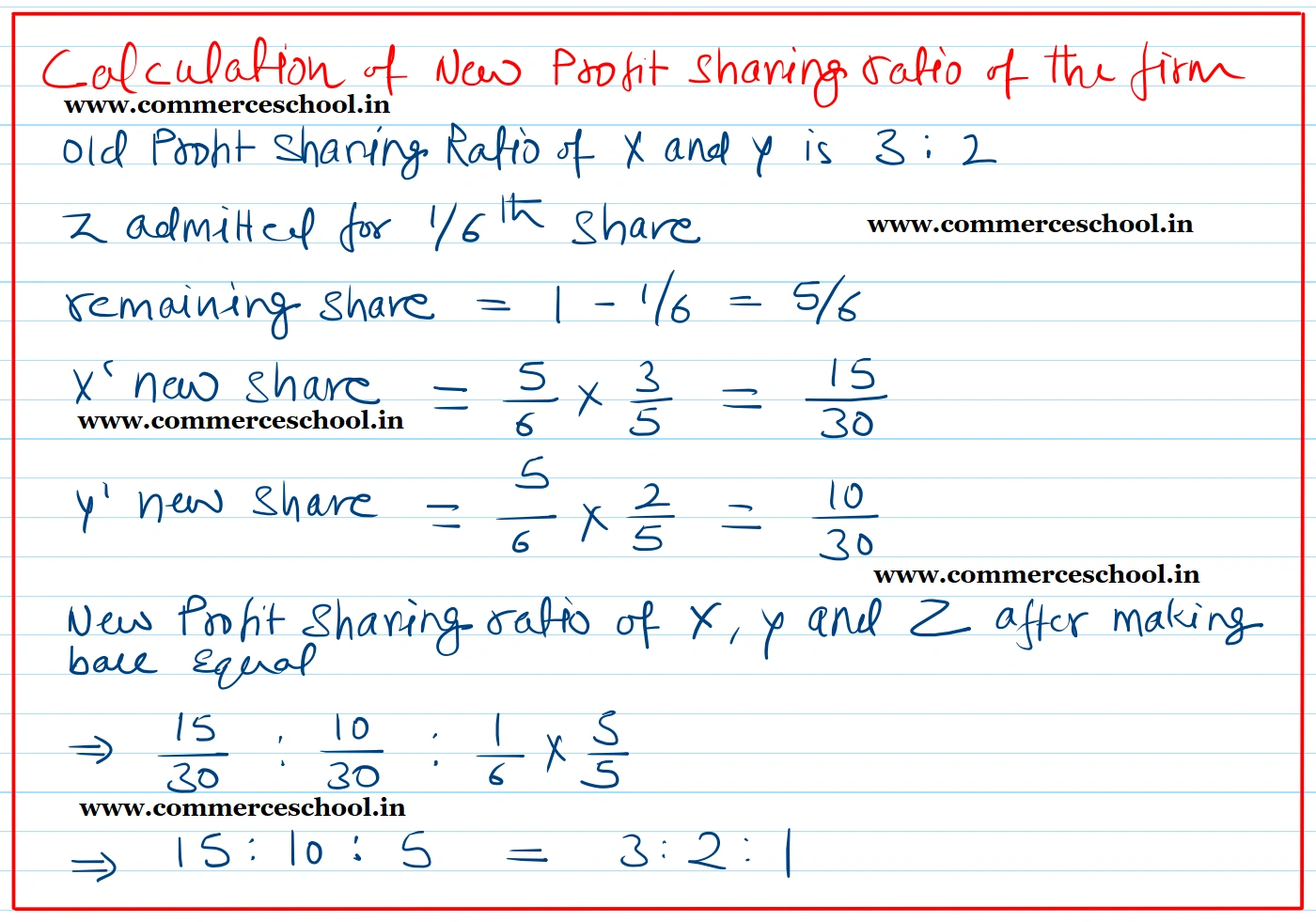

X and Y were partners in the profit-sharing ratio of 3 : 2. Their balance sheet as at March 31, 2022 was as follows:

