X, Y and Z are partners sharing profits and losses in the ratio of 3 : 2 : 1. Balance Sheet of the firm as at 31st March, 2022 was as follows:

X, Y and Z are partners sharing profits and losses in the ratio of 3 : 2 : 1. Balance Sheet of the firm as at 31st March, 2022 was as follows:

| Liabilities | ₹ | Assets | ₹ | |

| Creditors

Workmen Compensation Reserve Investments Fluctuation Reserve Capital A/cs: X Y Z |

21,000 12,000 6,000 68,000 32,000 21,000 |

Cash at Bank

Debtors Stock Investment (Market Value ₹ 17,600) Patents Machinery Goodwill Advertisement Suspense |

40,000

|

5,750 38,000 30,000 15,000 10,000 50,000 6,000 5,250 |

| 1,60,000 | 1,60,000 |

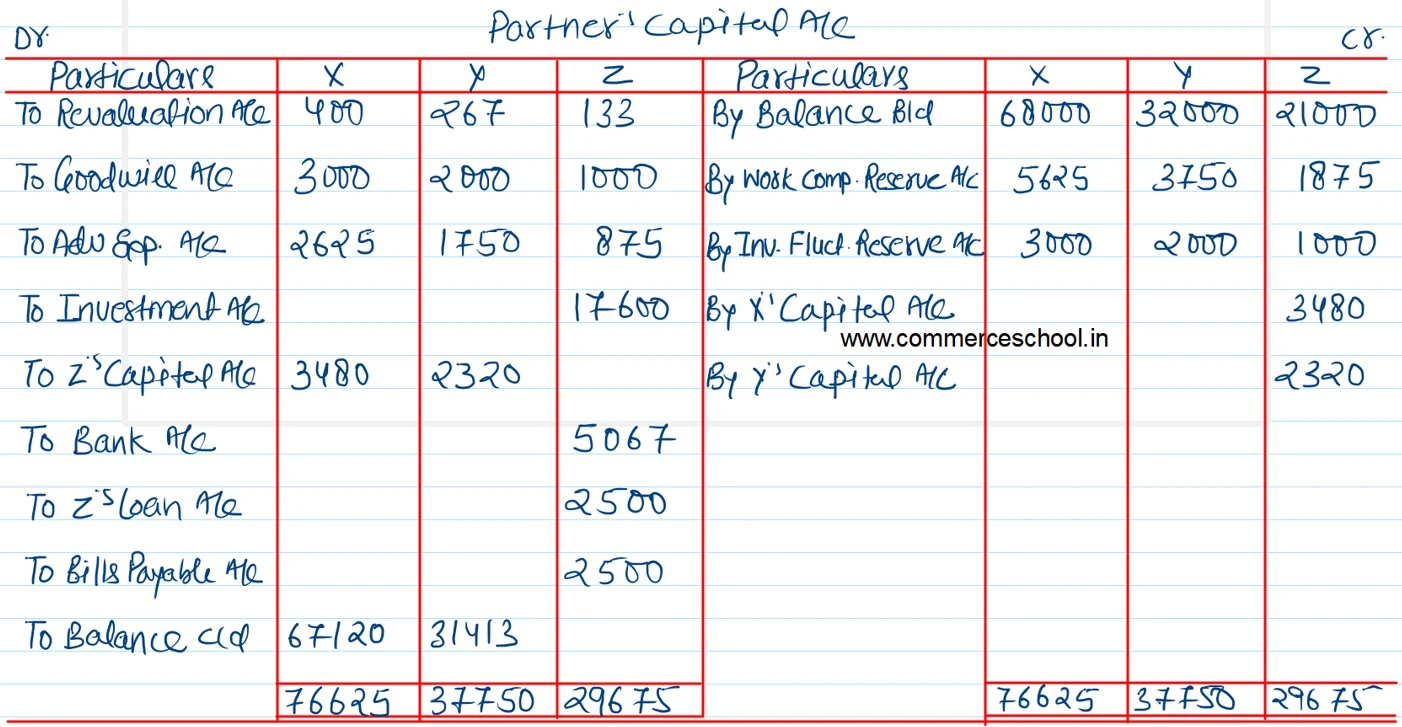

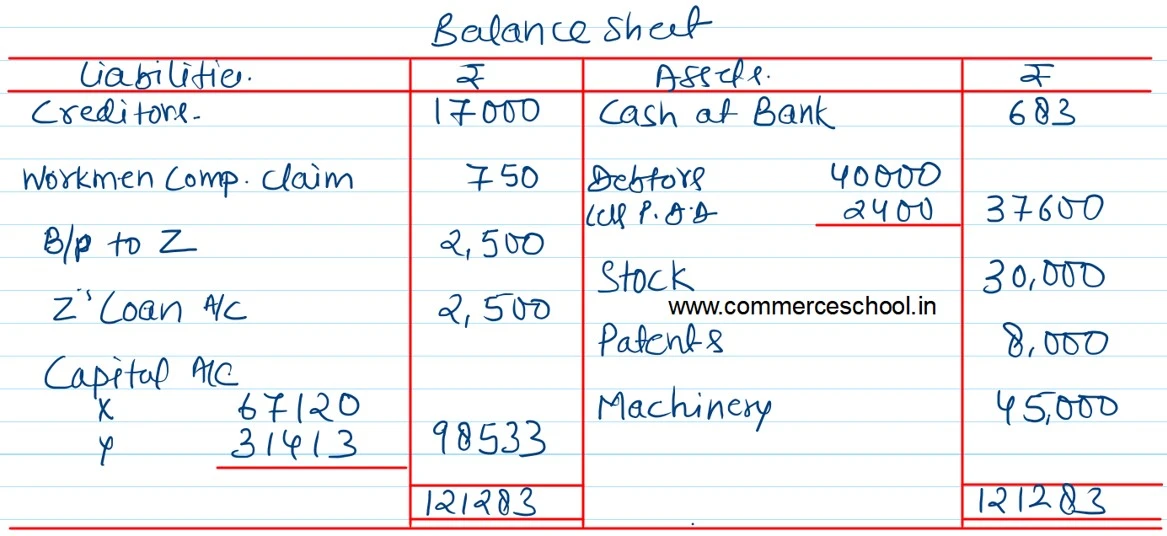

Z retired on 1st April, 2022 on the following terms:

a) Goodwill of the firm is to be valued at ₹ 34,800.

b) Value of Patents is to be reduced by 20% and that of machinery to 90%.

c) Provision for Doubtful Debts is to be @6% on debtors.

d) Z took the investment at market value.

e) Liability for Workmen Compensation to the extent of ₹ 750 is to be created.

f) A liability of ₹ 4,000 included in creditors is not to be paid.

g) Amount due to Z to be paid as follows:

₹ 5,067 immediately, 50% of the balance within one year and the balance by a draft for 3 months.

Give necessary Journal entries for the treatment of goodwill, prepare Revaluation Account, Capital Accounts and the Balance Sheet of the new firm.