X, Y and Z are partners in a firm sharing profits and losses equally. The balance Sheet of the firm as at 31st March, 2023 stood as follows:

X, Y and Z are partners in a firm sharing profits and losses equally. The balance Sheet of the firm as at 31st March, 2023 stood as follows:

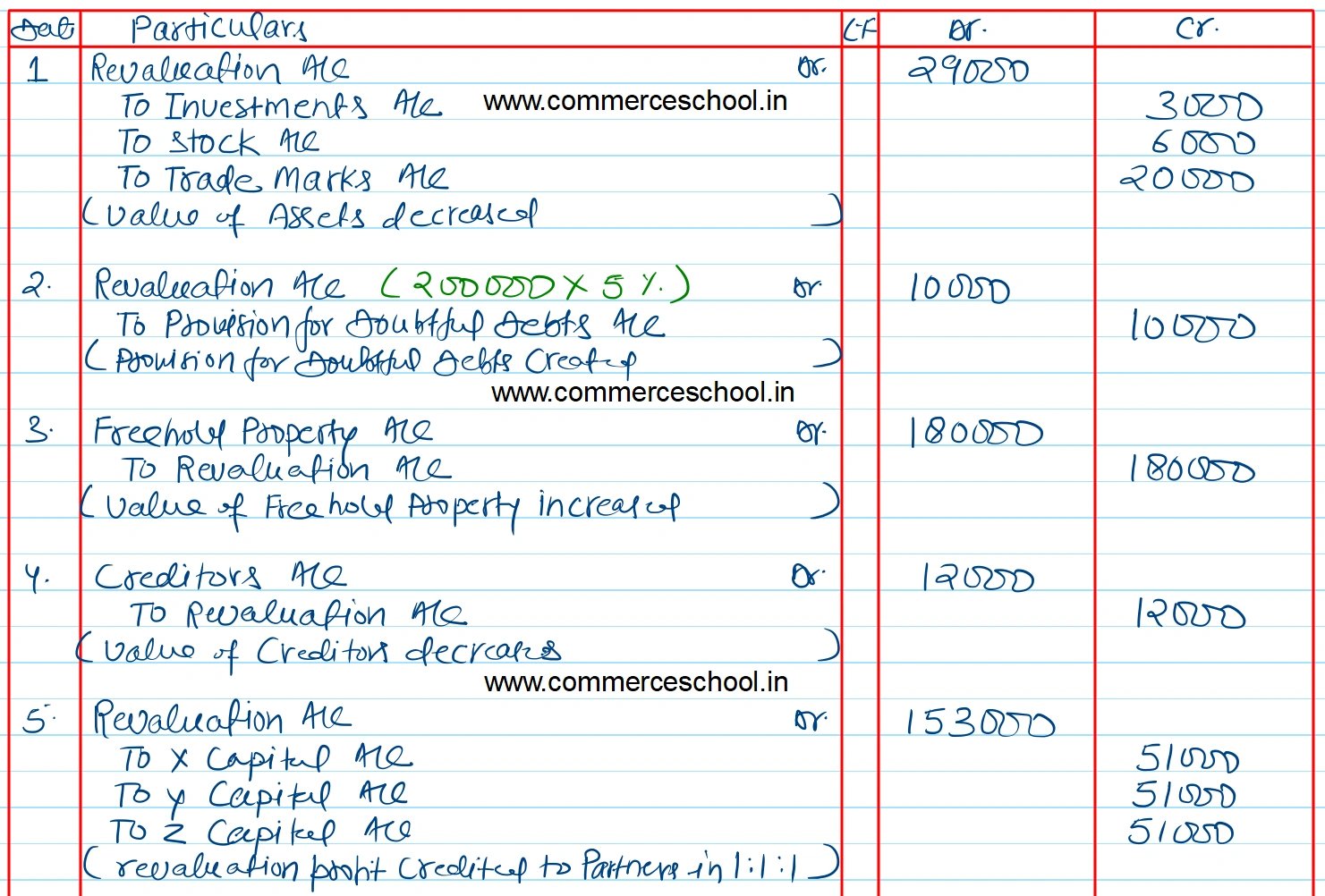

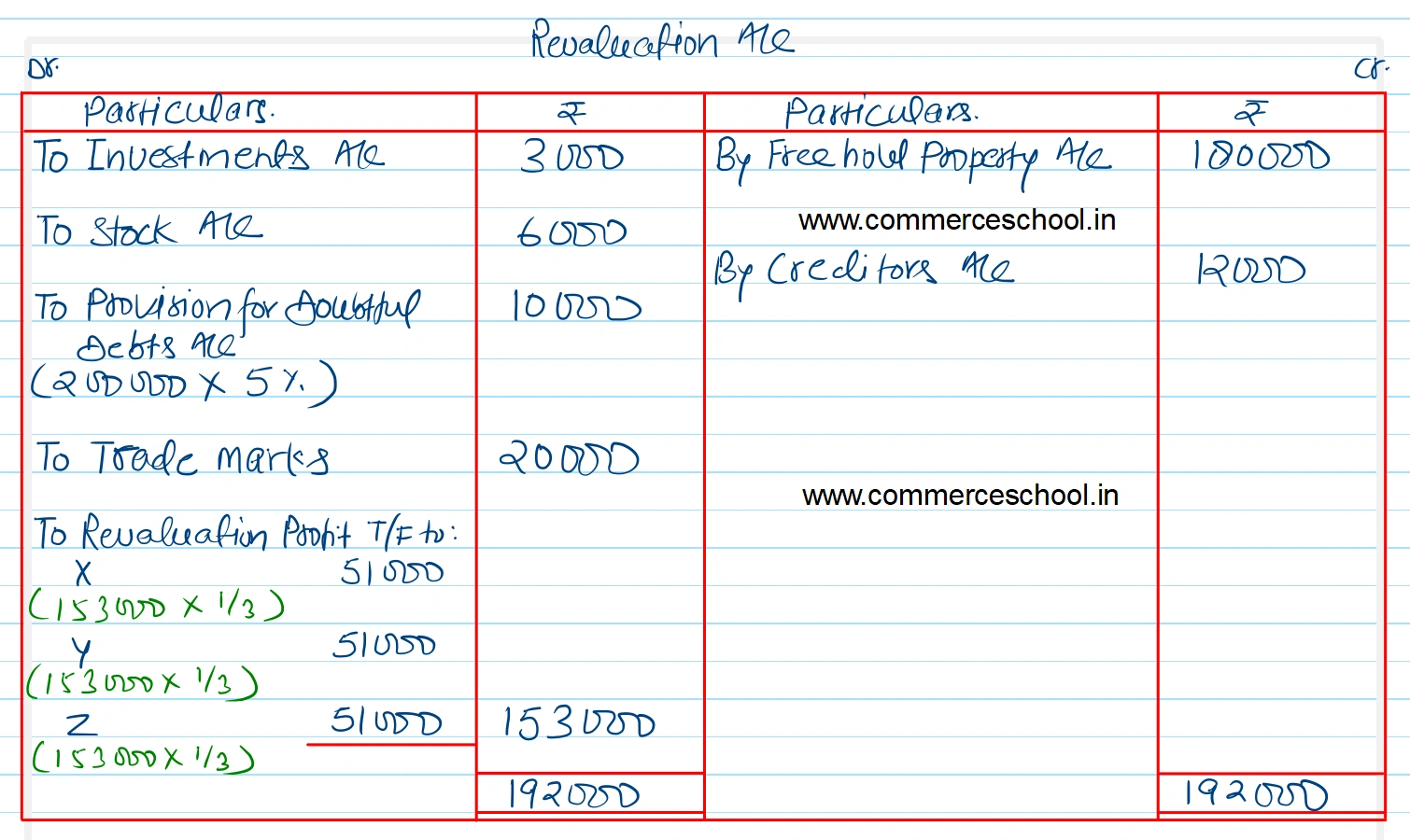

Z retires on 1st April, 2023 subject to the following adjustments:

(i) Freehold Property be valued at ₹ 5,80,000.

