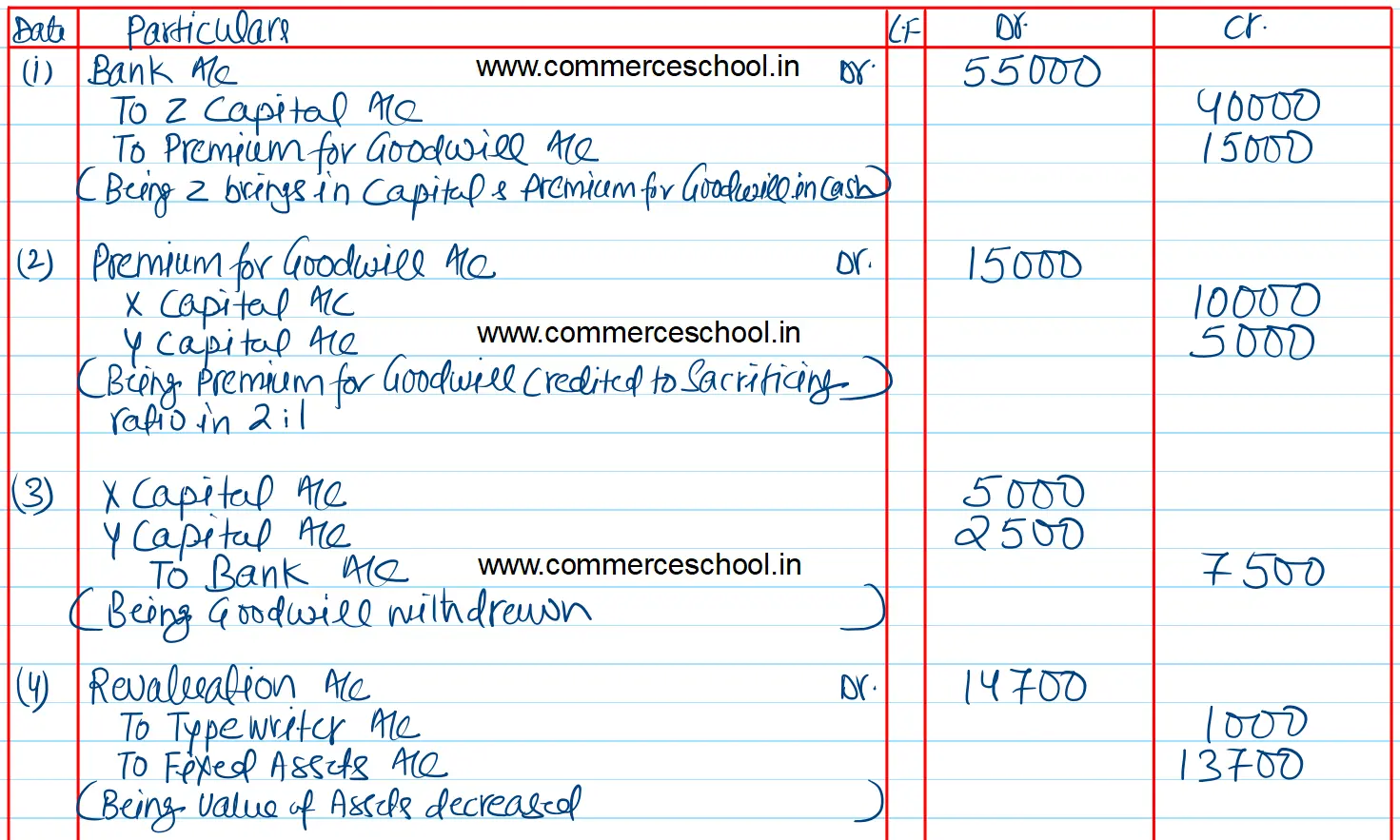

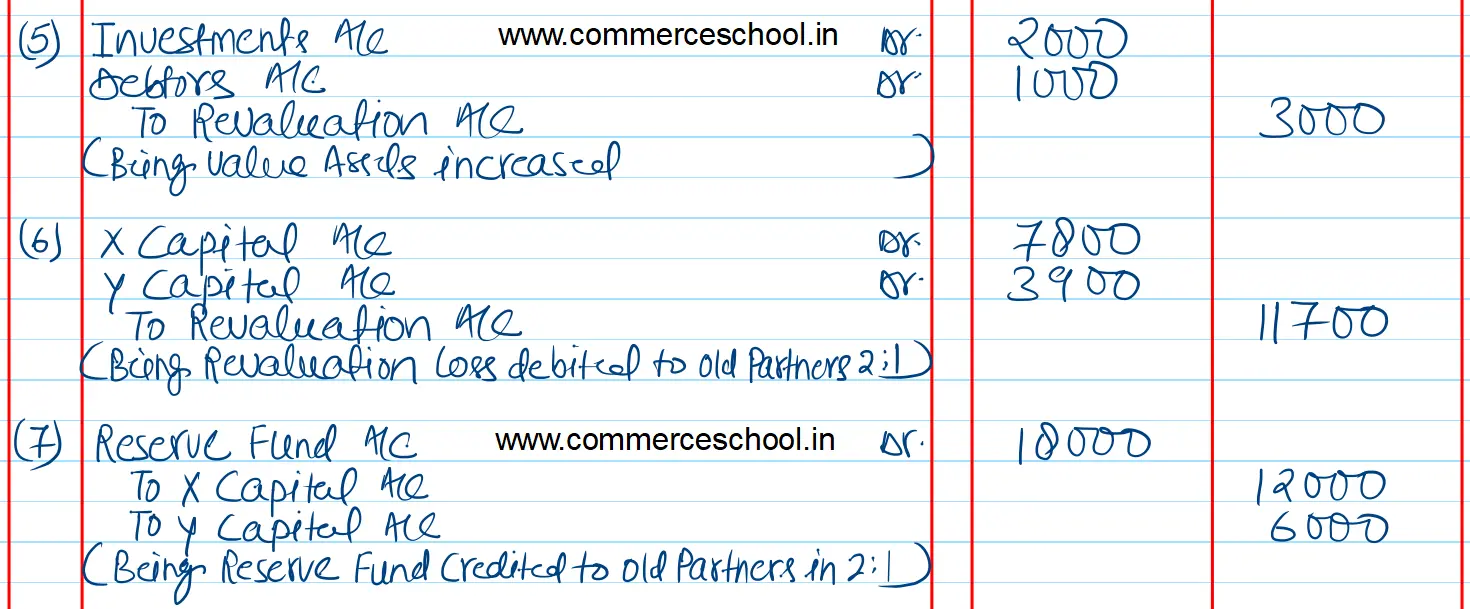

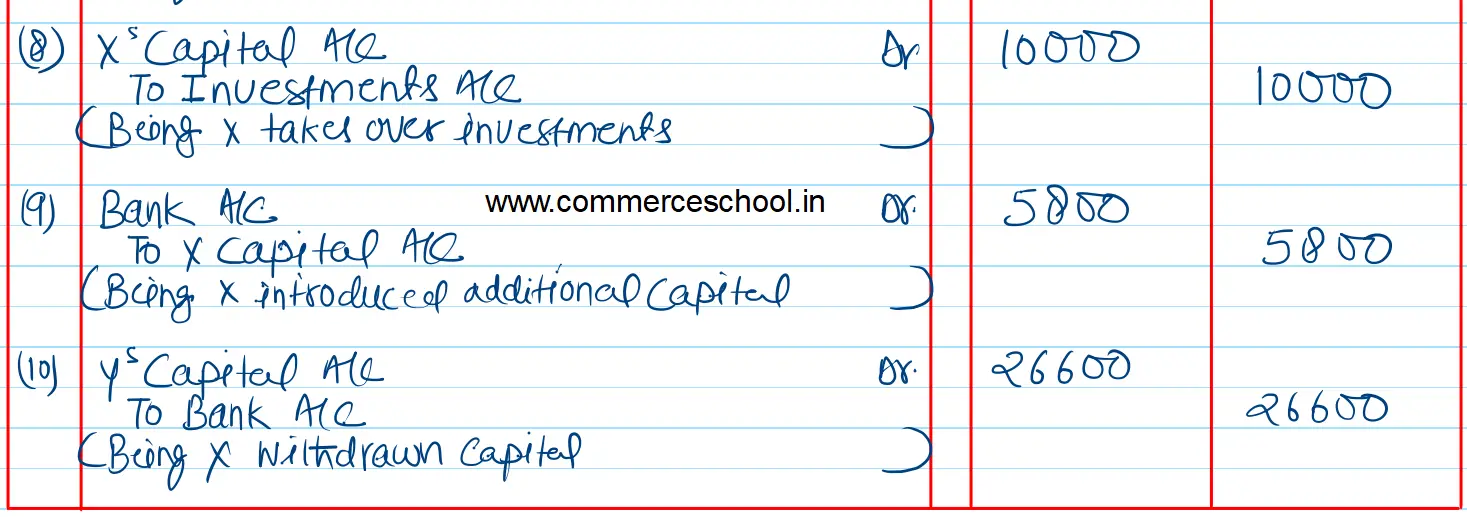

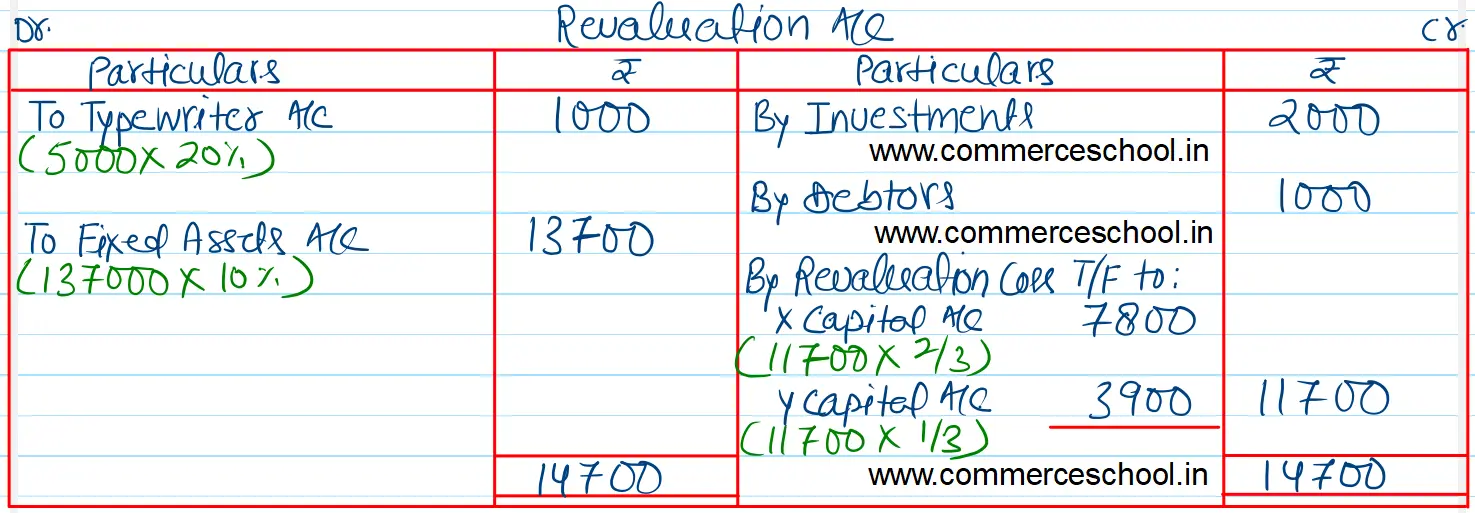

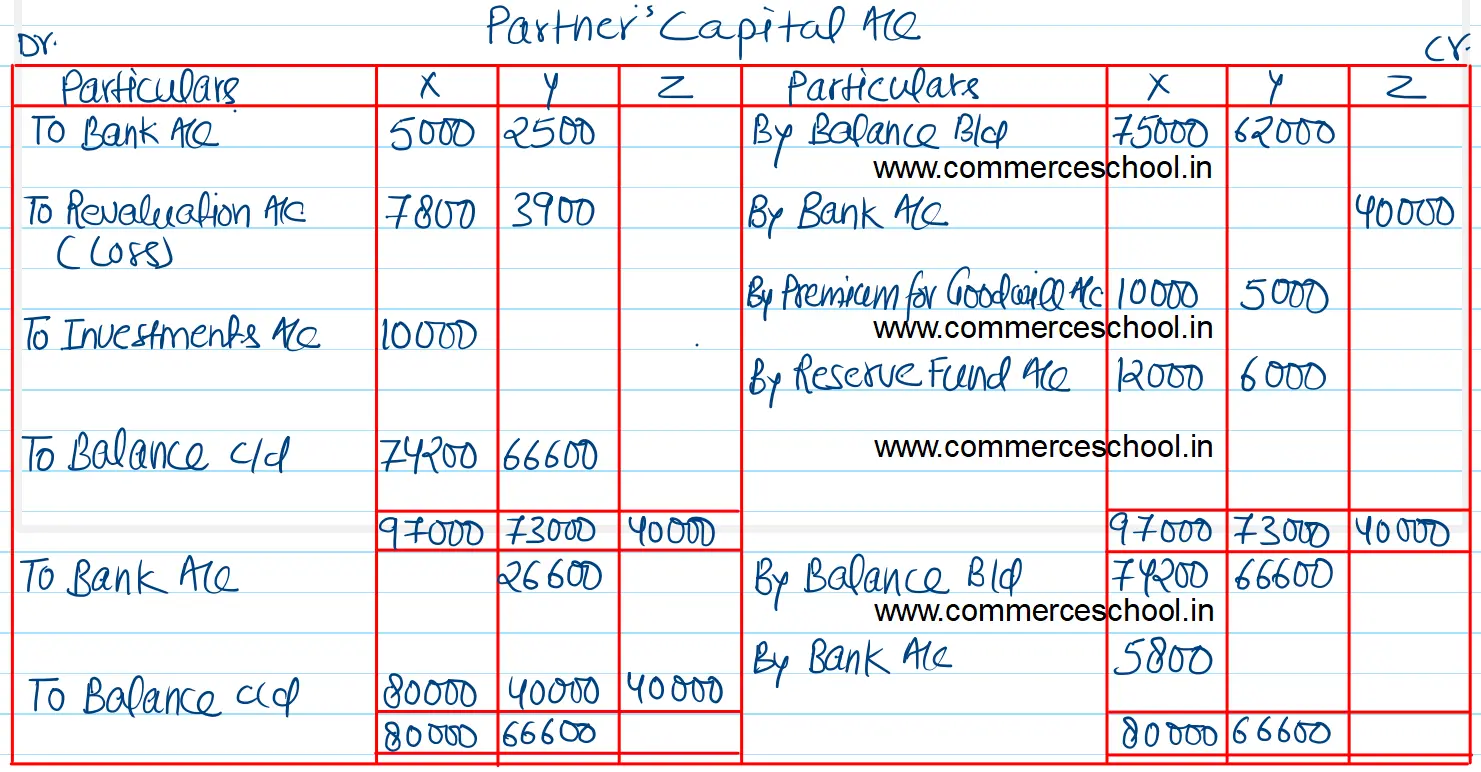