X and Y were partners in the profit-sharing ratio of 3 : 2. Their balance sheet as at March 31, 2022 was as follows:

Balance Sheet as at March 31, 2022

| Liabilities | ₹ | Assets | ₹ |

| Creditors | 56,000 | Plant and Machinery | 70,000 |

| General Reserve | 14,000 | Buildings | 98,000 |

|

Capital Accounts: X 1,19,000 Y 1,12,000 |

2,31,000 | Stock | 21,000 |

|

Debtors (-) Provision |

35,000 | ||

| Cash in Hand | 77,000 | ||

| 3,01,000 | 3,01,000 |

Z was admitted for 1/6th share on the following terms:

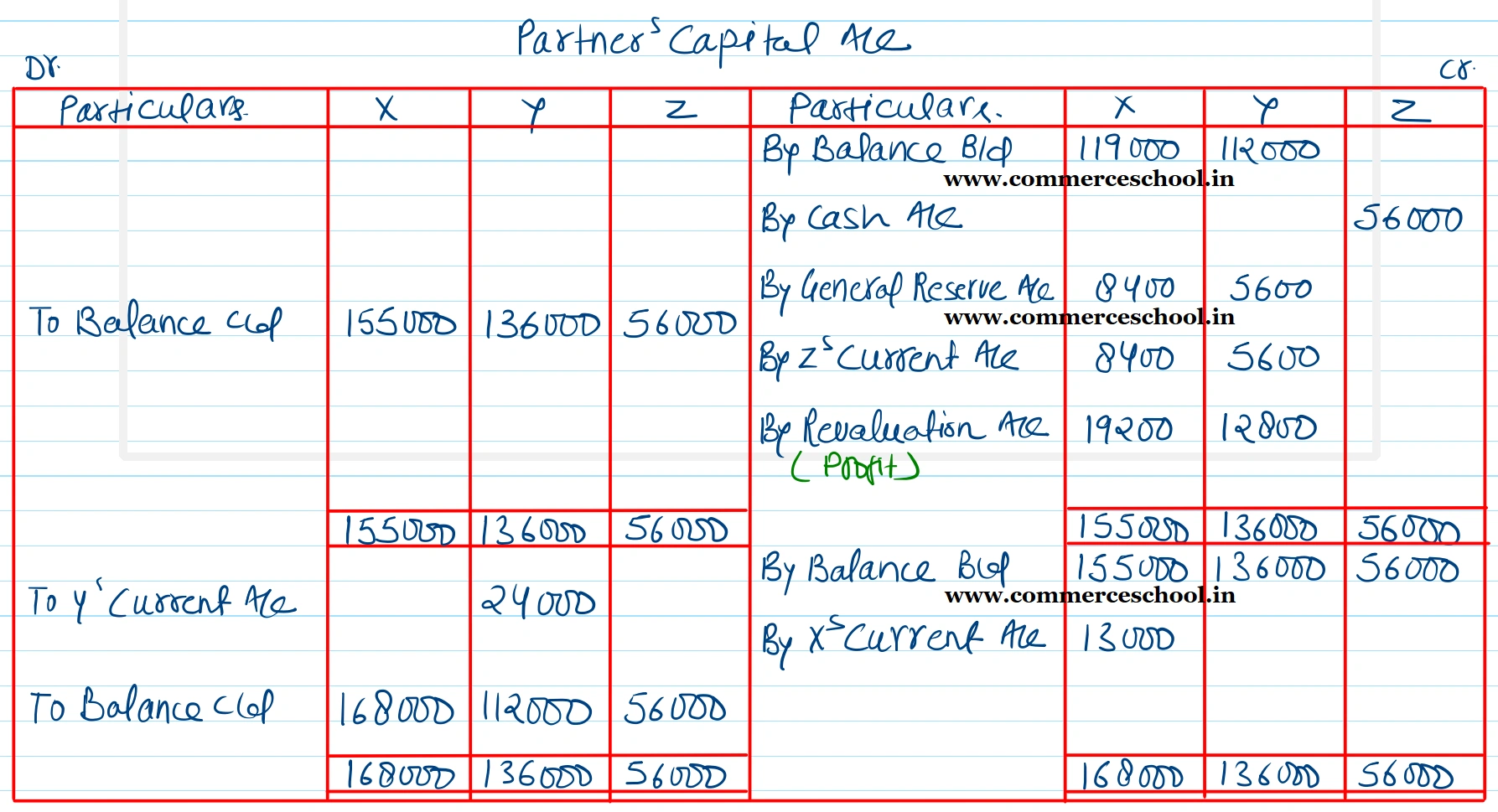

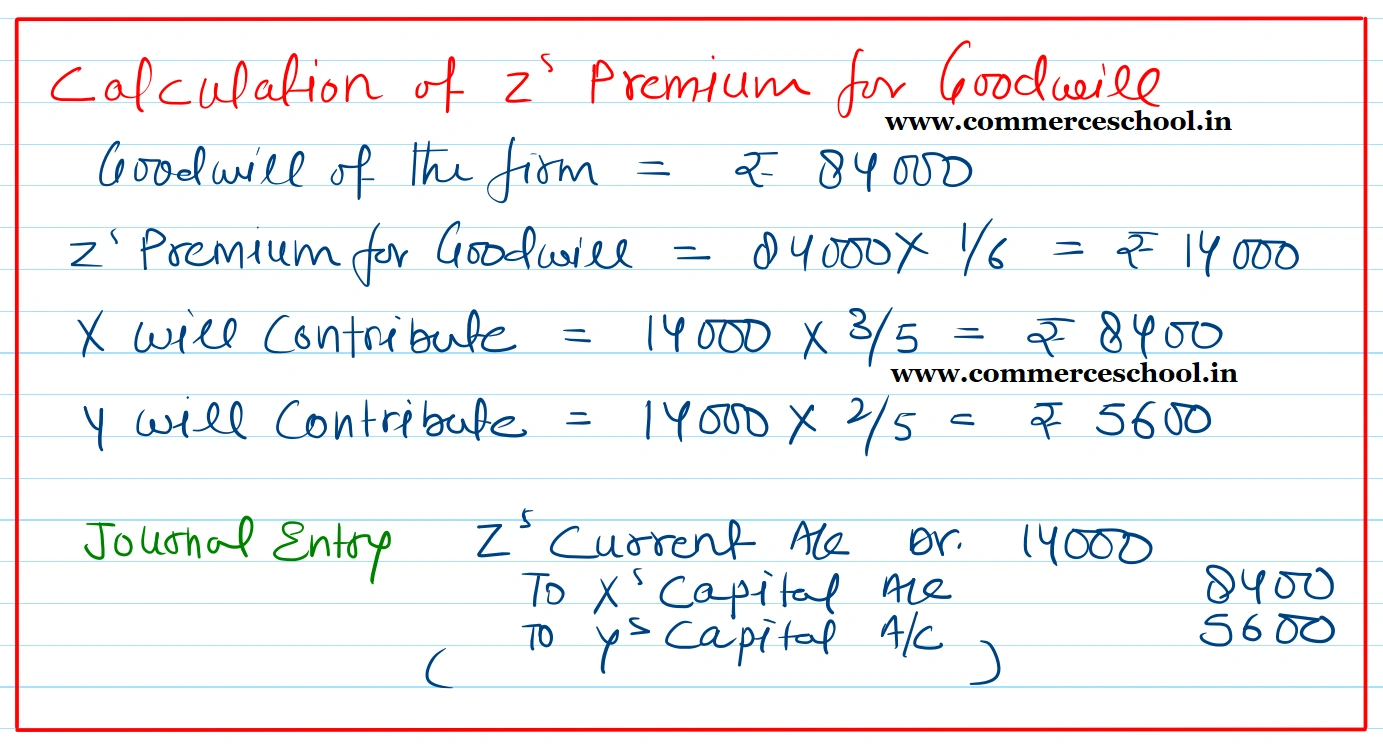

(i) Z will bring ₹ 56,000 as his share of capital, but was not able to bring any amount to compensate the sacrificing partners.

