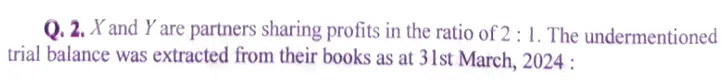

X and Y are partners sharing profits in the ratio of 2 : 1. The undermentioned trial balance was extracted from their books as at 31st March, 2024:

X and Y are partners sharing profits in the ratio of 2 : 1. The undermentioned trial balance was extracted from their books as at 31st March, 2024:

| Particulars | Dr. | Cr. |

|

X’s Capital Y’s Capital X’s Drawings Y’s Drawings Stock (1st April, 2023) Purchases and Sales Debtors and Creditors Buildings Cash in Hand Bank Overdraft Salaries to Staff Rent Advertising Expenditure Travelling Expenses |

40,000 32,000 45,200 8,68,000 1,52,000 6,00,000 5,900

74,700 26,400 6,000 31,300 |

3,20,000 2,40,000

12,45,000 48,000

27,500 |

| 18,80,500 | 18,80,500 |

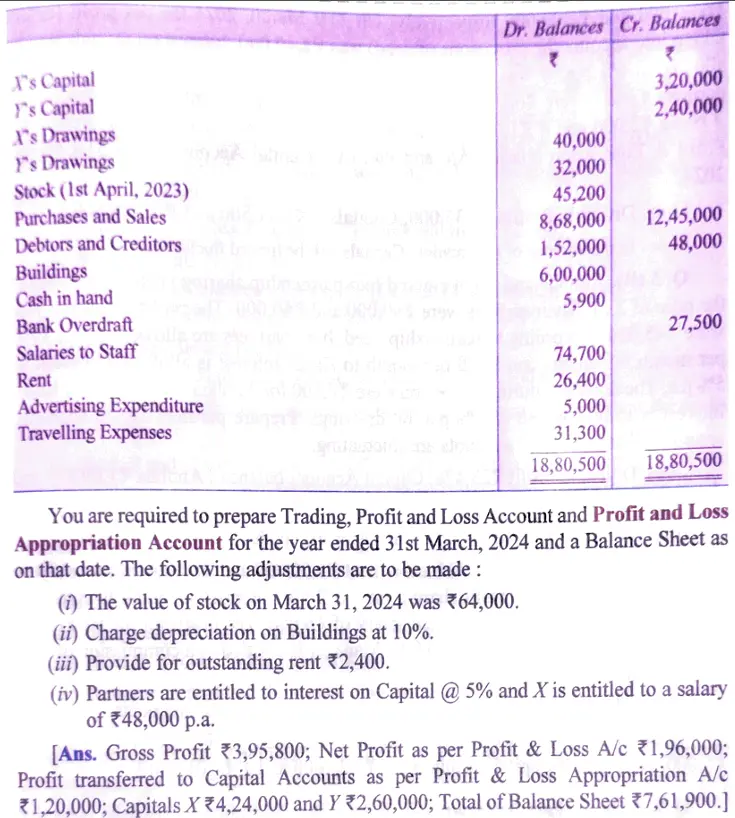

You are required to prepare Trading, Profit and Loss Appropriation Account for the year ended 31st March, 2024 and a Balance Sheet as on that date. The following adjustments are to be made:

