X and Y share profits in the ratio of 5 : 3. Their balance sheet as at 31st March, 2024 was as follows:

X and Y share profits in the ratio of 5 : 3. Their balance sheet as at 31st March, 2024 was as follows:

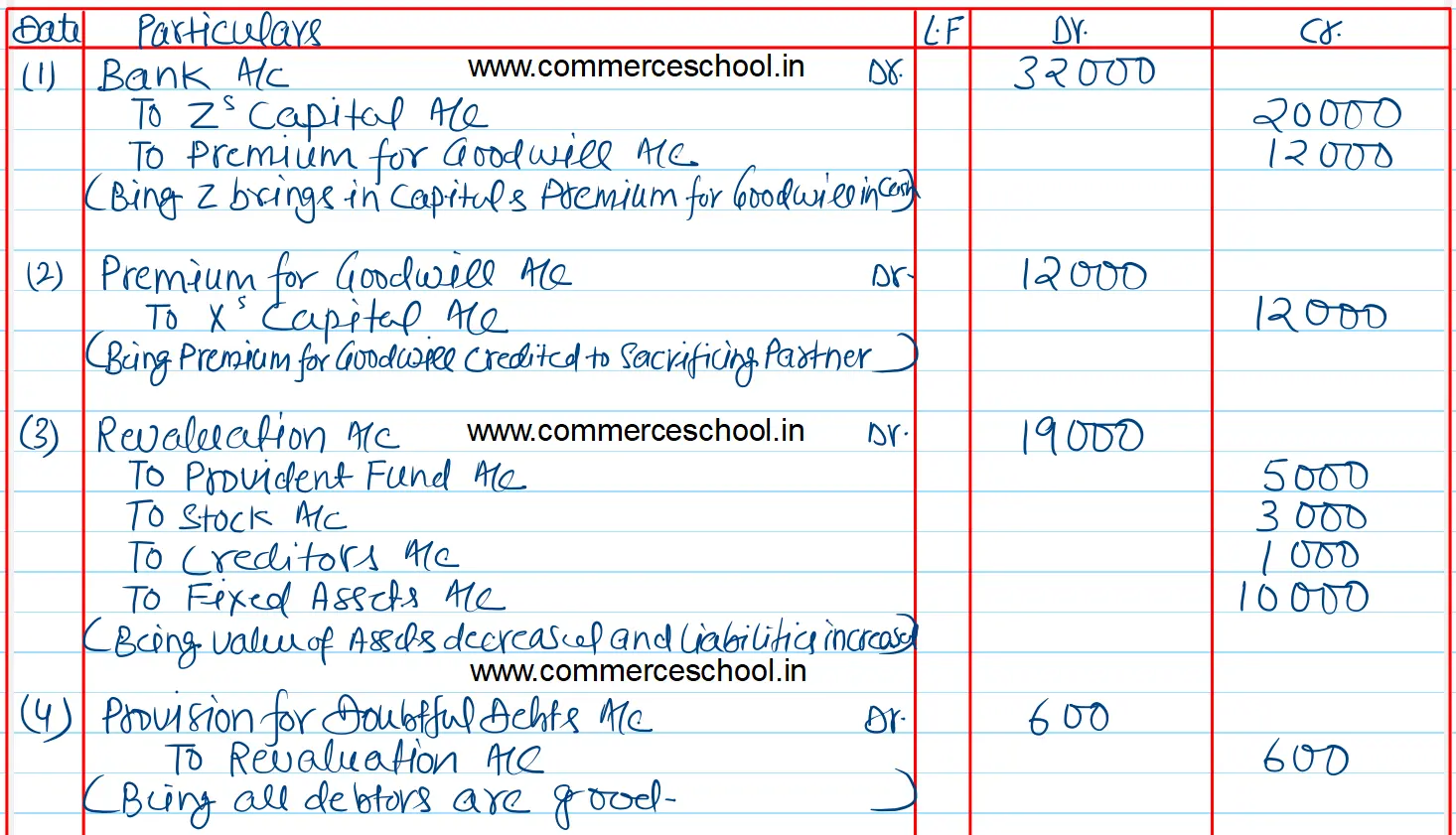

