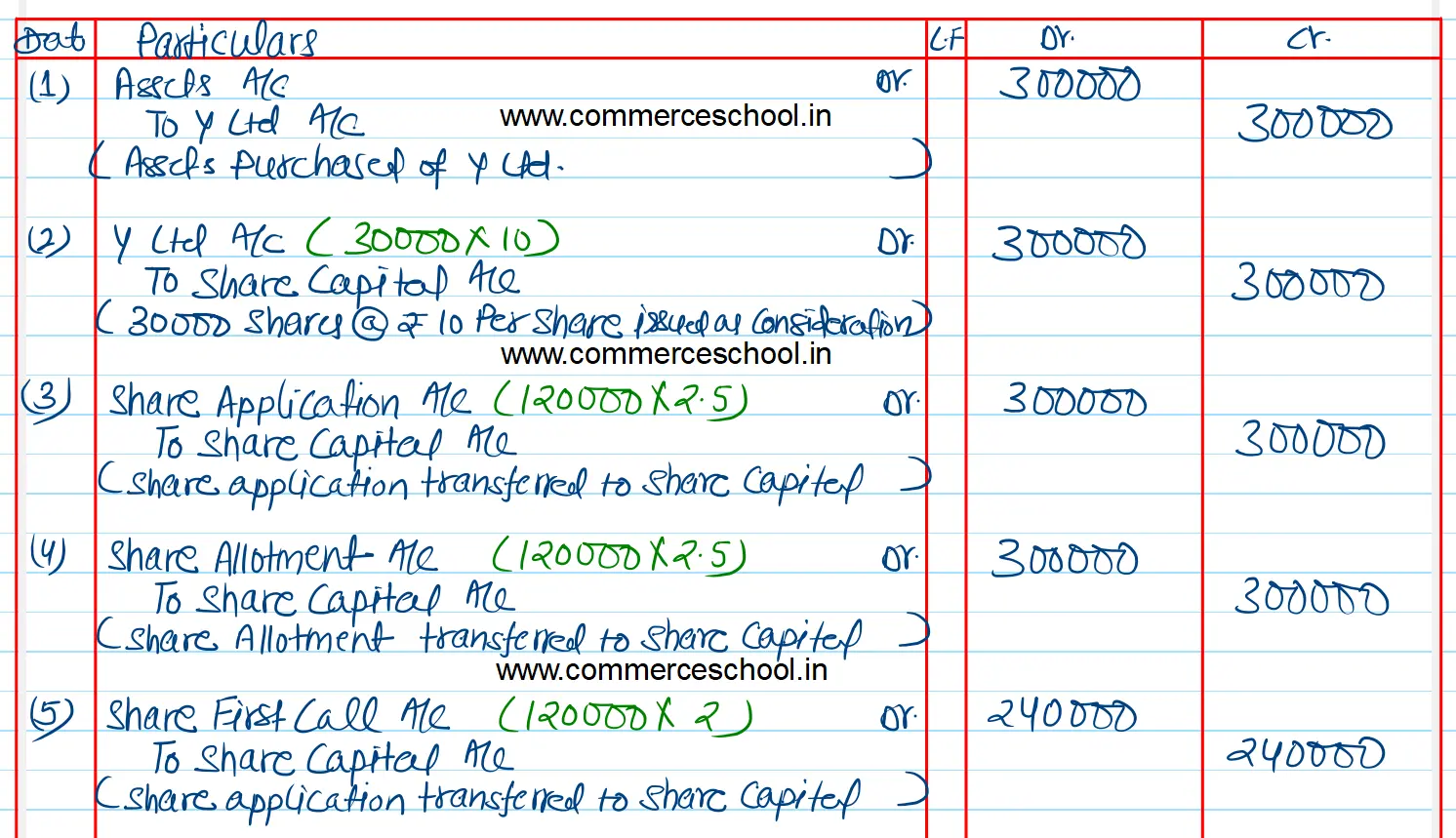

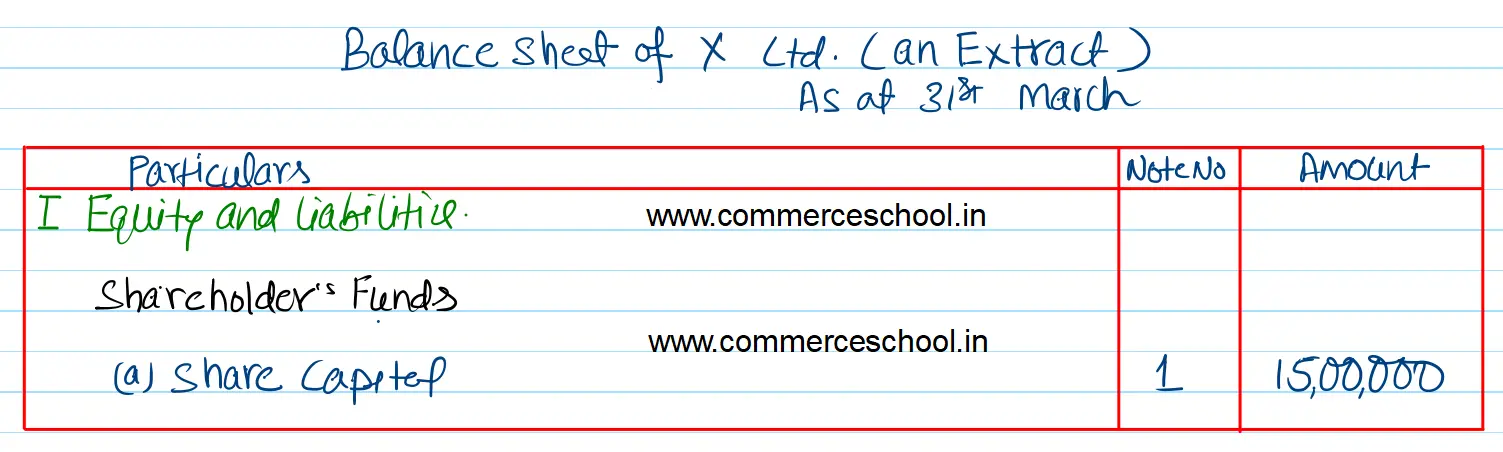

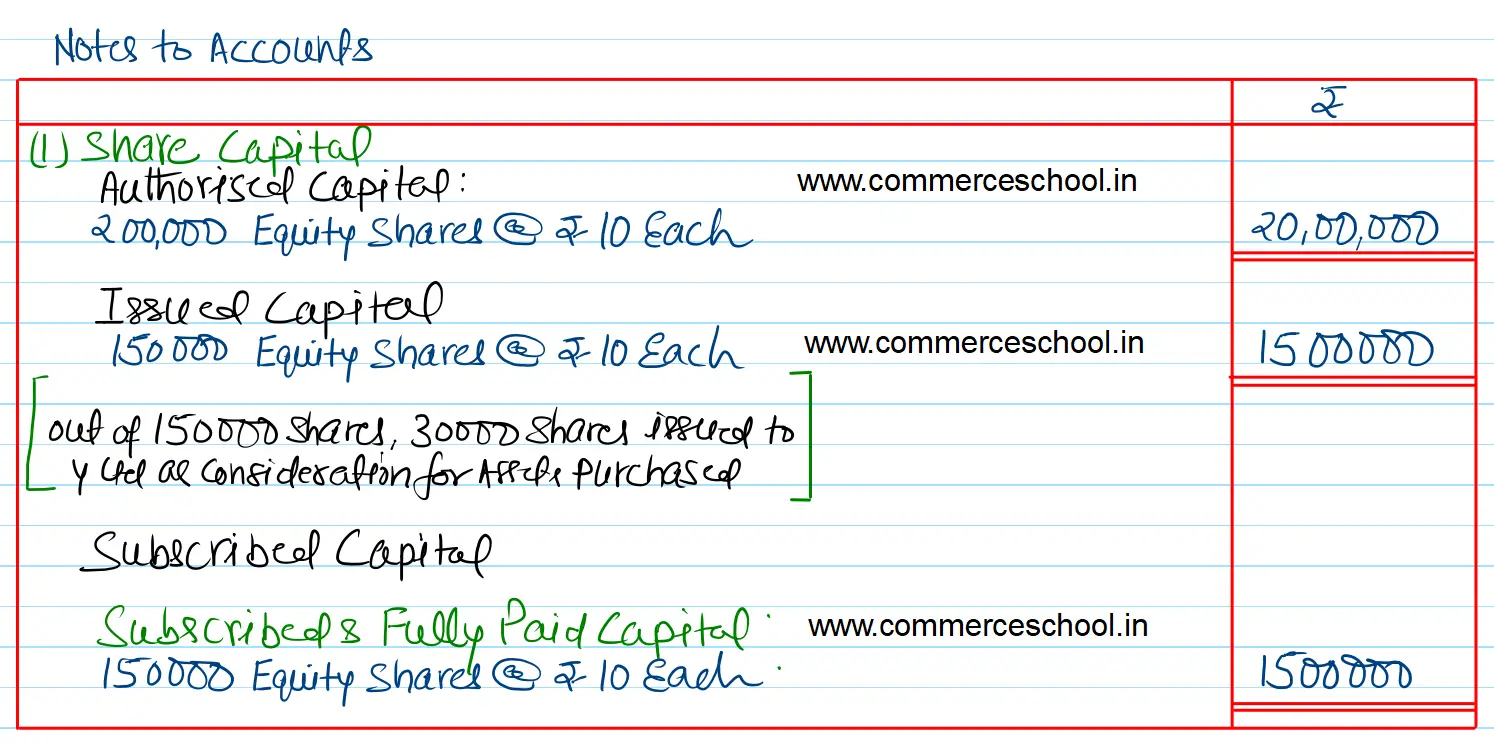

X Ltd. was registered with an authorised capital of 2,00,000 shares of ₹ 10 each. It purchased assets of Y Ltd. for ₹ 3,00,000 and issued fully paid shares for purchase consideration

