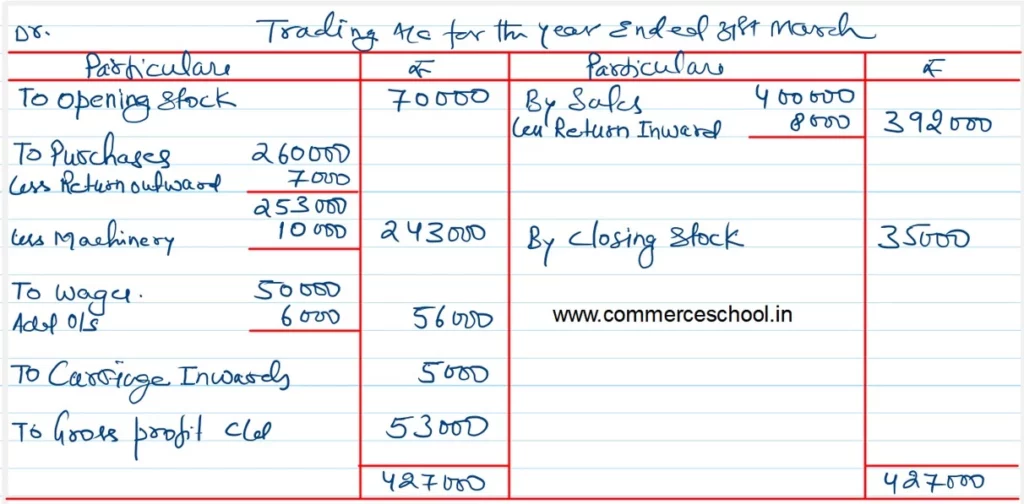

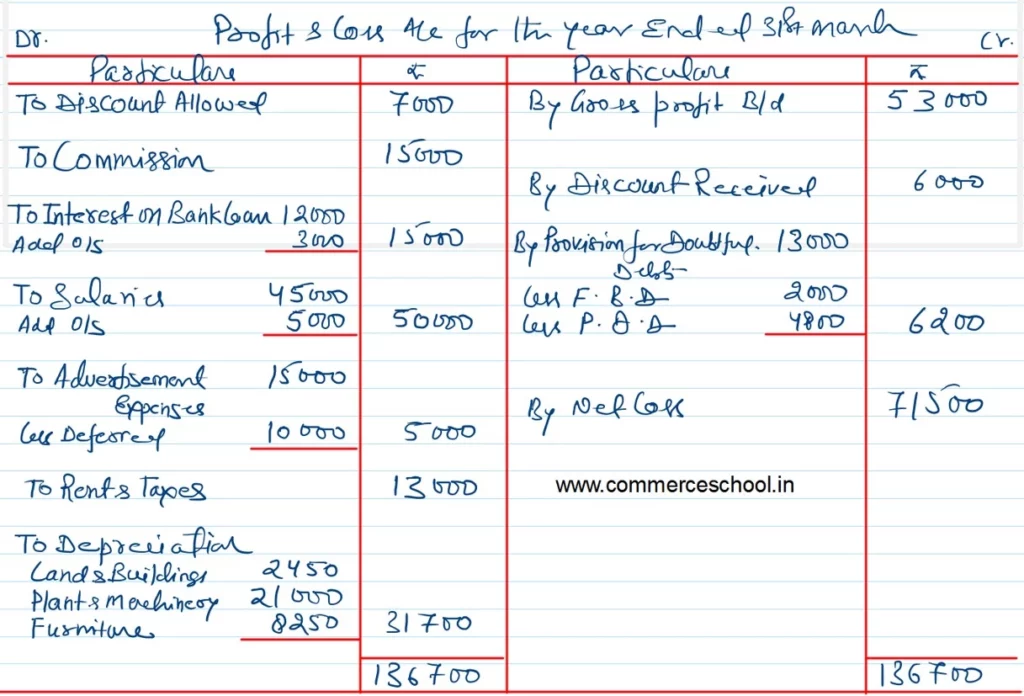

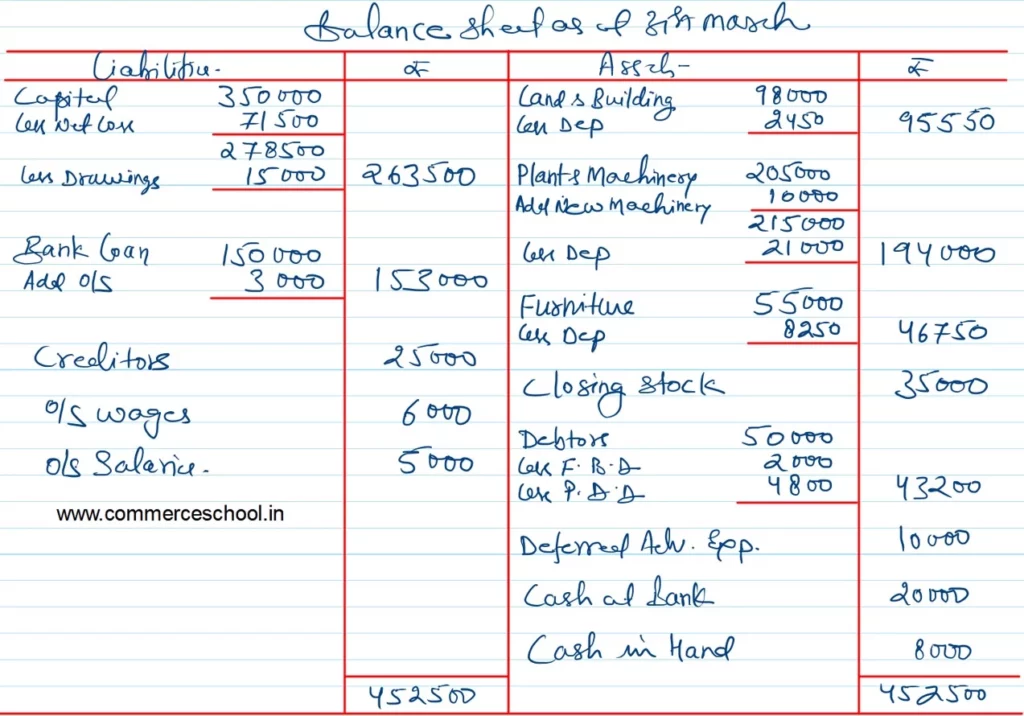

From the following Trial Balance of Pawan, prepare Trading, Profit & Loss Account for the year ending 31st March, 2023 and a Balance Sheet as on that date:

From the following Trial Balance of Pawan, prepare Trading, Profit & Loss Account for the year ending 31st March, 2023 and a Balance Sheet as on that date:

| Heads of Accounts | Dr. | Cr. |

|

Drawings Capital Plant and Machinery Debtors Creditors Returns Inward Returns Outward Discount Allowed Discount Received Commission Interest on Bank Loan Furniture Provision for Doubtful Debts Wages Salaries Advertisment Expenses Rent and Taxes Purchases Sales Stock on 1st April, 2022 Carriage Inwards Land and Building Cash in Hand Cash at Bank 10% Bank Loan as on 1st April, 2022 |

15,000 – 2,05,000 50,000 – 8,000 – 7,000 15,000 12,000 55,000 – 50,000 45,000 15,000 13,000 2,60,000 – 70,000 5,000 98,000 8,000 20,000 – |

– 3,50,000 – – 25,000 – 7,000 – 6,000 – – – 13,000 – – – – – 4,00,000 – – – – – 1,50,000 |

| Total | 9,51,000 | 9,51,000 |

Adjustments:

(i) The cost of stock on 31st March, 2023 was ₹ 37,000. However, its market value was ₹ 35,000.

(ii) Wages outstanding were ₹ 6,000 and slaries outstanding were ₹ 5,000 on 31st March, 2023.

(iii) Depreciate: Land and Building @ 2 and 1/2%, Plant and Machinery @ 10% p.a. and Furniture @ 15% p.a.

(iv) Amount of Purchases includes purchase of machinery for ₹ 10,000 on 1st October, 2022.

(v) Debtors include bad debts of ₹ 2,000. Maintain a provision for doubtful debts @ 10% on Debtors.

(vi) One-third of advertisement expenses are to be written off.