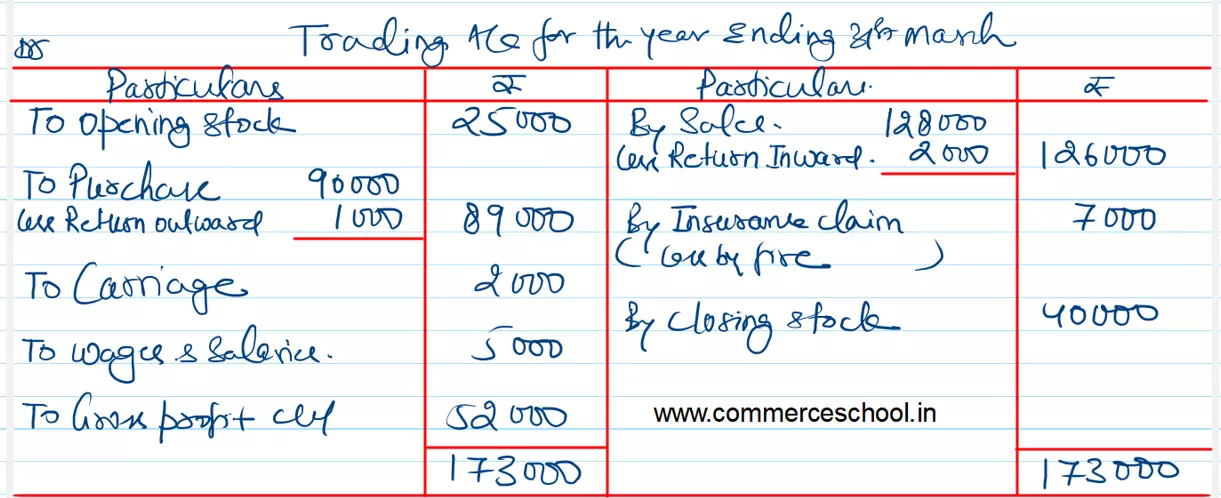

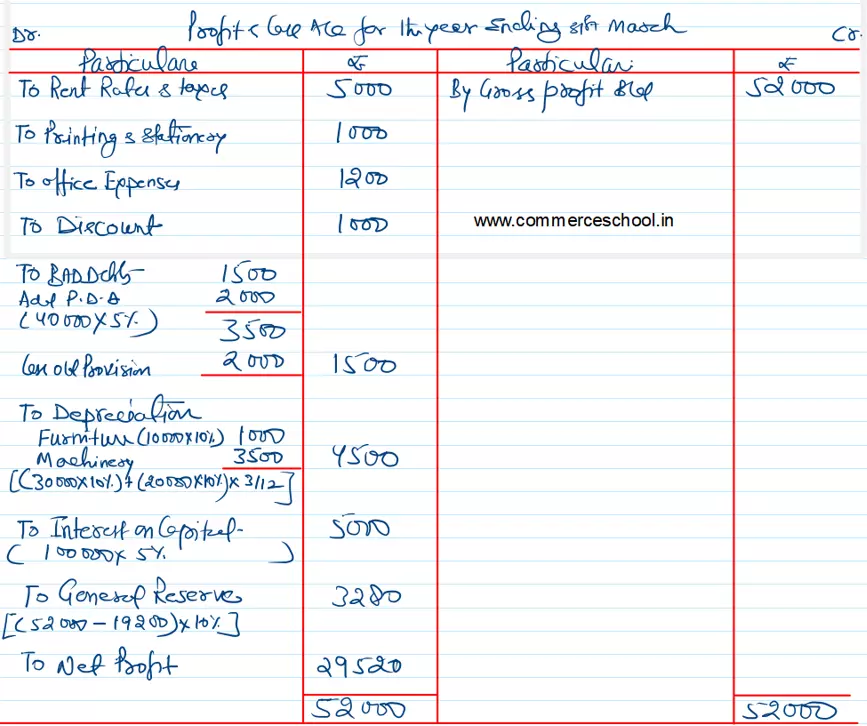

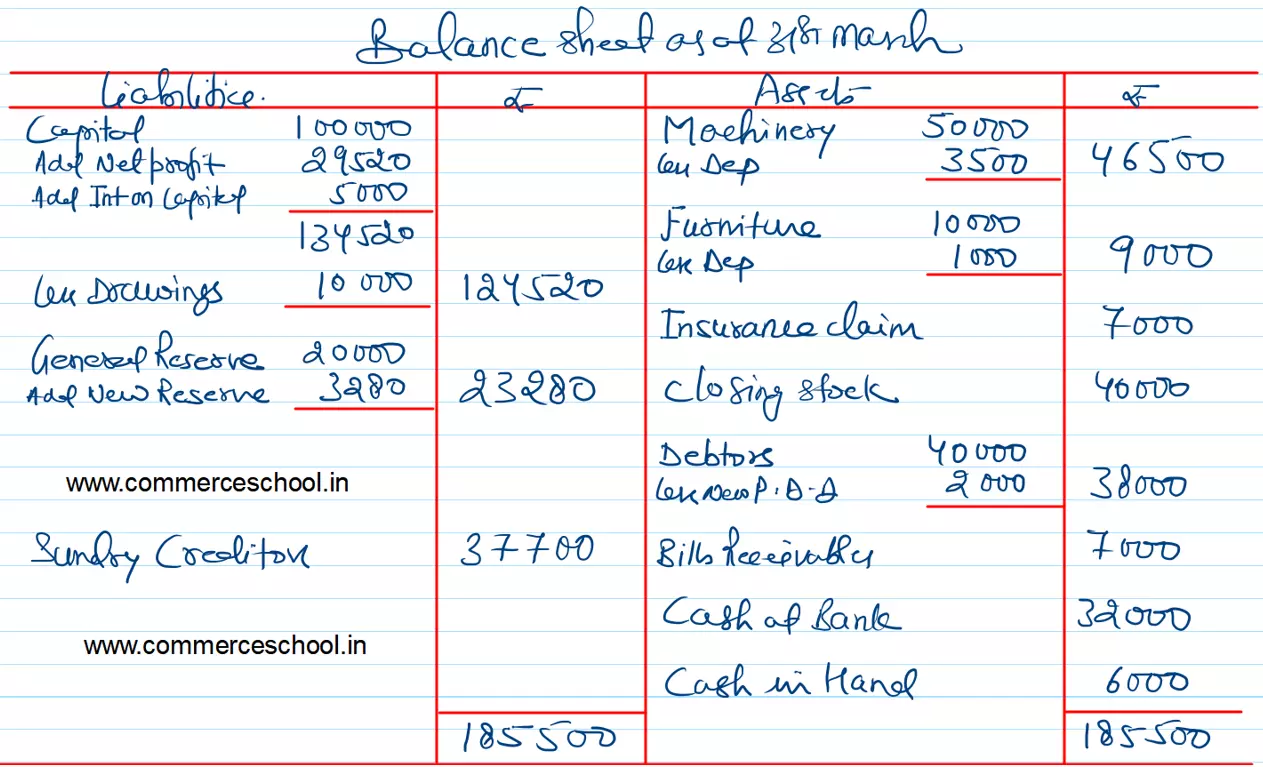

Prepare Trading and Profit & Loss Account for the year ending on 31st March, 2023 and Balance Sheet as on that date from the following balances of Trial Balance:

Prepare Trading and Profit & Loss Account for the year ending on 31st March, 2023 and Balance Sheet as on that date from the following balances of Trial Balance:

| Particulars | ₹ | Particulars | ₹ |

|

Debit Balances: Drawings Machinery Stock Purchases Returns Inward Furniture Carriage Rent, Rates and Taxes Printing and Stationery Office Expenses Bad Debts Sundry Debtors |

10,000 50,000 25,000 90,000 2,000 10,000 2,000 5,000 1,000 1,200 1,500 40,000 |

Bills Receivable Discount Wages and Salaries Cash in Hand Cash at Bank Credit Balances Capital Returns Outward Provision for Doubtful Debts Creditors Sales General Reserve |

7,000 1,000 5,000 6,000 32,000 1,00,000 1,000 2,000 37,700 1,28,000 20,000 |

Adjustment:

(i) The value of stock on 31st March, 2023, ₹ 40,000.

(ii) Provision for Doubtful Debts is to be maintained at 5% on Sundry Debtors.

(iii) Charge depreciation on both Furniture and Machinery @ 10% p.a.

(iv) Machinery costing ₹ 20,000 was purchased on 1st January, 2023.

(v) Allow interest on capital @ 5% p.a.

(vi) A fire occurred on 20th March, 2023 and stock of the value of ₹ 7,000 was destroyed. It was fully insured and the insurance company admitted the claim in full.

(vii) 10% of net profit to be carried to General Reserve.

[Gross Profit – ₹ 52,000; Net Profit – ₹ 29,520; Balance Sheet Total – ₹ 1,85,500.]

[Hint: Net Profit, i.e., Profit before transfer to General Reserve – ₹ 32,800. Transfer to General Reserve – ₹ 3,280 (i.e., 10% of ₹ 32,800.)