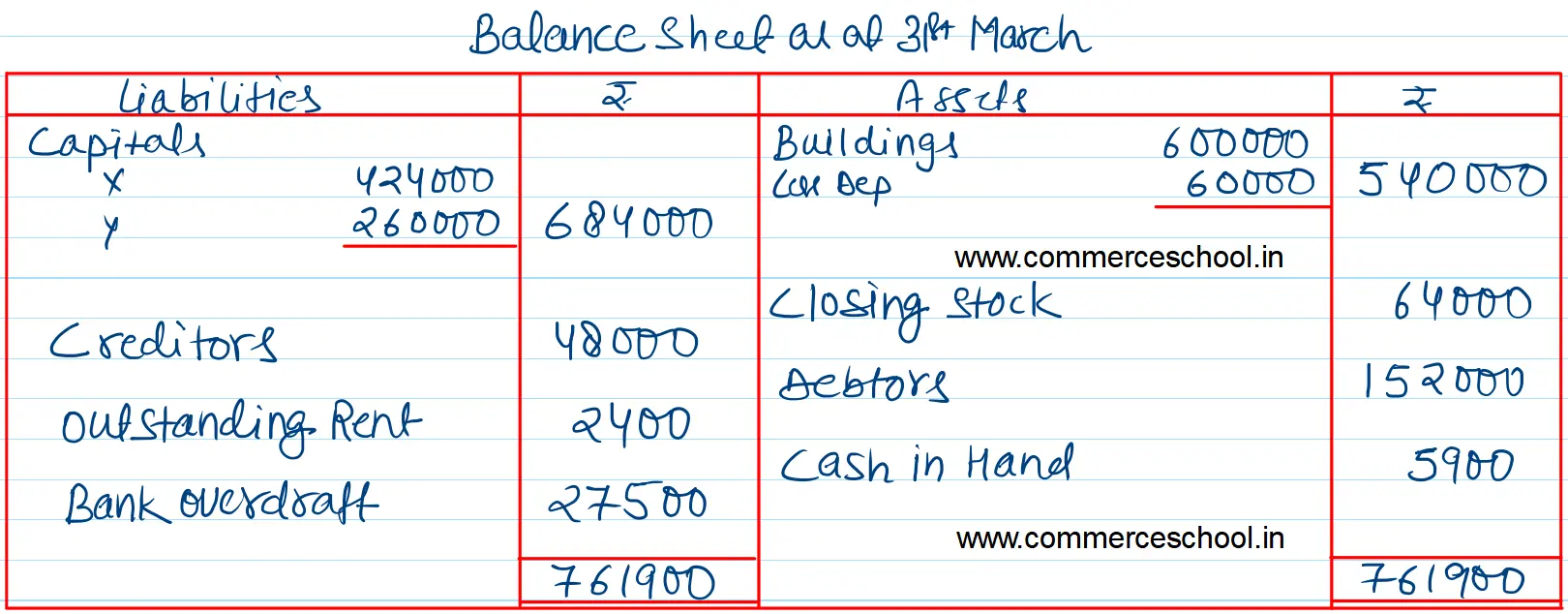

(i) The value of stock on March 31, 2024 was ₹ 64,000.

(ii) Charge depreciation on Buildings at 10%.

(iii) Provide for outstanding rent ₹ 2,400.

