Xen, Sam, and Tim are partners in a firm. For the year ended 31st March 2022, the profit of the firm ₹ 12,00,000 was distributed equally among them, without giving effect to the following terms of the partnership deed:

Xen, Sam, and Tim are partners in a firm. For the year ended 31st March 2022, the profit of the firm ₹ 12,00,000 was distributed equally among them, without giving effect to the following terms of the partnership deed:

i) Sam’s guarantee to the firm that the firm would earn a profit of at least ₹ 1,35,000. Any shortfall in these profits would be met by him.

ii) Profits to be shared in the ratio of 2:2:1.

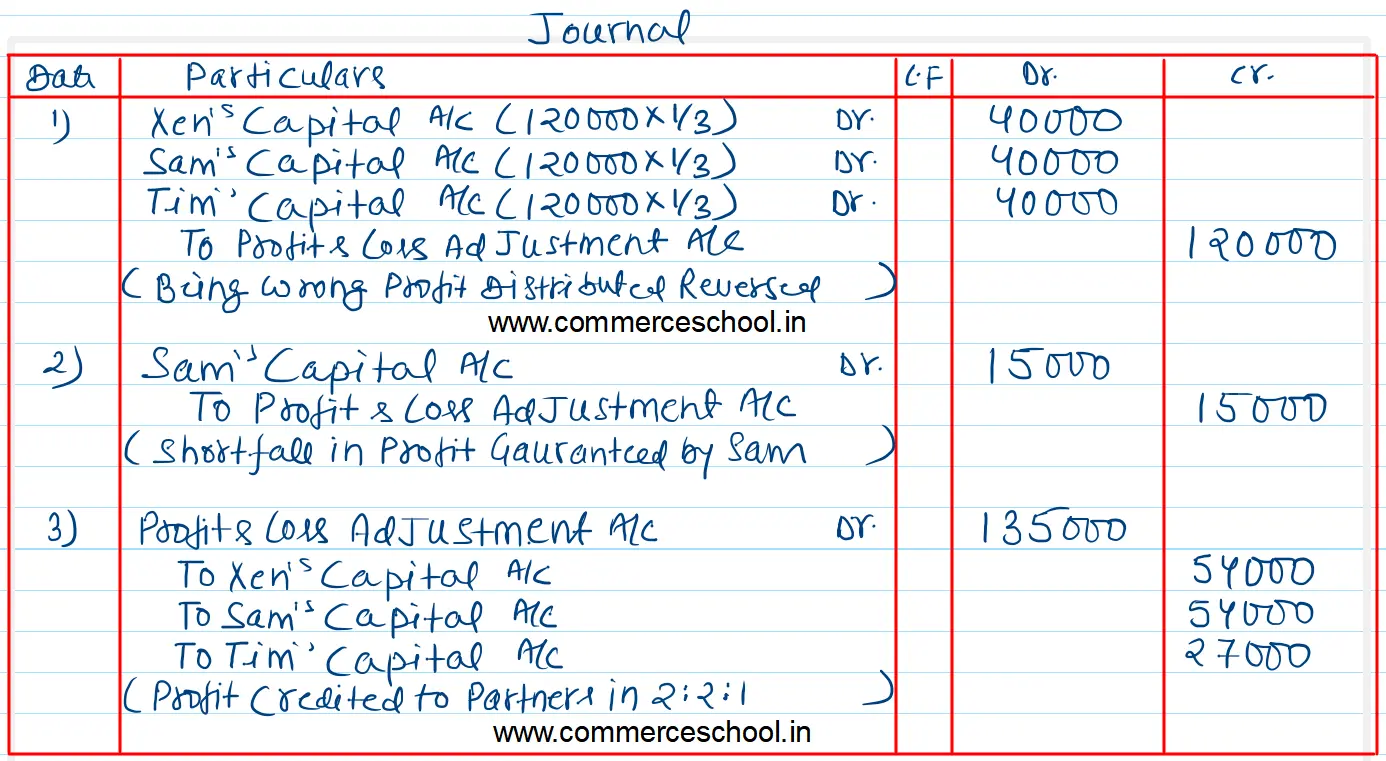

You are required to pass the necessary Journal entries to rectify the error in accounting.

Solution:-

Note:-

1. Profit wrongly distributed earlier in 1 : 1 : 1 is reversed in first country.

2. Sam’s guaranteed that the firm would earn at least ₹ 1,35,000 profit and any shortfall would be met by him. Thus the short fall ₹ 15,000 ( ₹ 135,000 – ₹ 1,20,000) is debited by Sam’s Capital A/c and credit to firm’s Profity and Loss Adjustment Account.

3. Correct Profit ₹ 1,35,000 is credited to partner’s in their correct profit sharing ratio i.e., 2 : 2 : 1.

If Question says to pass all necessary journal entries, neither adjustment table is prepared nor single adjustment entry is passed. Instead, Journal entries are passed for each transactions debiting and crediting partner’s capital/current A/c by opening a separate Profit and Loss Adjustment Account.