X, Y and Z are in the partnership and on 1st April, 2023, their respective capitals were ₹ 2,00,000; ₹ 1,20,000 and ₹ 1,00,000. Y is entitled to a salary of ₹ 25,000 and Z ₹ 20,000 per annum

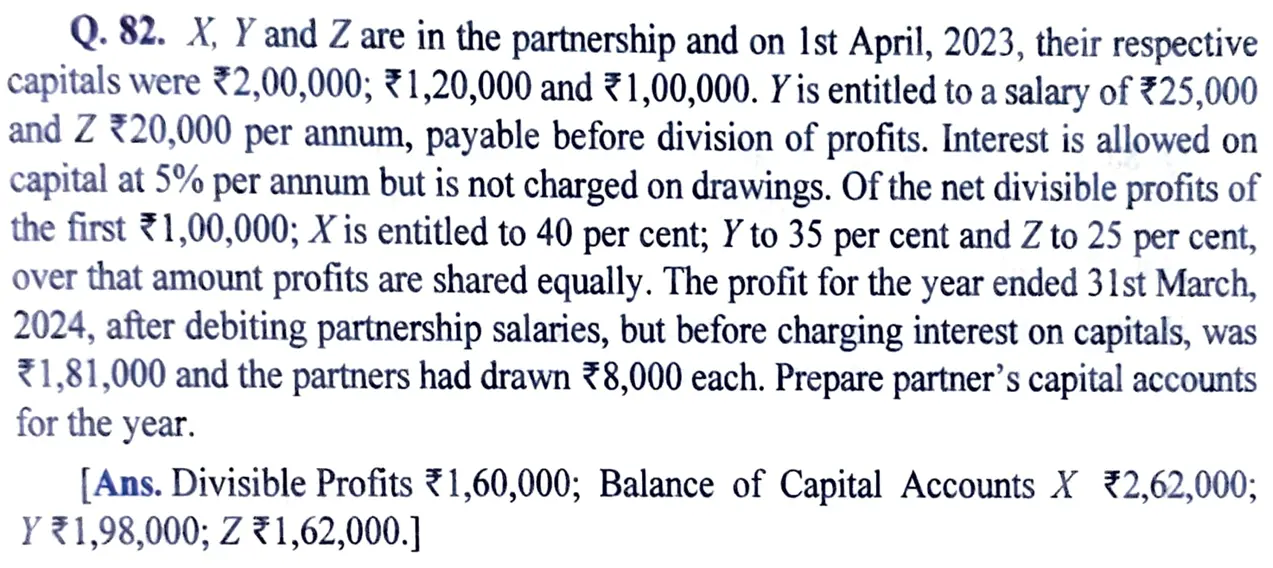

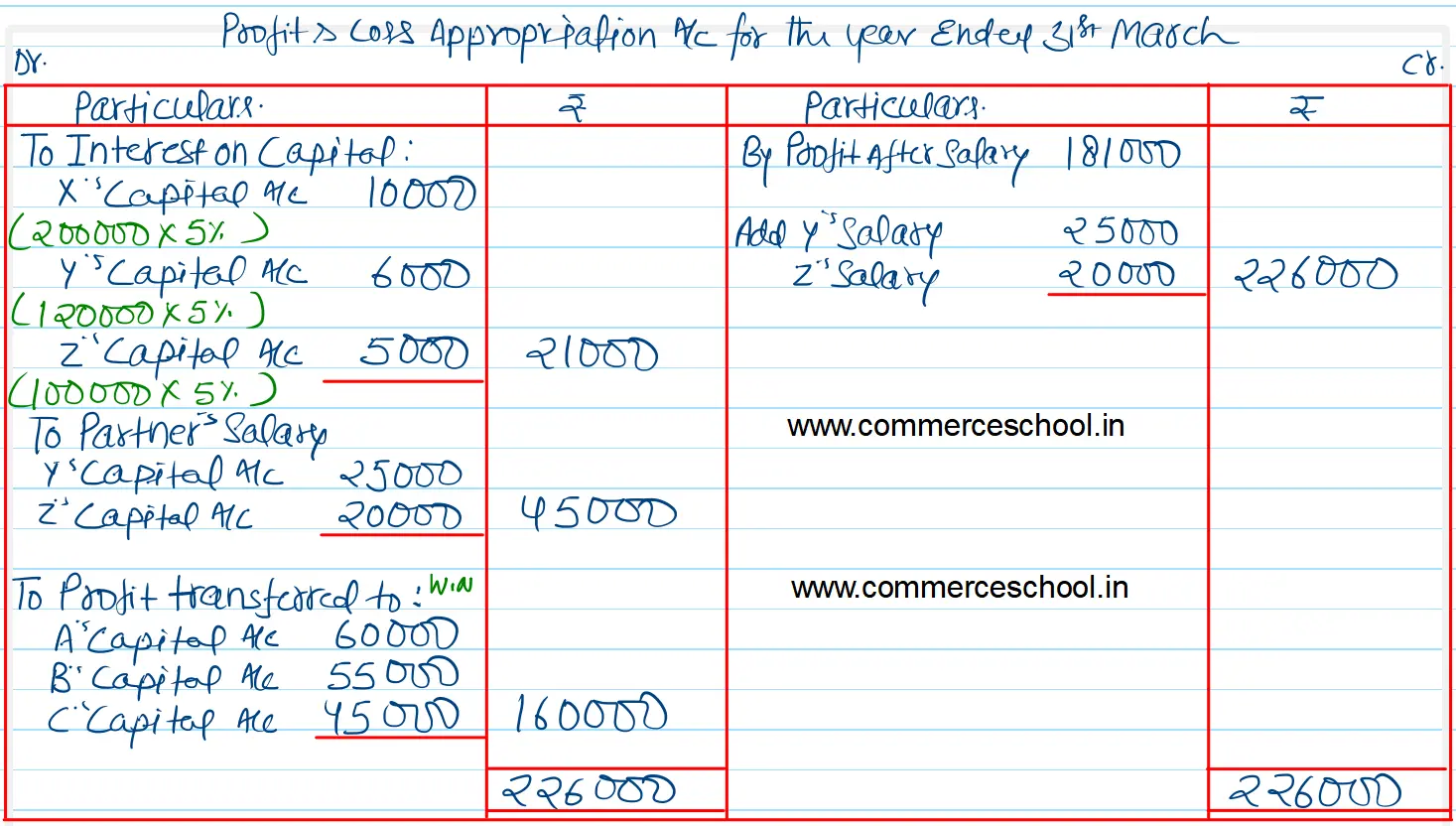

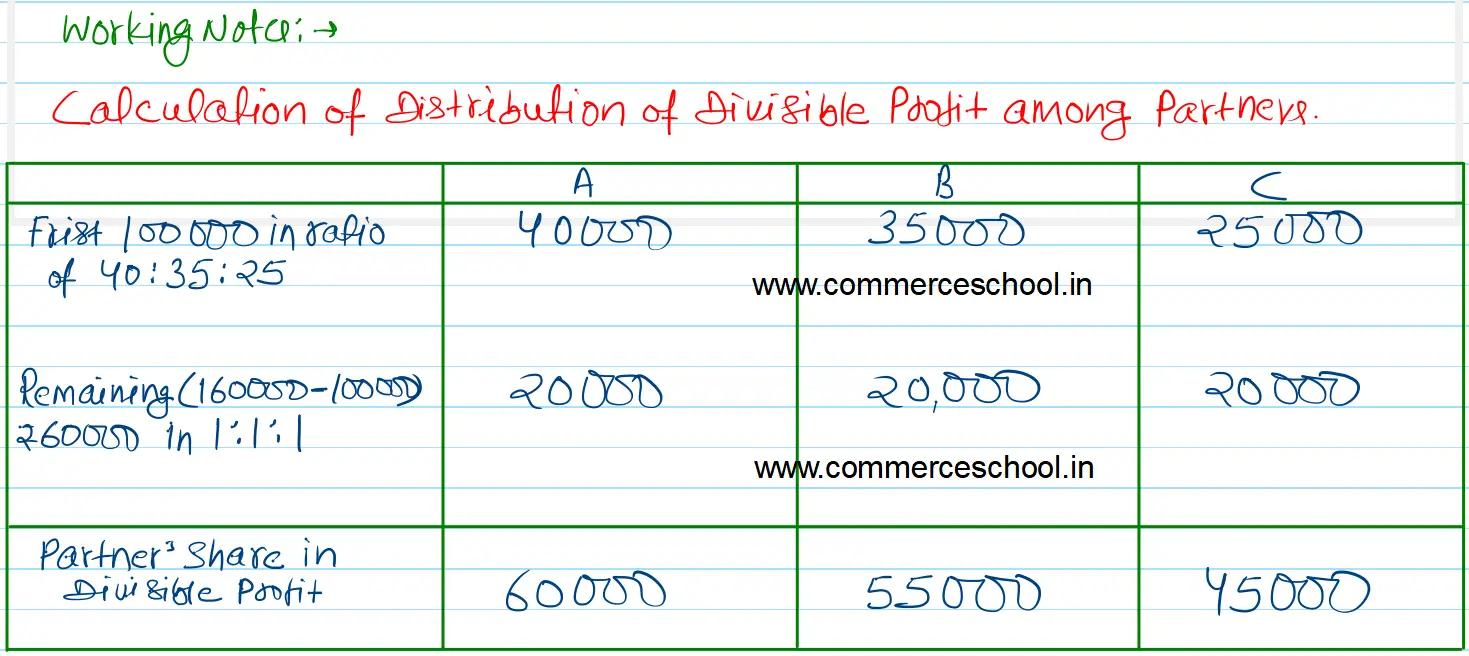

X, Y and Z are in the partnership and on 1st April, 2023, their respective capitals were ₹ 2,00,000; ₹ 1,20,000 and ₹ 1,00,000. Y is entitled to a salary of ₹ 25,000 and Z ₹ 20,000 per annum, payable before division of profits. Interest is allowed on capital at 5% per annum but is not charged on drawings. Of the net divisible profits of the first ₹ 1,00,000; X is entitled to 40 per cent; Y to 35 per cent and Z to 25 per cent, over that amount profits are shared equally. The profit for the year ended 31st March, 2024, after debiting partnership salaries, but before charging interest on capitals, was ₹ 1,81,000 and the partners had drawn ₹ 8,000 each. Prepare pratner’s capital accounts for the year.

[Ans. Divisible Profits ₹ 1,60,000; Balance of Capital Accounts X ₹ 2,62,000; Y ₹ 1,98,000; Z ₹ 1,62,000.]