X, Y and Z were partners in a firm sharing profits in the ratio of 4 : 3 : 1. The firm closes its books on 31st March every year. On 1st February, 2023.

X, Y and Z were partners in a firm sharing profits in the ratio of 4 : 3 : 1. The firm closes its books on 31st March every year. On 1st February, 2023. Y died and it was decided that the new profit sharing ratio between X and Z will be equal. Partnership Deed provided for the following on the death of a partner:

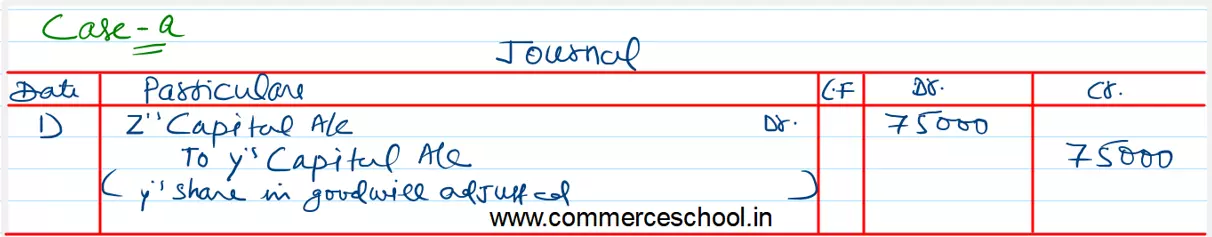

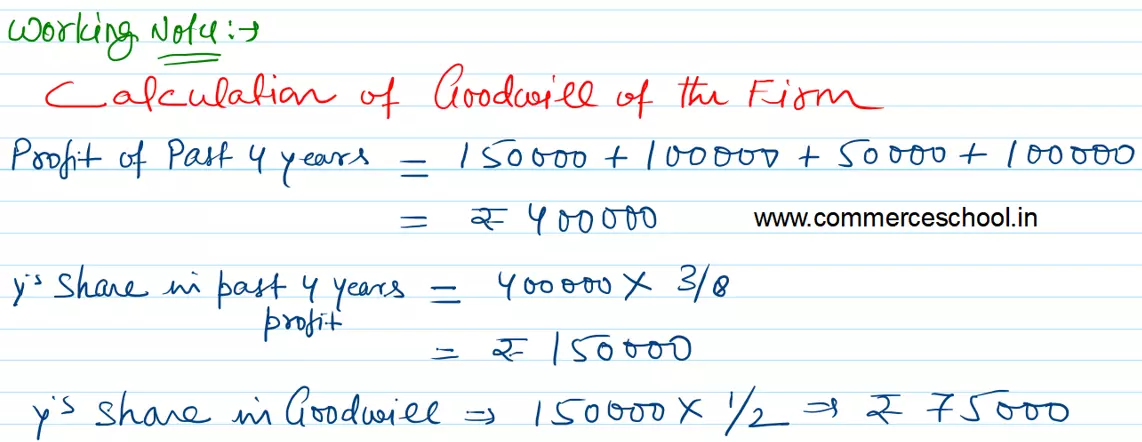

(a) His share of goodwill be calculated on the basis of half of the profits credited to his account during the previous four completed years. The firm’s profits for the last four years were:

| Year | Profits (₹) |

| 2018-19 | 1,50,000 |

| 2019-20 | 1,00,000 |

| 2020-21 | 50,000 |

| 2021-22 | 1,00,000 |

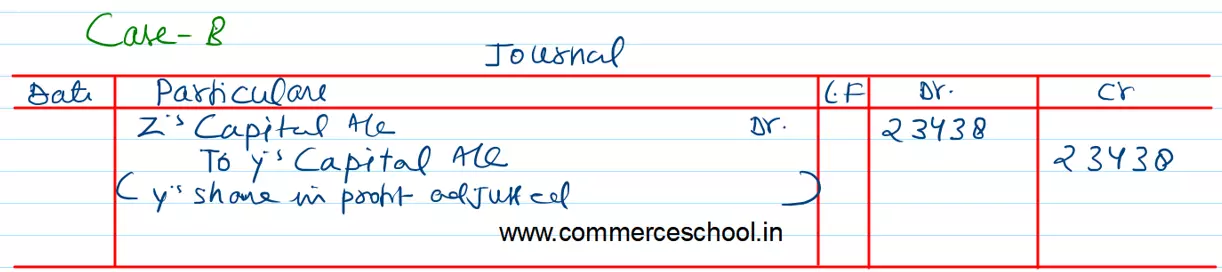

(b) His share of profit in the year of his death was to be computed on the basis of average profit of past two years.

Pass necessary Journal entries relating to goodwill and profit to be transferred to Y’s Capital Account.