(ii) Investments be valued at ₹ 47,000; and stocks be valued at ₹ 94,000;

(iii) A provision of 5% be made for doubtful debts.

(iv) Trade Marks are valueless.

(v) An item of ₹ 12,000 included in creditors is not likely to be claimed.

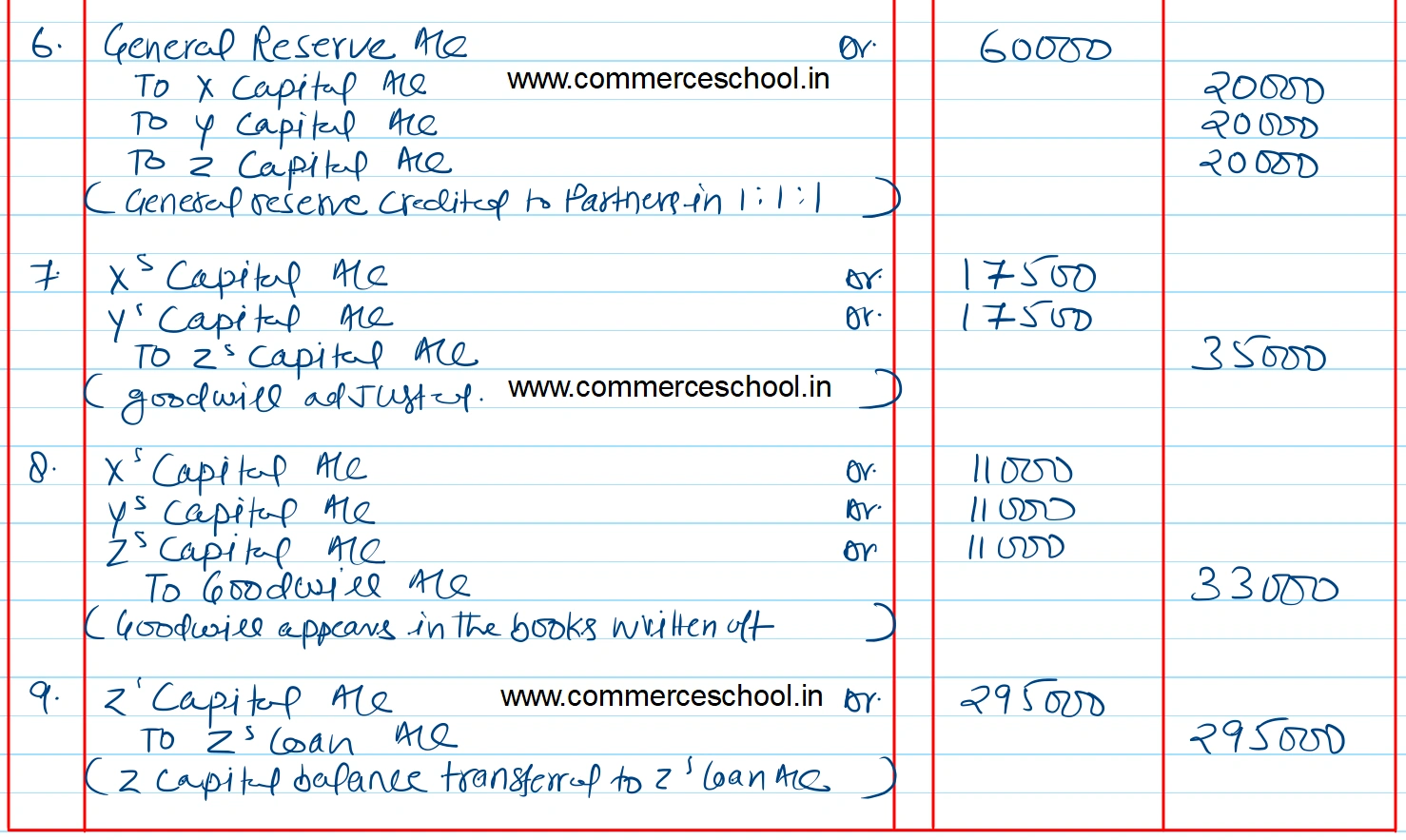

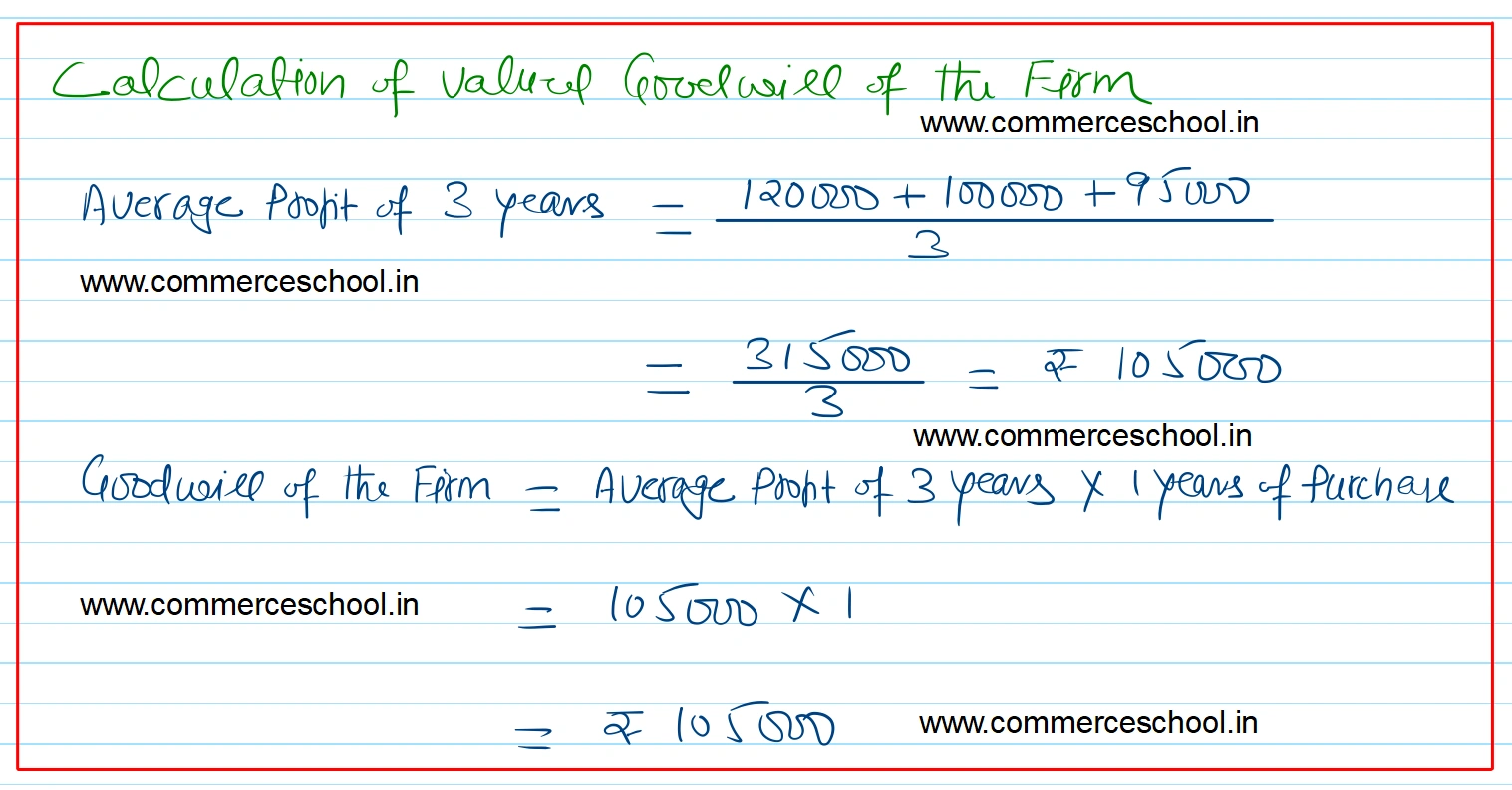

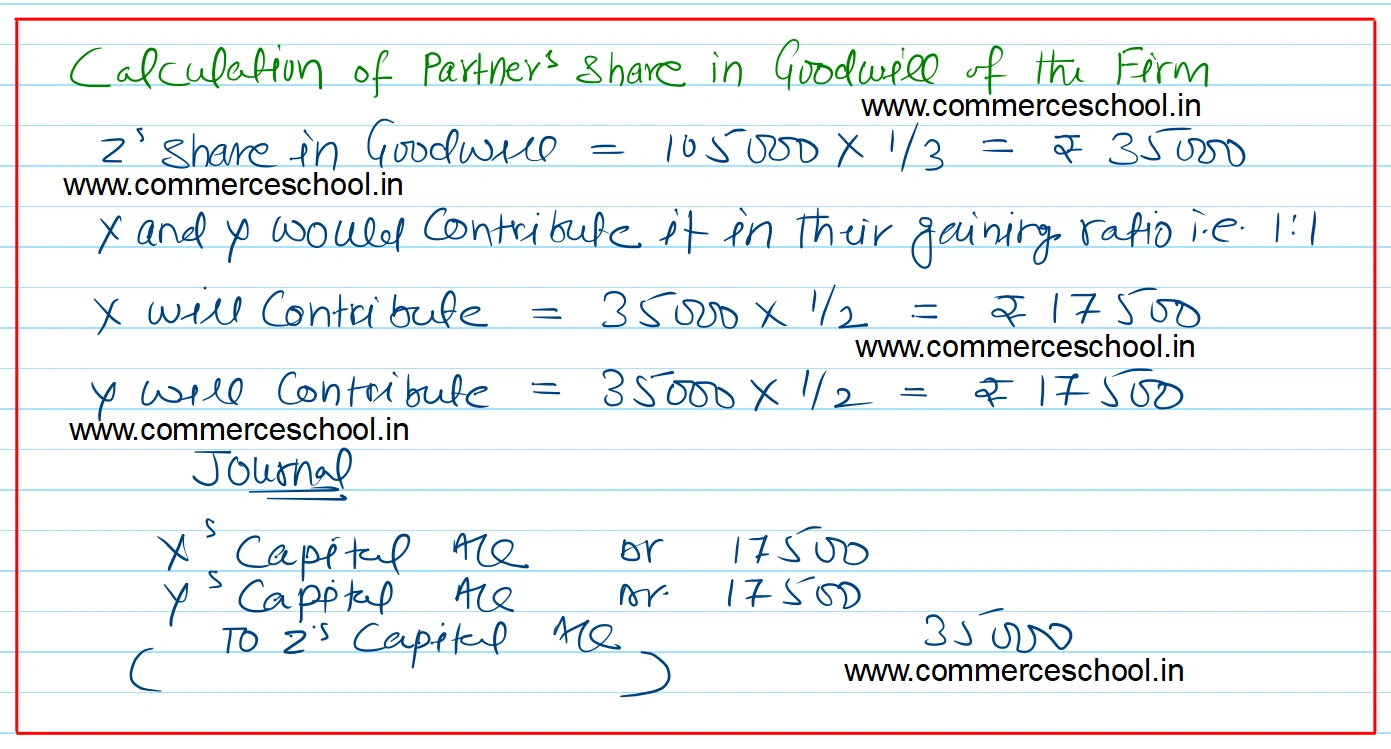

(vi) Goodwill be valued at one year’s purchase of the average profit of the last three years. Profits ending 31st March were : 2021 ₹ 1,20,000; 2022 ₹ 1,00,000 and 2023 ₹ 95,000.

