X, Y and Z were in partnership sharing profits in proportion to their capitals. Their Balance Sheet as on 31st March, 2018 was as follows:

X, Y and Z were in partnership sharing profits in proportion to their capitals. Their Balance Sheet as on 31st March, 2018 was as follows:

| Liabilities | ₹ | Assets | ₹ | |

| Sundry Creditors

Workmen’s Compensation Fund General Reserve Capitals: X Y Z |

16,600 9,000 6,000 90,000 60,000 30,000 |

Cash

Debtors Stock Machinery Building |

21,000 |

15,000 19,600 19,000 58,000 1,00,000 |

| 2,11,600 | 2,11,600 |

On the above date, Y retired owing to ill health. The following adjustments were agreed upon for the calculation of the amount due to Y:

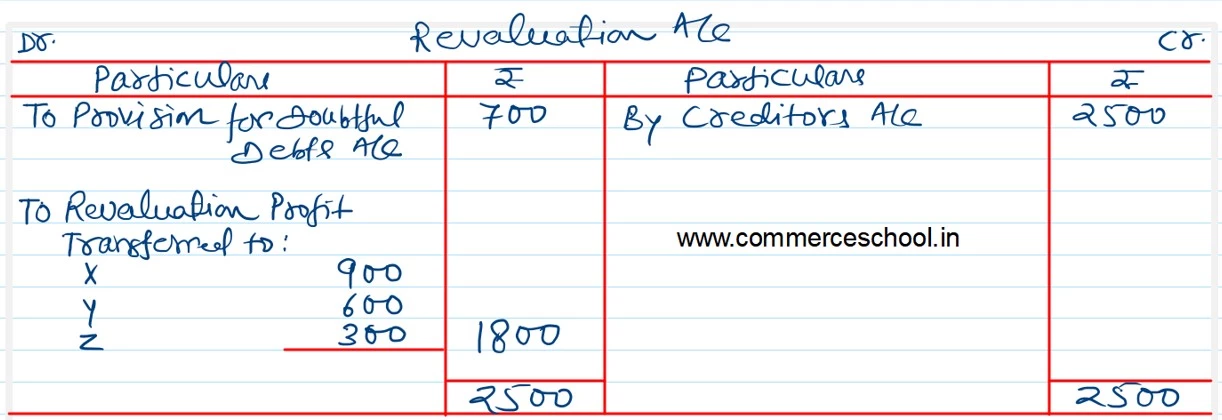

a) Provision for Doubtful Debts to be increased to 10% of Debtors.

