X, Y and Z were partners in a firm. Z died on 31st May, 2022. His share of profit from the closure of the last accounting year till the date of death was to be calculated on the basis of the average of three completed years of profits before death.

X, Y and Z were partners in a firm. Z died on 31st May, 2022. His share of profit from the closure of the last accounting year till the date of death was to be calculated on the basis of the average of three completed years of profits before death. Profits for the years ended 31st March, 2020, 2021 and 2022 were ₹ 18,000; ₹ 19,000 and ₹ 17,000 respectively.

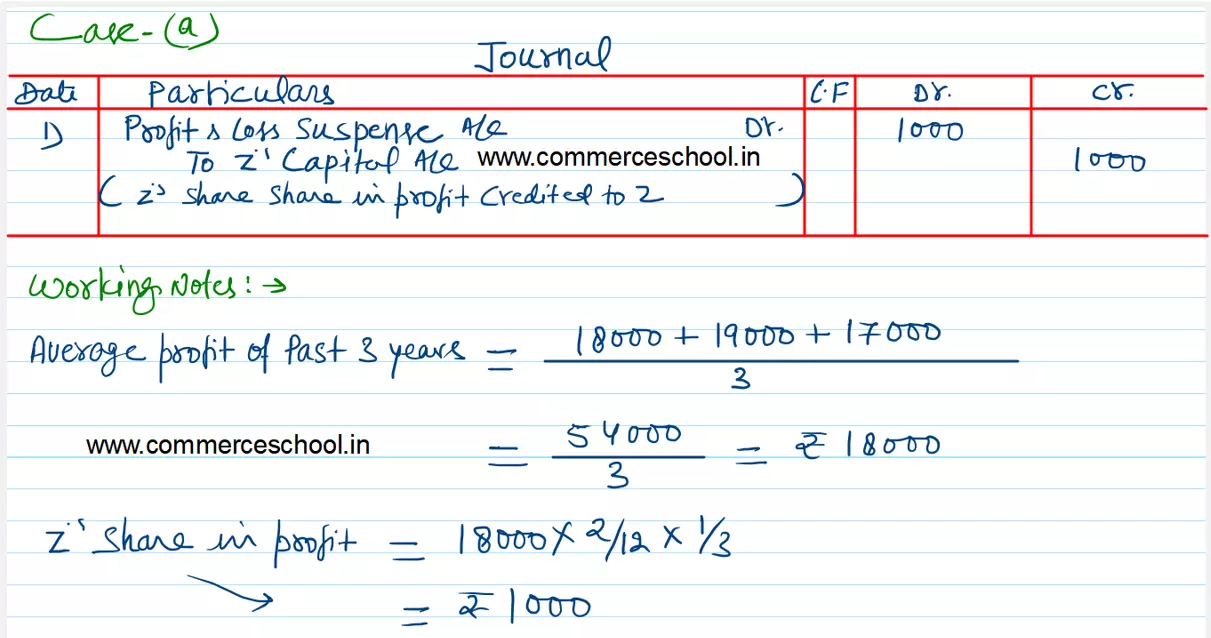

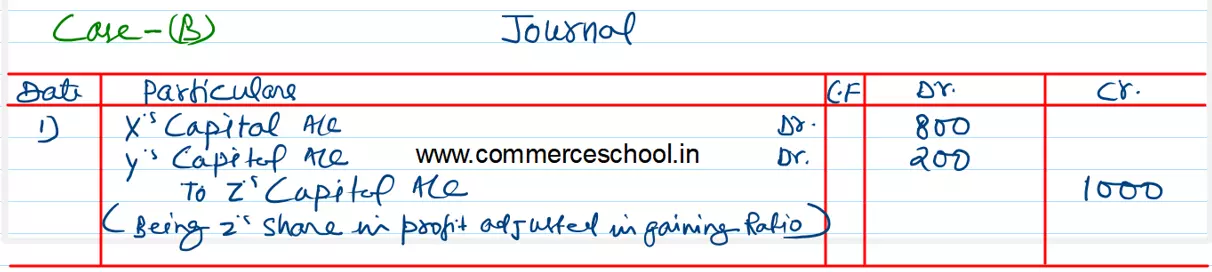

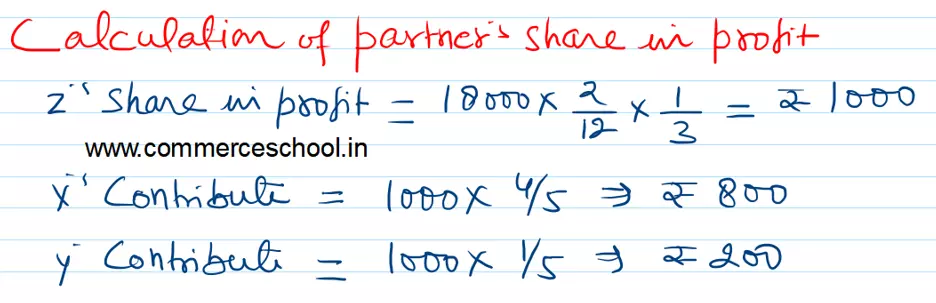

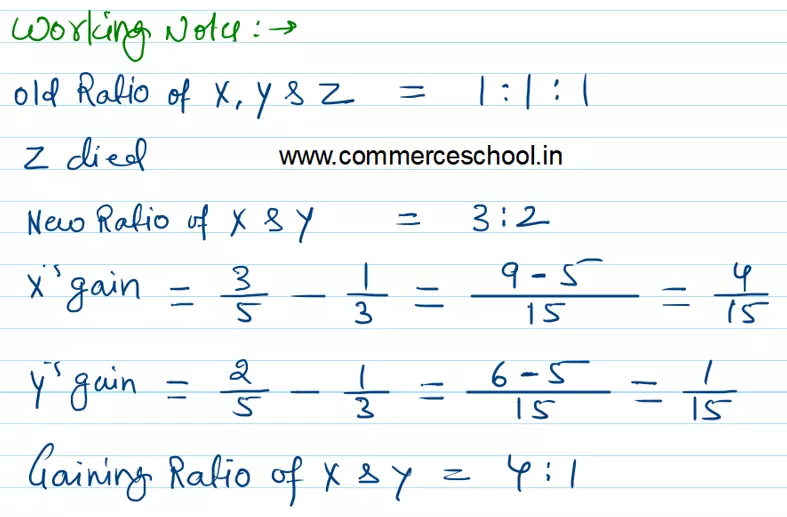

Calculate Z’s share of profit till his death and pass necessary Journal entry for the same when:

(a) Profit sharing ratio of remaining partners does not change, and

(b) Profit sharing ratio of remaining partners changes and new ratio being 3 : 2.

Anurag Pathak Changed status to publish