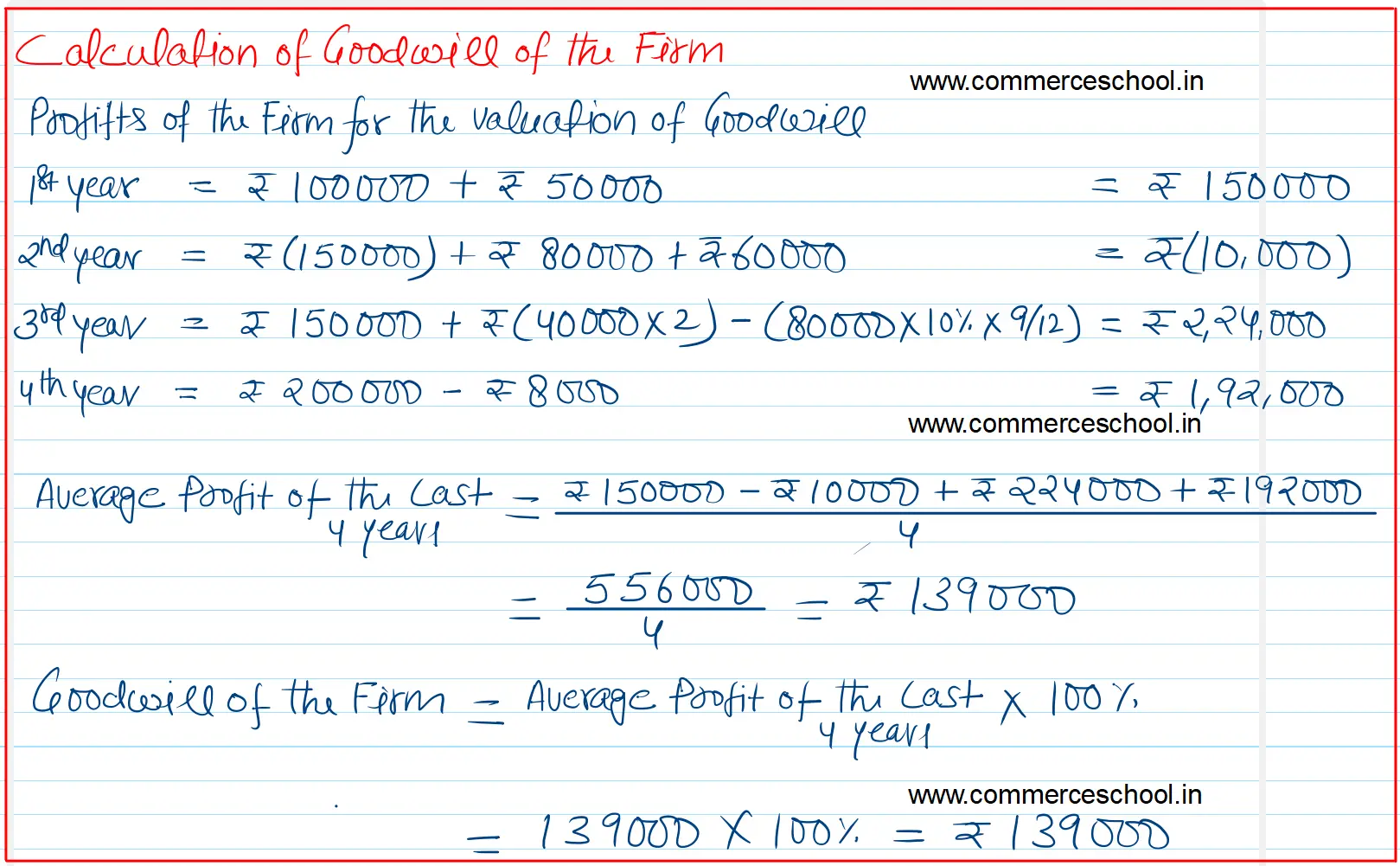

X purchased the business of Y from 1st April, 2023. For this purpose goodwill is to be valued at 100% of the average annual profits of the last four years. The profits shown on Y’s business for the last four years were:

X purchased the business of Y from 1st April, 2023. For this purpose goodwill is to be valued at 100% of the average annual profits of the last four years. The profits shown on Y’s business for the last four years were:

Verification of books of accounts revealed the following:

(i) During the year ended 31st March, 2021, a machine got destroyed in accident and ₹ 60,000 was written off as loss in Profit & Loss Account.

(ii) On 1st July 2021, Two Computers costing ₹ 40,000 each were purchased and were debited to Travelling Expenses Account on which depreciation is to be charged @ 10% p.a. on Straight Line Method.

Calculate the value of goodwill.

[Ans. Goodwill ₹ 1,39,000.]

Hint: Profit for the year ended 31st March 2022 ₹ 2,24,000 and for 2023 ₹ 1,92,000.

| Year Ended | Profits | |

| 31st March 2020 | 1,00,000 | (after debiting loss of stock by fire ₹ 50,000) |

| 31st March 2021 | (1,50,000) | (includes voluntary retirement compensation paid ₹ 80,000) |

| 31st March 2022 | 1,50,000 | |

| 31st March 2023 | 2,00,000 |

Anurag Pathak Answered question