X and Y were partners sharing profits in the ratio of 1 : 2. Their Balance Sheet as at 31st March, 2024 was as follows:

X and Y were partners sharing profits in the ratio of 1 : 2. Their Balance Sheet as at 31st March, 2024 was as follows:

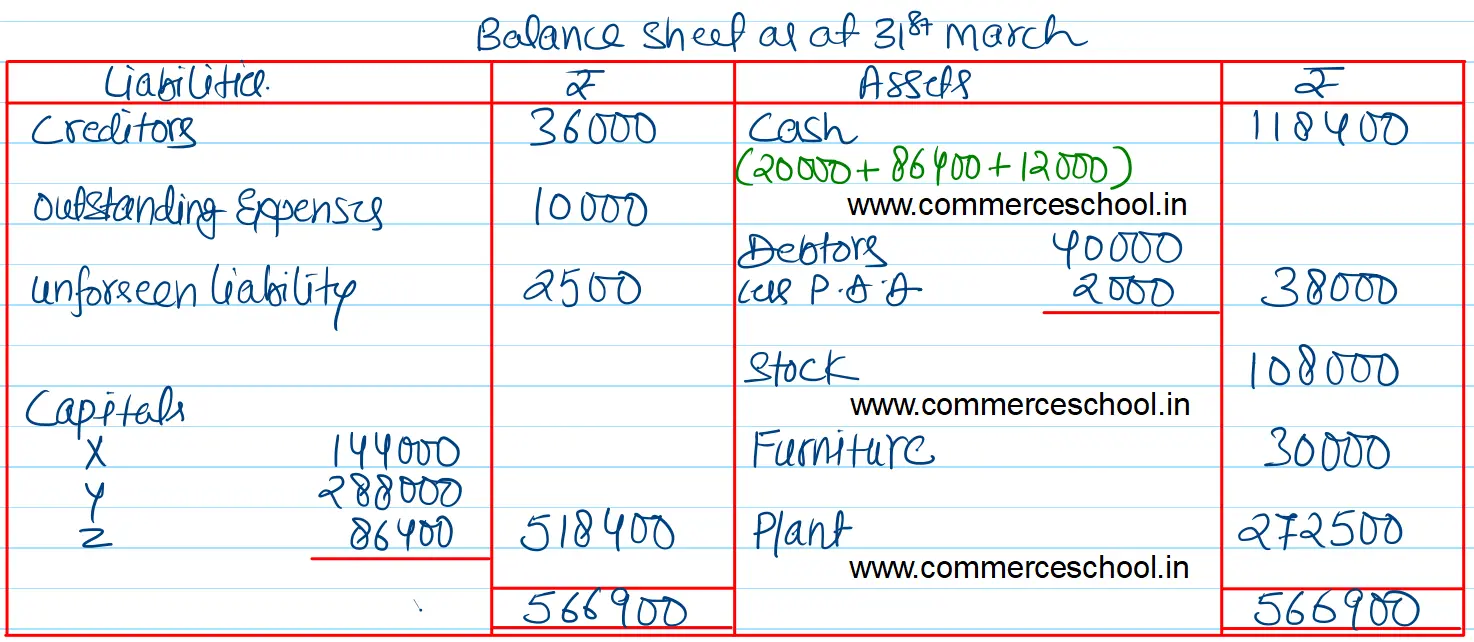

Balance Sheet

| Liabilities | ₹ | Assets | ₹ |

| Creditors | 36,000 | Cash | 20,000 |

| Outstanding Expenses | 4,000 | Debtors 40,000 Less: Provision 500 |

39,500 |

| Capitals X Y |