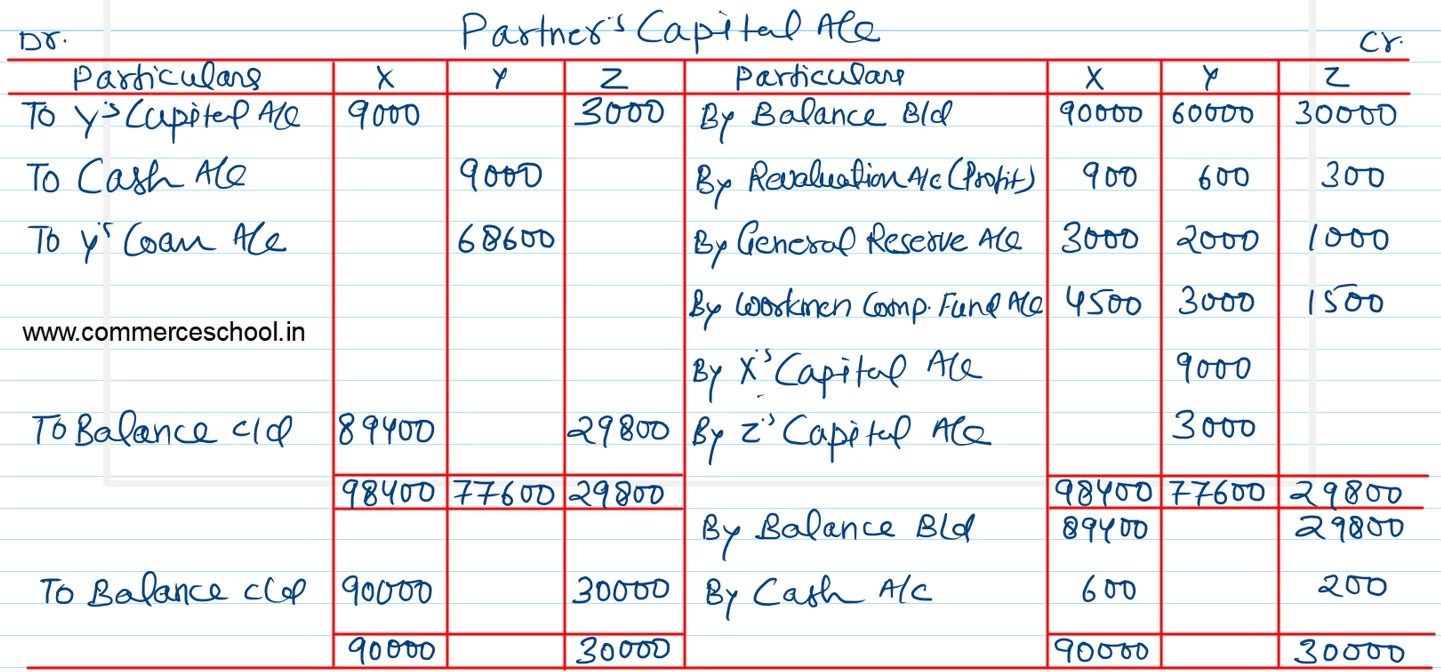

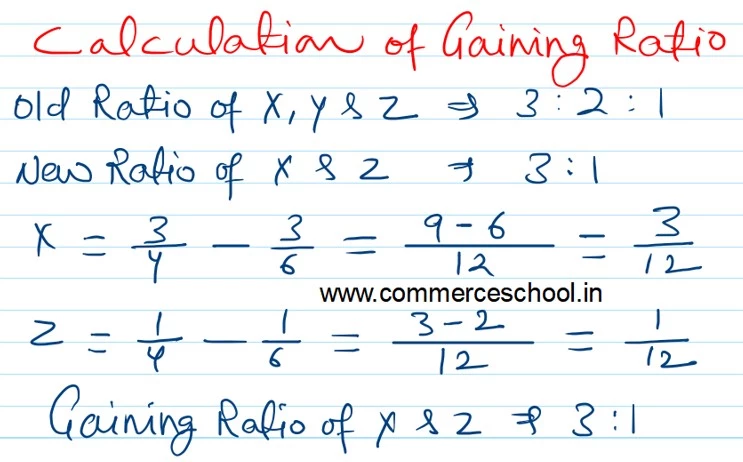

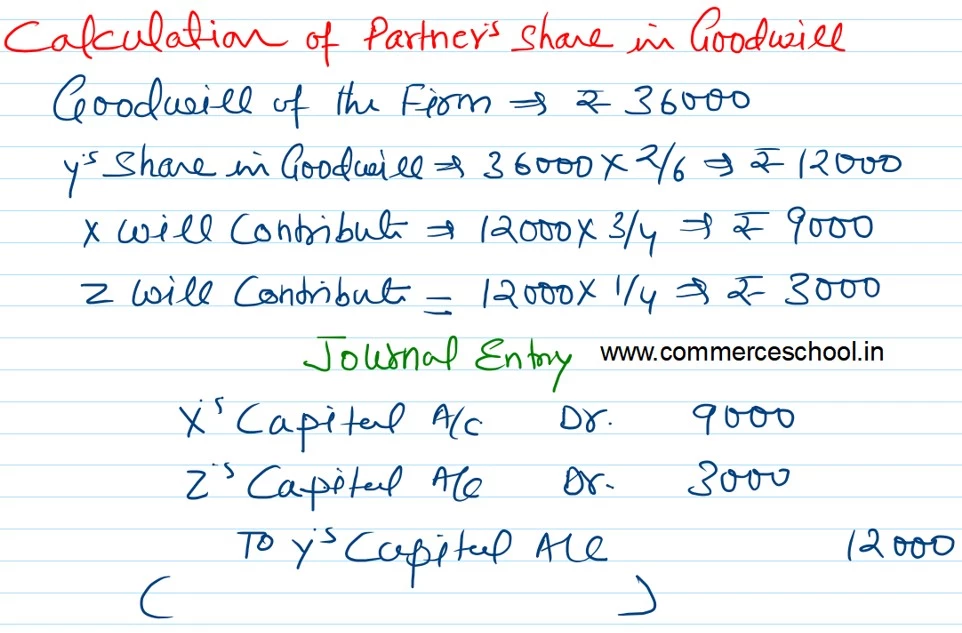

b) Goodwill of the firm be valued at ₹ 36,000 and be adjusted into the Capital Accounts of X and Z, who will share profits in future in the ratio of 3 : 1.

c) Included in the value of Sundry Creditors was ₹ 2,500 for an outstanding legal claim, which will not arise.

