The following is the Balance Sheet of X and Y as at 30th June, 2022. Sundry Creditors ₹ 20,000 Bills Payable ₹ 20,000

The following is the Balance Sheet of X and Y as at 30th June, 2022.

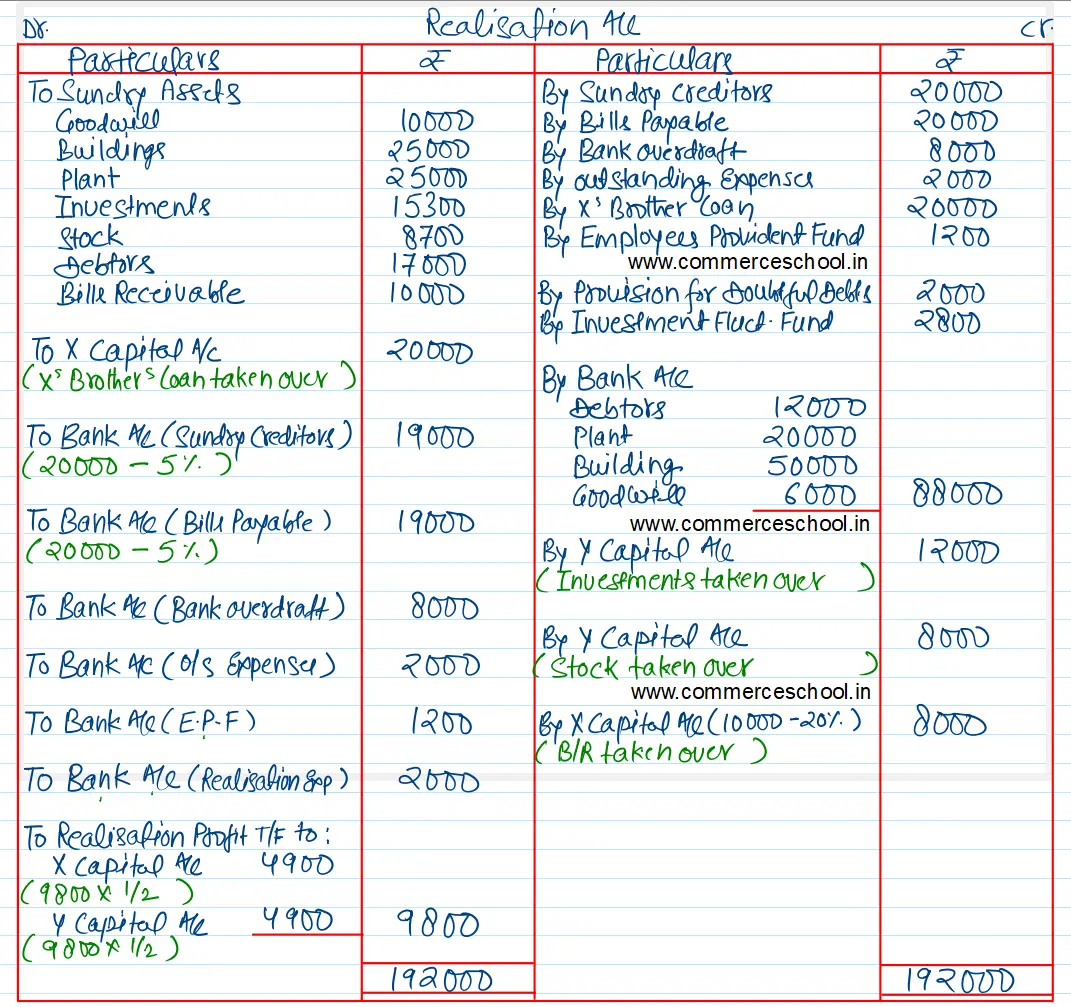

The firm was dissolved on 30th June, 2022 and the following arrangements were decided upon:

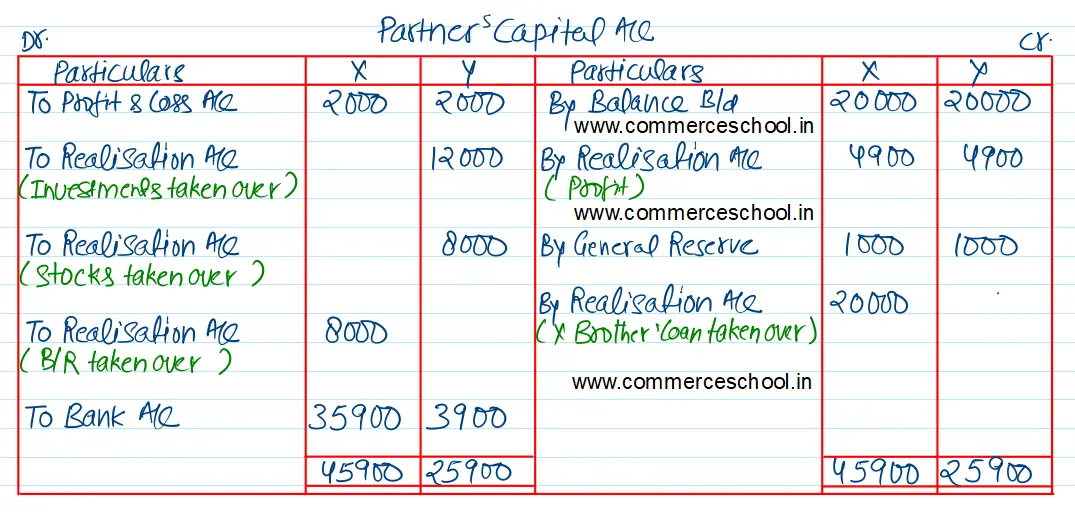

(a) X agreed to pay off his brother’s loan;