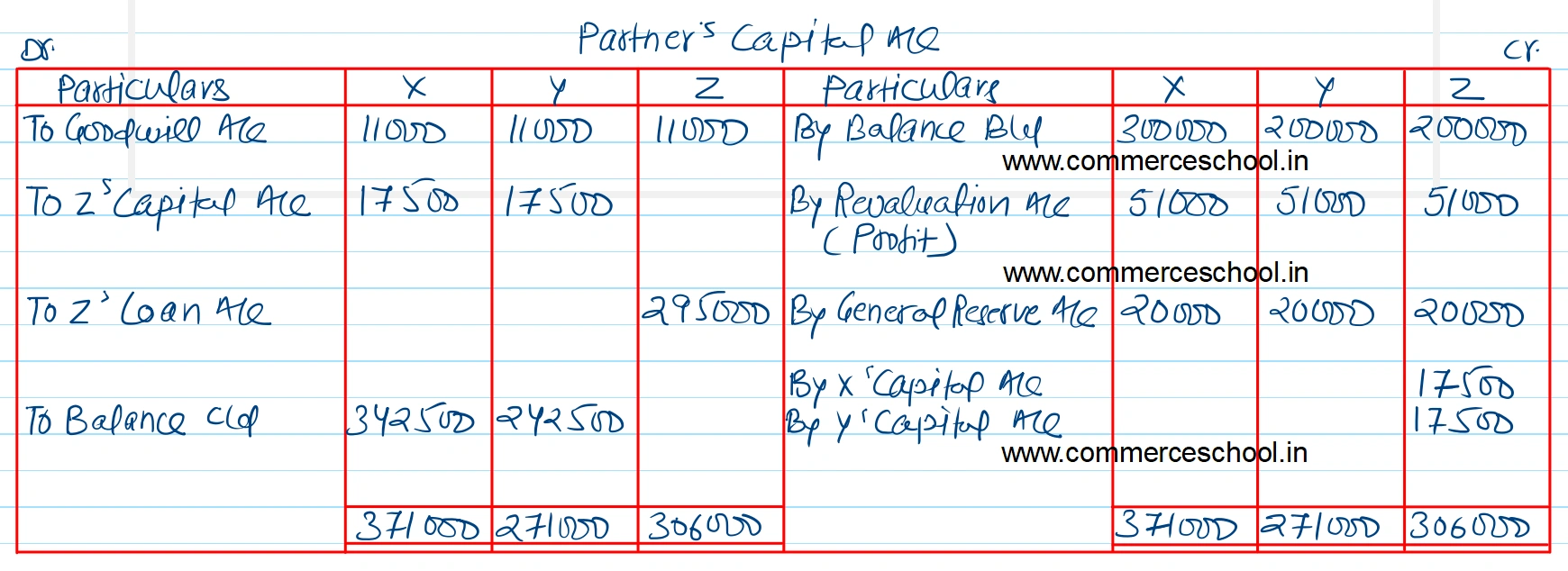

Pass journal entries, give capital accounts and the balance Sheet of the remaining partners.

