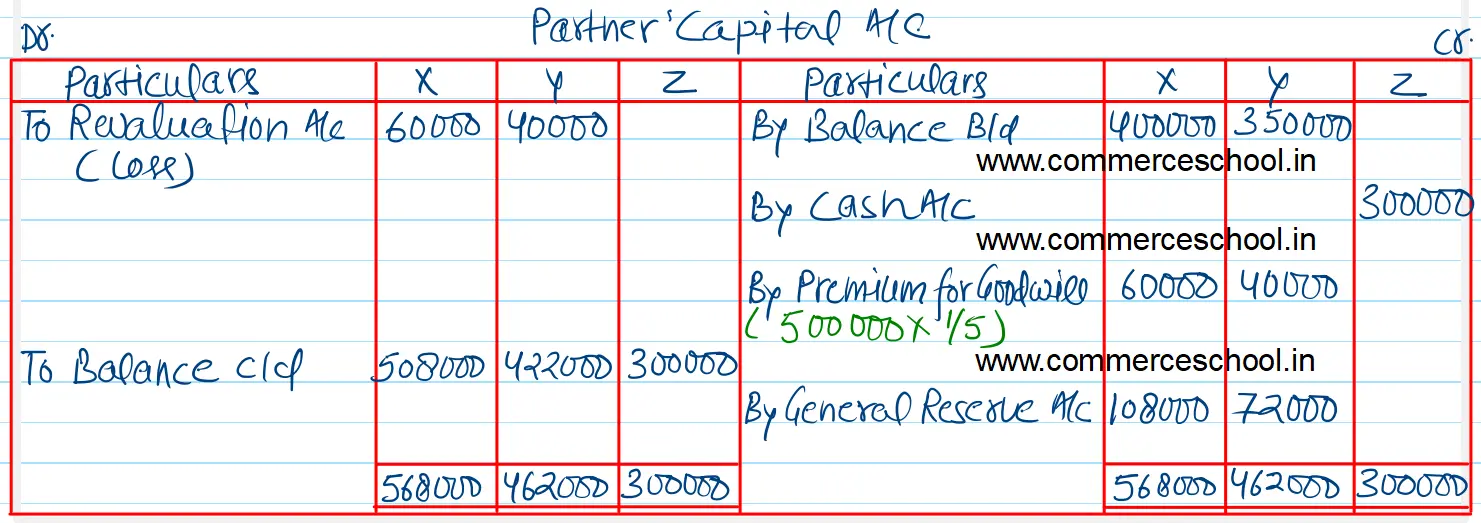

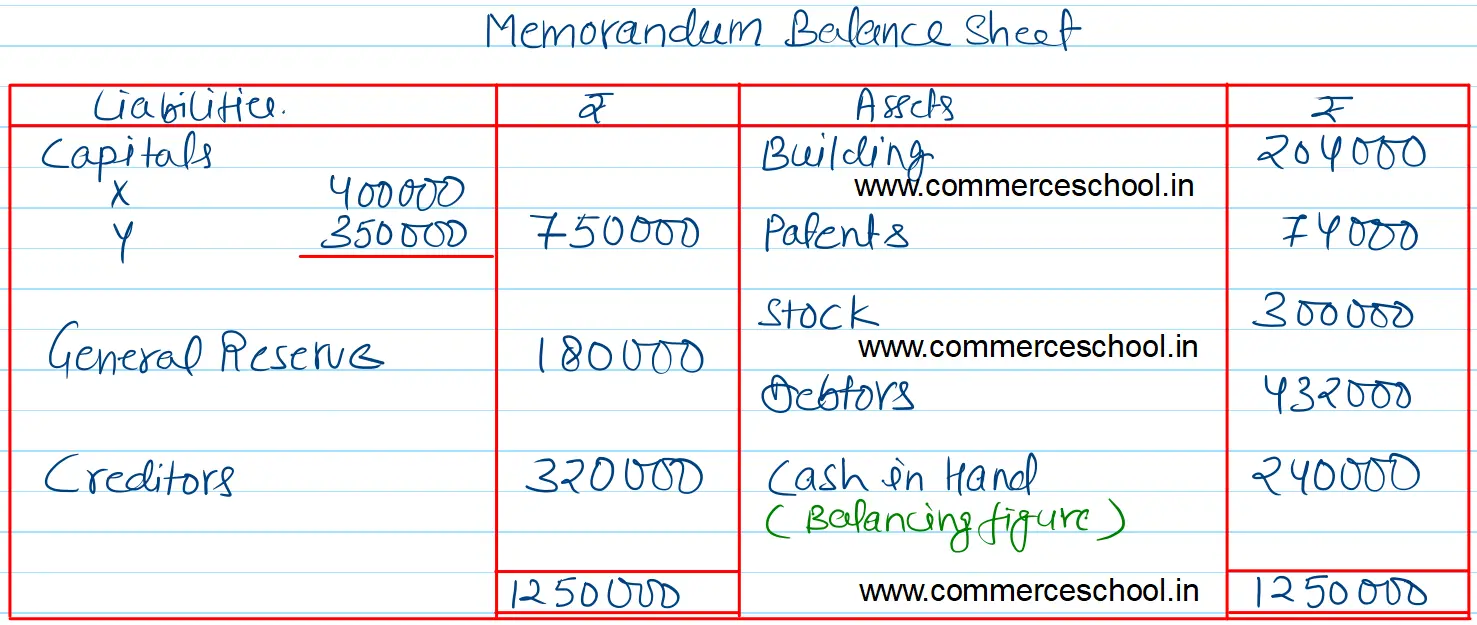

X and Y were partners with capitals of ₹ 4,00,000 and ₹ 3,50,000. They shared profits in the ratio of 3 : 2. On 1st April, 2024, they admitted Z for 1/5th share. On this date their creditors were ₹ 3,20,000 and general reserve ₹ 1,80,000

X and Y were partners with capitals of ₹ 4,00,000 and ₹ 3,50,000. They shared profits in the ratio of 3 : 2. On 1st April, 2024, they admitted Z for 1/5th share. On this date their creditors were ₹ 3,20,000 and general reserve ₹ 1,80,000.

