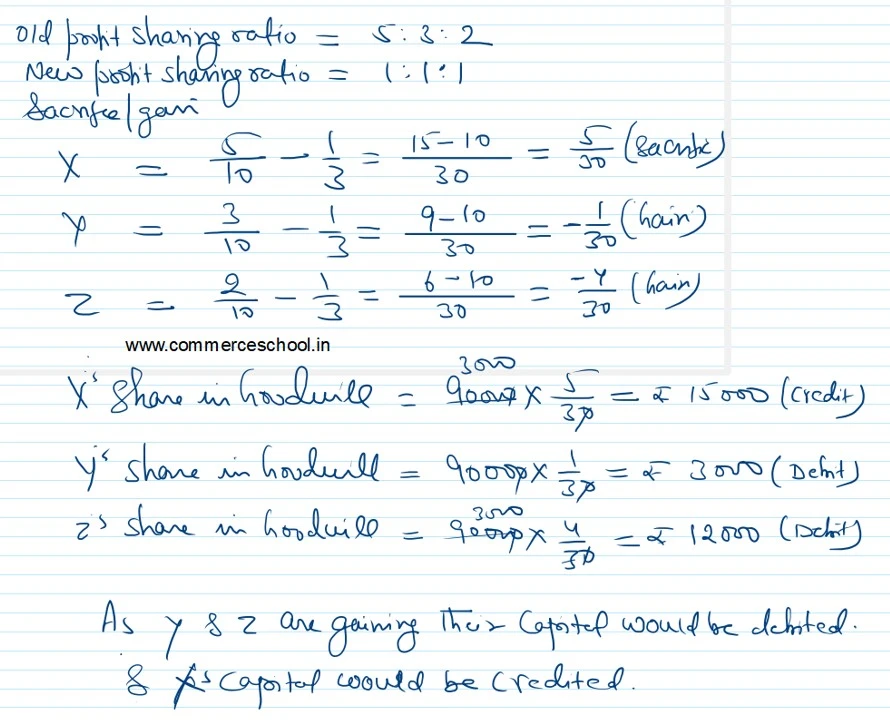

X, Y and Z are partners sharing profits and losses in the ratio of 5 : 3 : 2. From 1st April 2023, they decided to share profits and losses equally. The Partnership Deed provides that in the event of any change in the profit sharing ratio, goodwill is to be valued at two years’ purchase of the average profit of the preceding five years. The Profits and losses of the preceding years ended 31st March are:

X, Y, and Z are partners sharing profits and losses in the ratio of 5 : 3 : 2.

From 1st April 2023, they decided to share profits and losses equally.

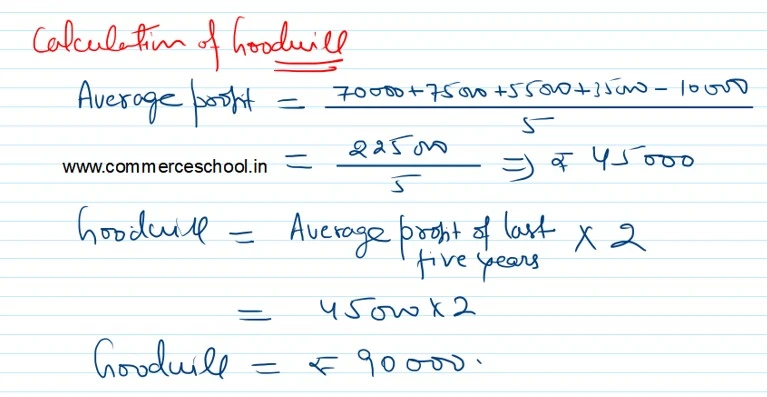

The Partnership Deed provides that in the event of any change in the profit sharing ratio, goodwill is to be valued at two years’ purchase of the average profit of the preceding five years.

The Profits and losses of the preceding years ended 31st March are:

| Year | Profits (₹) |

| 2019 | 70,000 |

| 2020 | 75,000 |

| 2021 | 55,000 |

| 2022 | 35,000 |

| 2023 | 10,000 (Loss) |

Calculate the value of goodwill and pass the Journal entry.

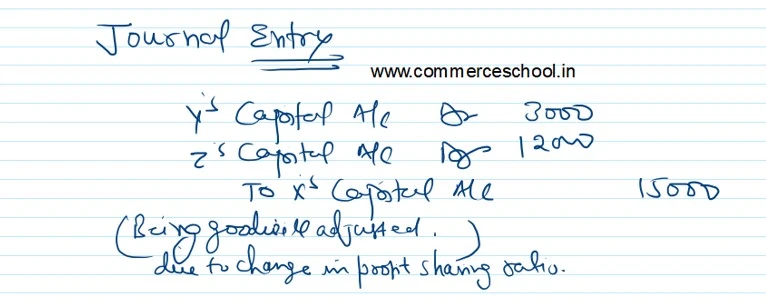

[Ans.: Goodwill = ₹ 90,000; Dr. Y’s Capital A/c by ₹ 3,000 and Z’s Capital A/c by ₹ 12,000; Cr. X’s Capital A/c by ₹ 15,000.]

Anurag Pathak Changed status to publish