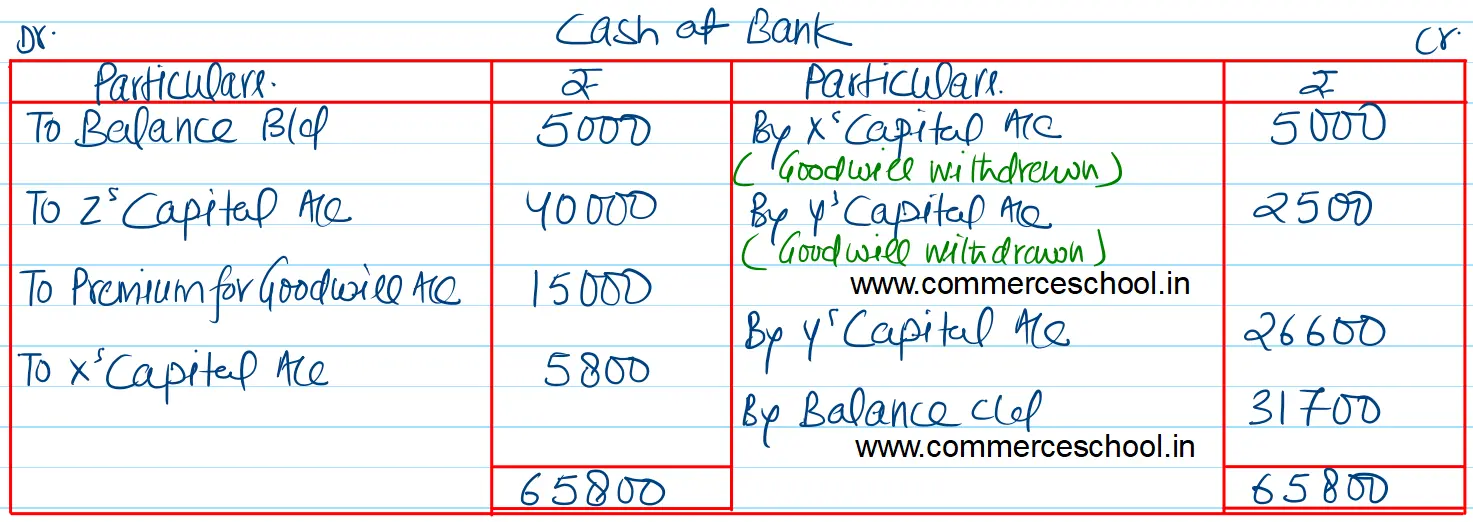

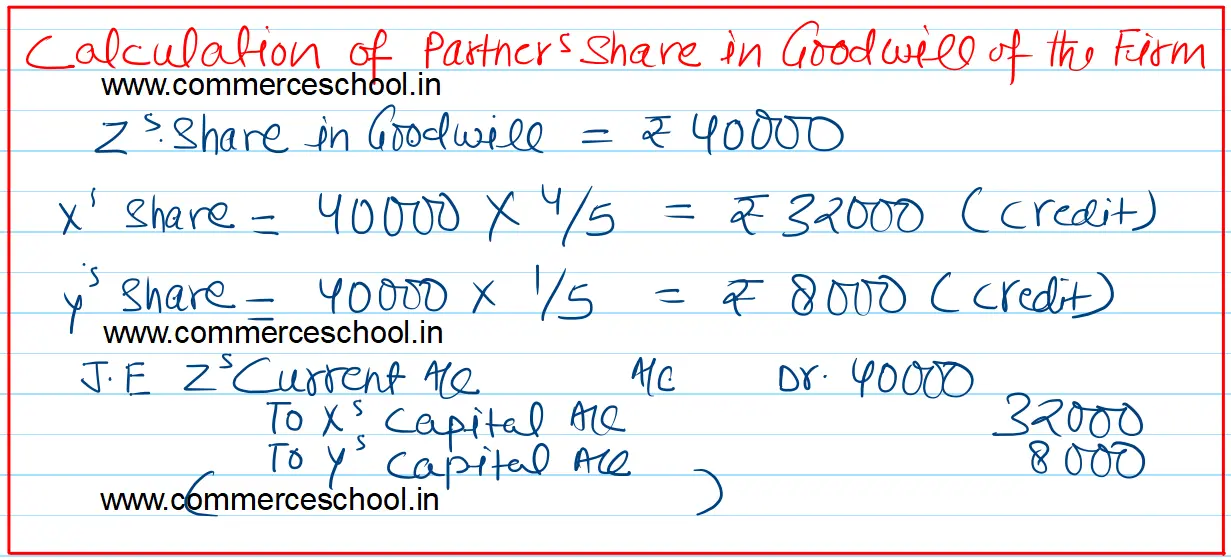

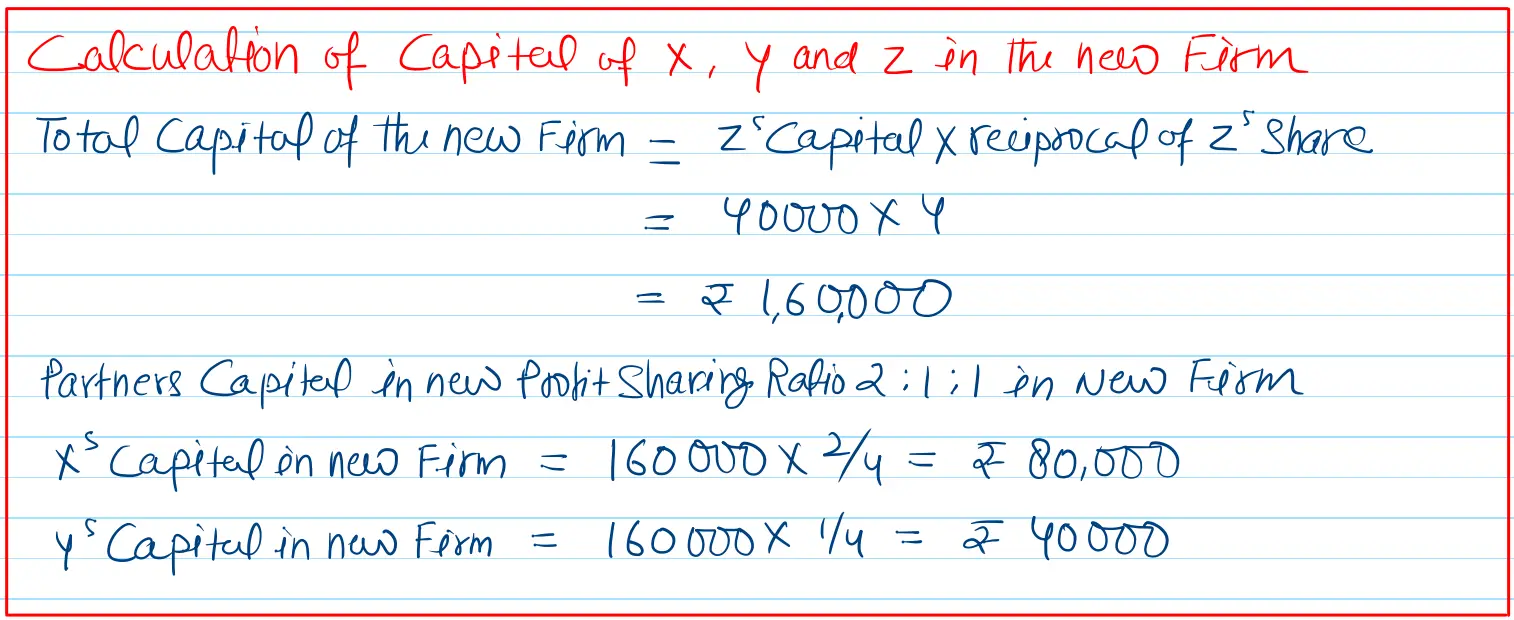

They admit Z into partnership from 1st April, 2022 on the following terms: (i) Z brings in ₹ 40,000 as his capital and he is given 1/4th share in profits. (ii) Z brings in ₹ 15,000 for goodwill, half of which is withdrawn by old partners. (iii) Investments are valued at ₹ 10,000. X taken over Investments at this value. (iv) Typewriter is to be depreciated by 20% and fixed Assets by 10%. (v) An old customer, whose account was written off as bad debts, has promised to pay ₹ 1,000. (vi) By bringing in or withdrawing cash, the Capitals of X and Y are to be made proportionate to that of Z on their profit sharing basis. Pass Journal entries, prepare capital accounts and new B/S of the firm. [Ans. Loss on Revaluation ₹ 11,700; Capital A/cs X ₹ 80,000; Y ₹ 40,000; Z ₹ 40,000; Bank Balance ₹ 31,700; B/S Total ₹ 1,85,000; X brings in ₹ 5,800; Y withdraws ₹ 26,600.]