X, Y and Z decided to dissolve partnership. The position as at 31st December, 2023, the date of dissolution was as follows:

X, Y and Z decided to dissolve partnership. The position as at 31st December, 2023, the date of dissolution was as follows:

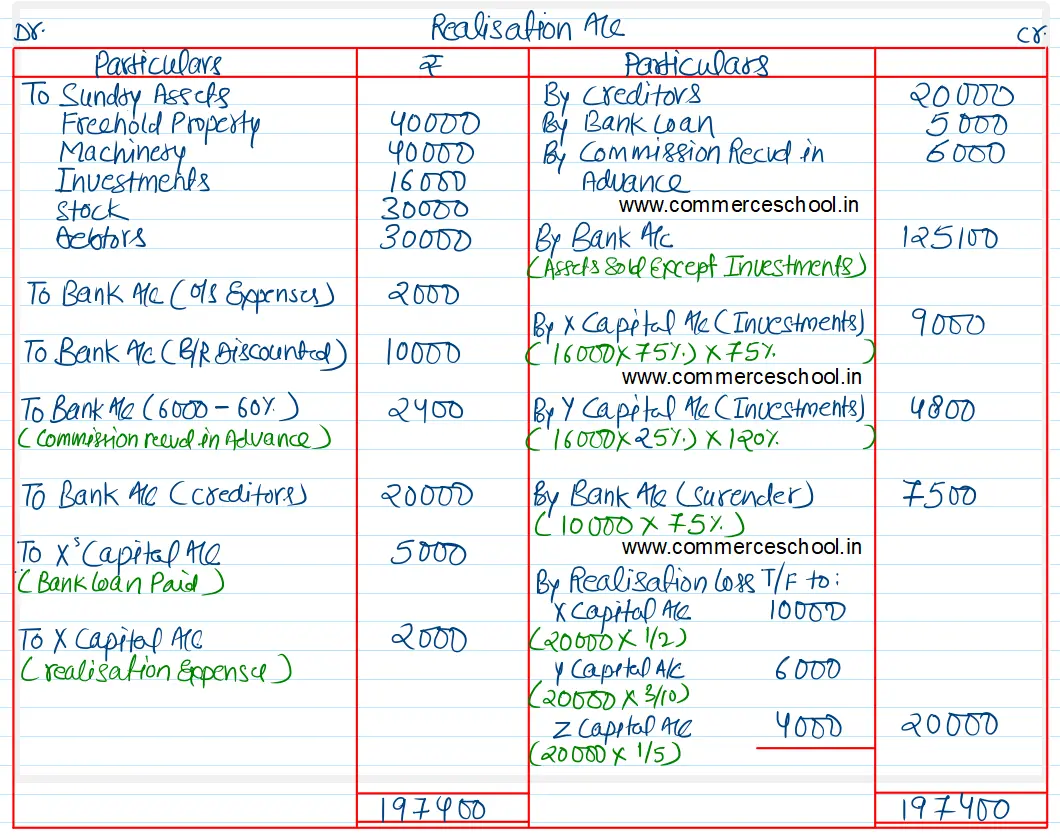

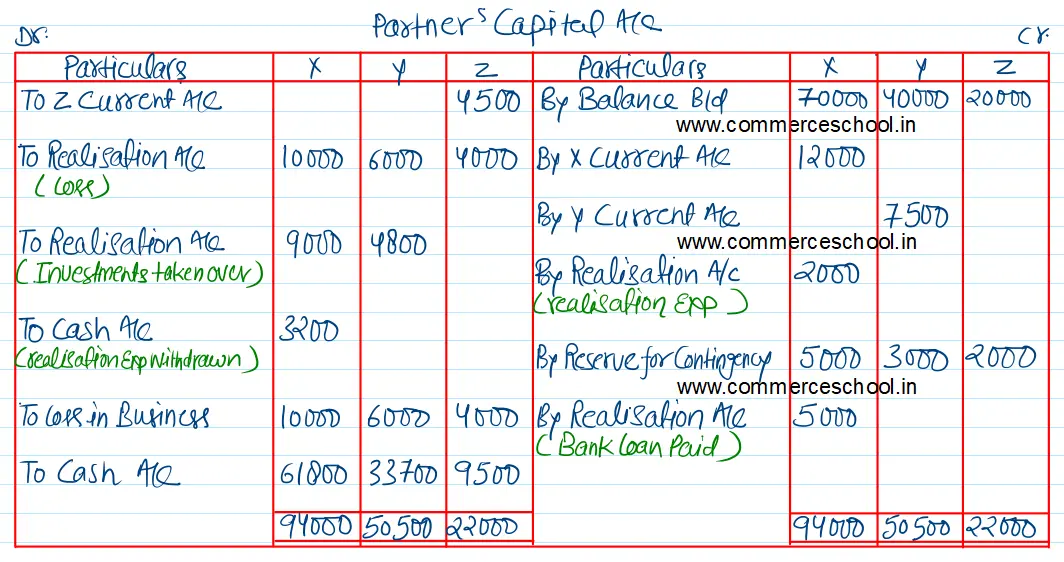

They shared profits in the ratio of X: 1/2, Y: 3/10 and Z: 1/5.

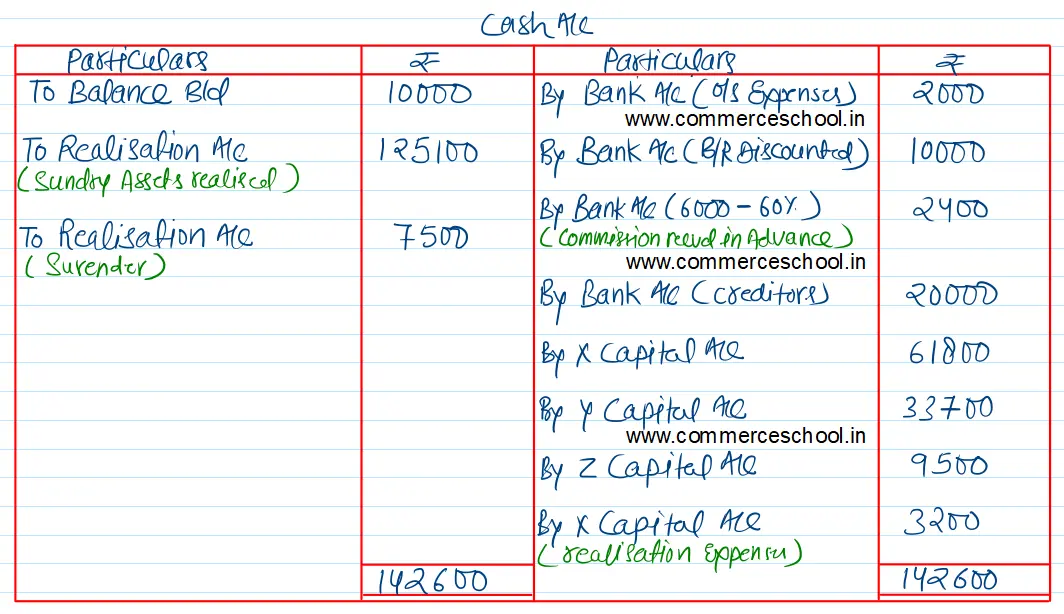

X agreed to bear all realisation expenses. For this service X is paid ₹ 2,000. Actual expenses amounted to ₹ 3,200 which was withdrawn by him from the firm.

Other information are:

(1) Assets, with the exception of investments and Cash, are sold for ₹ 1,25,100. 75% of the investments are taken over by X at 75% of their book value. He also agrees to discharge the Bank Loan. The remaining investments were taken over by Y at the market value of 120%.

(2) There were outstanding expenses amounting to ₹ 5,000. These were settled for ₹ 2,000.

(3) A B/R for ₹ 10,000 was received from a customer Mr. Surender Kumar and the bill was discounted from the bank. Surender became insolvent and 75 paise per ₹ were received from his estate.

(4) Commission received in advance was returned to the customers after deducting 60% for work done.

You are required to prepare the necessary accounts.

[Ans. Loss on Realisation ₹ 20,000; Final Payment to X ₹ 61,800; Y ₹ 33,700 and Z ₹ 9,500; Total of Cash A/c ₹ 1,42,600.]

| Liabilities | ₹ | Assets | ₹ |

| Creditors | 20,000 | Freehold Property | 40,000 |

| Bank Loan | 5,000 | Machinery | 40,000 |

| Capitals: X Y Z | 70,000 40,000 20,000 | Investments | 16,000 |

| Current Accounts: X Y | 12,000 7,500 | Stock | 30,000 |

| Reserve for Contingency | 10,000 | Debtors | 30,000 |

| Commission Received in Advance | 6,000 | Cash | 10,000 |

| Loss in Business | 20,000 | ||

| Current Account: Z | 4,500 | ||

| 1,90,500 | 1,90,500 |

Anurag Pathak Answered question October 2, 2024