You are given the Balance Sheet of A, B and C who are partners sharing profits in the ratio of 2 : 2 : 1 as at March 31, 2022. Creditors ₹ 40,000

You are given the Balance Sheet of A, B and C who are partners sharing profits in the ratio of 2 : 2 : 1 as at March 31, 2022.

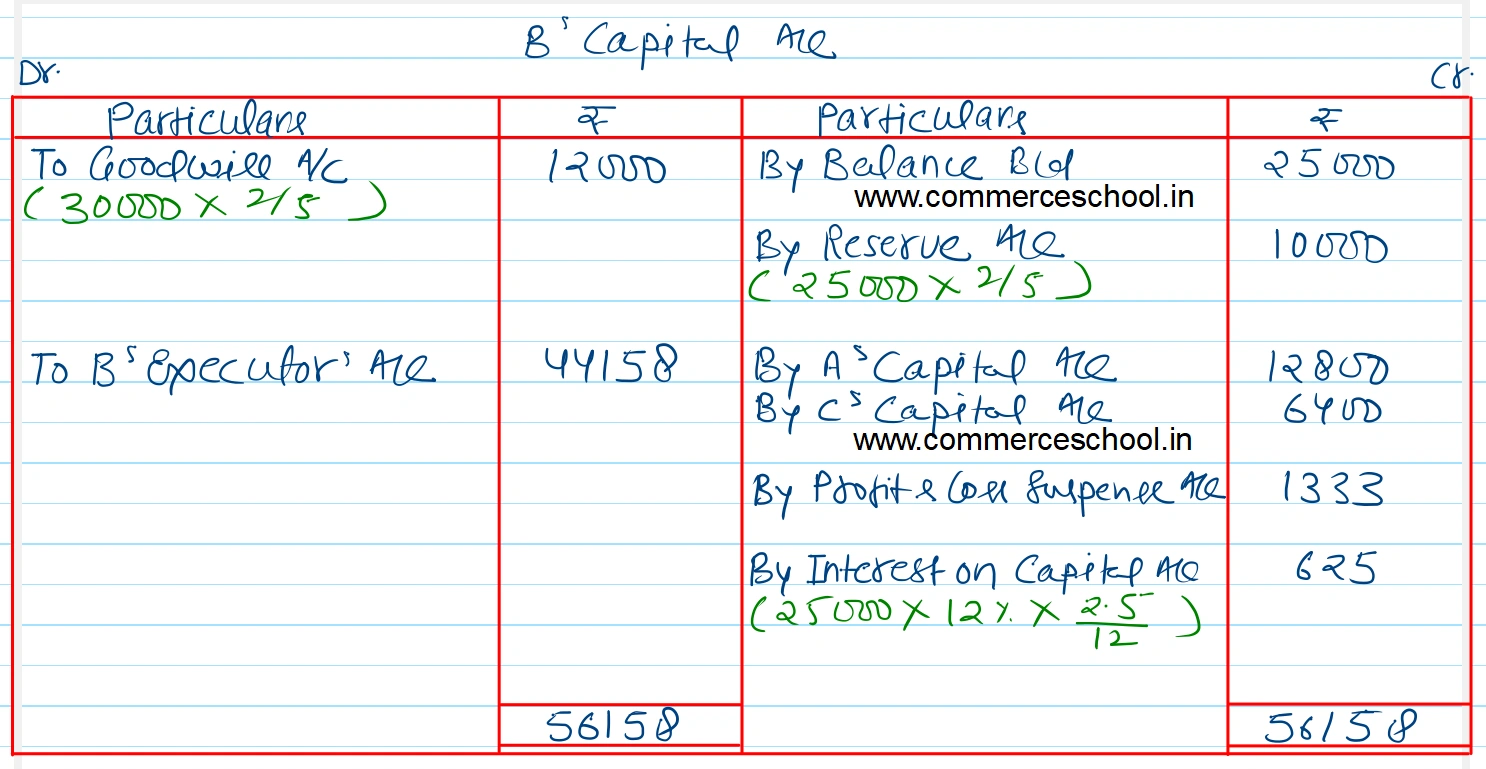

B died on June 15, 2022. According to the deed, his legal representatives are entitled to:

(a) Balance in Capital Account;

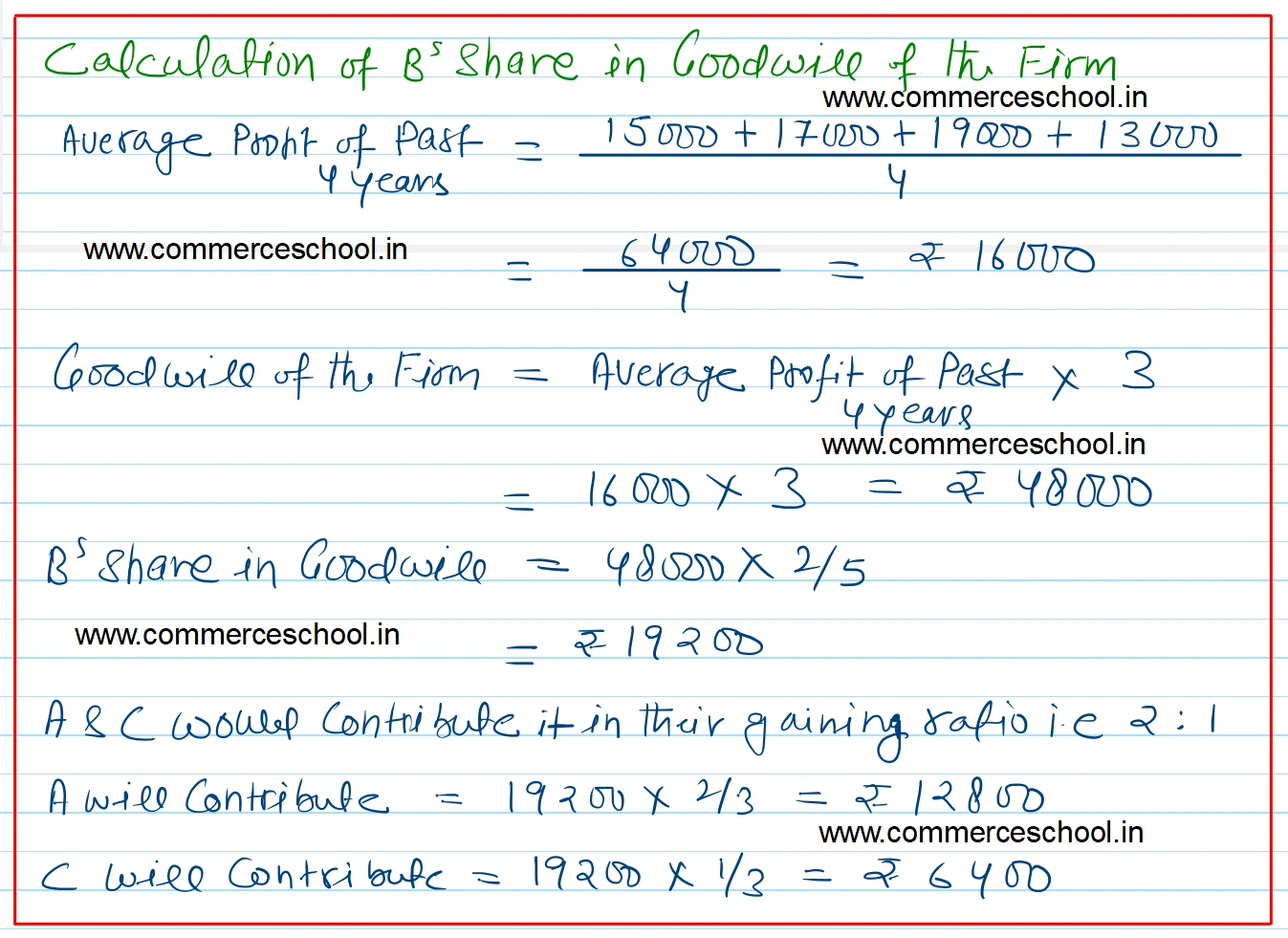

(b) Share of goodwill valued on the basis of thrice the average of the past 4 year’s profits;