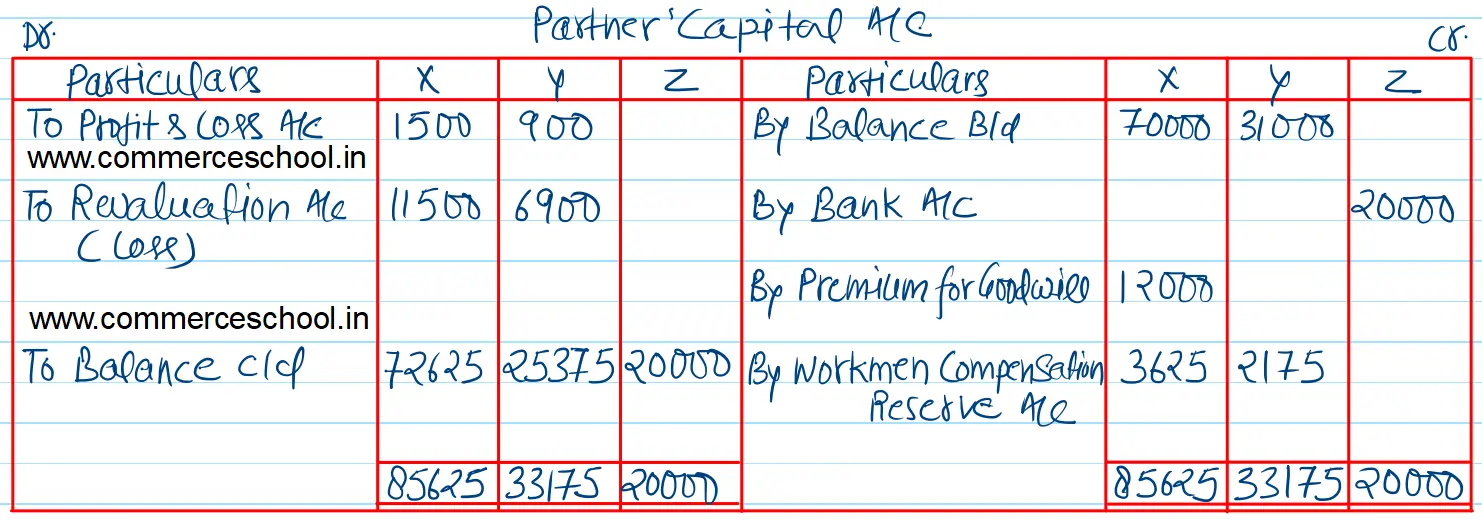

They admit Z into partnership on 1st April, 2024 with 1/8th share in profits. Z brings ₹ 20,000 as his capital and ₹ 12,000 for goodwill in cash. Z acquires his share entirely from X. Following revaluations are also made:

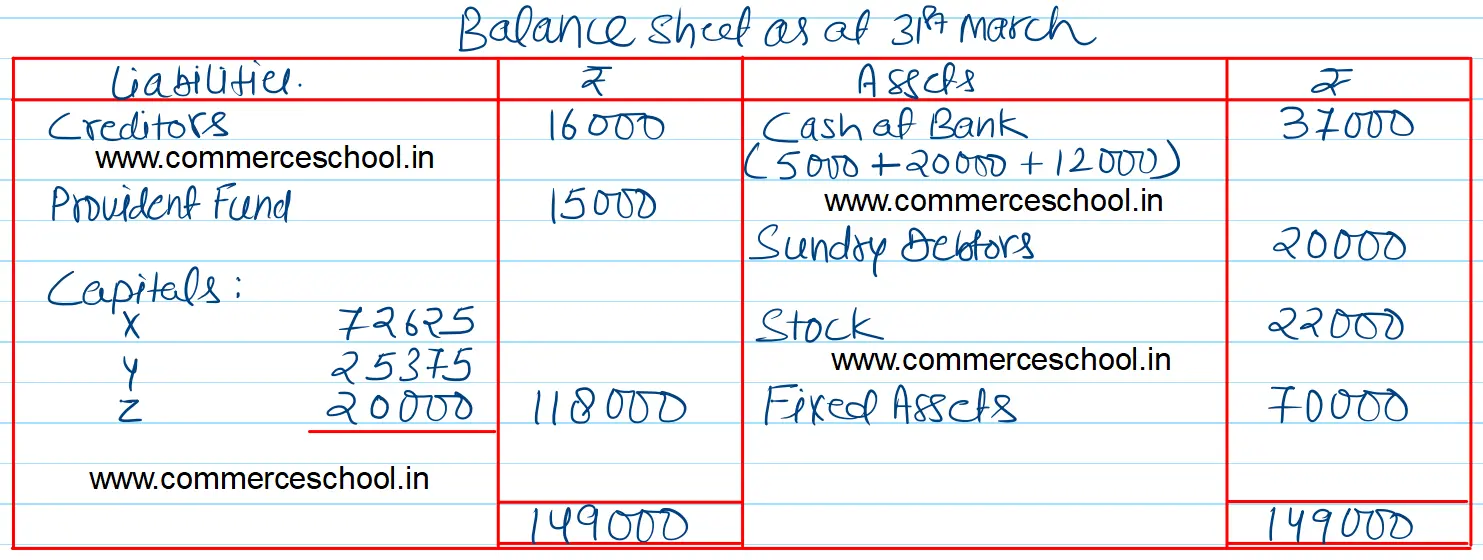

Balance Sheet as at 31st March

| Liabilities | ₹ | Assets | ₹ |

| Creditors | 15,000 | Cash at Bank | 5,000 |

| Provident Fund | 10,000 | Sundry Debtors 20,000 Less: Provision 600 | 19,400 |

| Workmen’s Compensation Reserve | 5,800 | Stock | 25,000 |

| Capitals: X Y | 70,000 31,000 | Fixed Assets | 80,000 |

| Profit & Loss A/c | 2,400 | ||

| 1,31,800 | 1,31,800 |

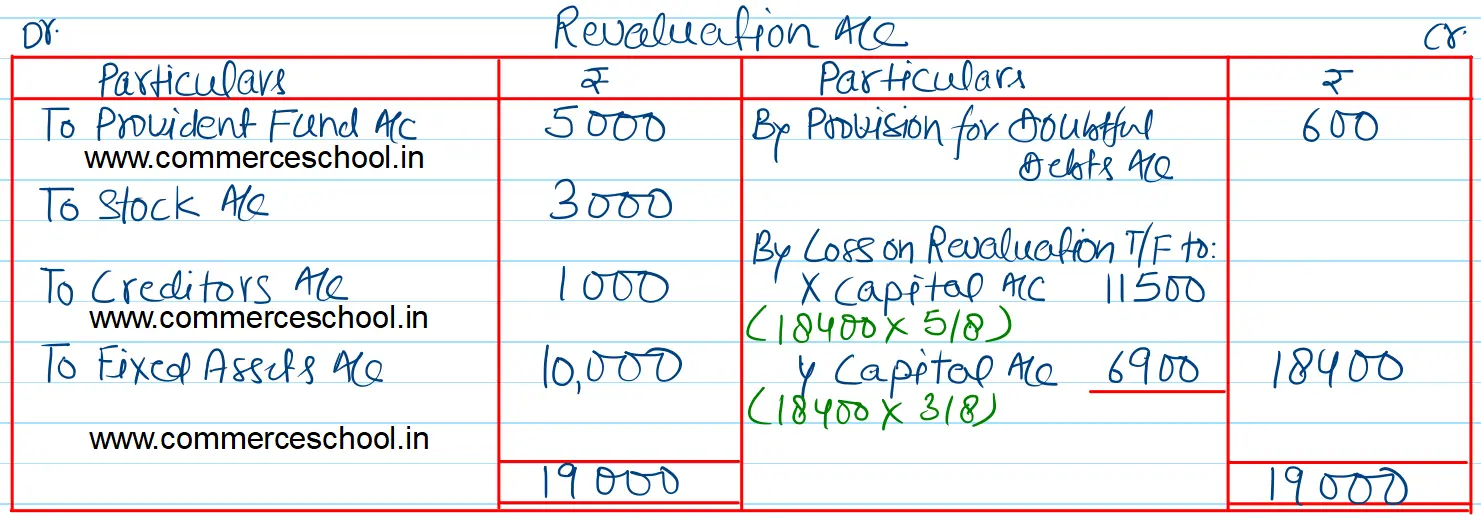

- Provident fund is to be increased by ₹ 5,000.

