X and Y are partners with capital of ₹ 13,00,000 and ₹ 20,00,000. They share profits in the ratio of 1 : 2. They admit Z as a partner with 1/5th share in the profits of the firm. Z brings in ₹ 12,00,000 as his share of capital

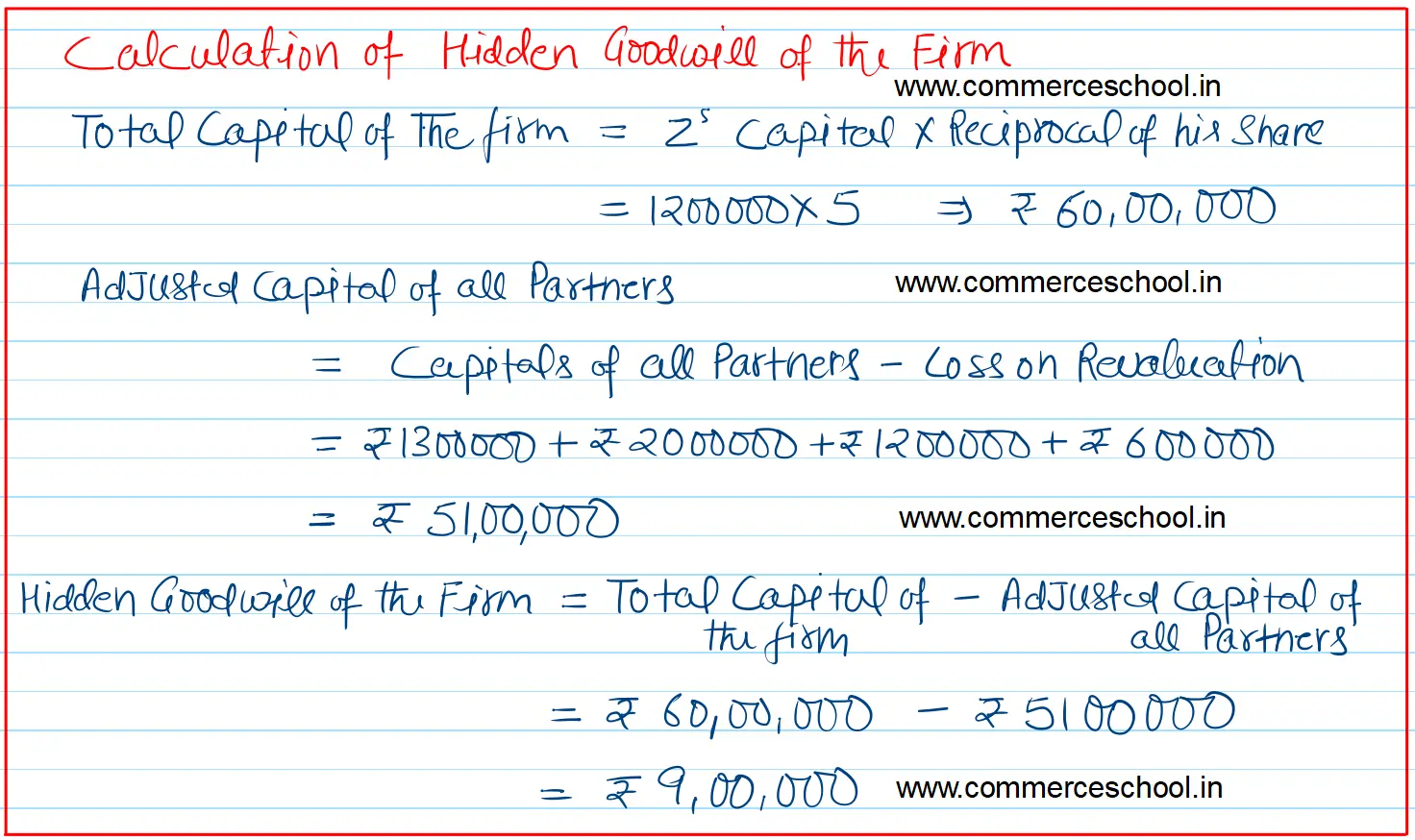

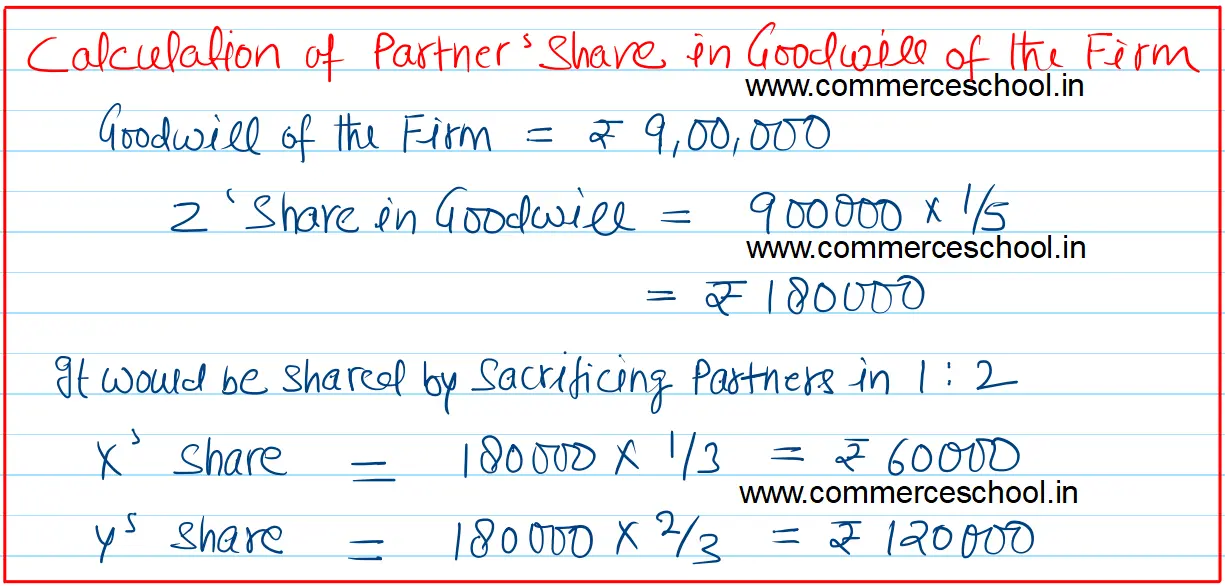

X and Y are partners with capital of ₹ 13,00,000 and ₹ 20,00,000. They share profits in the ratio of 1 : 2. They admit Z as a partner with 1/5th share in the profits of the firm. Z brings in ₹ 12,00,000 as his share of capital. The Profit and Loss account showed a credit balance of ₹ 6,00,000 as on the date of admission of Z. Give the necessary Journal entries to record the goodwill.

[Ans. Hidden Goodwill ₹ 9,00,000.]

Hint: Balance of P& L will be credited to the Capital Accounts of X and Y and hidden goodwill will be calculated thereafter.

Anurag Pathak Answered question