X Ltd. was registered with an authorised capital of 2,00,000 shares of ₹ 10 each. It purchased assets of Y Ltd. for ₹ 3,00,000 and issued fully paid shares for purchase consideration. It also invited applications for 1,20,000 shares payable as under:

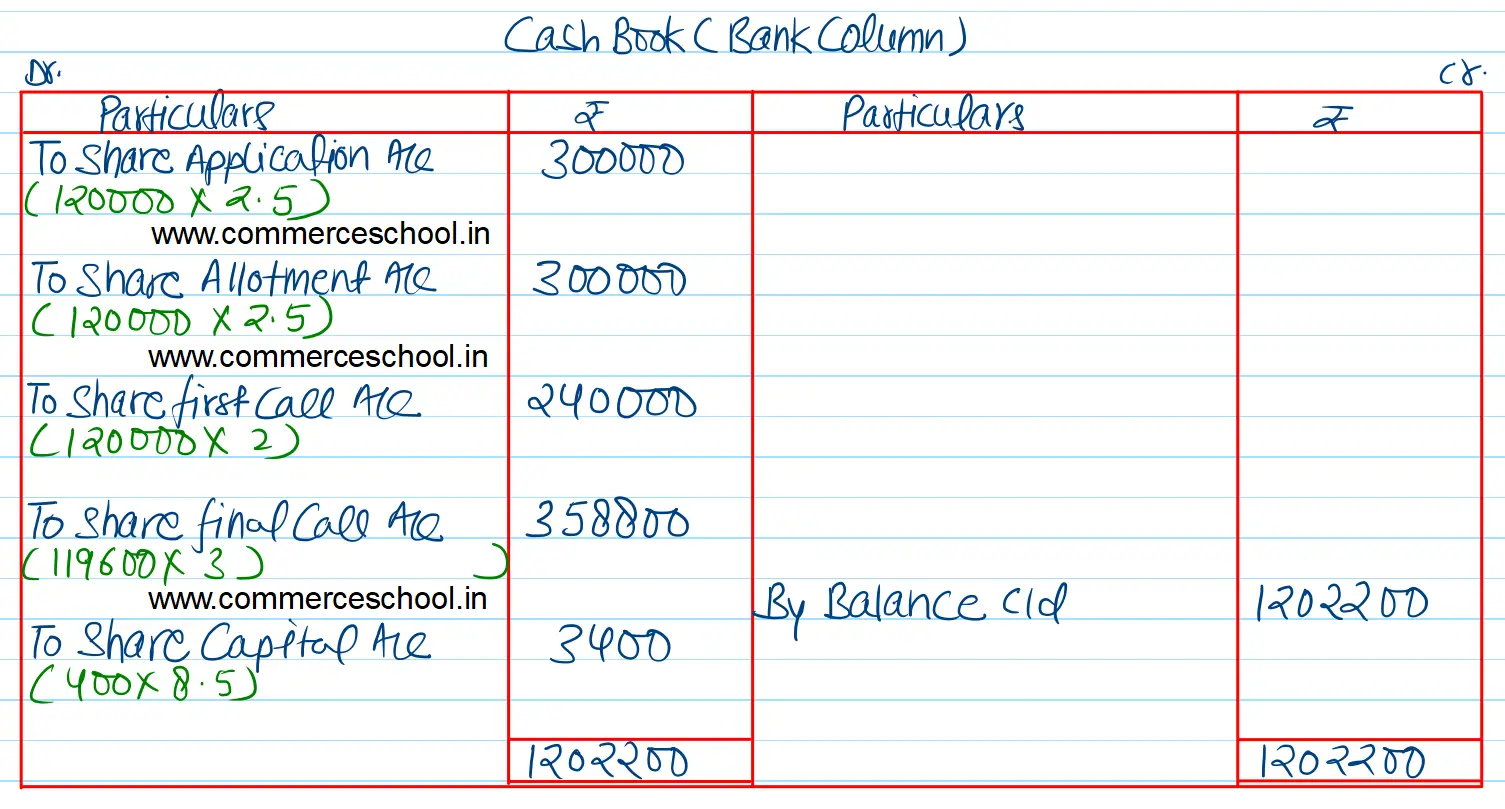

₹ 2,50 on application

₹ 2.50 on allotment

₹ 2 on first call

₹ 3 on final call.

Amount due on allotment and first call was duly received. However, a shareholder holding 400 shares did not pay the final call. Directors forfeited the shares of defaulting shareholder and reissued them at ₹ 8.50 per share as fully paid up. Pass entries in the Cash Book and Journal. Show the Share Capital in the Balance Sheet of the Company.

[Ans. Cash at Bank ₹ 12,02,200; Capital Reserve ₹ 2,200.]