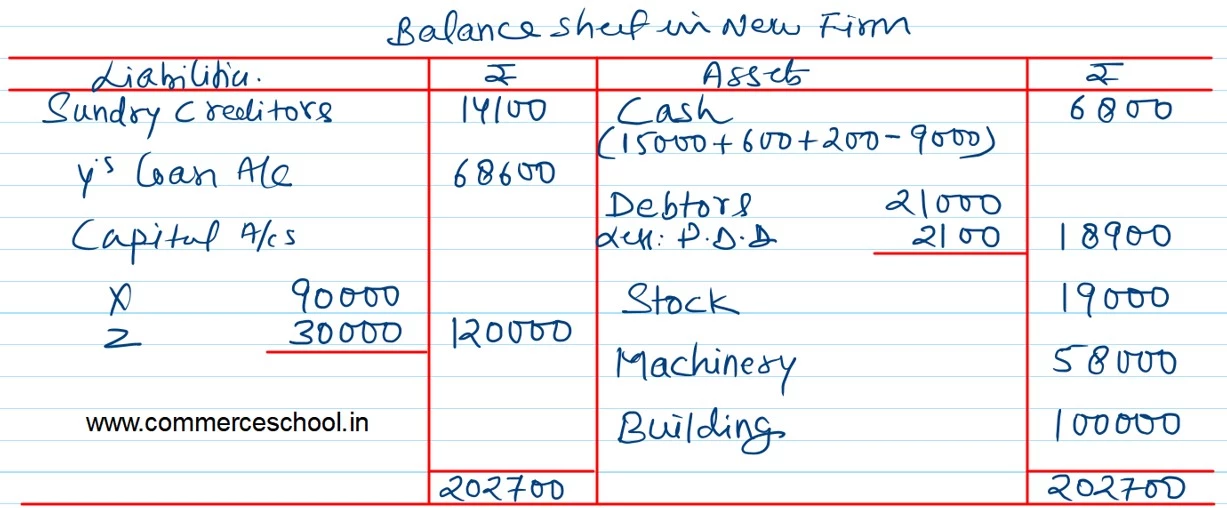

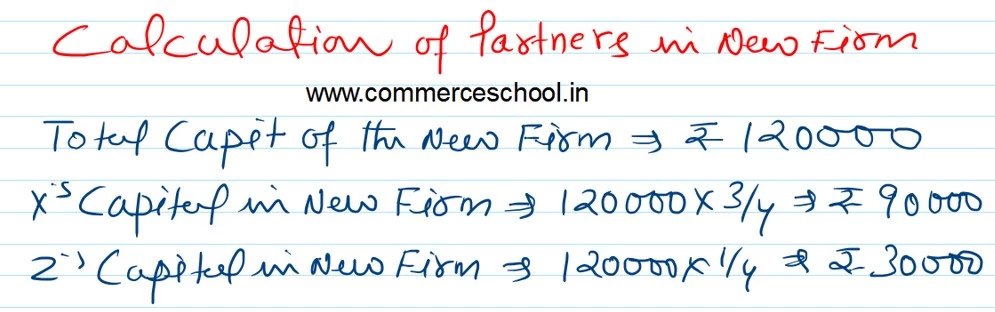

d) X and Z also decided that the total capital of the new firm will be ₹ 1,20,000 in their profit sharing ratio. Actual cash to be brought in or to be paid off as the case may be:

e) Y to be paid ₹ 9,000 immediately and balance to be transferred to his Loan Account.

Prepare Revaluation Account, Partner’s Capital Accounts and Balance Sheet of the new firm after Y’s retirement.

[Ans.: Gain (Profit) on Revaluation – ₹ 1,800; Y’s Loan A/c -₹ 68,600; Partner’s Capital Accounts: X – ₹ 90,000; Z – ₹ 30,000; Total of Balance Sheet of the New Firm – ₹ 2,02,700.]