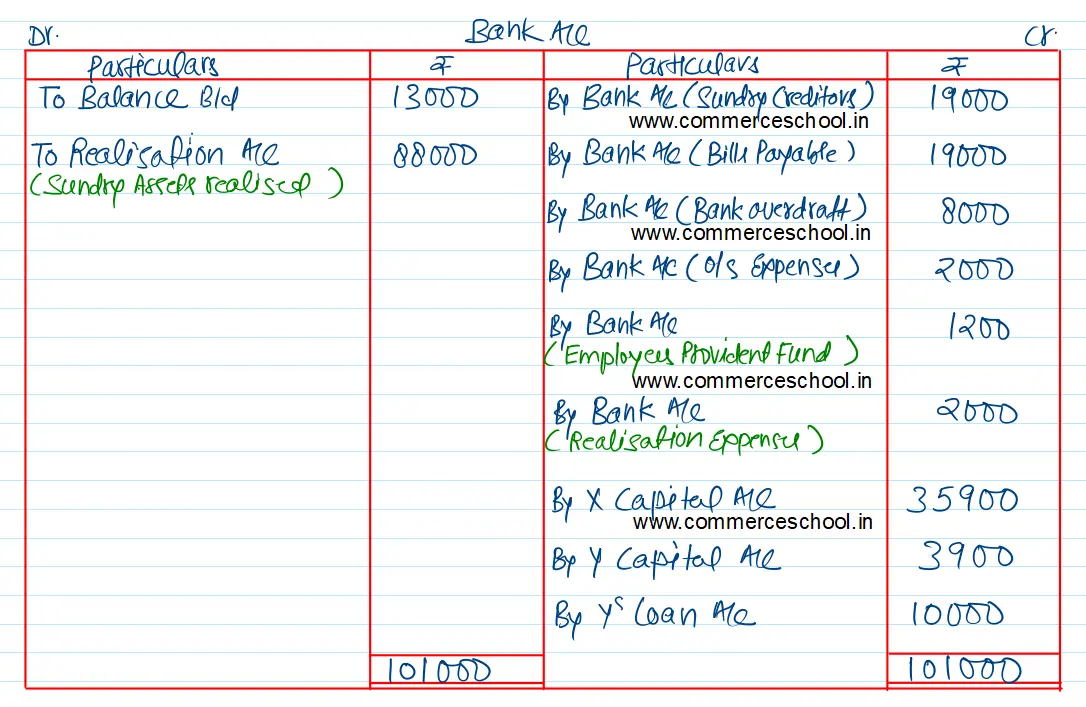

(b) Debtors realised ₹ 12,000;

(c) Y took over all the investments at ₹ 12,000.

(d) Other assets realised as follows:

Plant – ₹ 20,000, Building – ₹ 50,000, Goodwill – ₹ 6,000

(e) Sundry Creditors and Bills payable were settled at 5% discount, Y accepted stock at ₹ 8,000 and X took over Bills Receivable at 20% discount.

(f) Realisation Expenses amounted to ₹ 2,000.

You are required to pass Journal Entries.

[Ans. Gain on Realisation ₹ 9,800; Final Payment to X ₹ 35,900 and Y ₹ 3,900; Total of Bank A/c ₹ 1,01,000.]

| Liabilities | ₹ | Assets | ₹ |

| Sundry Creditors | 20,000 | Goodwill | 10,000 |

| Bills Payable | 20,000 | Buildings | 25,000 |

| Bank Overdraft | 8,000 | Plant | 25,000 |

| Outstanding Expenses | 2,000 | Investments | 15,300 |

| X’s brother’s Loan | 20,000 | Stock | 8,700 |

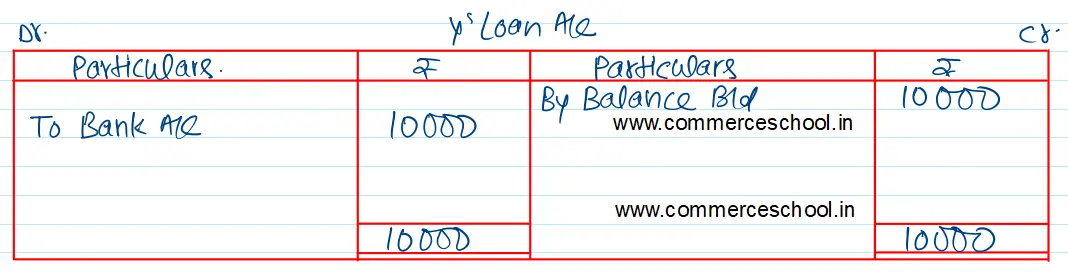

| Y’s Loan | 10,000 | Debtors 17,000 Less: Provision 2,000 | 15,000 |

| Investment Fluctuation Fund | 2,800 | Bills Receivable | 10,000 |

| Employee’s Provident Fund | 1,200 | Cash at Bank | 13,000 |

| General Reserve | 2,000 | Profit and Loss A/c (Dr. Balance) | 4,000 |

| X’s Capital Y’s Capital | 20,000 20,000 | ||

| 1,26,000 | 1,26,000 |

Anurag Pathak Answered question