The following is the Balance Sheet of A, B and C, as at 31st March, 2024 Creditors ₹ 30,000 Mrs. A’s Loan ₹ 20,000

The following is the Balance Sheet of A, B and C, as at 31st March, 2024:

| Liabilities | ₹ | Assets | ₹ |

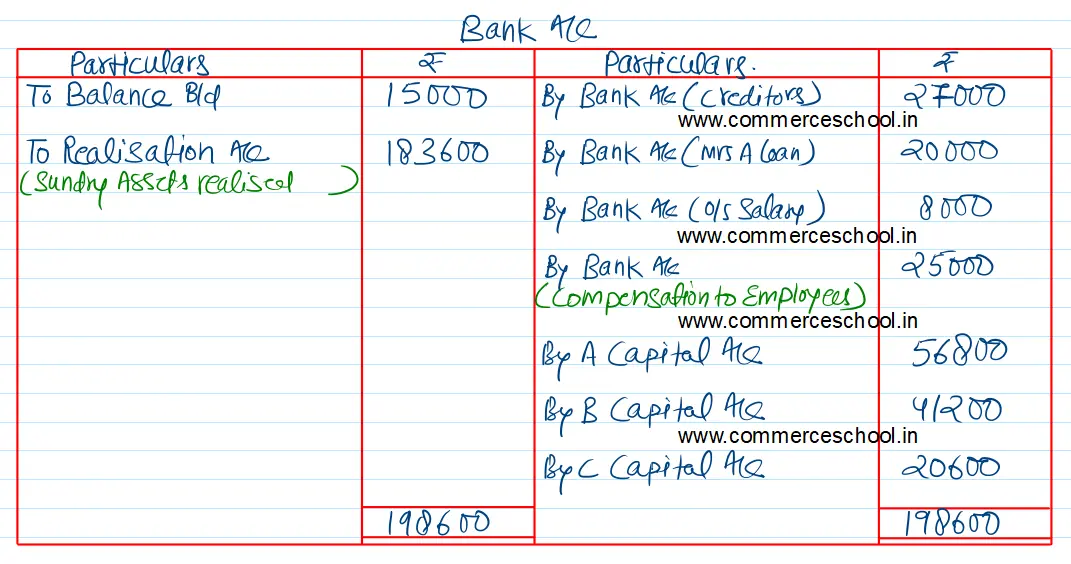

| Creditors | 30,000 | Bank | 15,000 |

| Mrs. A’s Loan | 20,000 | Bills Receivable | 12,000 |

| Outstanding Salary | 8,000 | Stock | 40,000 |

| Investment Fluctuation Fund | 10,000 |

Sundry Debtors 40,000 Less: Provision for Doubtful Debts 40,00 |

36,000 |

| Reserves | 12,000 | Land and Buildings | 50,000 |

|

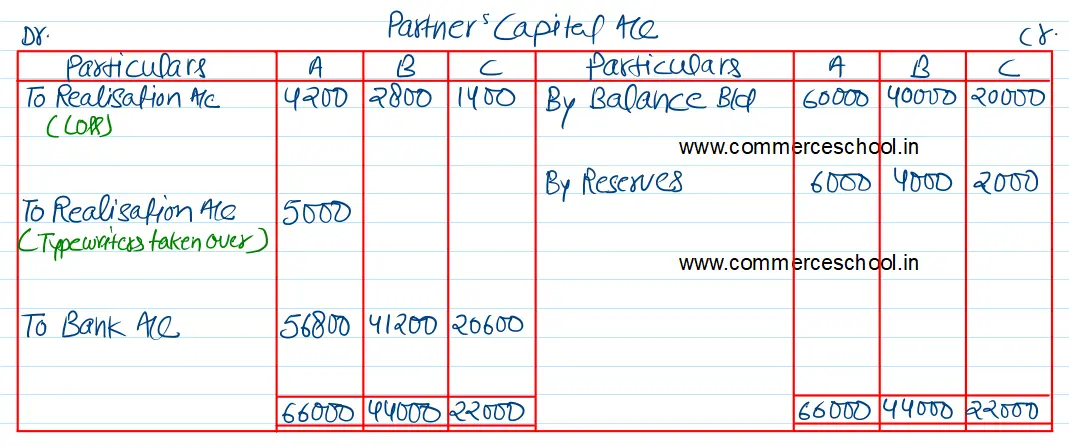

Capital Accounts: A B C |

60,000 40,000 20,000 |

Furniture | 10,000 |

| Typewriters | 7,000 | ||

| Investments | 28,500 | ||

| Accrued Income | 1,500 | ||

| 2,00,000 | 2,00,000 |

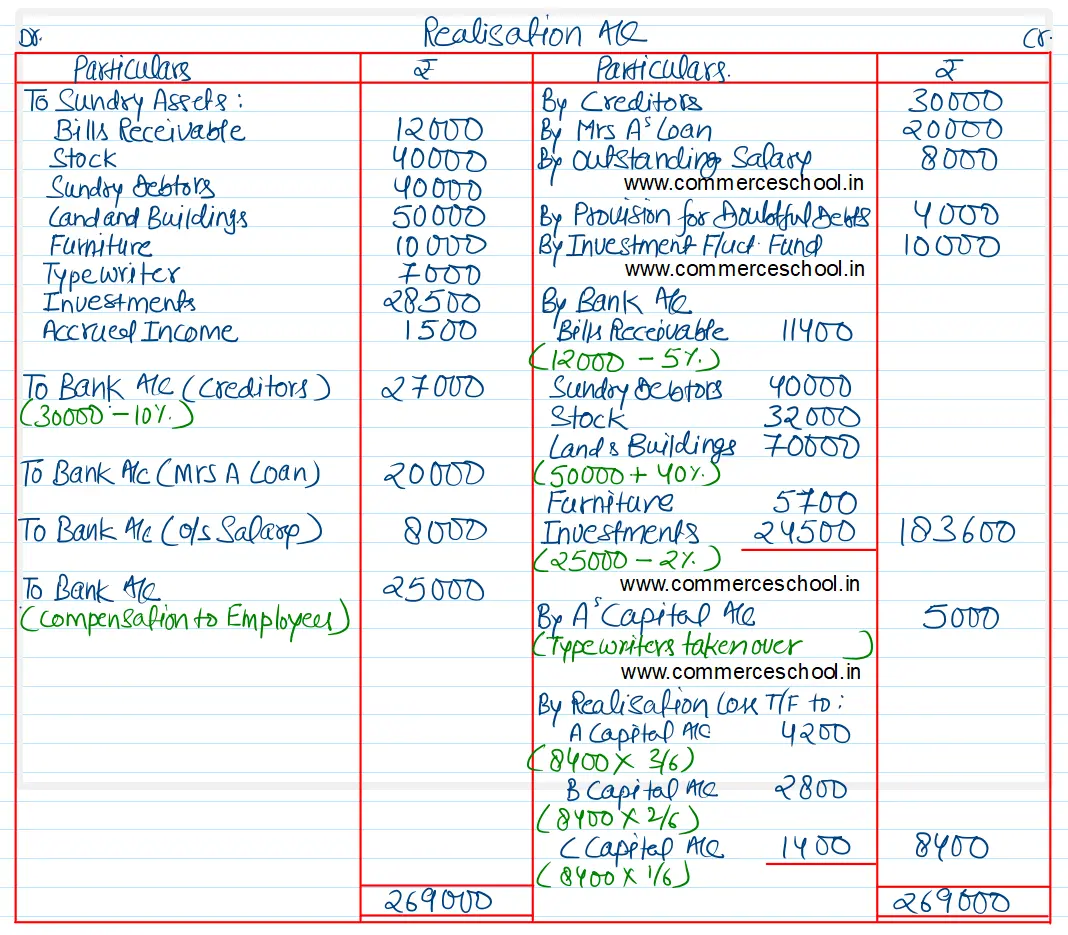

The profit and loss sharing ratios of the partners are 3 : 2 : 1. At the above date, partners decide to dissolve the firm.

The assets realised were as follows:

(i) Bills Receivable were realised at a discount of 5%, Debtors were all good; Stock realised ₹ 32,000. Land and Buildings realised at 40% higher than the book value.

(ii) Furniture was sold for ₹ 6,000 by auction and auctioneer’s commission amounted to ₹ 300.

(iii) Typewriters were taken over by A for an agreed valuation of ₹ 5,000.

(iv) Investments were sold in the open market at a price of ₹ 25,000, for which a commission of 2% was paid to the broker.

(v) Creditors agreed to accept 10% less. All other liabilities were paid off at their book value.

(vi) The firm retrenched their employees three months before the dissolution of the firm and the firm had to pay ₹ 25,000 as compensation. This liability was not appearing in the above Balance Sheet.

Close the books of the firm by preparing Realisation Account, Partner’s Capital Accounts, and Bank Account.

[Ans. Loss on Realisation ₹ 8,400; Final Payment to A ₹ 56,800; B ₹ 41,200 and C ₹ 20,600.]