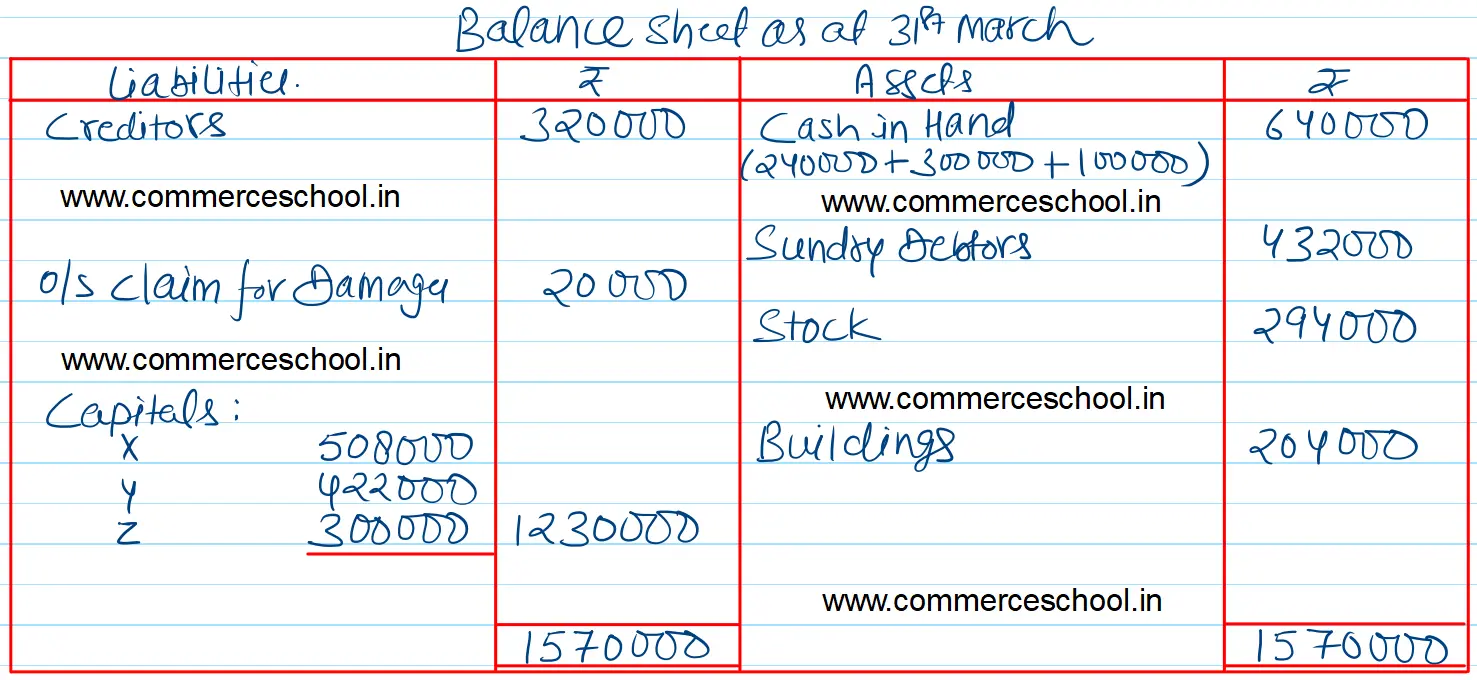

Their assets apart from cash consisted of Debtors ₹ 4,32,000; Stock ₹ 3,00,000, Patents ₹ 74,000 and Building ₹ 2,04,000.

Z is to bring in ₹ 3,00,000 as his Capital and to bring in his share of Goodwill in Cash subject to the following terms:

(a) Goodwill of the firm to be valued at ₹ 5,00,000.

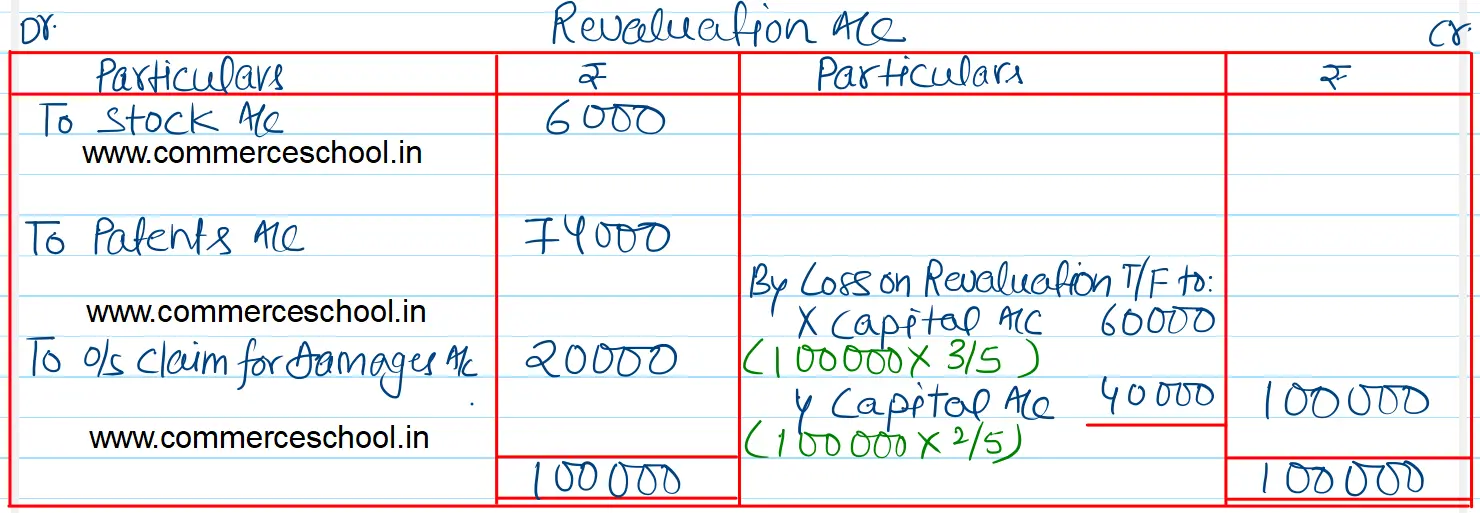

(b) Stock be valued at ₹ 2,94,000.

(c) Patents are valueless.

(d) There was a claim against the firm for damages amounting to ₹ 20,000. The claim has now been accepted.

Prepare Revaluation Account, Partner’s Capital Accounts and the Balance Sheet of the new firm.

[Ans. Loss on Revaluation ₹ 1,00,000; Capital A/cs X ₹ 5,08,000; Y ₹ 4,22,000 and Z ₹ 3,00,000; B/S Total ₹ 15,70,000.]