X, Y and Z contribute ₹ 3,00,000, ₹ 2,00,000 and ₹ 1,00,000 respectively by way of capital on which they agree to allow interest at 12% p.a

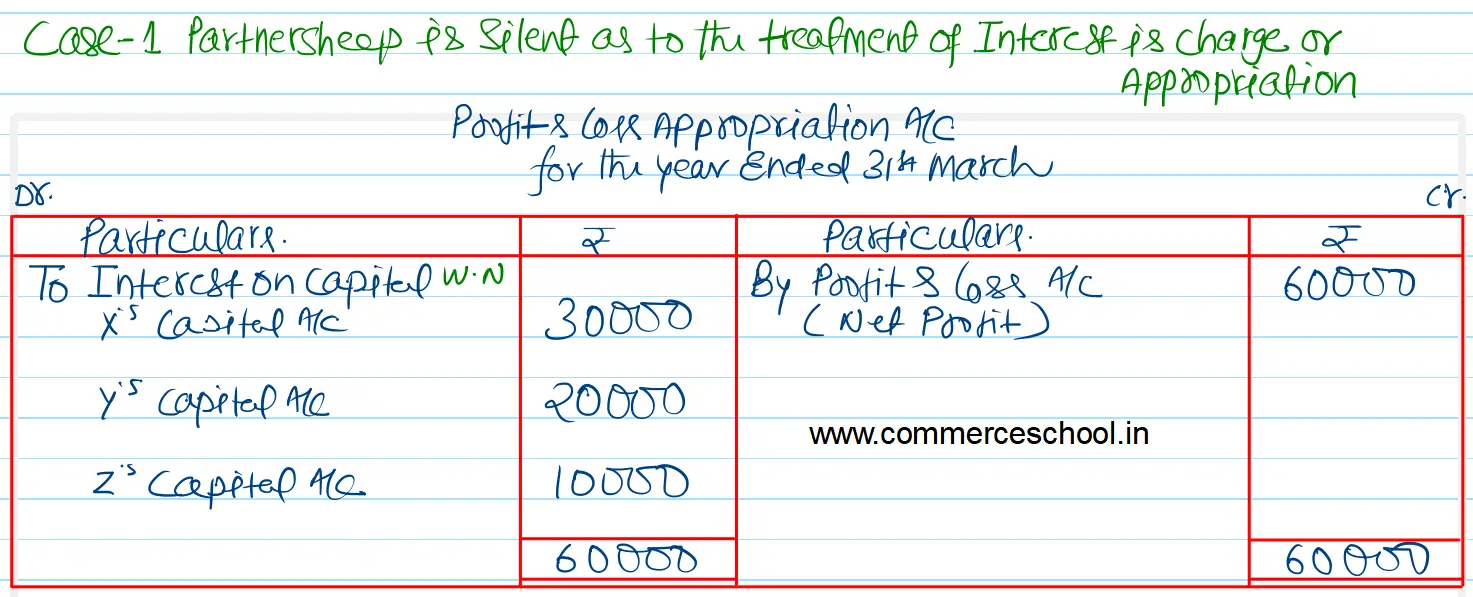

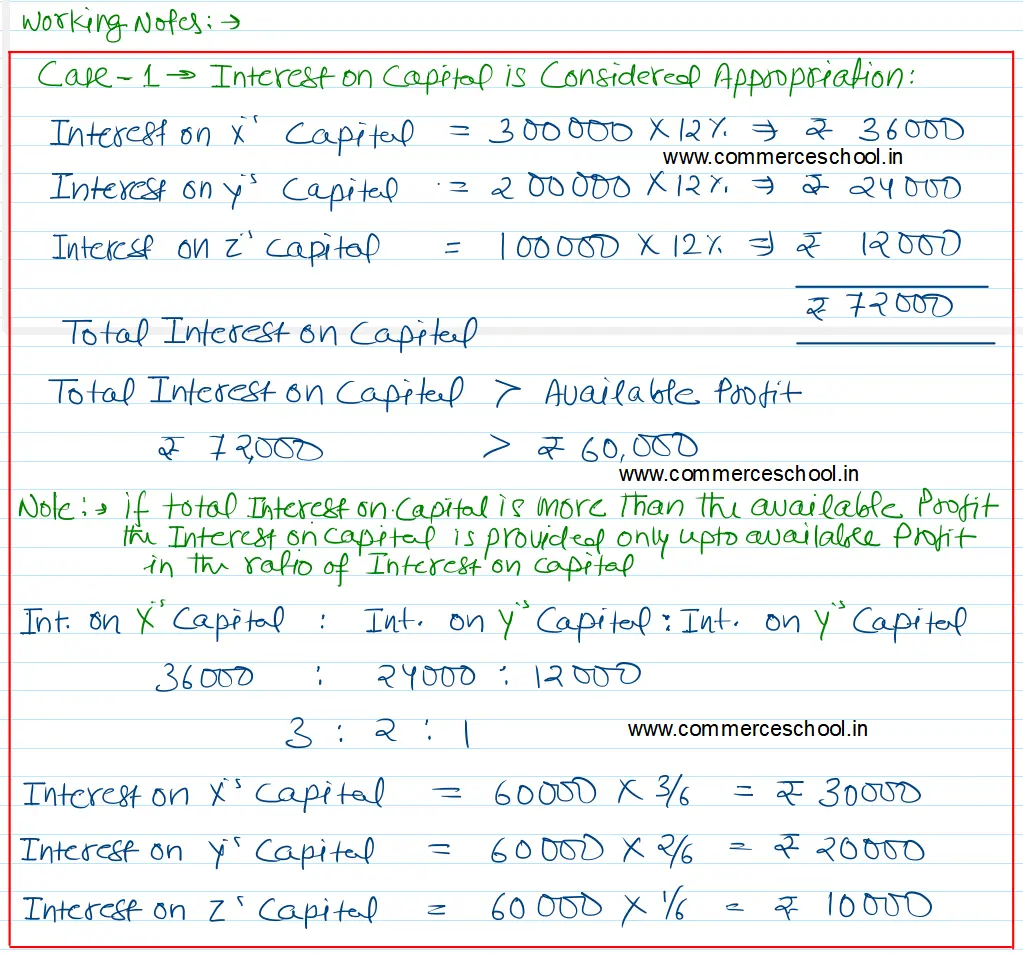

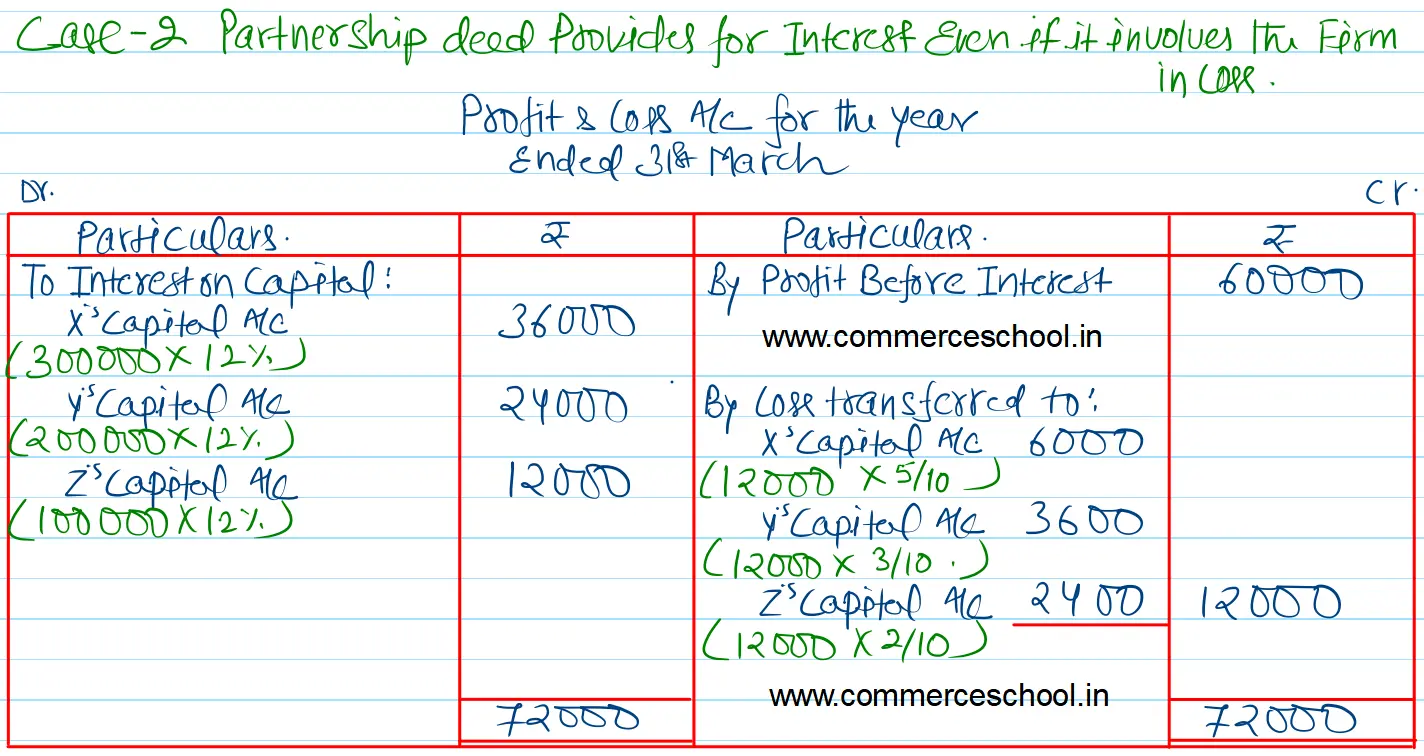

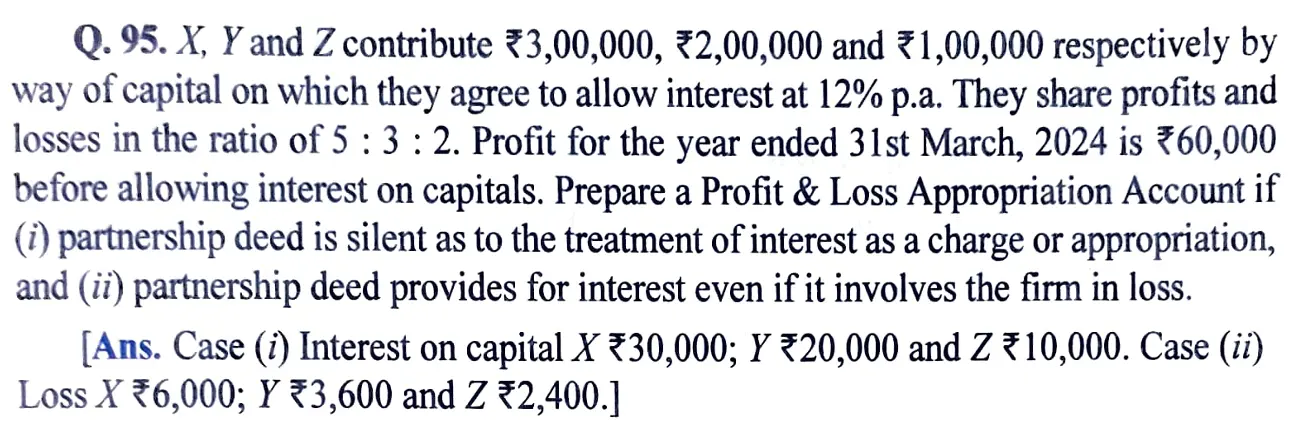

X, Y and Z contribute ₹ 3,00,000, ₹ 2,00,000 and ₹ 1,00,000 respectively by way of capital on which they agree to allow interest at 12% p.a. They share profits and losses in the ratio of 5 : 3 : 2. Profit for the year ended 31st March, 2024 is ₹ 60,000 before allowing interest on capitals. Prepare a Profit & Loss Appropriation Account if (i) Partnership deed is silent as to the treatment of interest as a charge or appropriation, and (ii) partnership deed provides for interest even if it involves the firm in loss.

[Ans. Case (I) Interest on capital X ₹ 30,000; Y ₹ 20,000 and Z ₹ 10,000. Case (ii) Loss X ₹ 6,000; Y ₹ 3,600 and Z ₹ 2,400.]

Anurag Pathak Changed status to publish