(ii) Goodwill of the firm is valued at ₹ 84,000.

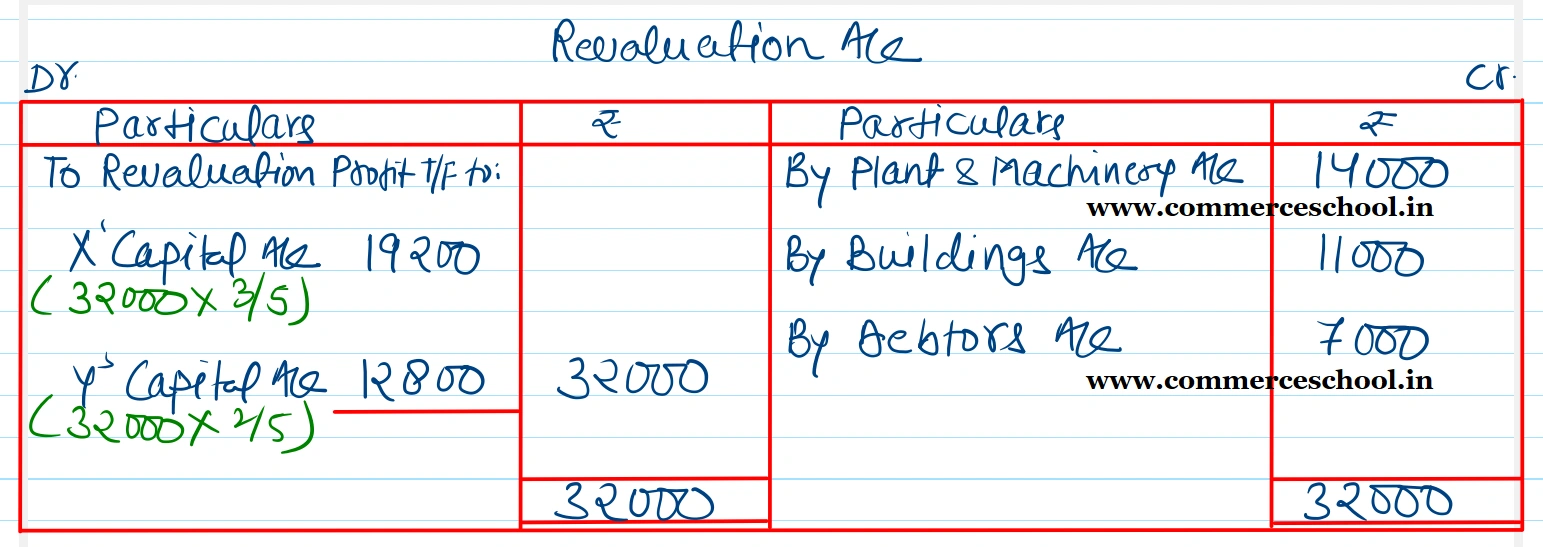

(iii) Plant and Machinery were found to be undervalued by ₹ 14,000. Building was to brought up to ₹ 1,09,000.

(iv) All debtors are goods.

(v) Capitals of X and Y will be adjusted on the basis of Z’s share and adjustments will be done by opening necessary current accounts.

You are requied to prepare revaluation account and Partner’s Capital Accounts.

[Ans. Gain on Revaluation ₹ 32,000; Capital Accounts X ₹ 1,68,000; Y ₹ 1,12,000 and Z ₹ 56,000; X’s Current A/c Dr. ₹ 13,000; Y’s Current A/c Cr. ₹ 24,000.]