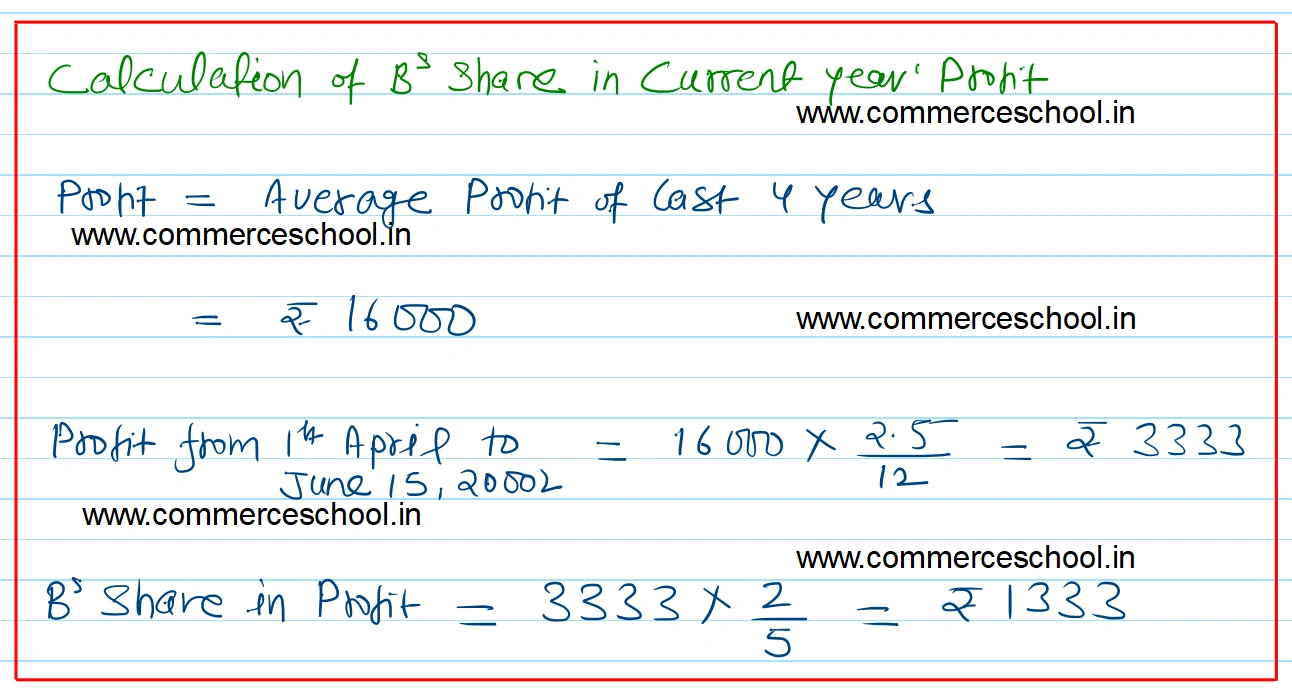

(c) Share in profits up to the date of death on the basis of average profits for the past 4 years;

(d) Interest on capital account @ 12% p.a.

Profits for the years ending on March 31 of 2019, 2020, 2021, 2022 respectively were ₹ 15,000, ₹ 17,000, ₹ 19,000 and ₹ 13,000.

B’s legal representatives were to be paid the amount due. A and C continued as partners by taking over B’s share equally. Work out the amount payable to B’s legal representatives.

[Ans. Amount paid to B’s representatives ₹ 44,158.]

Hints: (1) Share in profits for 2.5 months ₹ 1,333.

(2) B’s share of profit ₹ 1,333 will be credited to B and debited to A and C in their gaining ratio i.e., equally.

| Liabilities | ₹ | Assets | ₹ |

| Creditors | 40,000 | Goodwill | 30,000 |

| Reserve Fund | 25,000 | Fixed Assets | 60,000 |

| Capitals: A B C | 30,000 25,000 15,000 | Stock | 10,000 |

| Sundry Debtors | 20,000 | ||

| Cash at Bank | 15,000 | ||

| 1,35,000 | 1,35,000 |

Anurag Pathak Answered question