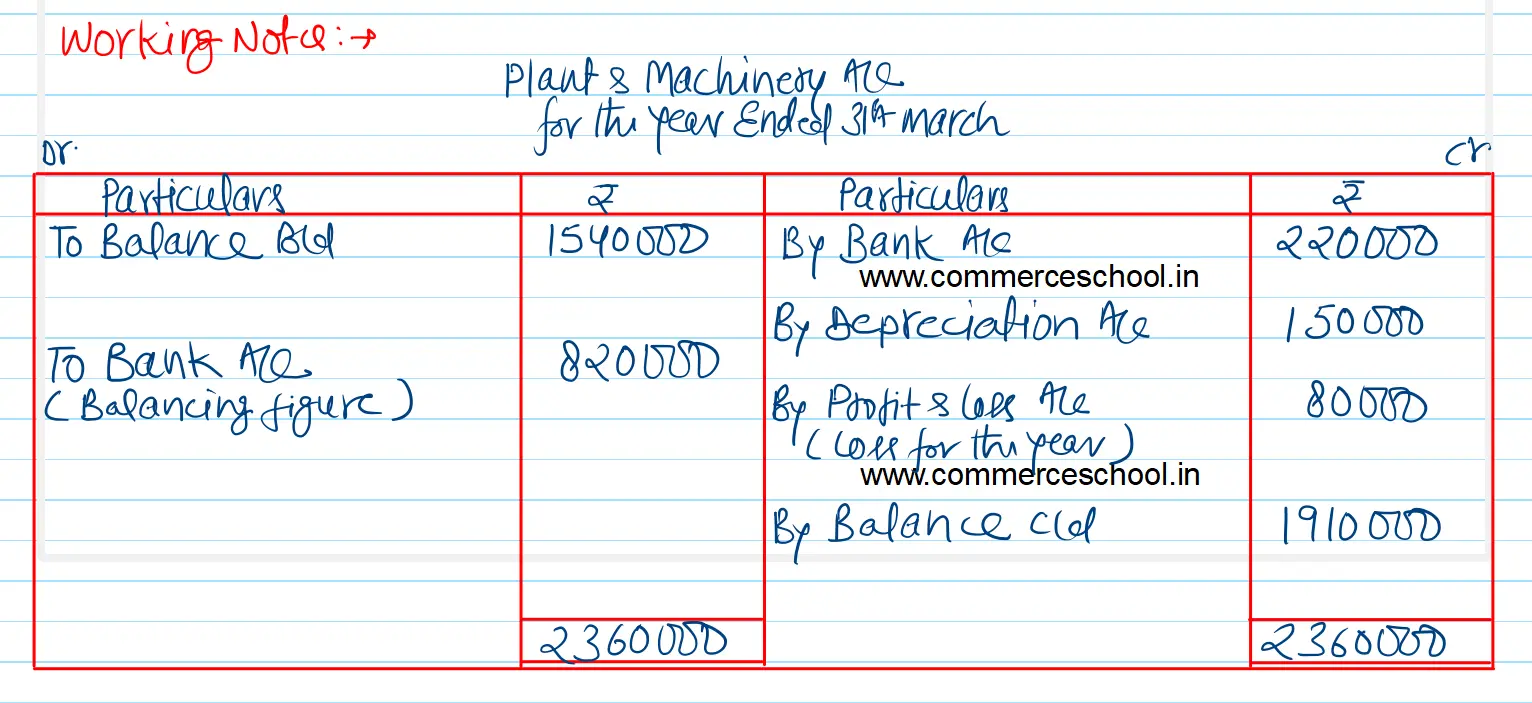

X Ltd. has Plant and Machinery whose written down value on 1st April, 2023 was ₹ 15,40,000 and on 31st March, 2024 was ₹ 19,10,000. Depreciation for the year was ₹ 1,50,000

X Ltd. has Plant and Machinery whose written down value on 1st April, 2023 was ₹ 15,40,000 and on 31st March, 2024 was ₹ 19,10,000. Depreciation for the year was ₹ 1,50,000. In the beginning of the year, a part of plant was sold for ₹ 2,20,000 which had a written down value of ₹ 3,00,000.

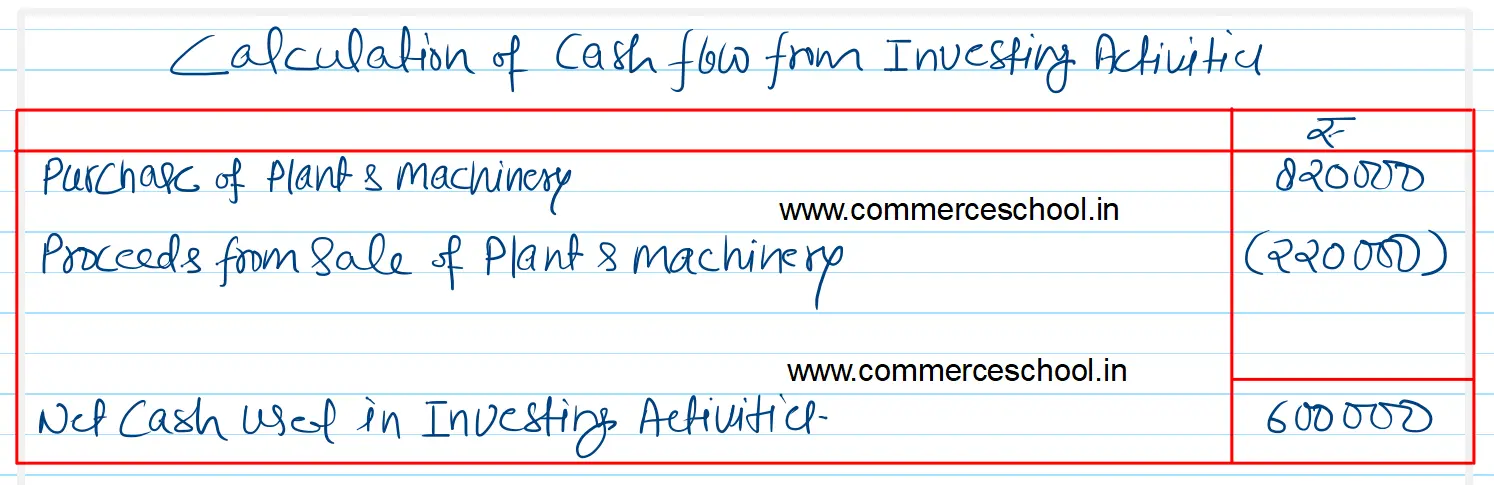

Calculate Cash Flow from Investing Activities.

[Ans. Net Cash used in Investing Activities ₹ 6,00,000.]

Anurag Pathak Answered question