1,50,000 3,00,000 |

Stock | 1,20,000 |

| Furniture | 30,000 | ||

| Plant | 2,72,500 | ||

| Patents | 8,000 | ||

| 4,90,000 | 4,90,000 |

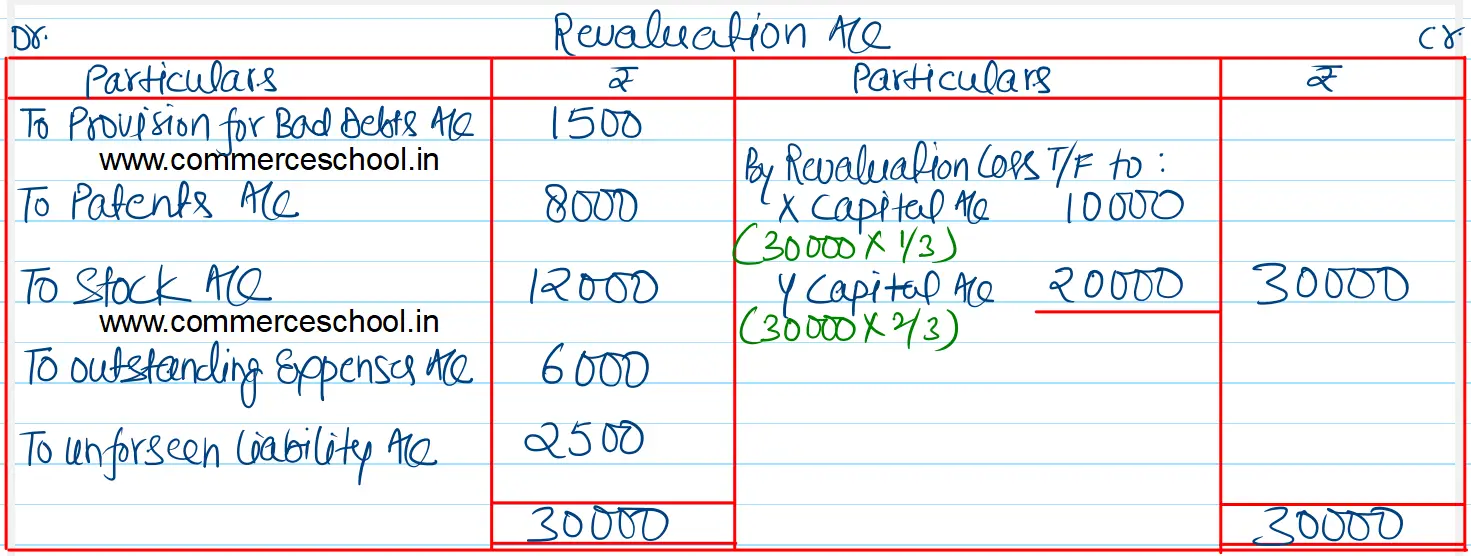

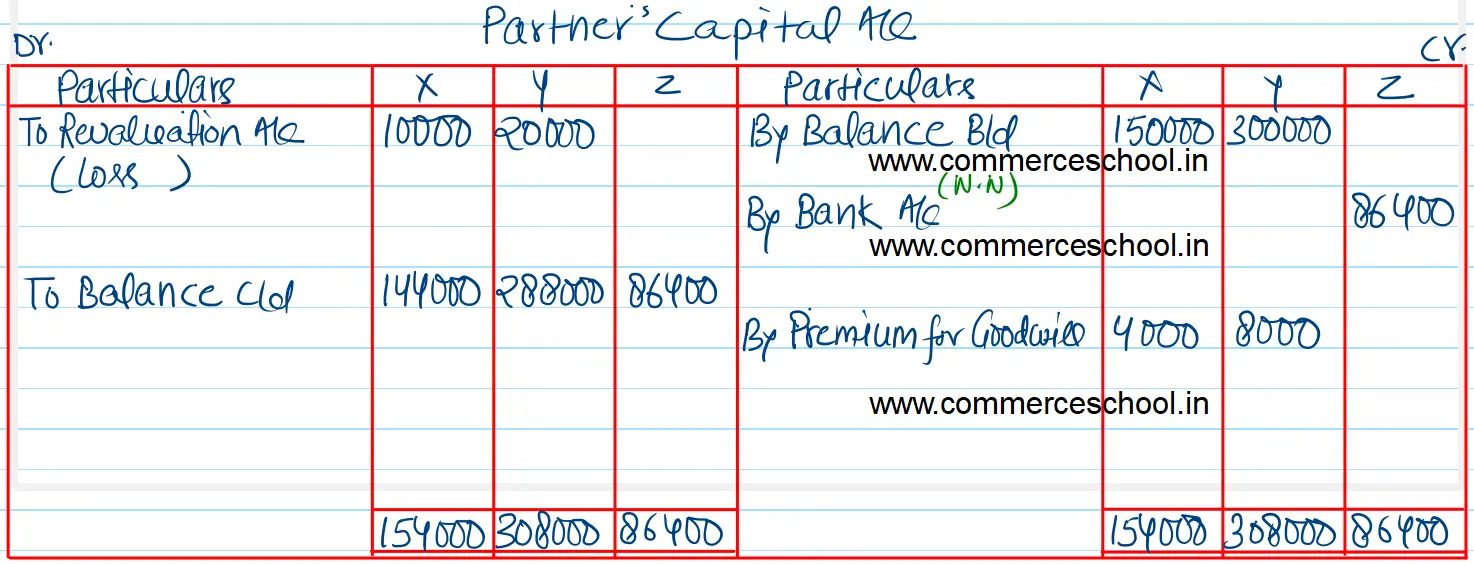

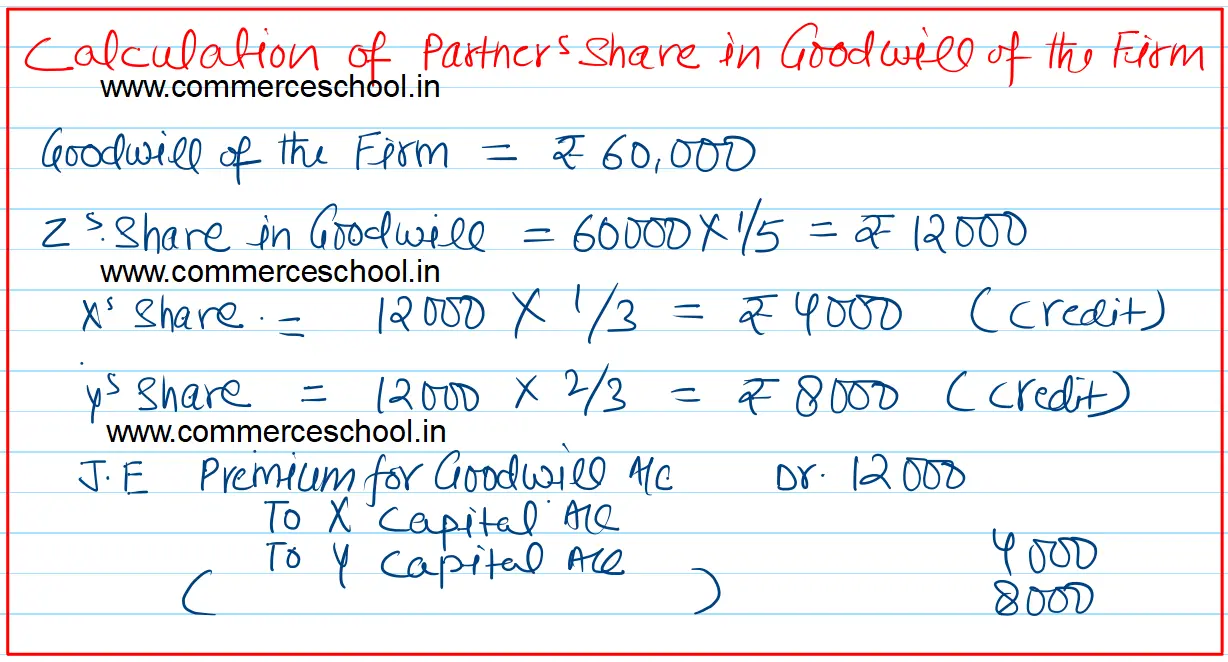

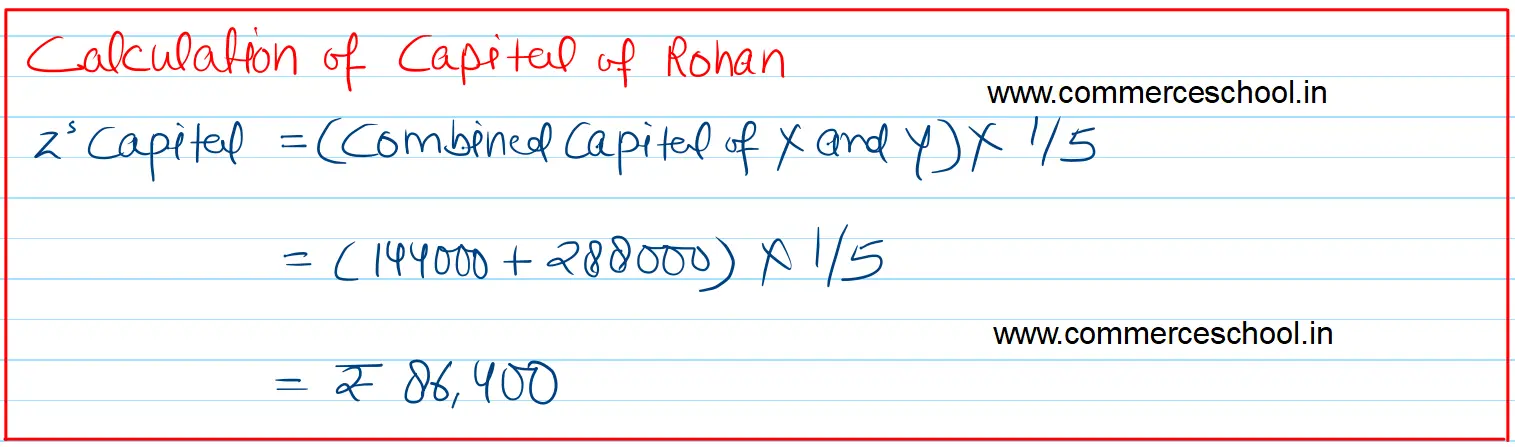

They agreed to admit Z for 1/5th share from 1st April, 2024 on the following terms: (i) Goodwill of the firm was valued at ₹ 60,000 and Z to bring in his share of premium for goodwill in cash. (ii) Provision for bad debts be raised by ₹ 1,500. (iii) Patents are valueless. (iv) Stock be reduced by 10%. (v) Outstanding expenses be increased by ₹ 6,000. (vi) ₹ 2,500 be provided for an unforeseen liability. Prepare Revaluation Account, Partner’s Capital Accounts and the Opening Balance Sheet. [Ans. Loss on Revaluation ₹ 30,000; Capital A/cs : X ₹ 1,44,000; Y ₹ 2,88,000 and Z ₹ 86,400. Cash Balance ₹ 1,18,400; B/S Total ₹ 5,66,900.]