- Debtors are all good. Therefore, no provision is required on debtors.

- Stock includes ₹ 3,000 for obsolete items.

- Creditors are to be paid ₹ 1,000 more.

- Fixed Assets are to be revalued at ₹ 70,000.

Anurag Pathak Answered question

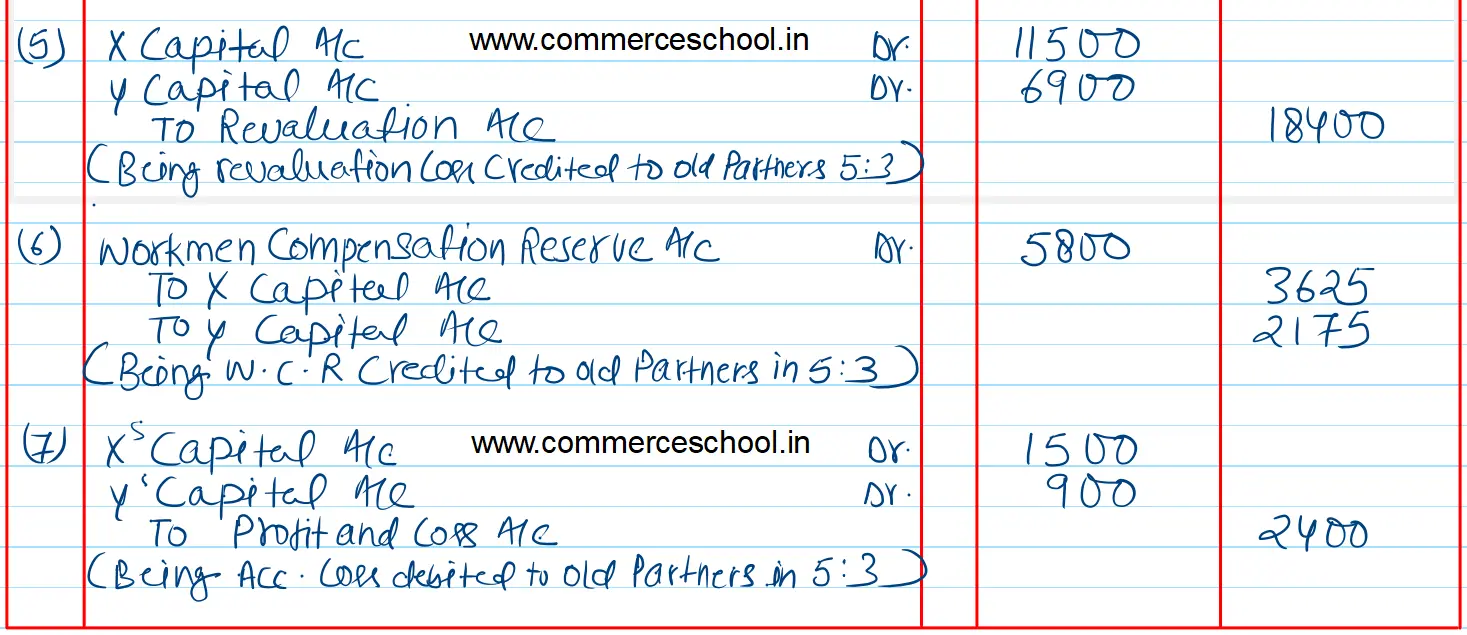

Solution:-

Note:-

As only X sacrifices to Z, the premium of goodwill is credited to the partner X.

Anurag Pathak Edited answer