X and Y are partners sharing profits in the ratio of 3 : 2 with capitals of ₹ 8,00,000 and ₹ 6,00,000 respectively.

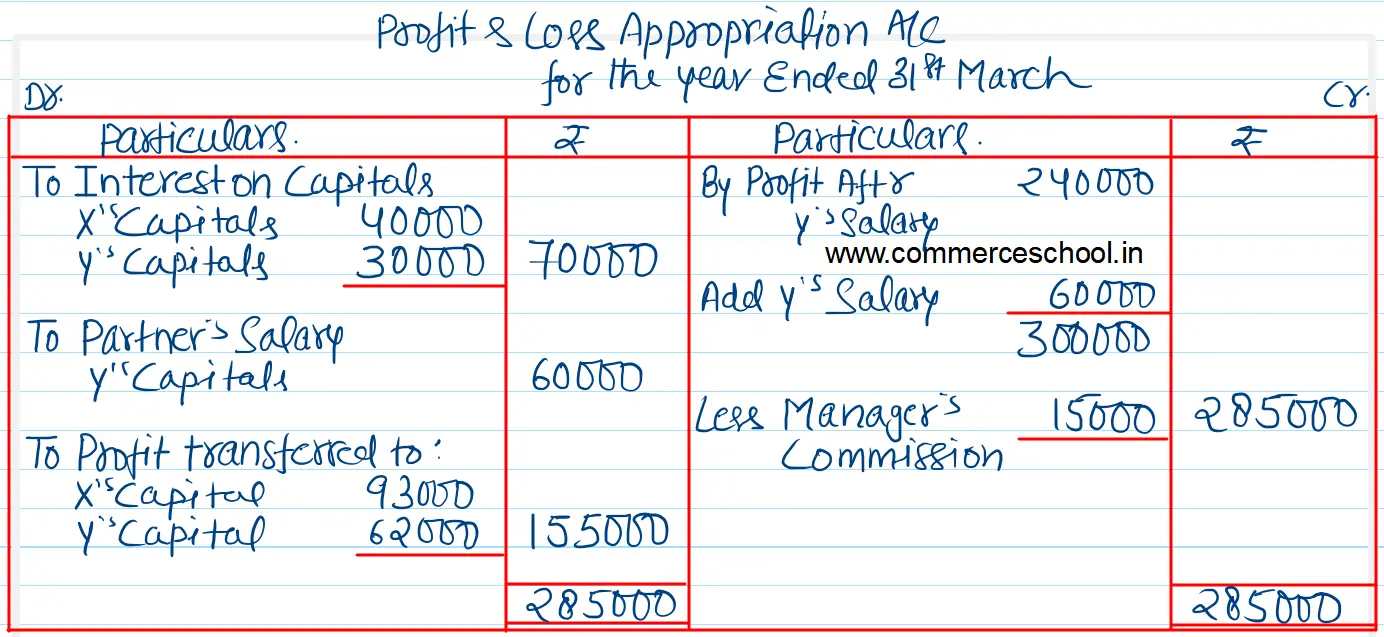

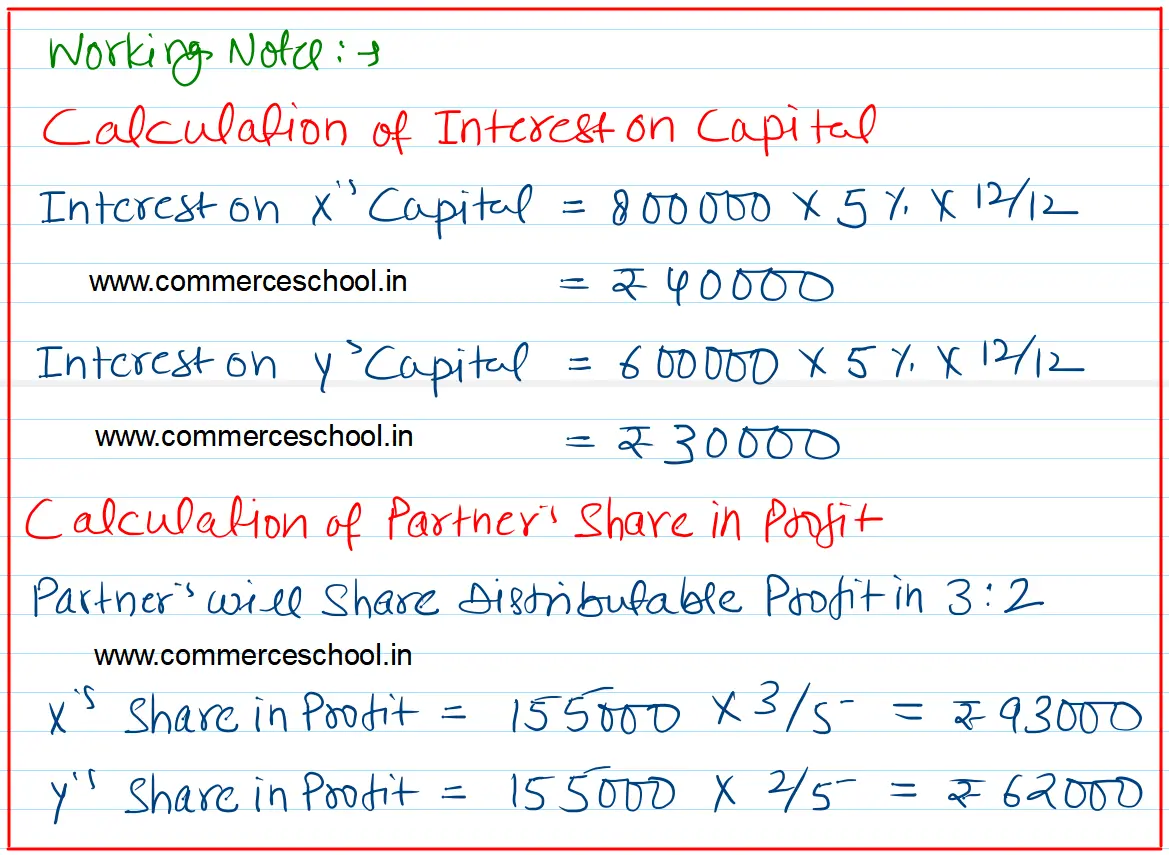

X and Y are partners sharing profits in the ratio of 3 : 2 with capitals of ₹ 8,00,000 and ₹ 6,00,000 respectively. Interest on capital is agreed @ 5% p.a. Y is to be allowed an annual salary of ₹ 60,000 which has not been withdrawn. Profit for the year ended 31st March 2023 before interest on capital but after charging Y’s salary was ₹ 2,40,000.

A provision of 5% of the net profit is to be made in respect of commission to the Manager.

Prepare a Profit and Loss Appropriation Account showing the allocation of profits.

[Ans: Provision for Manager’s Commission – ₹ 15,000 (i.e., 5% of ₹ 3,00,000), Share of Profit: X – ₹ 93,000; Y – ₹ 62,000.]

Anurag Pathak Changed status to publish April 10, 2024