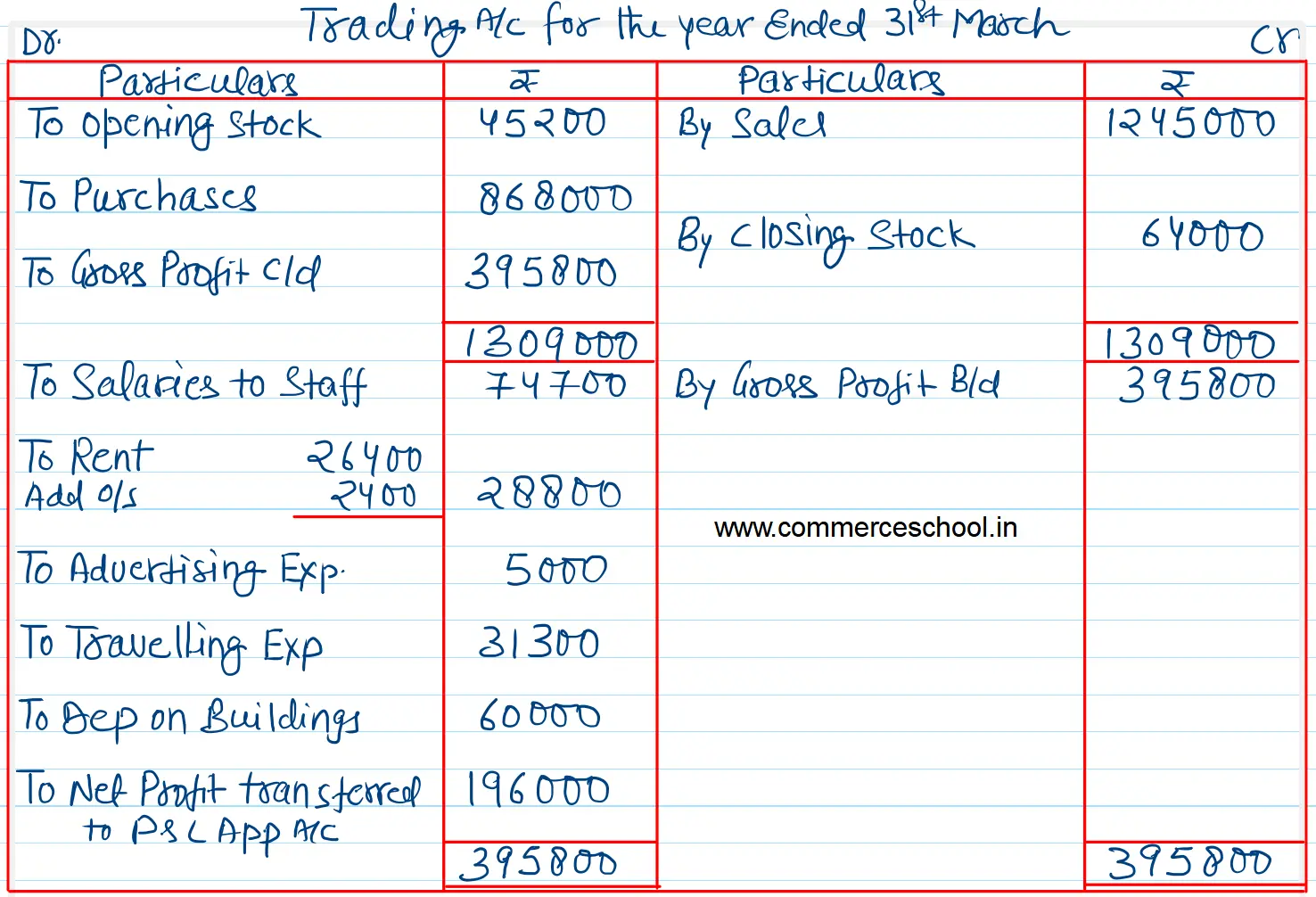

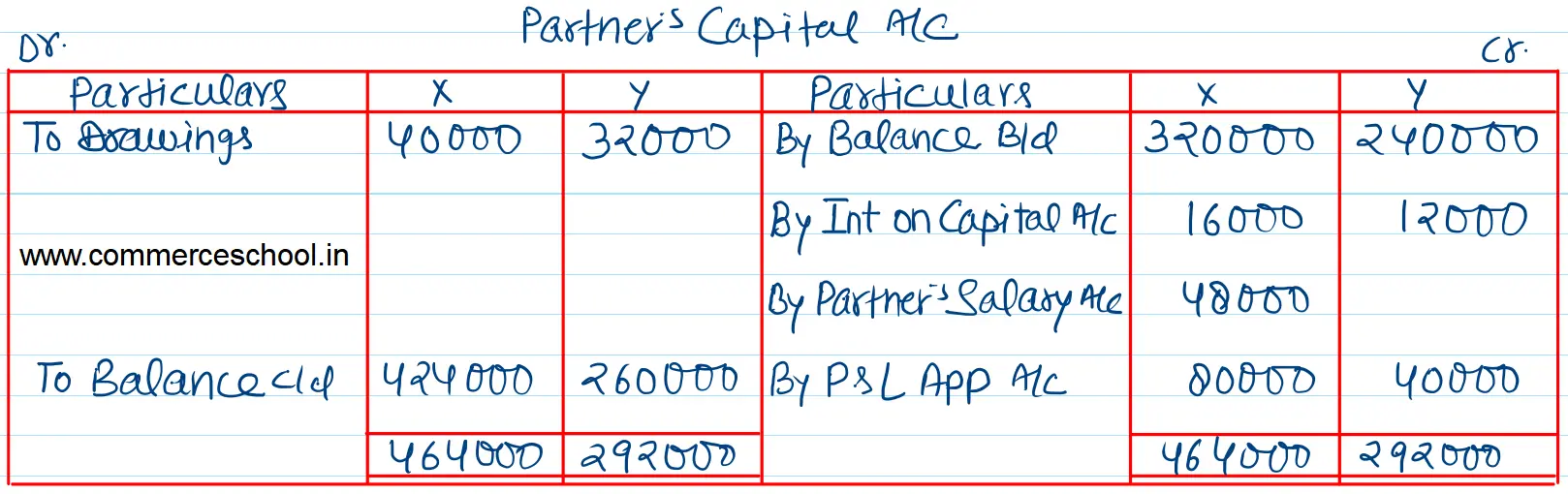

(iv) Partners are entitled to interest on Capital @ 5% and X is entitled to a salary of ₹ 48,000 p.a.

[Ans. Gross Profit ₹ 3,95,800; Net Profit as per Profit & Loss A/c ₹ 1,96,000; Profit transferred to Capital Accounts as per Profit & Loss Appropriation A/c ₹ 1,20,000; Capitals X ₹ 4,24,000 and Y ₹ 2,60,000; Total of Balance Sheet ₹ 7,61,900.