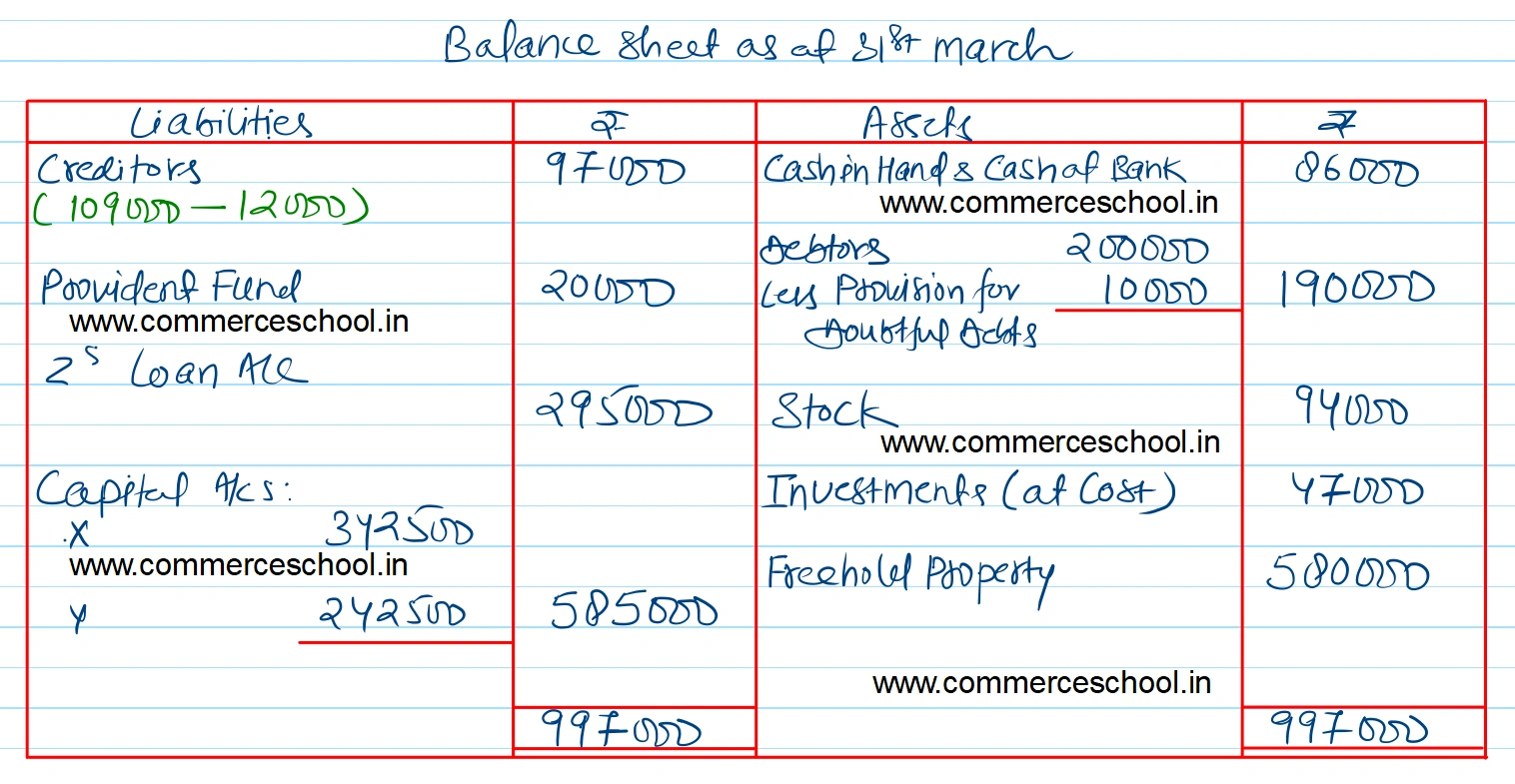

[Ans. Gain on Revaluation ₹ 1,53,000; Z’s Loan A/c ₹ 2,95,000; Capitals X ₹ 3,42,500; Y ₹ 2,42,500; B/S Total ₹ 9,97,000.]

| Liabilities | ₹ | Assets | ₹ |

| Creditors | 1,09,000 | Cash in Hand and Cash at Bank | 86,000 |

| General Reserve | 60,000 | Debtors | 2,00,000 |

| Provident Fund | 20,000 | Stock | 1,00,000 |

| Capitals: X Y Z | 3,00,000 2,00,000 2,00,000 | Investments (at cost) | 50,000 |

| Freehold Property | 4,00,000 | ||

| Trade Marks | 20,000 | ||

| Goodwill | 33,000 | ||

| 8,89,000 | 8,89,000 |

Anurag Pathak Answered question